Exam 20: Uncertainty, Risk, and Private Information

Exam 1: First Principles233 Questions

Exam 2: Economic Models: Trade-Offs and Trade 25382 Questions

Exam 3: Supply and Demand290 Questions

Exam 4: Consumer and Producer Surplus224 Questions

Exam 5: Price Controls and Quotas: Meddling With Markets227 Questions

Exam 6: Elasticity300 Questions

Exam 7: Taxes298 Questions

Exam 8: International Trade272 Questions

Exam 9: Decision Making by Individuals Firms201 Questions

Exam 10: The Rational Consumer372 Questions

Exam 11: Behind the Supply Curve: Inputs and Costs362 Questions

Exam 12: Perfect Competition and the Supply Curve355 Questions

Exam 13: Monopoly350 Questions

Exam 14: Oligopoly294 Questions

Exam 15: Monopolistic Competition and Product Differentiation262 Questions

Exam 16: Externalities199 Questions

Exam 17: Public Goods Common Resources224 Questions

Exam 18: The Economics of the Welfare140 Questions

Exam 19: Factor Markets and the Distribution of Income369 Questions

Exam 20: Uncertainty, Risk, and Private Information202 Questions

Select questions type

When Lloyd's of London offered to provide insurance to merchant ships in the eighteenth century, Lloyd's was:

(Multiple Choice)

4.7/5  (43)

(43)

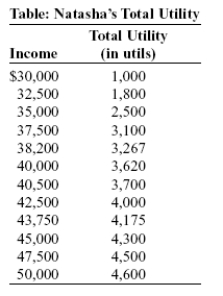

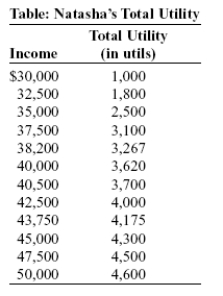

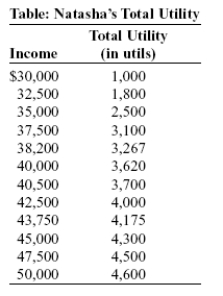

Use the following to answer questions:  -(Table: Natasha's Total Utility) Look at the table Natasha's Total Utility. Natasha earns $50,000 per year but faces losing $20,000 of it if she is late with her work. If there is a 25% probability that Natasha will be late with her work and her income will then equal $30,000, her expected income is:

-(Table: Natasha's Total Utility) Look at the table Natasha's Total Utility. Natasha earns $50,000 per year but faces losing $20,000 of it if she is late with her work. If there is a 25% probability that Natasha will be late with her work and her income will then equal $30,000, her expected income is:

(Multiple Choice)

4.8/5  (24)

(24)

Use the following to answer questions:

Scenario: Health Costs

Alan is hoping for a healthy year, meaning that he would have zero health costs. Given his habits, there is a 40% chance that Alan will develop a health issue resulting in $50,000 in health costs. Assume these are the only two conditions that could exist for Alan in the coming year.

-(Scenario: Health Costs) Look at the scenario Health Costs. When Alan's probability of developing a health problem decreases, holding everything else constant, Alan's expected value of health care costs:

(Multiple Choice)

4.9/5  (34)

(34)

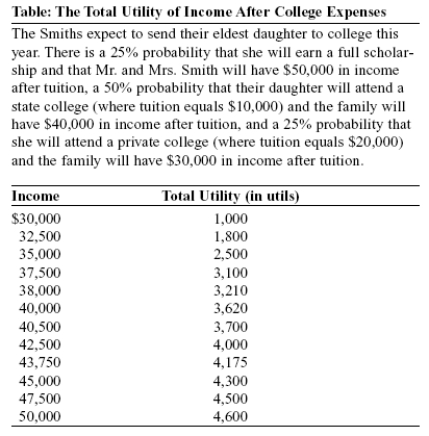

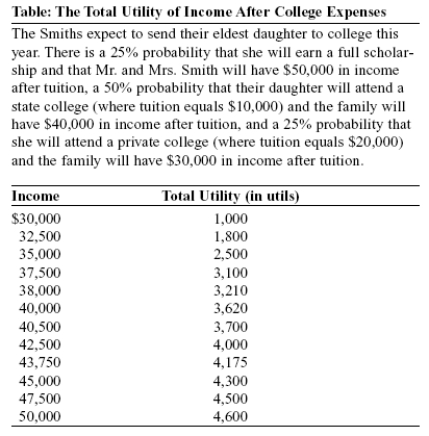

Use the following to answer questions:  -(Table: Total Utility of Income After College Expenses) Look at the table Total Utility of Income After College Expenses. What certain income after tuition leaves Mr. and Mrs. Smith just as well off as their uncertain income after tuition?

-(Table: Total Utility of Income After College Expenses) Look at the table Total Utility of Income After College Expenses. What certain income after tuition leaves Mr. and Mrs. Smith just as well off as their uncertain income after tuition?

(Multiple Choice)

4.8/5  (40)

(40)

Use the following to answer questions:  -(Table: Natasha's Total Utility) Look at the table Natasha's Total Utility. Natasha earns $50,000 per year but faces losing $20,000 of it if she is late with her work. If there is a 25% probability that Natasha will be late with her work and her income will equal $30,000, the premium for a fair insurance policy to eliminate the uncertainty in her income would equal:

-(Table: Natasha's Total Utility) Look at the table Natasha's Total Utility. Natasha earns $50,000 per year but faces losing $20,000 of it if she is late with her work. If there is a 25% probability that Natasha will be late with her work and her income will equal $30,000, the premium for a fair insurance policy to eliminate the uncertainty in her income would equal:

(Multiple Choice)

4.8/5  (38)

(38)

Use the following to answer questions:  -(Table: Total Utility of Income After College Expenses) Look at the table Total Utility of Income After College Expenses. The Smith family's expected total utility is _____ utils.

-(Table: Total Utility of Income After College Expenses) Look at the table Total Utility of Income After College Expenses. The Smith family's expected total utility is _____ utils.

(Multiple Choice)

4.9/5  (34)

(34)

In a particular insurance market, there is a decrease in the degree of risk aversion among suppliers. Holding everything else constant, the equilibrium premium will _____ and the equilibrium quantity of insurance will _____.

(Multiple Choice)

4.8/5  (43)

(43)

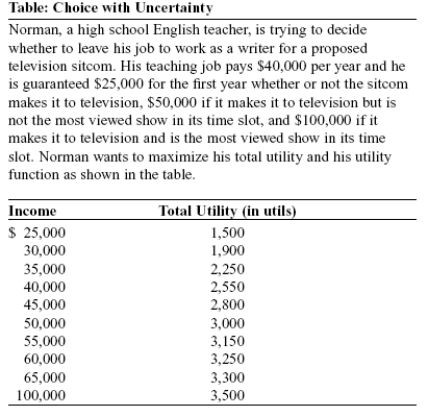

Use the following to answer questions:  -(Table: Choice with Uncertainty) Look at the table Choice with Uncertainty. Suppose the probability that the sitcom does not make it to television is 30%, that it makes it to television but is not the most viewed show in its time slot is 50%, and that it makes it to television and is the most viewed show in its time slot is 20%. Given this information, Norman's expected total utility is _____ utils.

-(Table: Choice with Uncertainty) Look at the table Choice with Uncertainty. Suppose the probability that the sitcom does not make it to television is 30%, that it makes it to television but is not the most viewed show in its time slot is 50%, and that it makes it to television and is the most viewed show in its time slot is 20%. Given this information, Norman's expected total utility is _____ utils.

(Multiple Choice)

4.8/5  (35)

(35)

A person who is willing to pay an insurance premium to lessen financial risk is said to be:

(Multiple Choice)

4.9/5  (48)

(48)

When an individual knows more about his or her own actions than other people do, incentives are distorted, which causes:

(Multiple Choice)

4.8/5  (33)

(33)

Use the following to answer questions:

Scenario: Used Car Market

In the used car market, cars of poor quality are called lemons, while cars of good quality are plums. Suppose the probability of obtaining a lemon is 60% and the probability of obtaining a plum is 40%. Also assume a plum is worth $15,000 and a lemon is worth $3,000.

-(Scenario: Used Car Market) Look at the scenario Used Car Market. If buyers cannot distinguish between lemons and plums, eventually this used car market will:

(Multiple Choice)

4.9/5  (39)

(39)

Suppose the wealth of buyers in the insurance market falls. We would expect insurance premiums to _____ as the _____ curve shifts _____.

(Multiple Choice)

4.8/5  (36)

(36)

Use the following to answer questions:  -(Table: Natasha's Total Utility) Natasha earns $50,000 per year but faces losing $20,000 of it if she is late with her work. If there is a 25% probability that Natasha will be late with her work and her income will then equal $30,000, her expected total utility is _____ utils.

-(Table: Natasha's Total Utility) Natasha earns $50,000 per year but faces losing $20,000 of it if she is late with her work. If there is a 25% probability that Natasha will be late with her work and her income will then equal $30,000, her expected total utility is _____ utils.

(Multiple Choice)

4.8/5  (34)

(34)

Use the following to answer questions:

Scenario: Diversification

Morris is considering investing $10,000 in a sunglass company or a rain poncho company. If it is a rainy year and he invests only in the sunglass company, he will lose $5,000. However, if it is a rainy year and he invests only in the rain poncho company, he will earn $10,000. If it is a sunny year and he invests only in the sunglass company, he will earn $10,000; if he invests only in the rain poncho company, he will lose $5,000 in a sunny year. There is a 50% chance of a sunny year and a 50% chance of a rainy year.

-(Scenario: Diversification) Look at the scenario Diversification. If Morris invests all of his money in the sunglass company, what is his expected gain or loss?

(Multiple Choice)

4.8/5  (40)

(40)

Sellers of used cars may have private information to which buyers are not privy. This leads to all of the following EXCEPT:

(Multiple Choice)

4.8/5  (34)

(34)

At the end of the 1980s, Lloyd's of London was in severe financial trouble because of:

(Multiple Choice)

4.9/5  (36)

(36)

Use the following to answer questions:

Scenario: Diversification

Morris is considering investing $10,000 in a sunglass company or a rain poncho company. If it is a rainy year and he invests only in the sunglass company, he will lose $5,000. However, if it is a rainy year and he invests only in the rain poncho company, he will earn $10,000. If it is a sunny year and he invests only in the sunglass company, he will earn $10,000; if he invests only in the rain poncho company, he will lose $5,000 in a sunny year. There is a 50% chance of a sunny year and a 50% chance of a rainy year.

-(Scenario: Diversification) Look at the scenario Diversification. If Morris invests all of his money in the rain poncho company, what is his expected gain or loss?

(Multiple Choice)

4.9/5  (40)

(40)

Showing 61 - 80 of 202

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)