Exam 20: Uncertainty, Risk, and Private Information

Exam 1: First Principles233 Questions

Exam 2: Economic Models: Trade-Offs and Trade 25382 Questions

Exam 3: Supply and Demand290 Questions

Exam 4: Consumer and Producer Surplus224 Questions

Exam 5: Price Controls and Quotas: Meddling With Markets227 Questions

Exam 6: Elasticity300 Questions

Exam 7: Taxes298 Questions

Exam 8: International Trade272 Questions

Exam 9: Decision Making by Individuals Firms201 Questions

Exam 10: The Rational Consumer372 Questions

Exam 11: Behind the Supply Curve: Inputs and Costs362 Questions

Exam 12: Perfect Competition and the Supply Curve355 Questions

Exam 13: Monopoly350 Questions

Exam 14: Oligopoly294 Questions

Exam 15: Monopolistic Competition and Product Differentiation262 Questions

Exam 16: Externalities199 Questions

Exam 17: Public Goods Common Resources224 Questions

Exam 18: The Economics of the Welfare140 Questions

Exam 19: Factor Markets and the Distribution of Income369 Questions

Exam 20: Uncertainty, Risk, and Private Information202 Questions

Select questions type

On any particular day, the probability that it will rain is 25% and that you will be sick is 10%. The probability that both happen on the same day is:

(Multiple Choice)

4.7/5  (32)

(32)

Suppose that an individual is risk-averse. If this individual's utility function is depicted in a graph, with income measured on the horizontal axis and utils on the vertical axis, the graph will be an upward-sloping:

(Multiple Choice)

4.9/5  (31)

(31)

By offering a menu of policies with different premiums and deductibles, insurance companies can _____ their customers; for example, a low-risk customer will often buy insurance with a lower _____ but a higher _____ than a high-risk customer.

(Multiple Choice)

4.8/5  (37)

(37)

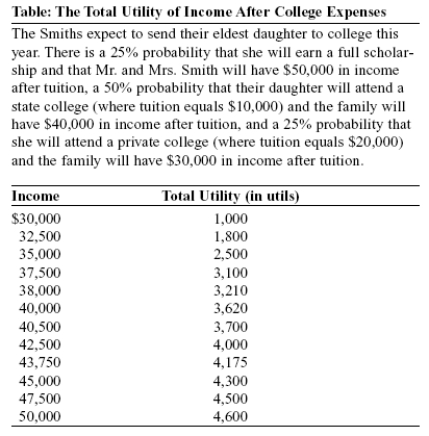

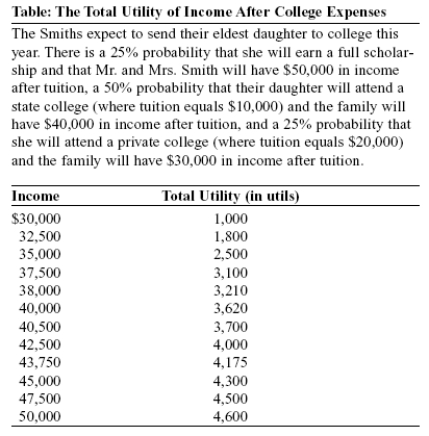

Use the following to answer questions:  -(Table: Total Utility of Income After College Expenses) Look at the table Total Utility of Income After College Expenses. The Smith family's expected income after tuition is:

-(Table: Total Utility of Income After College Expenses) Look at the table Total Utility of Income After College Expenses. The Smith family's expected income after tuition is:

(Multiple Choice)

4.9/5  (36)

(36)

Two consumers go to the insurance company to purchase life insurance. James is a smoker and a police officer who races motorcycles in his spare time. Kathy is a nonsmoker and a librarian who likes to make quilts in her spare time. The insurance company knows that both consumers are 40 years old, but the company has no information about occupations or hobbies. How does the private information in this situation set up an adverse-selection problem? How could the insurance company lessen this problem?

(Essay)

4.7/5  (36)

(36)

Use the following to answer questions:

Scenario: Choosing Insurance

The Ramirez family owns three cars and is considering buying insurance to cover the cost of repairs. They face two possible states: in state 1 their cars need no repairs and their income available for purchasing other goods and services is $50,000; in state 2 their cars need $10,000 worth of repairs and their income available for purchasing other goods and services is reduced to $40,000. The probability of repairs is 10%, while the probability of no repairs is 90%.

-(Scenario: Choosing Insurance) Look at the scenario Choosing Insurance. The premium on a fair insurance policy for the Ramirez family will be:

(Multiple Choice)

4.8/5  (40)

(40)

Which of the following is a principle of the insurance industry?

(Multiple Choice)

4.8/5  (41)

(41)

Jill is a risk-averse expected-utility maximizer. Jack offers her the following bet: he will toss a coin and pay her $5 if it comes down heads, but if it comes down tails, Jill will have to pay him $5. Even though heads and tails are equally likely, Jill will not take the bet.

(True/False)

4.8/5  (33)

(33)

If an insurance company insured 100,000 cars across the state against theft, which of the following would NOT be true?

(Multiple Choice)

4.8/5  (31)

(31)

Use the following to answer questions:

Scenario: Flood Area

Suppose you own a home that is estimated to be worth $250,000. You live in a flood plain; as a result, the probability that you will lose your home to a flood is 30%.

-(Scenario: Flood Area) Look at the scenario Flood Area. A flood may occur, causing you to lose your entire home. In this case, your expected loss resulting from the flood would be:

(Multiple Choice)

4.9/5  (31)

(31)

Which of the following is TRUE if the insurance market is efficient?

(Multiple Choice)

4.7/5  (40)

(40)

Warranties that cover the cost of a repair or replacement will:

(Multiple Choice)

4.7/5  (35)

(35)

Use the following to answer question:  -(Table: Crop Income) Look at the table Crop Income. Brent is a farmer, and his income depends on the weather.A) Calculate Brent's expected income.

B) Calculate Brent's expected utility.

-(Table: Crop Income) Look at the table Crop Income. Brent is a farmer, and his income depends on the weather.A) Calculate Brent's expected income.

B) Calculate Brent's expected utility.

(Essay)

4.8/5  (40)

(40)

If a stock analyst believes there is a 25% probability that the stock price of Dymonatis will be $30 at the end of the year, a 50% probability that it will be $40, and a 25% probability that it will be $50, then the expected value of the stock at the end of the year is:

(Multiple Choice)

4.8/5  (42)

(42)

Use the following to answer questions:  -(Table: Total Utility of Income After College Expenses) Look at the table Total Utility of Income After College Expenses. The premium for a fair insurance policy to pay their daughter's tuition and eliminate the uncertainty in the Smith family's income after tuition would equal:

-(Table: Total Utility of Income After College Expenses) Look at the table Total Utility of Income After College Expenses. The premium for a fair insurance policy to pay their daughter's tuition and eliminate the uncertainty in the Smith family's income after tuition would equal:

(Multiple Choice)

4.8/5  (30)

(30)

You own a shoe store and need a new sales associate. You have a large stack of applications, but unfortunately you have no idea who is a strong salesperson and who is a weak one. What kind of problem are you facing and how can you solve it?

(Essay)

5.0/5  (39)

(39)

Amanda recently graduated from college, and she has a job offer with uncertain income: there is a 70% probability that she will make $10,000 and a 30% probability that she will make $70,000. The expected value of Amanda's income is:

(Multiple Choice)

4.9/5  (38)

(38)

_____ of insurance are often risk-averse, and _____ of insurance are interested in reducing their exposure to risk.

(Multiple Choice)

4.8/5  (28)

(28)

Showing 181 - 200 of 202

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)