Exam 12: State and Local Taxes

Exam 1: Business Income, Deductions, and Accounting Methods105 Questions

Exam 2: Property Acquisition and Cost Recovery86 Questions

Exam 3: Property Dispositions111 Questions

Exam 4: Business Entities Overview81 Questions

Exam 5: Corporate Operations114 Questions

Exam 6: Accounting for Income Taxes106 Questions

Exam 7: Corporate Taxation: Non-Liquidating Distributions101 Questions

Exam 8: Corporate Formation, Reorganization, and Liquidation108 Questions

Exam 9: Forming and Operating Partnerships114 Questions

Exam 10: Dispositions of Partnership Interests and Partnership Distributions94 Questions

Exam 11: S Corporations132 Questions

Exam 12: State and Local Taxes114 Questions

Exam 13: The Us Taxation of Multinational Transactions88 Questions

Exam 14: Transfer Taxes and Wealth Planning114 Questions

Select questions type

Separate-return states require each member of a consolidated group with income tax nexus to file their own state income tax return.

(True/False)

4.8/5  (36)

(36)

The Wayfair decision reversed the Quill decision, which had affirmed that out-of-state businesses must have physical presence within a state before the state may require the collection of sales taxes from in-state customers.

(True/False)

4.9/5  (29)

(29)

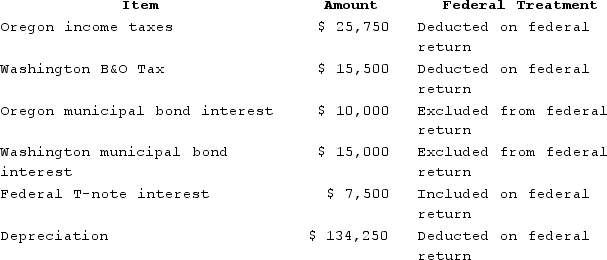

Moss Incorporated is a Washington corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

Moss's Oregon depreciation was $145,500. Moss's federal taxable income was $549,743. Assuming Oregon taxes all municipal bond interest, calculate Moss's Oregon state tax base.

Moss's Oregon depreciation was $145,500. Moss's federal taxable income was $549,743. Assuming Oregon taxes all municipal bond interest, calculate Moss's Oregon state tax base.

(Short Answer)

4.8/5  (37)

(37)

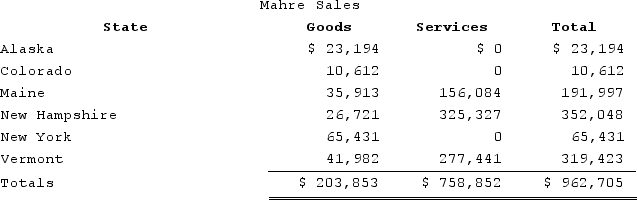

Mahre, Incorporated, a New York corporation, runs ski tours in several states. Mahre also has a New York retail store and an Internet store, which ships to out-of-state customers. The ski tours operate in Maine, New Hampshire, and Vermont, where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:  Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (6.75 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit in Maine?

Assume the following sales tax rates: Alaska (0 percent), Colorado (7.75 percent), Maine (8.5 percent), New Hampshire (6.75 percent), New York (8 percent), and Vermont (5 percent). How much sales and use tax must Mahre collect and remit in Maine?

(Multiple Choice)

4.8/5  (45)

(45)

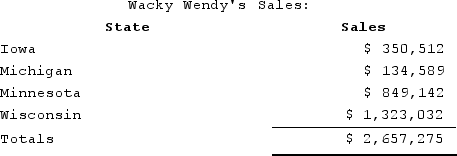

Wacky Wendy produces gourmet cheese in Wisconsin. Wendy has sales as follows:  Wendy is a Wisconsin corporation and has the following operations:

Wendy has income tax nexus in Iowa, Minnesota, and Wisconsin. The Michigan sales are shipped from Wisconsin (a throwback state). $100,000 of the Wisconsin sales were to the federal government. What is Wendy's Wisconsin sale numerator?

Wendy is a Wisconsin corporation and has the following operations:

Wendy has income tax nexus in Iowa, Minnesota, and Wisconsin. The Michigan sales are shipped from Wisconsin (a throwback state). $100,000 of the Wisconsin sales were to the federal government. What is Wendy's Wisconsin sale numerator?

(Multiple Choice)

4.9/5  (36)

(36)

Big Company and Little Company are both owned by Mrs. Smith. Big and Little file a consolidated federal tax return. Big manufactures office paper and other paper supplies and is based in Washington. Little operates a logging operation in Montana. Sixty percent of Little's sales are made to Big. Ten percent of Big's raw materials come from Little. There are no common officers or board members. There are no common service providers. What are the factors for and against filing a unitary tax return?

(Essay)

4.8/5  (39)

(39)

Which of the following isn't a requirement of Public Law 86-272?

(Multiple Choice)

4.9/5  (31)

(31)

Assume Tennis Pro discovered that one salesperson has gone into Arkansas once each year for the past four years and performed activities that create both sales tax nexus and income tax nexus. Assume that Arkansas sales were $25,000 each year. Assume that Tennis Pro business income would be $200,000 each year and that Tennis Pro's Arkansas apportionment percentage would be 1 percent. Assume there would be no Arkansas nonbusiness income. Assume that Arkansas sales and use tax rate was 6.5 percent and corporate income tax rate was 5 percent. What would Tennis Pro's Arkansas sales and use tax and income tax liability be, ignoring any possible penalties and interest?

(Essay)

4.8/5  (39)

(39)

Interest and dividends are allocated to the state of commercial domicile.

(True/False)

4.9/5  (33)

(33)

Mighty Manny, Incorporated manufactures ice scrapers and distributes them across the midwestern United States. Mighty Manny is incorporated and headquartered in Michigan. It has product sales to customers in Illinois, Indiana, Michigan, Minnesota, Wisconsin, and Wyoming. It has sales personnel only in the states discussed and all these states have adopted Wayfair legislation. Determine the state in which Mighty Manny does not have sales tax nexus given the following scenarios:

(Multiple Choice)

4.9/5  (40)

(40)

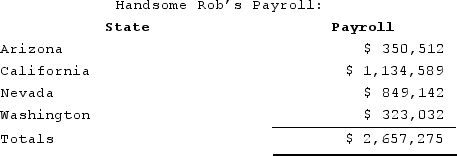

Handsome Rob provides transportation services in several western states. Rob has payroll as follows:  Rob is a California corporation and the following is true:

Rob has income tax nexus in Arizona, California, Nevada, and Washington. The Washington drivers spend 25 percent of their time driving through Oregon. California payroll includes $200,000 of payroll for services provided in Nevada by California-based drivers. What is Rob's California payroll numerator?

Rob is a California corporation and the following is true:

Rob has income tax nexus in Arizona, California, Nevada, and Washington. The Washington drivers spend 25 percent of their time driving through Oregon. California payroll includes $200,000 of payroll for services provided in Nevada by California-based drivers. What is Rob's California payroll numerator?

(Multiple Choice)

4.8/5  (46)

(46)

The throwback rule requires a company, for apportionment purposes, to include all sales of inventory sold into a state without income tax nexus rather than from the state from where the inventory was shipped.

(True/False)

5.0/5  (50)

(50)

All of the following are false regarding apportionment except?

(Multiple Choice)

4.9/5  (43)

(43)

All states employ some combination of sales and use tax, income or franchise tax, or property tax to fund their government operations.

(True/False)

4.9/5  (34)

(34)

Purchases of inventory for resale are typically exempt from sales and use taxes.

(True/False)

4.7/5  (32)

(32)

Roxy operates a dress shop in Arlington, Virginia. Roxy also ships dresses nationwide upon request. Roxy's Virginia sales are $1,000,000 and out-of-state sales are $200,000. Assuming that Virginia's sales tax rate is 5 percent, what is Roxy's Virginia sales and use tax collection obligation?

(Multiple Choice)

4.8/5  (32)

(32)

Federal/state adjustments correct for differences between two states' tax laws.

(True/False)

4.8/5  (37)

(37)

Roxy operates a dress shop in Arlington, Virginia. Lisa, a Maryland resident, comes in for a measurement and purchases a $2,600 dress that is shipped to her Maryland residence using a common carrier. Roxy's total Maryland sales are $33,800 on 15 transactions. Assuming that Virginia's sales tax rate is 5 percent and that Maryland's sales tax rate is 7 percent, what is Roxy's sales and use tax collection obligation?

(Multiple Choice)

4.9/5  (43)

(43)

Gordon operates the Tennis Pro Shop in Blacksburg, Virginia. The shop sells, manufactures, and customizes tennis racquets for serious amateurs. Virginia has a 5 percent sales tax. Assume that a District of Columbia customer picks up a $2,000 racquet order in the Blacksburg store and drives it back to the District of Columbia (where the sales tax rate is 8.5 percent). Determine the sales and use tax liabilityof the customer. (Assume the shop has no sales personnel or property in District of Columbia, and District of Columbia sales don't exceed the Wayfair thresholds.)

(Essay)

4.9/5  (39)

(39)

Showing 21 - 40 of 114

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)