Exam 13: Financial Statement Analysis

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

Which of the following would be considered an "Other comprehensive income" item?

(Multiple Choice)

4.7/5  (28)

(28)

Hobson Corporation had net sales for the year of $300,000 and average total assets of $200,000. The asset turnover is ____________ times.

(Short Answer)

4.8/5  (31)

(31)

In performing a vertical analysis, the base for sales revenues on the income statement is

(Multiple Choice)

4.9/5  (42)

(42)

Which one of the following would not be considered a liquidity ratio?

(Multiple Choice)

4.7/5  (38)

(38)

The current assets of Orangette Company are $292,500. The current liabilities are $130,000. The current ratio expressed as a proportion is

(Multiple Choice)

4.8/5  (38)

(38)

In horizontal analysis, the base year is the most current year being examined.

(True/False)

4.7/5  (34)

(34)

Horizontal, vertical, and circular analyses are the basic tools of financial statement analysis.

(True/False)

4.9/5  (38)

(38)

Vertical analysis is a technique for evaluating a series of financial statement data over a period of time to determine the increase (decrease) that has taken place.

(True/False)

4.9/5  (47)

(47)

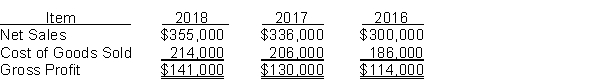

The following items were taken from the financial statements of Mint, Inc., over a three-year period:  Instructions

Compute the following for each of the above time periods.

a. The amount and percentage change from 2016 to 2017.

b. The amount and percentage change from 2017 to 2018.

Instructions

Compute the following for each of the above time periods.

a. The amount and percentage change from 2016 to 2017.

b. The amount and percentage change from 2017 to 2018.

(Essay)

4.9/5  (36)

(36)

When preparing an income statement, which of the following is the proper order for income statement components?

(Multiple Choice)

4.7/5  (39)

(39)

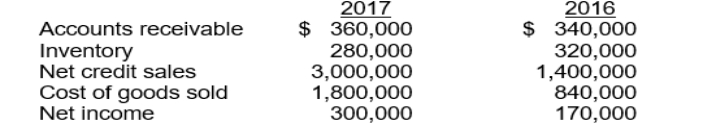

The following information is available for Patterson Company:  The inventory turnover for 2017 is

The inventory turnover for 2017 is

(Multiple Choice)

4.9/5  (42)

(42)

Exeter Corporation had net income of $3,000,000 in 2016. Using 2016 as the base year, net income decreased by 40% in 2017 and increased by 110% in 2018.

Instructions

Compute the net income reported by Exeter Corporation for 2017 and 2018.

(Short Answer)

4.8/5  (39)

(39)

Comparative information taken from the Bergeron Company financial statements is shown below:  Instructions

Using horizontal analysis, show the percentage change from 2016 to 2017 with 2016 as the base year.

Instructions

Using horizontal analysis, show the percentage change from 2016 to 2017 with 2016 as the base year.

(Essay)

4.7/5  (42)

(42)

The following data are taken from the financial statements of Bar Harbor Company:  Instructions

(a) Compute the accounts receivable turnover and the average collection period for both years.

(b) What conclusion can an analyst draw about the management of the accounts receivable?

Instructions

(a) Compute the accounts receivable turnover and the average collection period for both years.

(b) What conclusion can an analyst draw about the management of the accounts receivable?

(Essay)

5.0/5  (34)

(34)

Comprehensive income includes all changes in stockholders' equity during a period except those resulting from investments by stockholders and distributions to stockholders.

(True/False)

4.7/5  (46)

(46)

Which of the following items appears on the income statement before income before income taxes?

(Multiple Choice)

4.7/5  (41)

(41)

Horizontal analysis of comparative financial statements includes the

(Multiple Choice)

4.8/5  (34)

(34)

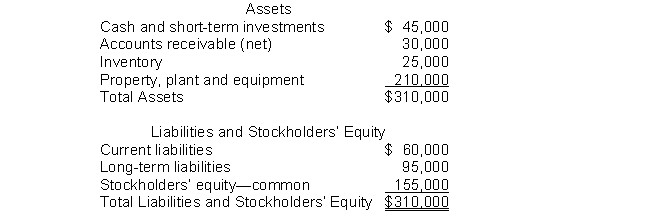

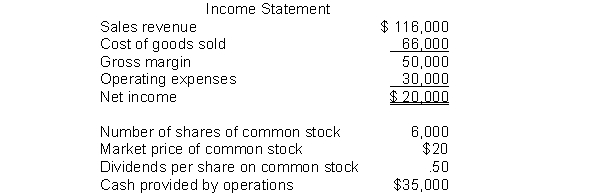

The following information pertains to Blue Flower Company. Assume that all balance sheet amounts represent both average and ending balance figures. Assume that all sales were on credit.

What is the return on common stockholders' equity for this company?

What is the return on common stockholders' equity for this company?

(Multiple Choice)

4.9/5  (39)

(39)

The order of presentation of items that may appear on the statement of comprehensive income is

(Multiple Choice)

4.7/5  (42)

(42)

Showing 161 - 180 of 259

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)