Exam 20: Forming and Operating Partnerships

Exam 1: An Introduction to Tax134 Questions

Exam 2: Tax Compliance, the Irs, and Tax Authorities109 Questions

Exam 3: Tax Planning Strategies and Related Limitations137 Questions

Exam 4: Individual Income Tax Overview, Dependents, and Filing Status130 Questions

Exam 5: Gross Income and Exclusions152 Questions

Exam 6: Individual Deductions117 Questions

Exam 7: Investments93 Questions

Exam 8: Individual Income Tax Computation and Tax Credits179 Questions

Exam 9: Business Income, Deductions, and Accounting Methods129 Questions

Exam 10: Property Acquisition and Cost Recovery131 Questions

Exam 11: Property Dispositions132 Questions

Exam 12: Compensation122 Questions

Exam 13: Retirement Savings and Deferred Compensation157 Questions

Exam 14: Tax Consequences of Home Ownership126 Questions

Exam 15: Entities Overview87 Questions

Exam 16: Corporate Operations126 Questions

Exam 17: Accounting for Income Taxes125 Questions

Exam 18: Corporate Taxation: Nonliquidating Distributions122 Questions

Exam 19: Corporate Formation, Reorganization, and Liquidation121 Questions

Exam 20: Forming and Operating Partnerships131 Questions

Exam 21: Dispositions of Partnership Interests and Partnership Distributions118 Questions

Exam 22: S Corporations157 Questions

Exam 23: State and Local Taxes139 Questions

Exam 24: The Us Taxation of Multinational Transactions105 Questions

Exam 25: Transfer Taxes and Wealth Planning145 Questions

Select questions type

In each of the independent scenarios below, how does the partner or partnership determine its holding period in the property received?

a. A partner contributes property in exchange for a partnership interest.

b. The partnership receives contributed property.

c. A partner contributes services in exchange for a partnership interest.

d. A partner purchases a partnership interest from an existing partner.

(Essay)

4.9/5  (40)

(40)

How does a partnership make a tax election for the current year?

(Multiple Choice)

4.8/5  (37)

(37)

Which of the following items is subject to the net investment income tax when a partner is not a material participant in the partnership?

(Multiple Choice)

4.8/5  (34)

(34)

This year, Reggie's distributive share from Almonte Partnership includes $8,000 of interest income, $4,000 of dividend income, and $60,000of ordinary business income.

A. Assume that Reggie materially participates in the partnership. How much of his distributive share from Almonte Partnership is potentially subject to the net investment income tax?

B. Assume that Reggie does not materially participate in the partnership. How much of his distributive share from Almonte Partnership is potentially subject to the net investment income tax?

(Essay)

4.9/5  (46)

(46)

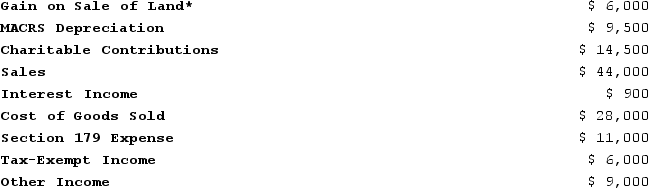

ER General Partnership, a medical supplies business, states in its partnership agreement that Erin and Ryan agree to split profits and losses according to a 40/60 ratio. Additionally, the partnership will provide Erin with a $19,000 guaranteed payment for services she provides to the partnership. ER Partnership reports the following revenues, expenses, gains, losses, and distributions for its current taxable year:

*The land is a Section 1231 asset.

Given these items, answer the following questions:

A. Compute Erin's share of ordinary income (loss)and separately stated items. Include her self-employment income as a separately stated item.

B. Compute Erin's self-employment income but assume ER Partnership is a limited partnership and Erin is a limited partner.

C. Compute Erin's self-employment income but assume ER Partnership is an LLC and Erin is personally liable for half of the debt of the LLC. Apply the IRS's proposed regulations in formulating your answer.

*The land is a Section 1231 asset.

Given these items, answer the following questions:

A. Compute Erin's share of ordinary income (loss)and separately stated items. Include her self-employment income as a separately stated item.

B. Compute Erin's self-employment income but assume ER Partnership is a limited partnership and Erin is a limited partner.

C. Compute Erin's self-employment income but assume ER Partnership is an LLC and Erin is personally liable for half of the debt of the LLC. Apply the IRS's proposed regulations in formulating your answer.

(Essay)

5.0/5  (42)

(42)

Hilary had an outside basis in LTL General Partnership of $14,000 at the beginning of the year. LTL reported the following items on Hilary's K-1 for the year: ordinary business income of $9,000, a $14,000 reduction in Hilary's share of partnership debt, a cash distribution of $24,000, and tax-exempt income of $7,000. What is Hilary's adjusted basis at the end of the year?

(Multiple Choice)

4.8/5  (36)

(36)

What form does a partnership use when filing an annual informational return?

(Multiple Choice)

4.9/5  (25)

(25)

If a taxpayer sells a passive activity with suspended passive activity losses from prior years, what type of income can generally be offset by the suspended passive losses in the year of sale?

(Multiple Choice)

4.8/5  (41)

(41)

On April 18, 20X8, Robert sold his 35 percent partnership interest in Fruit Wonder, LLC, to Richard for $120,000. Prior to selling his interest, Robert had a basis in Fruit Wonder of $80,000. Robert's basis included $5,000 of recourse debt and $15,000 of nonrecourse debt that had been allocated to him. Immediately after the purchase, what is Richard's tax basis in Fruit Wonder?

(Essay)

4.8/5  (36)

(36)

Hilary had an outside basis in LTL General Partnership of $10,000 at the beginning of the year. LTL reported the following items on Hilary's K-1 for the year: ordinary business income of $5,000, a $10,000 reduction in Hilary's share of partnership debt, a cash distribution of $20,000, and tax-exempt income of $3,000. What is Hilary's adjusted basis at the end of the year?

(Multiple Choice)

4.8/5  (48)

(48)

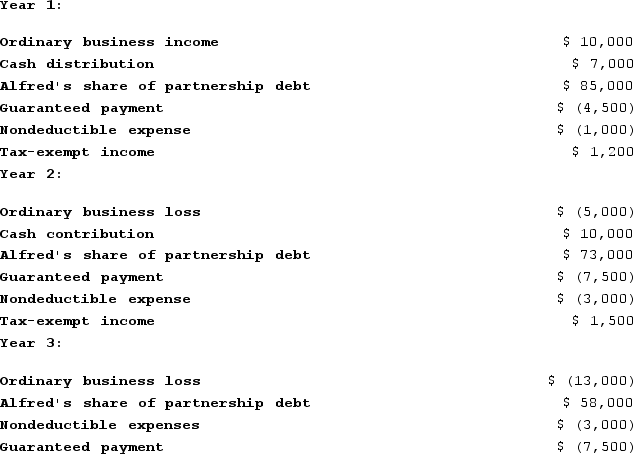

Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

(Essay)

4.7/5  (38)

(38)

Styling Shoes, LLC, filed its 20X8 Form 1065 on March 15, 20X9. Styling had three members with the following ownership interests and tax bases at the beginning of 20X8: (1)Jane, a member with a 25percent profits and capital interest and a $5,000 outside basis, (2)Joe, a member with a 45percent profits and capital interest and a $10,000 outside basis, and (3)Jack, a member with a 30percent profits and capital interest and a $2,000 outside basis. The following items were reported on Styling's Schedule K for the year: ordinary income of $100,000, Section 1231 gain of $15,000, charitable contributions of $25,000, and tax-exempt income of $3,000. In addition, Styling received an additional bank loan of $12,000 during 20X8. What is Jane's tax basis after adjustment for her share of these items?

(Multiple Choice)

4.9/5  (42)

(42)

A general partner's share of ordinary business income is similar to investment income; thus, a general partner only includes their guaranteed payments as self-employment income.

(True/False)

4.8/5  (29)

(29)

In X1, Adam and Jason formed ABC, LLC, a car dealership in Kansas City. In X2, Adam and Jason realized they needed an advertising expert to assist in their business. Thus, the two members offered Cory, a marketing expert, a one-third capital interest in their partnership for contributing his expert services. Cory agreed to this arrangement and received his capital interest in X2. If the value of the LLC's capital equals $180,000 when Cory receives his one-third capital interest, which of the following tax consequences does not occur in X2?

(Multiple Choice)

4.8/5  (28)

(28)

Erica and Brett decide to form their new motorcycle business as an LLC . Each will receive an equal profits (loss)interest by contributing cash, property, or both. In addition to the members' contributions, their LLC will obtain a $50,000 nonrecourse loan from First Bank at the time it is formed. Brett contributes cash of $5,000 and a building he bought as a storefront for the motorcycles. The building has an FMV of $45,000and an adjusted basis of $30,000 and is secured by a $35,000 nonrecourse mortgage that the LLC will assume. What is Brett's outside tax basis in his LLC interest?

(Multiple Choice)

4.8/5  (35)

(35)

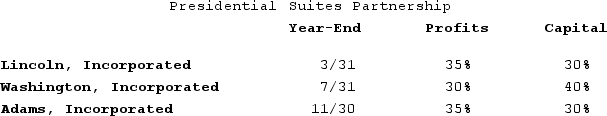

Lincoln, Incorporated, Washington, Incorporated, and Adams, Incorporated, form Presidential Suites Partnership on February 15, 20X9. Now, Presidential Suites must adopt its required tax year-end. The partners' year-ends, profits interests, and capital interests are reflected in the table below. Given this information, what tax year-end must Presidential Suites use, and what rule requires this year-end?

(Essay)

4.8/5  (35)

(35)

Actual or deemed cash distributions in excess of a partner's outside basis are generally taxable as capital gains.

(True/False)

4.8/5  (36)

(36)

On 12/31/X4, Zoom, LLC, reported a $60,000 loss on its books. The items included in the loss computation were $30,000 in sales revenue, $15,000 in qualified dividends, $22,000 in cost of goods sold, $50,000in charitable contributions, $20,000 in employee wages, and $13,000 of rent expense. How much ordinary business income (loss)will Zoom report on its X4 return?

(Multiple Choice)

4.8/5  (48)

(48)

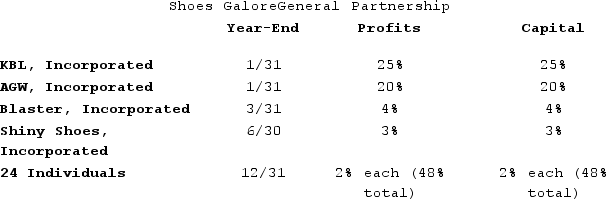

KBL, Incorporated, AGW, Incorporated, Blaster, Incorporated, Shiny Shoes, Incorporated, and a group of 24 individuals form Shoes Galore General Partnership on October 11, 20X9. Now, Shoes Galore must adopt its required tax year-end. The partners' year-ends, profits interests, and capital interests are reflected in the table below. Given this information, what tax year-end must Shoes Galore use, and what rule requires this year-end?

(Essay)

4.8/5  (32)

(32)

Nonrecourse debt is generally allocated according to the profit-sharing ratios of the partnership.

(True/False)

4.8/5  (28)

(28)

Showing 41 - 60 of 131

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)