Exam 3: Cost Behavior

Exam 1: Introduction to Managerial Accounting64 Questions

Exam 2: Basic Managerial Accounting Concepts238 Questions

Exam 3: Cost Behavior231 Questions

Exam 4: Cost-Volume-Profit Analysis: a Managerial Planning Tool185 Questions

Exam 5: Job-Order Costing196 Questions

Exam 6: Process Costing177 Questions

Exam 7: Activity-Based Costing and Management178 Questions

Exam 8: Absorption and Variable Costing, and Inventory Management125 Questions

Exam 9: Profit Planning186 Questions

Exam 10: Standard Costing: a Managerial Control Tool180 Questions

Exam 11: Flexible Budgets and Overhead Analysis173 Questions

Exam 12: Performance Evaluation and Decentralization167 Questions

Exam 13: Short-Run Decision Making: Relevant Costing170 Questions

Exam 14: Capital Investment Decisions172 Questions

Exam 15: Statement of Cash Flows185 Questions

Exam 16: Financial Statement Analysis190 Questions

Select questions type

Select the appropriate cost behavior for each of the costs listed below.

a.

variable

b.

fixed

-raw materials

(Short Answer)

4.9/5  (38)

(38)

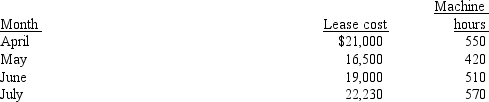

Figure 3-3.

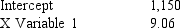

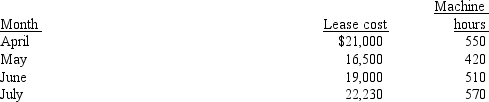

Okafor Company manufactures skis. The management accountant wants to calculate the fixed and variable costs associated with the leasing of machinery. Data for the past four months were collected.

-Refer to Figure 3-3. Using the high-low method calculate the fixed cost of leasing

-Refer to Figure 3-3. Using the high-low method calculate the fixed cost of leasing

(Multiple Choice)

4.9/5  (41)

(41)

The percentage of variability in the dependent variable explained by an independent variable is called the ____________________________________.

(Short Answer)

4.7/5  (31)

(31)

Select the appropriate type of cost for each of the definitions listed below.

a.

variable

b.

fixed

c.

mixed

d.

step

-total cost = total fixed cost + total variable cost

(Short Answer)

4.8/5  (32)

(32)

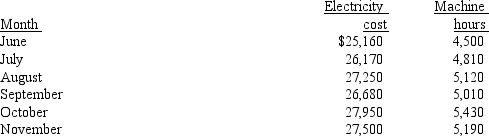

Figure 3-13.

The following 6 months of data were collected on electricity cost and the number of machine hours in a factory.

-Refer to Figure 3-13. An independent variable value used in calculating the cost line using the high-low method is:

-Refer to Figure 3-13. An independent variable value used in calculating the cost line using the high-low method is:

(Multiple Choice)

4.7/5  (34)

(34)

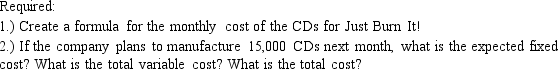

Just Burn It! Manufactures blank CDs. The company incurs $22,000 in monthly depreciation costs on its manufacturing equipment as well as monthly advertising costs of $2,000 to place ads in newspapers and on the radio. Each CD requires materials and manufacturing overhead resources. On average the company uses 26,000 pounds of material to manufacture 12,000 CDs per month. Each pound of material costs $2.50. The manufacturing overhead is driven by machine hours and on average the company incurs $30,000 in manufacturing overhead to produce 12,000 CDs per month.

(Essay)

4.7/5  (34)

(34)

Figure 3-4.

Botana Company constructed the following formula for monthly utility cost.

Total utility cost = $1,200 + ($8.10* labor hours)

Assume that 775 labor hours are budgeted for the month of April.

-Refer to Figure 3-4. Calculate the total utility cost for the month of April.

(Multiple Choice)

4.8/5  (39)

(39)

When a mixed cost is graphed the Y-intercept corresponds to the

(Multiple Choice)

4.8/5  (47)

(47)

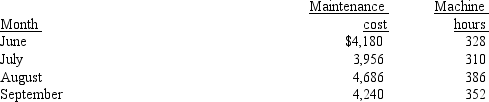

Figure 3-7.

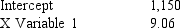

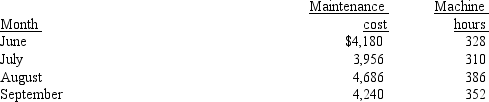

Margola Company produces hand-held calculators. The company controller wanted to calculate the fixed and variable costs associated with the maintenance cost incurred by the factory. Data for the past four months were collected.

Coefficients shown by a regression program are:

Coefficients shown by a regression program are:

-Refer to Figure 3-7. Using the results of regression, calculate the fixed cost of maintenance.

-Refer to Figure 3-7. Using the results of regression, calculate the fixed cost of maintenance.

(Multiple Choice)

4.7/5  (45)

(45)

Figure 3-7.

Margola Company produces hand-held calculators. The company controller wanted to calculate the fixed and variable costs associated with the maintenance cost incurred by the factory. Data for the past four months were collected.

Coefficients shown by a regression program are:

Coefficients shown by a regression program are:

-Refer to Figure 3-7. Using the results of regression, the cost formula for maintenance cost was

-Refer to Figure 3-7. Using the results of regression, the cost formula for maintenance cost was

(Multiple Choice)

5.0/5  (40)

(40)

Figure 3-3.

Okafor Company manufactures skis. The management accountant wants to calculate the fixed and variable costs associated with the leasing of machinery. Data for the past four months were collected.

-Refer to Figure 3-3. What would Okafor Company's cost formula be to estimate the cost of leasing within the relevant range?

-Refer to Figure 3-3. What would Okafor Company's cost formula be to estimate the cost of leasing within the relevant range?

(Multiple Choice)

4.8/5  (41)

(41)

If at a given volume total costs and fixed costs are known, the variable costs per unit may be computed as follows:

(Multiple Choice)

5.0/5  (37)

(37)

Computing unit fixed costs may result in misleading information.

(True/False)

4.7/5  (31)

(31)

Select the appropriate cost behavior for each of the costs listed below.

a.

variable

b.

fixed

-factory supplies

(Short Answer)

4.9/5  (32)

(32)

Which of the following is an example of a discretionary fixed cost?

(Multiple Choice)

4.9/5  (40)

(40)

Showing 121 - 140 of 231

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)