Exam 10: Activity-Based Costing

Exam 1: Introduction to Management Accounting49 Questions

Exam 2: An Introduction to Cost Terms and Concepts64 Questions

Exam 3: Cost Assignment29 Questions

Exam 4: Accounting Entries for a Job Costing System15 Questions

Exam 5: Process Costing29 Questions

Exam 6: Joint and By-Product Costing61 Questions

Exam 7: Income Effects of Alternative Cost Accumulation Systems45 Questions

Exam 8: Cost-Volume-Profit Analysis60 Questions

Exam 9: Measuring Relevant Costs and Revenues for Decision-Making81 Questions

Exam 10: Activity-Based Costing40 Questions

Exam 11: Pricing Decisions and Profitability Analysis59 Questions

Exam 12: Decision-Making Under Conditions of Risk and Uncertainty29 Questions

Exam 13: Capital Investment Decisions: Appraisal Methods77 Questions

Exam 14: Capital Investment Decisions: the Impact of Capital Rationing, Taxation, Inflation and Risk25 Questions

Exam 15: The Budgeting Process86 Questions

Exam 16: Management Control Systems64 Questions

Exam 17: Standard Costing and Variance Analysis 181 Questions

Exam 18: Standard Costing and Variance Analysis 2: Further Aspects12 Questions

Exam 19: Divisional Financial Performance Measures51 Questions

Exam 20: Transfer Pricing in Divisionalized Companies50 Questions

Exam 21: Cost Management95 Questions

Exam 22: Strategic Management Accounting32 Questions

Exam 23: Cost Estimation and Cost Behaviour63 Questions

Exam 24: Quantitative Models for the Planning and Control of Stocks42 Questions

Exam 25: The Application of Linear Programming to Management Accounting30 Questions

Select questions type

Which of the following is a FALSE statement about target costing?

Free

(Multiple Choice)

4.9/5  (48)

(48)

Correct Answer:

D

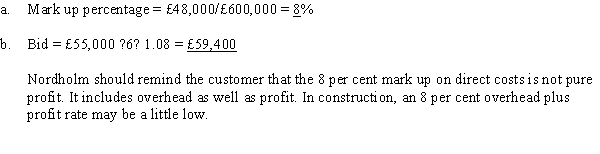

Nordholm Construction Company builds houses. Each job requires a bid. Nordholm's bidding policy is to estimate the costs of materials, direct labour, and subcontractor's costs. These are totaled and a mark up is applied to cover overhead and profit. In the coming year, Nordholm believes it will be the successful bidder on ten jobs with the following total revenues and costs:  The residual will cover overhead and profits.

Required:

a.

What is the mark up percentage on total direct costs?

b.

Suppose Nordholm is asked to bid on a job with estimated direct costs of £55,000. What is the bid? If the customer complains that the profit seems pretty high, how might Nordholm counter that?

The residual will cover overhead and profits.

Required:

a.

What is the mark up percentage on total direct costs?

b.

Suppose Nordholm is asked to bid on a job with estimated direct costs of £55,000. What is the bid? If the customer complains that the profit seems pretty high, how might Nordholm counter that?

Free

(Essay)

4.9/5  (31)

(31)

Correct Answer:

Figure 10-2

Anderson Company manufactures a variety of toys and games. John Boone, president, is disappointed in the sales of a new board game. The game sold only 10,000 units in 2011 when 30,000 were projected. Sales for 2008 look no better. At £100 per game, it is not a hot seller. Direct costs of the board game are £56 variable cost and £100,000 fixed. John is considering several options. Option One: Cut the price to £70 and perhaps sell 15,000 units. Option Two: Cut the price to £60, reduce material costs by £10, and cut advertising by £60,000. Anticipated volume for this option is 10,000 units. Option Three: Cut the price to £80 and include a £10 mail-in rebate offer. It is anticipated that 15,000 units could be sold and only 30 per cent of the rebate coupons would be redeemed.

-Which of the following statements is FALSE?

Free

(Multiple Choice)

4.8/5  (28)

(28)

Correct Answer:

B

Figure 10-2

Anderson Company manufactures a variety of toys and games. John Boone, president, is disappointed in the sales of a new board game. The game sold only 10,000 units in 2011 when 30,000 were projected. Sales for 2008 look no better. At £100 per game, it is not a hot seller. Direct costs of the board game are £56 variable cost and £100,000 fixed. John is considering several options. Option One: Cut the price to £70 and perhaps sell 15,000 units. Option Two: Cut the price to £60, reduce material costs by £10, and cut advertising by £60,000. Anticipated volume for this option is 10,000 units. Option Three: Cut the price to £80 and include a £10 mail-in rebate offer. It is anticipated that 15,000 units could be sold and only 30 per cent of the rebate coupons would be redeemed.

-Refer to Figure 10-2. Which option is preferred?

(Multiple Choice)

4.8/5  (43)

(43)

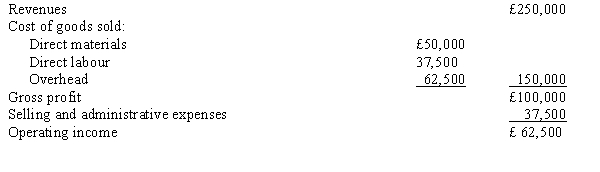

Figure 10-4

Jamie Ltd. had the following information:  -Refer to Figure 10-4. What is the mark up based on materials?

-Refer to Figure 10-4. What is the mark up based on materials?

(Multiple Choice)

4.9/5  (36)

(36)

Figure 10-1

Wheat Manufacturing has four categories of overhead. The four categories and the expected overhead costs for each category for next year are as follows:  Currently, overhead is applied using a predetermined overhead rate based upon budgeted direct labour hours. For next year, 20,000 direct labour hours are budgeted.

The company has been asked to submit a bid for a proposed job. The plant manager feels that obtaining this job would result in new business in future years. Usually bids are based upon full manufacturing cost plus 15 per cent.

Estimates for the proposed job are as follows:

Currently, overhead is applied using a predetermined overhead rate based upon budgeted direct labour hours. For next year, 20,000 direct labour hours are budgeted.

The company has been asked to submit a bid for a proposed job. The plant manager feels that obtaining this job would result in new business in future years. Usually bids are based upon full manufacturing cost plus 15 per cent.

Estimates for the proposed job are as follows:  In the past, full manufacturing cost has been calculated by allocating overhead using a volume-based cost driver--direct labour hours. The plant manager has heard of a new way of applying overhead that uses cost pools and cost drivers.

Expected activity for the four activity-based cost drivers that would be used are as follows:

In the past, full manufacturing cost has been calculated by allocating overhead using a volume-based cost driver--direct labour hours. The plant manager has heard of a new way of applying overhead that uses cost pools and cost drivers.

Expected activity for the four activity-based cost drivers that would be used are as follows:  -Refer to Figure 10-1. If Wheat Manufacturing used direct labour hours as the cost driver and the company's bid is full cost plus 15 per cent, the company's bid would be

-Refer to Figure 10-1. If Wheat Manufacturing used direct labour hours as the cost driver and the company's bid is full cost plus 15 per cent, the company's bid would be

(Multiple Choice)

4.8/5  (36)

(36)

Figure 10-2

Anderson Company manufactures a variety of toys and games. John Boone, president, is disappointed in the sales of a new board game. The game sold only 10,000 units in 2011 when 30,000 were projected. Sales for 2008 look no better. At £100 per game, it is not a hot seller. Direct costs of the board game are £56 variable cost and £100,000 fixed. John is considering several options. Option One: Cut the price to £70 and perhaps sell 15,000 units. Option Two: Cut the price to £60, reduce material costs by £10, and cut advertising by £60,000. Anticipated volume for this option is 10,000 units. Option Three: Cut the price to £80 and include a £10 mail-in rebate offer. It is anticipated that 15,000 units could be sold and only 30 per cent of the rebate coupons would be redeemed.

-Refer to Figure 10-2. What is the profit (loss) from Option Two?

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following stages has revenues for the entire industry decreasing?

(Multiple Choice)

4.8/5  (34)

(34)

If activity-based costing is used, materials handling would be classified as a

(Multiple Choice)

4.9/5  (39)

(39)

Figure 10-1

Wheat Manufacturing has four categories of overhead. The four categories and the expected overhead costs for each category for next year are as follows:  Currently, overhead is applied using a predetermined overhead rate based upon budgeted direct labour hours. For next year, 20,000 direct labour hours are budgeted.

The company has been asked to submit a bid for a proposed job. The plant manager feels that obtaining this job would result in new business in future years. Usually bids are based upon full manufacturing cost plus 15 per cent.

Estimates for the proposed job are as follows:

Currently, overhead is applied using a predetermined overhead rate based upon budgeted direct labour hours. For next year, 20,000 direct labour hours are budgeted.

The company has been asked to submit a bid for a proposed job. The plant manager feels that obtaining this job would result in new business in future years. Usually bids are based upon full manufacturing cost plus 15 per cent.

Estimates for the proposed job are as follows:  In the past, full manufacturing cost has been calculated by allocating overhead using a volume-based cost driver--direct labour hours. The plant manager has heard of a new way of applying overhead that uses cost pools and cost drivers.

Expected activity for the four activity-based cost drivers that would be used are as follows:

In the past, full manufacturing cost has been calculated by allocating overhead using a volume-based cost driver--direct labour hours. The plant manager has heard of a new way of applying overhead that uses cost pools and cost drivers.

Expected activity for the four activity-based cost drivers that would be used are as follows:  -Refer to Figure 10-1. If Wheat Manufacturing used activity-based cost drivers to assign overhead and the company's bid is full cost plus 15 per cent, the company's bid would be

-Refer to Figure 10-1. If Wheat Manufacturing used activity-based cost drivers to assign overhead and the company's bid is full cost plus 15 per cent, the company's bid would be

(Multiple Choice)

4.9/5  (32)

(32)

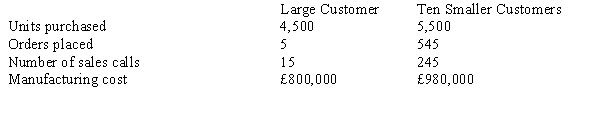

Figure 10-5

Ander Company produces precision equipment for major buyers. Of the six customers, one accounts for 40 per cent of the sales, with the remaining five accounting for the rest of the sales. The five smaller customers purchase equipment in roughly equal quantities. Orders placed by the smaller customers are about the same size. Data concerning Ander's customer activity follow:  Order-filling costs for Ander Company total £360,000, and sales-force costs are £375,000.

-Refer to Figure 10-5 above, what amount of sales-force costs would be allocated to the five smaller customers if these costs are allocated based on sales volume?

Order-filling costs for Ander Company total £360,000, and sales-force costs are £375,000.

-Refer to Figure 10-5 above, what amount of sales-force costs would be allocated to the five smaller customers if these costs are allocated based on sales volume?

(Multiple Choice)

4.9/5  (38)

(38)

____ is the pricing of a new product at a low initial price to build market share quickly.

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following accurately describes the effect target costing has on the manufacturing design function?

(Multiple Choice)

4.8/5  (30)

(30)

If activity-based costing is used, modifications made by engineering to the product design of several products would be classified as a

(Multiple Choice)

4.7/5  (45)

(45)

Bay Company produces boats for 11 major buyers. Of the 11 customers, one accounts for 45 per cent of the sales, with the remaining ten accounting for the rest of the sales. The ten smaller customers purchase boats in roughly equal quantities. Orders placed by the smaller customers are about the same size. Data concerning Bay's customer activity follow:  Order-filling costs for Bay Company total £401,500, and sales-force costs are £260,000.

Required:

a.

Determine the amount of selling costs (order-filling and sales-force costs) allocated to (1) the large customer and (2) the ten smaller customers if these costs are allocated based on sales volume.

b.

b.

Determine the amount of selling costs (order-filling and sales-force costs) allocated to (1) the large customer and (2) the ten smaller customers if these costs are assigned using activity-based costing.

c.

Comment on the differences in amounts attributed to the smaller customers in requirements a and

Order-filling costs for Bay Company total £401,500, and sales-force costs are £260,000.

Required:

a.

Determine the amount of selling costs (order-filling and sales-force costs) allocated to (1) the large customer and (2) the ten smaller customers if these costs are allocated based on sales volume.

b.

b.

Determine the amount of selling costs (order-filling and sales-force costs) allocated to (1) the large customer and (2) the ten smaller customers if these costs are assigned using activity-based costing.

c.

Comment on the differences in amounts attributed to the smaller customers in requirements a and

(Essay)

4.8/5  (36)

(36)

Figure 10-2

Anderson Company manufactures a variety of toys and games. John Boone, president, is disappointed in the sales of a new board game. The game sold only 10,000 units in 2011 when 30,000 were projected. Sales for 2008 look no better. At £100 per game, it is not a hot seller. Direct costs of the board game are £56 variable cost and £100,000 fixed. John is considering several options. Option One: Cut the price to £70 and perhaps sell 15,000 units. Option Two: Cut the price to £60, reduce material costs by £10, and cut advertising by £60,000. Anticipated volume for this option is 10,000 units. Option Three: Cut the price to £80 and include a £10 mail-in rebate offer. It is anticipated that 15,000 units could be sold and only 30 per cent of the rebate coupons would be redeemed.

-Refer to Figure 10-2. What is the profit (loss) from Option Three?

(Multiple Choice)

4.8/5  (45)

(45)

Setting prices below cost for the purpose of injuring competitors and eliminating competition is

(Multiple Choice)

4.8/5  (41)

(41)

____ is where a higher price is charged at the beginning of a product's life cycle.

(Multiple Choice)

4.9/5  (43)

(43)

Figure 10-3

Farr Company had the following information:  -Refer to Figure 10-3. What is the mark up based on prime costs?

-Refer to Figure 10-3. What is the mark up based on prime costs?

(Multiple Choice)

4.9/5  (34)

(34)

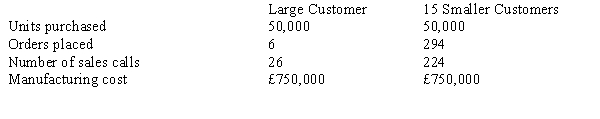

Johnson Company produces office equipment for 16 major buyers. Of the 16 customers, one accounts for 50 per cent of the sales, with the remaining 15 accounting for the rest of the sales. The 15 smaller customers purchase equipment in roughly equal quantities. Orders placed by the smaller customers are about the same size. Data concerning Johnson's customer activity follow:  Order-filling costs for Johnson Company total £270,000, and sales-force costs are £300,000.

Required:

a.

Determine the amount of selling costs (order-filling and sales-force costs) allocated to (1) the large customer and (2) the 15 smaller customers if these costs are allocated based on sales volume.

b.

b.

Determine the amount of selling costs (order-filling and sales-force costs) allocated to (1) the large customer and (2) the 15 smaller customers if these costs are assigned using activity-based costing.

c.

Comment on the differences in amounts attributed to the smaller customers in requirements a and

Order-filling costs for Johnson Company total £270,000, and sales-force costs are £300,000.

Required:

a.

Determine the amount of selling costs (order-filling and sales-force costs) allocated to (1) the large customer and (2) the 15 smaller customers if these costs are allocated based on sales volume.

b.

b.

Determine the amount of selling costs (order-filling and sales-force costs) allocated to (1) the large customer and (2) the 15 smaller customers if these costs are assigned using activity-based costing.

c.

Comment on the differences in amounts attributed to the smaller customers in requirements a and

(Essay)

4.7/5  (38)

(38)

Showing 1 - 20 of 40

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)