Exam 4: Accrual Accounting Concepts

Exam 1: The Purpose and Use of Financial Statements90 Questions

Exam 2: A Further Look at Financial Statements130 Questions

Exam 3: The Accounting Information System96 Questions

Exam 4: Accrual Accounting Concepts87 Questions

Exam 5: Merchandising Operations93 Questions

Exam 6: Reporting and Analyzing Inventory98 Questions

Exam 7: Internal Control and Cash95 Questions

Exam 8: Reporting and Analyzing Receivables70 Questions

Exam 9: Reporting and Analyzing Long-Lived Assets139 Questions

Exam 10: Reporting and Analyzing Liabilities98 Questions

Exam 12: Reporting and Analyzing Investments130 Questions

Exam 13: Statement of Cash Flows75 Questions

Exam 14: Performance Measurement66 Questions

Select questions type

Ray Autobody purchased a car jack for $16,000 on July 1. The estimated useful life of the car jack is 4 years. If the financial statements are prepared on December 31, Ray should make the following adjusting journal entry, assuming adjusting entries are made only annually:

(Multiple Choice)

4.8/5  (34)

(34)

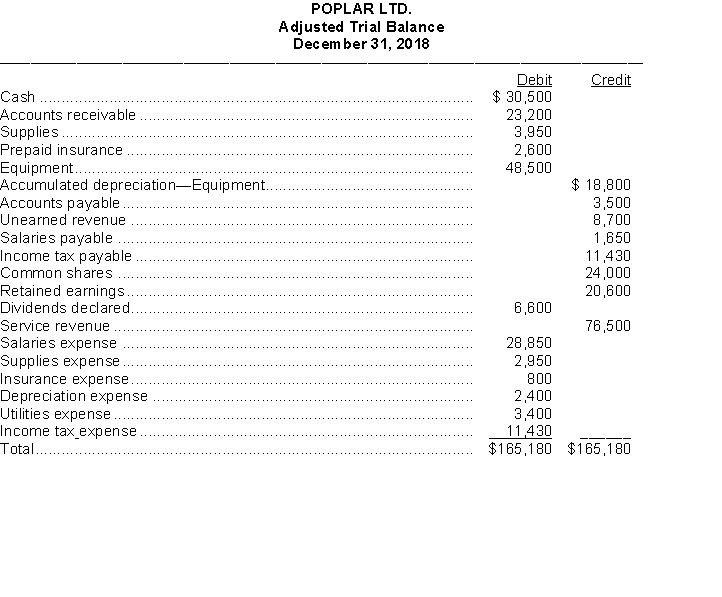

The adjusted trial balance for Poplar Ltd. at December 31, 2018, is shown below.  InstructionsPrepare the closing journal entries required.

InstructionsPrepare the closing journal entries required.

(Essay)

4.9/5  (37)

(37)

The cost of any depreciable asset less accumulated depreciation reflects the carrying amount of the asset.

(True/False)

5.0/5  (36)

(36)

On July 1, Kingston Store paid $15,000 to Location Realty for six months rent, starting July 1. Prepaid Rent was debited for the full amount. If financial statements are prepared on July 31, the adjusting entry to be made by Kingston Store is

(Multiple Choice)

4.9/5  (39)

(39)

A legal firm received $2,000 cash for legal services to be rendered in the future. The full amount was credited to Unearned Revenue. If the legal services have been provided at the end of the accounting period and no adjusting entry has previously been made, this would cause

(Multiple Choice)

4.8/5  (30)

(30)

The purchase of certain types of long-lived (non-current) assets is essentially a long-term prepayment for services.

(True/False)

4.9/5  (31)

(31)

The Town Laundry Ltd. purchased $5,500 worth of laundry supplies on June 2 and recorded the purchase as an asset in the Supplies account. On June 30, a count of the laundry supplies indicated only $3,000 on hand. The adjusting entry that should be made by the company on June 30 is

(Multiple Choice)

4.9/5  (39)

(39)

Closing entries result in the transfer of net income or loss into the Retained Earnings account.

(True/False)

4.8/5  (39)

(39)

Accumulated Depreciation is a liability account and its normal account balance is a credit.

(True/False)

4.9/5  (45)

(45)

A dress shop makes a dress that sells for $200 and delivers it to the customer on June 30. The customer is sent a statement on July 7 and a cheque is received by the dress shop on July 11. When should the $200 be recognized as revenue?

(Multiple Choice)

4.9/5  (36)

(36)

The post-closing trial balance will have fewer accounts than the adjusted trial balance.

(True/False)

4.9/5  (34)

(34)

When closing entries are posted, the result is a zero balance in each income statement account.

(True/False)

4.8/5  (35)

(35)

Under the accrual basis of accounting, expenses are only recognized when they are paid.

(True/False)

4.9/5  (33)

(33)

Under IFRS, which of the following is generally not a guideline for recognizing revenue?

(Multiple Choice)

4.9/5  (42)

(42)

Showing 41 - 60 of 87

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)