Exam 12: Decision-Making Under Conditions of Risk and Uncertainty

Exam 1: Introduction to Management Accounting49 Questions

Exam 2: An Introduction to Cost Terms and Concepts64 Questions

Exam 3: Cost Assignment29 Questions

Exam 4: Accounting Entries for a Job Costing System15 Questions

Exam 5: Process Costing29 Questions

Exam 6: Joint and By-Product Costing61 Questions

Exam 7: Income Effects of Alternative Cost Accumulation Systems45 Questions

Exam 8: Cost-Volume-Profit Analysis60 Questions

Exam 9: Measuring Relevant Costs and Revenues for Decision-Making81 Questions

Exam 10: Activity-Based Costing40 Questions

Exam 11: Pricing Decisions and Profitability Analysis59 Questions

Exam 12: Decision-Making Under Conditions of Risk and Uncertainty29 Questions

Exam 13: Capital Investment Decisions: Appraisal Methods77 Questions

Exam 14: Capital Investment Decisions: the Impact of Capital Rationing, Taxation, Inflation and Risk25 Questions

Exam 15: The Budgeting Process86 Questions

Exam 16: Management Control Systems64 Questions

Exam 17: Standard Costing and Variance Analysis 181 Questions

Exam 18: Standard Costing and Variance Analysis 2: Further Aspects12 Questions

Exam 19: Divisional Financial Performance Measures51 Questions

Exam 20: Transfer Pricing in Divisionalized Companies50 Questions

Exam 21: Cost Management95 Questions

Exam 22: Strategic Management Accounting32 Questions

Exam 23: Cost Estimation and Cost Behaviour63 Questions

Exam 24: Quantitative Models for the Planning and Control of Stocks42 Questions

Exam 25: The Application of Linear Programming to Management Accounting30 Questions

Select questions type

Which of the following statements is untrue regarding a probability distribution?

Free

(Multiple Choice)

4.8/5  (39)

(39)

Correct Answer:

C

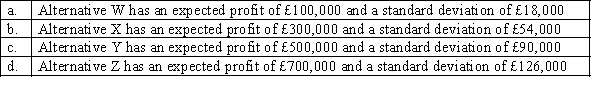

The following represent the expected values and standard deviations for alternatives W-Z:  Which of the following statements are true?

Which of the following statements are true?

Free

(Multiple Choice)

4.8/5  (32)

(32)

Correct Answer:

C

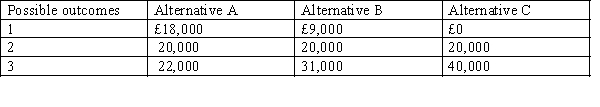

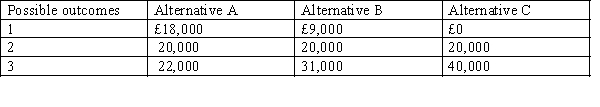

Figure 12-1

Joe Bloggs is considering the following three alternatives that are estimated to yield the following potential monetary benefits:  It is estimated that all of the outcomes are equally likely.

-Refer to Figure 12-1. Assume that Joe is a risk seeker. Which alternative is Joe likely to choose?

It is estimated that all of the outcomes are equally likely.

-Refer to Figure 12-1. Assume that Joe is a risk seeker. Which alternative is Joe likely to choose?

(Multiple Choice)

4.8/5  (45)

(45)

Jackson is considering launching a new product which it believes has an 80% probability of success. The company, however, is considering undertaking an advertising campaign at a cost of £40,000 which would increase the probability of success to 90%. If successful the product would generate income of £840,000 otherwise £294,000 would be received.

What will be the expected loss or gain from obtaining the additional information?

(Multiple Choice)

4.8/5  (34)

(34)

The following represent the expected values and standard deviations for alternatives a-d. Which alternative has the highest absolute risk?

(Multiple Choice)

4.9/5  (35)

(35)

The maximum amount that is worth paying to obtain additional information consists of:

(Multiple Choice)

4.9/5  (34)

(34)

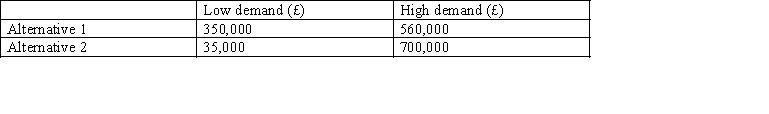

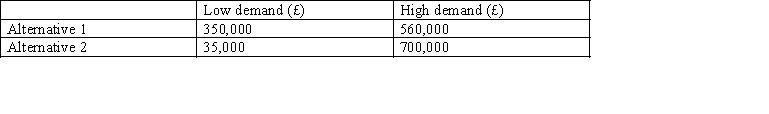

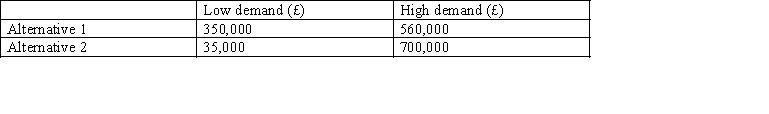

Figure 12-3

The Lee Company must choose between two mutually exclusive alternatives. With alternative 1 an inferior product will be marketed that is best suited to low levels of demand whereas alternative 2 is a superior product that is best suited to high levels of demand. There are only two possible levels of demand - high and low and the probabilities of each event occurring is 0.5. The predicted profits for each alterative are:  -Refer to Figure 12-3. Which alternative should the company choose using the maximax criterion?

-Refer to Figure 12-3. Which alternative should the company choose using the maximax criterion?

(Multiple Choice)

4.9/5  (43)

(43)

Figure 12-3

The Lee Company must choose between two mutually exclusive alternatives. With alternative 1 an inferior product will be marketed that is best suited to low levels of demand whereas alternative 2 is a superior product that is best suited to high levels of demand. There are only two possible levels of demand - high and low and the probabilities of each event occurring is 0.5. The predicted profits for each alterative are:  -Refer to Figure 12-3. Using the data above relating to the Lee Company, what is the amount of regret that is used to determine the choice of alternatives under consideration?

-Refer to Figure 12-3. Using the data above relating to the Lee Company, what is the amount of regret that is used to determine the choice of alternatives under consideration?

(Multiple Choice)

4.9/5  (42)

(42)

Figure 12-1

Joe Bloggs is considering the following three alternatives that are estimated to yield the following potential monetary benefits:  It is estimated that all of the outcomes are equally likely.

-Refer to Figure 12-1. Assume that Joe is a risk neutral. Which alternative is Joe likely to choose?

It is estimated that all of the outcomes are equally likely.

-Refer to Figure 12-1. Assume that Joe is a risk neutral. Which alternative is Joe likely to choose?

(Multiple Choice)

4.8/5  (29)

(29)

Sentosa Company is considering launching a new product which it believes has a 70% probability of success. The company is, however, considering undertaking an advertising campaign costing £60,000, which would increase the probability of success to 95%. If successful the product would generate income of £240,000 otherwise £84,000 would be received.

What is the maximum amount that the company should be prepared to pay for advertising?

(Multiple Choice)

4.8/5  (38)

(38)

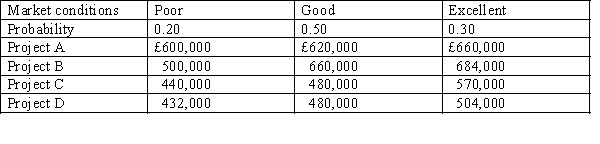

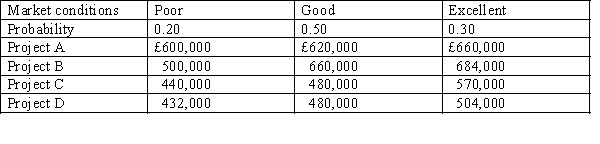

Figure 12-2

ZX Company is faced with choosing from the following four mutually exclusive alternatives. Each project has the same duration and the cash flows are expected to occur at the same point in time. Their net cash inflows will be determined by the prevailing market conditions. The forecast net cash inflows and their associated probabilities are shown below:  -Refer to Figure 12-2. The expected value of Project D is:

-Refer to Figure 12-2. The expected value of Project D is:

(Multiple Choice)

4.9/5  (46)

(46)

Figure 12-2

ZX Company is faced with choosing from the following four mutually exclusive alternatives. Each project has the same duration and the cash flows are expected to occur at the same point in time. Their net cash inflows will be determined by the prevailing market conditions. The forecast net cash inflows and their associated probabilities are shown below:  -Refer to Figure 12-2. Based on the expected value of net cash flows, which project should be undertaken?

-Refer to Figure 12-2. Based on the expected value of net cash flows, which project should be undertaken?

(Multiple Choice)

4.8/5  (43)

(43)

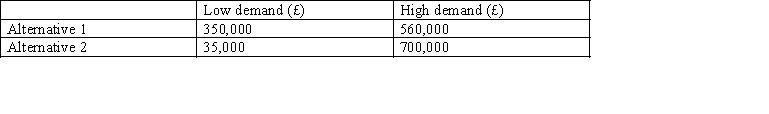

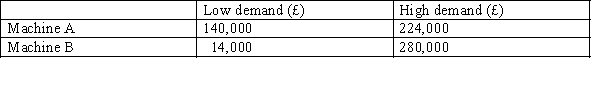

The Tamesek Company is considering purchasing one of two mutually exclusive machines. Machine A is most suited to low levels of demand whereas machine B is suited to high-level demand. There are only two possible outcomes and each has the same level of probability. The estimated profits for each demand level are as follows:  There is a possibility of employing a firm of management consultants who would be able to provide a perfect prediction of actual demand. What is the maximum amount that the company would be prepared to pay for the additional information?

There is a possibility of employing a firm of management consultants who would be able to provide a perfect prediction of actual demand. What is the maximum amount that the company would be prepared to pay for the additional information?

(Multiple Choice)

5.0/5  (35)

(35)

Figure 12-3

The Lee Company must choose between two mutually exclusive alternatives. With alternative 1 an inferior product will be marketed that is best suited to low levels of demand whereas alternative 2 is a superior product that is best suited to high levels of demand. There are only two possible levels of demand - high and low and the probabilities of each event occurring is 0.5. The predicted profits for each alterative are:  -Under what circumstances can risk reduction NOT be achieved from combining investments?

-Under what circumstances can risk reduction NOT be achieved from combining investments?

(Multiple Choice)

4.9/5  (39)

(39)

Figure 12-3

The Lee Company must choose between two mutually exclusive alternatives. With alternative 1 an inferior product will be marketed that is best suited to low levels of demand whereas alternative 2 is a superior product that is best suited to high levels of demand. There are only two possible levels of demand - high and low and the probabilities of each event occurring is 0.5. The predicted profits for each alterative are:  -Refer to Figure 12-3 and assume that the probabilities of 0.5 for high and 0.5 for low demand are changed to 0.6 and 0.4 respectively. How would the change in probabilities change the values used to apply the maximax, maximin and regret criteria?

-Refer to Figure 12-3 and assume that the probabilities of 0.5 for high and 0.5 for low demand are changed to 0.6 and 0.4 respectively. How would the change in probabilities change the values used to apply the maximax, maximin and regret criteria?

(Multiple Choice)

4.8/5  (40)

(40)

Showing 1 - 20 of 29

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)