Exam 8: Absorption and Variable Costing, and Inventory Management

Exam 1: Introduction to Managerial Accounting64 Questions

Exam 2: Basic Managerial Accounting Concepts238 Questions

Exam 3: Cost Behavior231 Questions

Exam 4: Cost-Volume-Profit Analysis: a Managerial Planning Tool185 Questions

Exam 5: Job-Order Costing196 Questions

Exam 6: Process Costing177 Questions

Exam 7: Activity-Based Costing and Management178 Questions

Exam 8: Absorption and Variable Costing, and Inventory Management125 Questions

Exam 9: Profit Planning186 Questions

Exam 10: Standard Costing: a Managerial Control Tool180 Questions

Exam 11: Flexible Budgets and Overhead Analysis173 Questions

Exam 12: Performance Evaluation and Decentralization167 Questions

Exam 13: Short-Run Decision Making: Relevant Costing170 Questions

Exam 14: Capital Investment Decisions172 Questions

Exam 15: Statement of Cash Flows185 Questions

Exam 16: Financial Statement Analysis190 Questions

Select questions type

MATCHING

Match the type of income statement to the costs it includes.

a.

Variable costing income statement

b.

Absorption costing income statement

c.

Both types of income statements

-Fixed selling expense

(Short Answer)

4.8/5  (33)

(33)

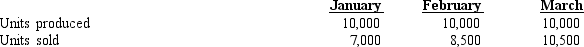

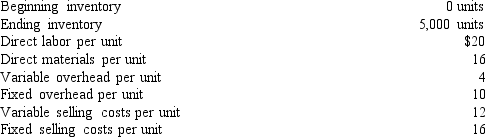

Figure 8-8.

Steele Corporation has the following information for January, February, and March:

Production costs per unit (based on 10,000 units) are as follows:

Production costs per unit (based on 10,000 units) are as follows:

There were no beginning inventories for January, and all units were sold for $50. Costs are stable over the three months.

-Refer to Figure 8-8. What is the February ending inventory for Steele Corporation using the absorption costing method?

There were no beginning inventories for January, and all units were sold for $50. Costs are stable over the three months.

-Refer to Figure 8-8. What is the February ending inventory for Steele Corporation using the absorption costing method?

(Multiple Choice)

4.7/5  (33)

(33)

Which of the following types of costs is a product cost for absorption costing but a period cost for variable costing?

(Multiple Choice)

4.9/5  (38)

(38)

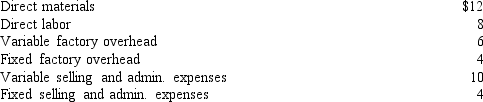

Figure 8-4.

The following information pertains to Mayberry Corporation:

-Refer to Figure 8-4. What is the value of the ending inventory using the absorption costing method?

-Refer to Figure 8-4. What is the value of the ending inventory using the absorption costing method?

(Multiple Choice)

4.9/5  (43)

(43)

The inventory cost that can include processing costs, cost of insurance for shipping, and unloading is called

(Multiple Choice)

4.8/5  (40)

(40)

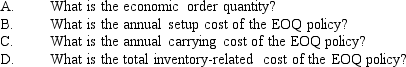

Simon Company sells 900 units of its deluxe product each year. The cost of setting up for one production run is $150; the cost of carrying one unit in inventory for a year is $3.

(Essay)

4.9/5  (41)

(41)

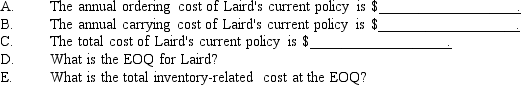

Laird Company uses 405 units of a part each year. The cost of placing one order is $5; the cost of carrying one unit in inventory for a year is $2. Laird currently orders 81 units at a time.

(Essay)

5.0/5  (41)

(41)

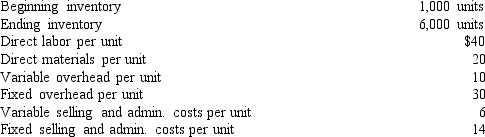

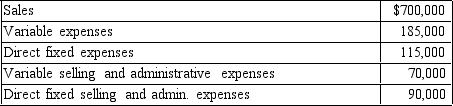

Figure 8-12.

Assume the following information for a product line:

-Refer to Figure 8-12. What is the segment margin of the product line?

-Refer to Figure 8-12. What is the segment margin of the product line?

(Multiple Choice)

4.8/5  (48)

(48)

Gross margin is to absorption costing as ____ is to variable costing.

(Multiple Choice)

4.8/5  (39)

(39)

Inventory values calculated using variable costing as opposed to absorption costing will generally be

(Multiple Choice)

4.8/5  (47)

(47)

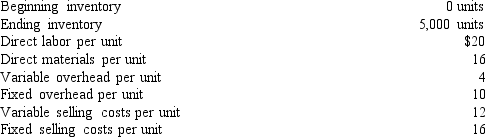

Figure 8-9.

The following information pertains to Stark Corporation:

-Refer to Figure 8-9. What is the value of ending inventory using the absorption costing method?

-Refer to Figure 8-9. What is the value of ending inventory using the absorption costing method?

(Multiple Choice)

4.8/5  (36)

(36)

Inventory under absorption costing includes only direct materials and direct labor.

(True/False)

4.8/5  (36)

(36)

______________ is computed by multiplying the lead time by the difference between the maximum rate of usage and the average rate of usage.

(Short Answer)

4.8/5  (36)

(36)

On a segmented income statement, fixed expenses are broken down into _____________ and ______________.

(Essay)

4.7/5  (36)

(36)

The _______________ income statement groups expenses according to cost behavior.

(Short Answer)

4.8/5  (48)

(48)

When production is less than sales volume, income under absorption costing will be ____ income using variable costing procedures.

(Multiple Choice)

4.9/5  (32)

(32)

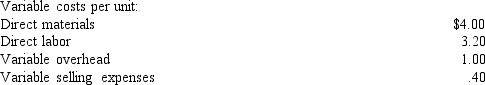

Figure 8-2.

Loring Company had the following data for the month:

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units. During the month, 2,000 units were produced. Loring started the month with 300 units in beginning inventory, with unit product cost equal to this month's unit product cost. A total of 2,100 units were sold during the month at price of $14. Selling and administrative expense for the month, all fixed, totaled $3,600.

-Refer to Figure 8-2. What is operating income under variable costing?

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units. During the month, 2,000 units were produced. Loring started the month with 300 units in beginning inventory, with unit product cost equal to this month's unit product cost. A total of 2,100 units were sold during the month at price of $14. Selling and administrative expense for the month, all fixed, totaled $3,600.

-Refer to Figure 8-2. What is operating income under variable costing?

(Multiple Choice)

4.9/5  (32)

(32)

MATCHING

Match the type of income statement to the costs it includes.

a.

Variable costing income statement

b.

Absorption costing income statement

c.

Both types of income statements

-Administrative expense

(Short Answer)

4.9/5  (48)

(48)

Figure 8-9.

The following information pertains to Stark Corporation:

-Refer to Figure 8-9. Absorption costing income would be ____ the variable costing income.

-Refer to Figure 8-9. Absorption costing income would be ____ the variable costing income.

(Multiple Choice)

4.8/5  (28)

(28)

Showing 61 - 80 of 125

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)