Exam 8: Absorption and Variable Costing, and Inventory Management

Exam 1: Introduction to Managerial Accounting64 Questions

Exam 2: Basic Managerial Accounting Concepts238 Questions

Exam 3: Cost Behavior231 Questions

Exam 4: Cost-Volume-Profit Analysis: a Managerial Planning Tool185 Questions

Exam 5: Job-Order Costing196 Questions

Exam 6: Process Costing177 Questions

Exam 7: Activity-Based Costing and Management178 Questions

Exam 8: Absorption and Variable Costing, and Inventory Management125 Questions

Exam 9: Profit Planning186 Questions

Exam 10: Standard Costing: a Managerial Control Tool180 Questions

Exam 11: Flexible Budgets and Overhead Analysis173 Questions

Exam 12: Performance Evaluation and Decentralization167 Questions

Exam 13: Short-Run Decision Making: Relevant Costing170 Questions

Exam 14: Capital Investment Decisions172 Questions

Exam 15: Statement of Cash Flows185 Questions

Exam 16: Financial Statement Analysis190 Questions

Select questions type

The profit contribution each segment makes toward covering a company's common fixed costs is called ______________.

(Short Answer)

4.7/5  (39)

(39)

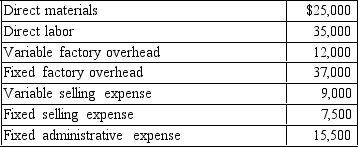

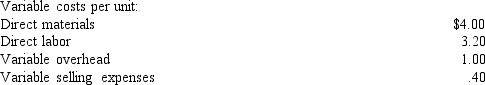

Figure 8-1.

Last year, Fabre Company produced 20,000 units and sold 18,000 units at a price of $12. Costs for last year were as follows:

Fixed factory overhead is applied based on expected production. Last year, Fabre expected to produce 20,000 units.

-Refer to Figure 8-1. Assuming that beginning inventory was zero, what is the value of ending inventory under variable costing?

Fixed factory overhead is applied based on expected production. Last year, Fabre expected to produce 20,000 units.

-Refer to Figure 8-1. Assuming that beginning inventory was zero, what is the value of ending inventory under variable costing?

(Multiple Choice)

4.9/5  (29)

(29)

Grass Valley Mining mines three products. Gold ore sells for $1,000 per ton, variable costs are $400 per ton, and fixed mining costs are $250,000. Last year the segment margin was $(100,000). How many tons of gold ore did Grass Valley Mining sell last year?

(Multiple Choice)

4.8/5  (33)

(33)

Generally Accepted Accounting Principles (GAAP) require the use of which accounting method for external reporting?

(Multiple Choice)

4.9/5  (43)

(43)

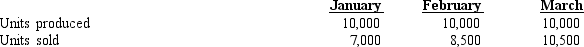

Figure 8-8.

Steele Corporation has the following information for January, February, and March:

Production costs per unit (based on 10,000 units) are as follows:

Production costs per unit (based on 10,000 units) are as follows:

There were no beginning inventories for January, and all units were sold for $50. Costs are stable over the three months.

-Refer to Figure 8-8. What is the January ending inventory for Steele Corporation using the variable costing method?

There were no beginning inventories for January, and all units were sold for $50. Costs are stable over the three months.

-Refer to Figure 8-8. What is the January ending inventory for Steele Corporation using the variable costing method?

(Multiple Choice)

4.9/5  (28)

(28)

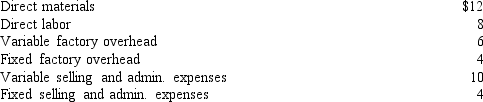

Figure 8-6.

Bailey Company incurred the following costs in manufacturing desk calculators:

During the period, the company produced and sold 2,000 units.

-Refer to Figure 8-6. What is the inventory cost per unit using absorption costing?

During the period, the company produced and sold 2,000 units.

-Refer to Figure 8-6. What is the inventory cost per unit using absorption costing?

(Multiple Choice)

4.9/5  (39)

(39)

Match each statement with the correct item below.

a.

the costs of not having a product available when demanded by a customer

b.

the costs of carrying inventory

c.

approach that maintains goods should be pulled through the system by present demand

d.

the number of units in the order quantity that minimizes the total cost

e.

the costs of placing and receiving an order

-Just-in-time

(Short Answer)

4.9/5  (34)

(34)

Absorption costing treats fixed factory overhead as a ____________.

(Short Answer)

4.8/5  (38)

(38)

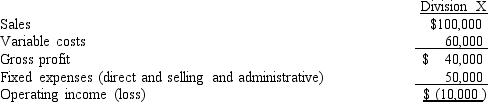

Consider the following portion of a segmented income statement for the year just ended. Assume fixed expenses of Division X include $30,000 of direct expenses and that the discontinuance of the department will not affect the sales of the other departments nor reduce the common expenses.  What is X's divisional segment margin?

What is X's divisional segment margin?

(Multiple Choice)

4.8/5  (45)

(45)

JIT responds to the problems traditionally solved by carrying inventories by

(Multiple Choice)

4.8/5  (32)

(32)

Variable costing treats fixed factory overhead as a ______________.

(Short Answer)

4.7/5  (35)

(35)

The ___________________ income statement groups expenses according to function.

(Short Answer)

4.8/5  (38)

(38)

When the economic order quantity (EOQ) model is applied to units produced within the company, ordering costs become

(Multiple Choice)

4.9/5  (40)

(40)

All ______________ expenses will vanish if a particular segment is eliminated.

(Short Answer)

4.8/5  (30)

(30)

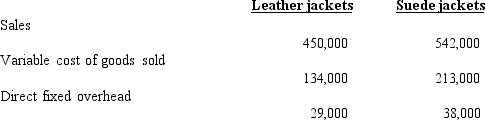

Prepare a segmented income statement for Mario Co. for the coming year, using variable costing.

A sales commission of 2% of sales is paid for each of the two product lines. Direct fixed selling and administrative expense was estimated to be $32,000 for the leather jackets and $66,000 for the suede jackets. Common fixed overhead for the factory was estimated to be $83,000 and common selling and administrative expense was estimated to be $14,000.

Required: Prepare a segmented income statement for Mario Co. for the coming year, using variable costing.

A sales commission of 2% of sales is paid for each of the two product lines. Direct fixed selling and administrative expense was estimated to be $32,000 for the leather jackets and $66,000 for the suede jackets. Common fixed overhead for the factory was estimated to be $83,000 and common selling and administrative expense was estimated to be $14,000.

Required: Prepare a segmented income statement for Mario Co. for the coming year, using variable costing.

(Essay)

4.8/5  (35)

(35)

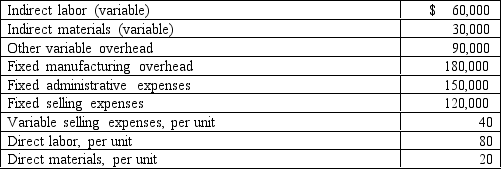

Last year, Baker Company produced 30,000 units and sold 28,000 units. Beginning inventory was zero. During the period, the following costs were incurred:

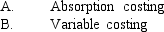

Required: Compute the dollar amount of ending inventory using:

Required: Compute the dollar amount of ending inventory using:

(Essay)

4.8/5  (41)

(41)

Figure 8-2.

Loring Company had the following data for the month:

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units. During the month, 2,000 units were produced. Loring started the month with 300 units in beginning inventory, with unit product cost equal to this month's unit product cost. A total of 2,100 units were sold during the month at price of $14. Selling and administrative expense for the month, all fixed, totaled $3,600.

-Refer to Figure 8-2. What is the unit product cost under variable costing?

Fixed overhead is $4,000 per month; it is applied to production based on normal activity of 2,000 units. During the month, 2,000 units were produced. Loring started the month with 300 units in beginning inventory, with unit product cost equal to this month's unit product cost. A total of 2,100 units were sold during the month at price of $14. Selling and administrative expense for the month, all fixed, totaled $3,600.

-Refer to Figure 8-2. What is the unit product cost under variable costing?

(Multiple Choice)

4.7/5  (38)

(38)

A ____________ is a subunit of a company of sufficient importance to warrant the production of performance reports.

(Short Answer)

4.9/5  (34)

(34)

Showing 81 - 100 of 125

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)