Exam 4: Supply and Demand: Applications and Extensions

Exam 1: The Economic Approach185 Questions

Exam 2: Some Tools of the Economist204 Questions

Exam 3: Demand, Supply, and the Market Process339 Questions

Exam 4: Supply and Demand: Applications and Extensions268 Questions

Exam 5: Difficult Cases for the Market, and the Role of Government134 Questions

Exam 6: The Economics of Political Action161 Questions

Exam 7: Taking the Nations Economic Pulse222 Questions

Exam 8: Economic Fluctuations, Unemployment, and Inflation182 Questions

Exam 9: An Introduction to Basic Macroeconomic Markets219 Questions

Exam 10: Dynamic Change, Economic Fluctuations, and the Ad--As Model193 Questions

Exam 11: Fiscal Policy: The Keynesian View and the Historical Development of Macroeconomics112 Questions

Exam 12: Fiscal Policy: Incentives, and Secondary Effects154 Questions

Exam 13: Money and the Banking System198 Questions

Exam 14: Modern Macroeconomics and Monetary Policy204 Questions

Exam 15: Stabilization Policy, Output, and Employment170 Questions

Exam 16: Creating an Environment for Growth and Prosperity125 Questions

Exam 17: Institutions, Policies, and Cross-Country Differences in Income and Growth115 Questions

Exam 18: Gaining From International Trade182 Questions

Exam 19: International Finance and the Foreign Exchange Market148 Questions

Exam 20: Special Topics274 Questions

Select questions type

The more elastic the supply of a product, the more likely it is that the burden of a tax will

Free

(Multiple Choice)

4.8/5  (34)

(34)

Correct Answer:

B

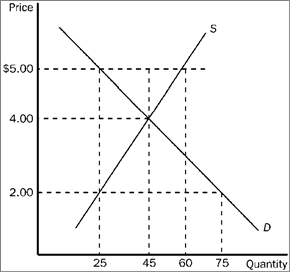

Figure 4-18  Refer to Figure 4-18. In this market, which of the following price controls would be binding?

Refer to Figure 4-18. In this market, which of the following price controls would be binding?

Free

(Multiple Choice)

4.7/5  (24)

(24)

Correct Answer:

A

Government programs such as Medicare substantially subsidize health care purchases by some consumers in the U.S. economy. Who benefits from these subsidies? How do they affect the price of health care? If you are not a recipient of this program, are you made better or worse off by the subsidy? Explain.

Free

(Essay)

4.8/5  (37)

(37)

Correct Answer:

The subsidy will increase the price of health care. The benefit will be split between consumers and producers depending on the elasticities of supply and demand. If you do not receive the subsidy, you are worse off because of the higher prices for health care.

Economists have argued that rent control is "the best way to destroy a city, other than bombing." Why would economists say this?

(Multiple Choice)

4.8/5  (39)

(39)

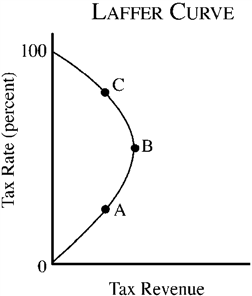

Use the figure below to answer the following question(s). Figure 4-11

Refer to Figure 4-11. On the Laffer curve shown, tax revenue could be increased by

Refer to Figure 4-11. On the Laffer curve shown, tax revenue could be increased by

(Multiple Choice)

4.7/5  (38)

(38)

When a supply and demand model is used to analyze the market for labor,

(Multiple Choice)

4.7/5  (27)

(27)

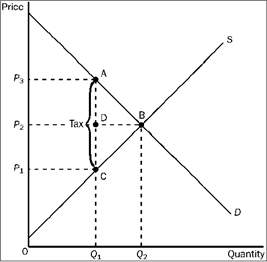

Figure 4-25  Refer to Figure 4-25. The benefit to the government is

Refer to Figure 4-25. The benefit to the government is

(Multiple Choice)

4.9/5  (36)

(36)

When a price floor is imposed above the equilibrium price of a commodity,

(Multiple Choice)

4.9/5  (35)

(35)

Which of the following generalizations about the benefit of a subsidy is correct?

(Multiple Choice)

4.9/5  (31)

(31)

A minimum wage that is set above a market's equilibrium wage will result in

(Multiple Choice)

4.9/5  (37)

(37)

If the government wants to generate large revenues from placing a tax on the consumption of a particular good, it should choose a good for which

(Multiple Choice)

4.8/5  (28)

(28)

A price floor set above an equilibrium price tends to cause persistent imbalances in the market because

(Multiple Choice)

4.9/5  (23)

(23)

Which of the following would tend to increase the wage of coal miners?

(Multiple Choice)

4.8/5  (34)

(34)

An excise tax levied on a product will impose a larger relative burden on consumers (and a smaller relative burden on sellers) when

(Multiple Choice)

4.8/5  (35)

(35)

In the supply and demand model, a subsidy granted to sellers is illustrated by

(Multiple Choice)

4.9/5  (37)

(37)

A price floor that sets the price of a good above market equilibrium will cause

(Multiple Choice)

4.7/5  (50)

(50)

Ava states, "If raising the minimum wage to $10 an hour is good, like Senator Largess suggests, then raising it to $20 an hour would be twice as good." Is Ava correct? Why or why not?

(Essay)

4.8/5  (41)

(41)

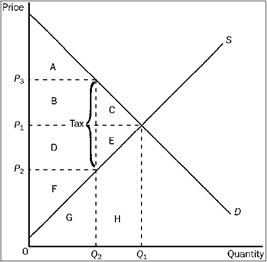

Figure 4-24  Refer to Figure 4-24. The amount of deadweight loss associated with the tax is equal to

Refer to Figure 4-24. The amount of deadweight loss associated with the tax is equal to

(Multiple Choice)

4.8/5  (39)

(39)

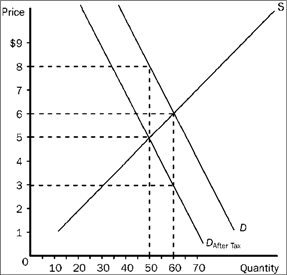

Figure 4-20  Refer to Figure 4-20. The price that sellers receive after the tax is imposed is

Refer to Figure 4-20. The price that sellers receive after the tax is imposed is

(Multiple Choice)

4.9/5  (25)

(25)

Showing 1 - 20 of 268

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)