Exam 2: The Recording Process

Exam 1: Accounting in Action243 Questions

Exam 2: The Recording Process195 Questions

Exam 3: Adjusting the Accounts219 Questions

Exam 4: Completing the Accounting Cycle225 Questions

Exam 5: Accounting for Merchandising Operations Perpetual Approach209 Questions

Exam 6: Inventories Periodic Approach203 Questions

Exam 7: Fraud, Internal Control, and Cash229 Questions

Exam 8: Accounting for Receivables238 Questions

Exam 9: Plant Assets, Natural Resources, and Intangible Assets291 Questions

Exam 10: Liabilities267 Questions

Exam 11: Corporations: Organization, Stock Transactions, and Stockholders Equity341 Questions

Exam 12: Statement of Cash Flows161 Questions

Exam 13: Financial Statement Analysis259 Questions

Exam 14: Managerial Accounting213 Questions

Exam 15: Job Order Costing205 Questions

Exam 16: Process Costing182 Questions

Exam 17: Activity-Based Costing185 Questions

Exam 18: Cost-Volume-Profit210 Questions

Exam 19: Cost-Volume-Profit Analysis: Additional Issues102 Questions

Exam 20: Incremental Analysis203 Questions

Exam 21: Pricing144 Questions

Exam 22: Budgetary Planning213 Questions

Exam 23: Budgetary Control and Responsibility Accounting210 Questions

Exam 24: Standard Costs and Balanced Scorecard204 Questions

Exam 25: Planning for Capital Investments192 Questions

Exam 26: Time Value of Money46 Questions

Exam 27: Investments202 Questions

Exam 28: Payroll Accounting38 Questions

Exam 29: Subsidiary Ledgers and Special Journals87 Questions

Exam 30: Other Significant Liabilities40 Questions

Select questions type

An _______________ is a record of increases and decreases in specific assets, liabilities, and stockholders' items.

(Short Answer)

4.7/5  (26)

(26)

Journalize the following business transactions in general journal form. Identify each transaction by number. You may omit explanations of the transactions.

1. The company issues stock in exchange for $40,000 cash

2. Purchased $400 of supplies on credit.

3. Purchased equipment for $8,000, paying $2,000 in cash and signed a 30-day, $6,000, note payable.

4. Real estate commissions billed to clients amount to $4,000.

5. Paid $700 in cash for the current month's rent.

6. Paid $200 cash on account for supplies purchased in transaction 2.

7. Received a bill for $600 for advertising for the current month.

8. Paid $2,200 cash for office salaries and wages.

9. The company paid dividends of $1,500.

10. Received a check for $3,000 from a client in payment on account for commissions billed in transaction 4.

(Essay)

4.8/5  (40)

(40)

In the first month of operations, the total of the debit entries to the cash account amounted to $1,200 and the total of the credit entries to the cash account amounted to $800. The cash account has a(n)

(Multiple Choice)

4.9/5  (39)

(39)

The ledger is merely a bookkeeping device and therefore does not provide much useful data for management.

(True/False)

4.8/5  (34)

(34)

Identify the impact on the accounting equation of the following transactions.

1. Purchased 36-month insurance policy for cash.

2. Purchased supplies on account.

3. Received utility bill to be paid at later date.

4. Paid utility bill previously accrued.

(Essay)

4.7/5  (39)

(39)

At January 31, 2018, the balance in Aislers Inc.'s supplies account was $750. During February, Aislers purchased supplies of $900 and used supplies of $1,125. At the end of February, the balance in the supplies account should be

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following is incorrect regarding a trial balance?

(Multiple Choice)

5.0/5  (31)

(31)

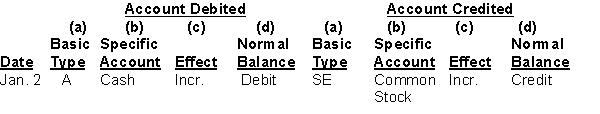

Selected transactions for Good Home, a property management company, in its first month of business, are as follows:

Jan. 2 Issued stock to investors for $15,000 cash.

3 Purchased used car for $5,200 cash for use in business.

9 Purchased supplies on account for $500.

11 Billed customers $2,100 for services performed.

16 Paid $450 cash for advertising.

20 Received $1,300 cash from customers billed on January 11.

23 Paid creditor $300 cash on balance owed.

28 Paid dividends of $2,000.

Instructions

For each transaction indicate the following.

(a) The basic type of account debited and credited (asset (A), liability (L), stockholders' equity (SE)).

(b) The specific account debited and credited (cash, rent expense, service revenue, etc.).

(c) Whether the specific account is increased (incr.) or decreased (decr).

(d) The normal balance of the specific account.

Use the following format, in which the January 2 transaction is given as an example.

(Essay)

4.9/5  (39)

(39)

When three or more accounts are required in one journal entry, the entry is referred to as a ________________ entry.

(Short Answer)

4.7/5  (39)

(39)

A debit is not the normal balance for which account listed below?

(Multiple Choice)

4.9/5  (42)

(42)

A sales slip, a check, and a cash register tape are examples of ________________ used as evidence that a transaction has taken place.

(Short Answer)

4.8/5  (32)

(32)

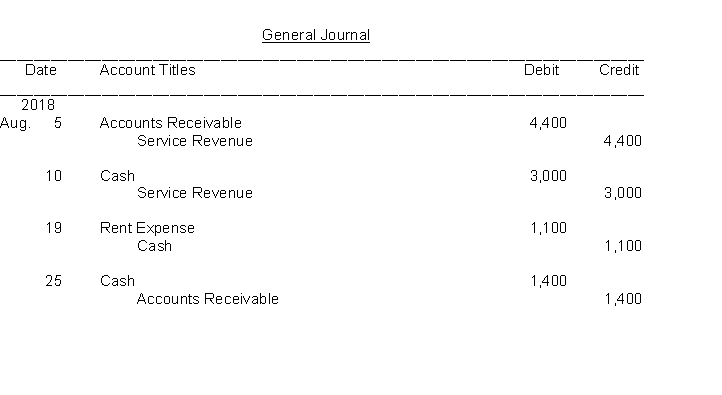

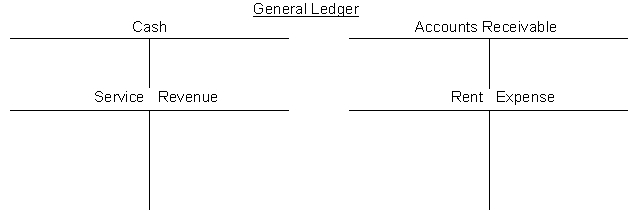

The transactions of the Liberty Belle Store are recorded in the general journal below. You are to post the journal entries to T-accounts.

(Essay)

4.8/5  (34)

(34)

The basic steps in the recording process are: _______________ each transaction, enter the transaction in a ________________, and transfer the _______________ information to appropriate accounts in the ________________.

(Short Answer)

4.8/5  (44)

(44)

An accounting record of the balances of all assets, liabilities, and stockholders' equity accounts is called a

(Multiple Choice)

4.9/5  (38)

(38)

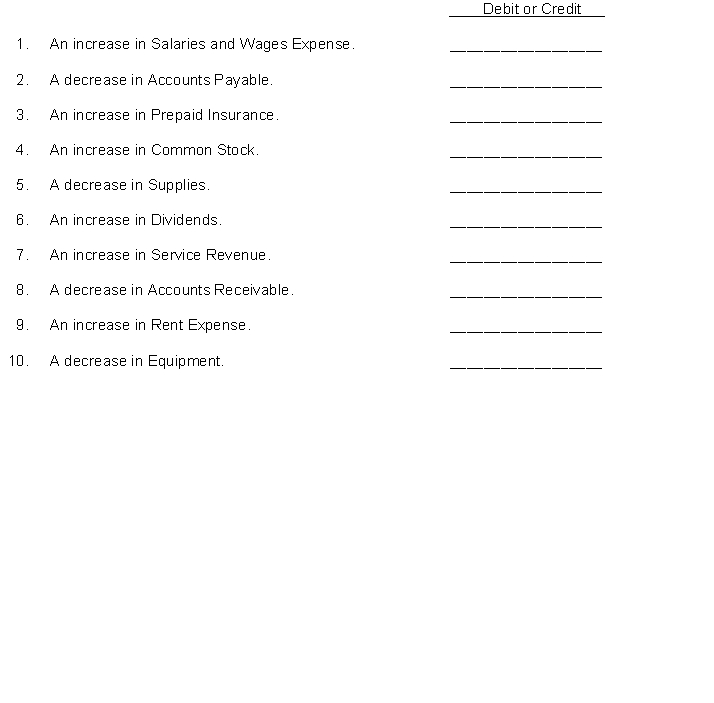

Under a double-entry system, show how the entry in each statement is entered in the ledger by using debit or credit to indicate the increase or decrease in the affected account.

(Essay)

4.9/5  (41)

(41)

Showing 41 - 60 of 195

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)