Exam 11: Reporting and Analyzing Shareholders Equity

Exam 1: The Purpose and Use of Financial Statements90 Questions

Exam 2: A Further Look at Financial Statements130 Questions

Exam 3: The Accounting Information System96 Questions

Exam 4: Accrual Accounting Concepts87 Questions

Exam 5: Merchandising Operations93 Questions

Exam 6: Reporting and Analyzing Inventory98 Questions

Exam 7: Internal Control and Cash95 Questions

Exam 8: Reporting and Analyzing Receivables70 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets139 Questions

Exam 10: Reporting and Analyzing Liabilities98 Questions

Exam 12: Reporting and Analyzing Investments130 Questions

Exam 13: Statement of Cash Flows75 Questions

Exam 14: Performance Measurement66 Questions

Select questions type

Use the following information for questions.

Fair Corporation issues 7,500 preferred shares for $25 per share.

-In the statement of financial position, the effects of the above transaction will be reported under

(Multiple Choice)

4.9/5  (34)

(34)

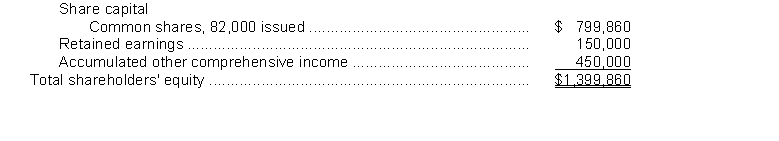

Glenn Corporation's shareholders' equity section at December 31, 2017 appears below:Shareholders' equity  On June 30, 2018, the board of directors declared a 15% stock dividend, distributable on July 31 to shareholders of record on July 15. The fair value of Glenn Corporation's shares on June 30 was $14.On December 1, 2018, the board of directors declared a 2-for-1 stock split effective December 15. Glenn Corporation's shares were selling for $20 on December 1, 2018, before the stock split was declared. Net income for 2018 was $230,000 and there were no cash dividends declared.Instructions

a. Prepare the journal entries on the appropriate dates to record the stock dividend and the stock split. If no entry is needed write "No entry required."

b. Prepare all closing entries required on December 31, 2018.

c. Fill in the amounts that would appear in the shareholders' equity section for Glenn Corporation at December 31, 2018, for the following items:

On June 30, 2018, the board of directors declared a 15% stock dividend, distributable on July 31 to shareholders of record on July 15. The fair value of Glenn Corporation's shares on June 30 was $14.On December 1, 2018, the board of directors declared a 2-for-1 stock split effective December 15. Glenn Corporation's shares were selling for $20 on December 1, 2018, before the stock split was declared. Net income for 2018 was $230,000 and there were no cash dividends declared.Instructions

a. Prepare the journal entries on the appropriate dates to record the stock dividend and the stock split. If no entry is needed write "No entry required."

b. Prepare all closing entries required on December 31, 2018.

c. Fill in the amounts that would appear in the shareholders' equity section for Glenn Corporation at December 31, 2018, for the following items:

(Essay)

4.8/5  (43)

(43)

The sale of shares in a corporation by one shareholder to another affects the total capital of the corporation.

(True/False)

4.9/5  (38)

(38)

Corporations reporting under IFRS have the option of preparing either a statement of changes in equity or a statement of retained earnings.

(True/False)

4.7/5  (35)

(35)

Companies reporting under ASPE must disclose basic earnings per share, but companies reporting under IFRS do not.

(True/False)

4.8/5  (32)

(32)

Which of the following would not be true of a privately held corporation?

(Multiple Choice)

4.7/5  (41)

(41)

Which of the following is not a significant date with respect to dividends?

(Multiple Choice)

4.8/5  (42)

(42)

Most companies in Canada have an unlimited amount of authorized shares.

(True/False)

4.8/5  (39)

(39)

If a corporation reports a net income, it should be closed to retained earnings. If it reports a loss, it should be closed to a contributed capital account.

(True/False)

4.9/5  (46)

(46)

When preferred shares are cumulative, preferred dividends not declared in a given period are called dividends in arrears.

(True/False)

4.8/5  (32)

(32)

The number of shares that may be issued according to the corporation's articles of incorporation is referred to as the

(Multiple Choice)

4.9/5  (27)

(27)

Basic earnings per share is calculated by dividing the net income available to common shareholders by the number of common shares issued at year end.

(True/False)

4.8/5  (43)

(43)

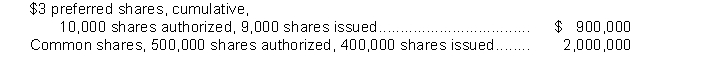

The shareholders' equity section of Starr Corporation at December 31, 2017, included the following:  Dividends were not declared on the preferred shares in 2017 and are in arrears.On September 15, 2018, the board of directors declared dividends on the preferred shares for 2017 and 2018, to shareholders of record on October 1, 2018, payable on October 15, 2018.On November 1, 2018, the board of directors declared a $0.50 per share dividend on the common shares, payable November 30, 2018, to shareholders of record on November 15, 2018.InstructionsPrepare the journal entries that should be made by Starr Corporation on the following dates in 2018: September 15, October 1, October 15, November 1, November 15, and November 30. If no entry is needed write "No entry required."

Dividends were not declared on the preferred shares in 2017 and are in arrears.On September 15, 2018, the board of directors declared dividends on the preferred shares for 2017 and 2018, to shareholders of record on October 1, 2018, payable on October 15, 2018.On November 1, 2018, the board of directors declared a $0.50 per share dividend on the common shares, payable November 30, 2018, to shareholders of record on November 15, 2018.InstructionsPrepare the journal entries that should be made by Starr Corporation on the following dates in 2018: September 15, October 1, October 15, November 1, November 15, and November 30. If no entry is needed write "No entry required."

(Essay)

4.8/5  (38)

(38)

The main purpose of a stock split is to increase the marketability of the shares.

(True/False)

4.8/5  (37)

(37)

A debit balance in the Retained Earnings account is called a deficit.

(True/False)

4.9/5  (31)

(31)

The number of common shares authorized can never be greater than the number of shares issued.

(True/False)

4.8/5  (36)

(36)

Showing 81 - 100 of 118

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)