Exam 20: Uncertainty, Risk, and Private Information

Exam 1: First Principles233 Questions

Exam 2: Economic Models: Trade-Offs and Trade 25382 Questions

Exam 3: Supply and Demand290 Questions

Exam 4: Consumer and Producer Surplus224 Questions

Exam 5: Price Controls and Quotas: Meddling With Markets227 Questions

Exam 6: Elasticity300 Questions

Exam 7: Taxes298 Questions

Exam 8: International Trade272 Questions

Exam 9: Decision Making by Individuals Firms201 Questions

Exam 10: The Rational Consumer372 Questions

Exam 11: Behind the Supply Curve: Inputs and Costs362 Questions

Exam 12: Perfect Competition and the Supply Curve355 Questions

Exam 13: Monopoly350 Questions

Exam 14: Oligopoly294 Questions

Exam 15: Monopolistic Competition and Product Differentiation262 Questions

Exam 16: Externalities199 Questions

Exam 17: Public Goods Common Resources224 Questions

Exam 18: The Economics of the Welfare140 Questions

Exam 19: Factor Markets and the Distribution of Income369 Questions

Exam 20: Uncertainty, Risk, and Private Information202 Questions

Select questions type

Given uncertainty, individuals attempt to maximize their:

Free

(Multiple Choice)

4.9/5  (40)

(40)

Correct Answer:

B

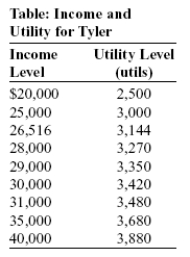

Use the following to answer questions:  -(Table: Income and Utility for Tyler) The table Income and Utility for Tyler shows the utility Tyler receives at various income levels, but she does not know what her income will be next year. There is a 40% chance her income will be $20,000, a 40% chance her income will be $30,000, and a 20% chance her income will be $40,000. We know that Tyler is risk-averse because:

-(Table: Income and Utility for Tyler) The table Income and Utility for Tyler shows the utility Tyler receives at various income levels, but she does not know what her income will be next year. There is a 40% chance her income will be $20,000, a 40% chance her income will be $30,000, and a 20% chance her income will be $40,000. We know that Tyler is risk-averse because:

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

D

The expected value of a random variable is:

Free

(Multiple Choice)

4.9/5  (36)

(36)

Correct Answer:

C

Use the following to answer questions:  -(Table: Income and Utility for Tyler) The table Income and Utility for Tyler shows the utility Tyler receives at various income levels, but she does not know what her income will be next year. There is a 40% chance her income will be $20,000, a 40% chance her income will be $30,000, and a 20% chance her income will be $40,000. What is her expected income?

-(Table: Income and Utility for Tyler) The table Income and Utility for Tyler shows the utility Tyler receives at various income levels, but she does not know what her income will be next year. There is a 40% chance her income will be $20,000, a 40% chance her income will be $30,000, and a 20% chance her income will be $40,000. What is her expected income?

(Multiple Choice)

4.9/5  (32)

(32)

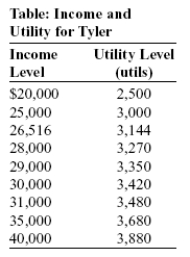

Use the following to answer questions:  -(Table: Total Utility of Income After College Expenses) Look at the table Total Utility of Income After College Expenses. Mr. and Mrs. Smith would be willing to pay as much as _____ for insurance to pay their daughter's tuition and eliminate the uncertainty in the family's income after tuition.

-(Table: Total Utility of Income After College Expenses) Look at the table Total Utility of Income After College Expenses. Mr. and Mrs. Smith would be willing to pay as much as _____ for insurance to pay their daughter's tuition and eliminate the uncertainty in the family's income after tuition.

(Multiple Choice)

4.8/5  (38)

(38)

In a particular insurance market, there is a decrease in the degree of risk aversion among buyers. Holding everything else constant, the equilibrium premium will _____ and the equilibrium quantity of insurance will _____.

(Multiple Choice)

4.8/5  (33)

(33)

The future price of one share of General Motors stock is a random variable.

(True/False)

4.7/5  (41)

(41)

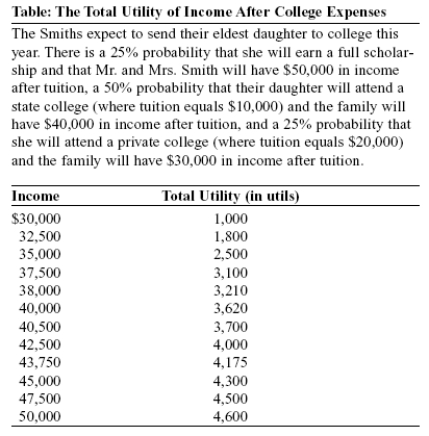

Use the following to answer questions:  -(Table: Choice with Uncertainty) Look at the table Choice with Uncertainty. Suppose the probability that the sitcom does not make it to television is 50%, that it makes it to television but is not the most viewed show in its time slot is 30%, and that it makes it to television and is the most viewed show in its time slot is 20%. Given this information, Norman's expected total utility is _____ utils.

-(Table: Choice with Uncertainty) Look at the table Choice with Uncertainty. Suppose the probability that the sitcom does not make it to television is 50%, that it makes it to television but is not the most viewed show in its time slot is 30%, and that it makes it to television and is the most viewed show in its time slot is 20%. Given this information, Norman's expected total utility is _____ utils.

(Multiple Choice)

4.9/5  (30)

(30)

Mary and Bob are trying to decide how much auto insurance to buy. They share the same expectations of an accident, with the same dollar loss. They also have the same income levels. However, Mary would rather buy very little insurance, while Bob would rather buy much more insurance. This suggests that:

(Multiple Choice)

4.9/5  (34)

(34)

Louis has invested $1,000 in the stock market. At the end of one year, there is a 30% chance that his stock will be worth only $800 and a 70% chance that it will be worth $1,200. The expected value of his stock at the end of one year is:

(Multiple Choice)

4.9/5  (35)

(35)

You have one ticket for a raffle with a grand prize of $1,000. There are two prizes worth $100 and five prizes worth $20. If only 100 tickets have been distributed, what is the expected value of your winnings?

(Essay)

4.8/5  (43)

(43)

Two possible events are independent if they happen at different times and in different places.

(True/False)

4.9/5  (35)

(35)

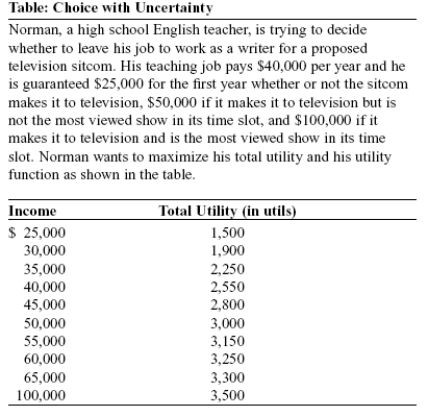

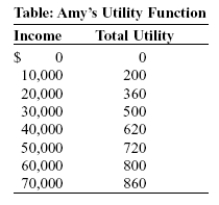

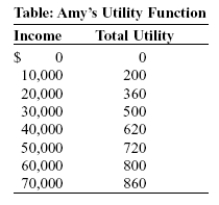

Use the following to answer questions:  -(Table: Amy's Utility Function) Look at the table Amy's Utility Function. Amy is an entrepreneur with current income equal to $40,000. Amy is considering development of a new product. The probability that her new product earns Amy $10,000 in additional income is 0.5, and the probability that Amy incurs a reduction of $10,000 from her current income is also 0.5. Suppose Amy can buy a fair insurance policy that will compensate her for any losses. Amy's premium will be _____, her guaranteed income will be _____, and her expected utility will be _____ utils.

-(Table: Amy's Utility Function) Look at the table Amy's Utility Function. Amy is an entrepreneur with current income equal to $40,000. Amy is considering development of a new product. The probability that her new product earns Amy $10,000 in additional income is 0.5, and the probability that Amy incurs a reduction of $10,000 from her current income is also 0.5. Suppose Amy can buy a fair insurance policy that will compensate her for any losses. Amy's premium will be _____, her guaranteed income will be _____, and her expected utility will be _____ utils.

(Multiple Choice)

4.7/5  (44)

(44)

Assume that flood insurance premiums are determined in the competitive market. Suppose that devastating floods along the Mississippi River have increased the degree of risk aversion among the insurance investors in this market. The _____ insurance shifts _____, leading to a(n) _____ in equilibrium premiums and a(n) _____ in the quantity of insurance bought and sold.

(Multiple Choice)

4.8/5  (34)

(34)

Use the following to answer questions:  -(Table: Amy's Utility Function) Look at the table Amy's Utility Function. Amy is an entrepreneur with current income equal to $40,000. Amy is considering development of a new product. The probability that her new product earns Amy $30,000 in additional income is 0.5, and the probability that Amy incurs a reduction of $10,000 from her current income is also 0.5. Amy's expected utility after developing her new product is _____ utils.

-(Table: Amy's Utility Function) Look at the table Amy's Utility Function. Amy is an entrepreneur with current income equal to $40,000. Amy is considering development of a new product. The probability that her new product earns Amy $30,000 in additional income is 0.5, and the probability that Amy incurs a reduction of $10,000 from her current income is also 0.5. Amy's expected utility after developing her new product is _____ utils.

(Multiple Choice)

4.9/5  (34)

(34)

Rhonda would like a better bicycle, and she considers selling her old one by advertising on the bulletin board in the student center. She decides against it because the used bicycles listed on the board are underpriced. This describes the problem of:

(Multiple Choice)

4.9/5  (44)

(44)

Amanda recently graduated from college, and she has a job offer with uncertain income. There is a 70% probability that she will make $10,000 and a 30% probability that she will make $70,000. Suppose Amanda is offered another job with a certain income. All else equal, if she has a constant marginal utility of income, she will accept the second job offer only if it pays more than:

(Multiple Choice)

4.9/5  (42)

(42)

Used-car dealers will often advertise how long they have been in business as a means of _____ their long-term _____.

(Multiple Choice)

4.7/5  (31)

(31)

Showing 1 - 20 of 202

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)