Exam 4: Supply and Demand: Applications and Extensions

Exam 1: The Economic Approach185 Questions

Exam 2: Some Tools of the Economist204 Questions

Exam 3: Demand, Supply, and the Market Process339 Questions

Exam 4: Supply and Demand: Applications and Extensions268 Questions

Exam 5: Difficult Cases for the Market, and the Role of Government134 Questions

Exam 6: The Economics of Political Action161 Questions

Exam 7: Taking the Nations Economic Pulse222 Questions

Exam 8: Economic Fluctuations, Unemployment, and Inflation182 Questions

Exam 9: An Introduction to Basic Macroeconomic Markets219 Questions

Exam 10: Dynamic Change, Economic Fluctuations, and the Ad--As Model193 Questions

Exam 11: Fiscal Policy: The Keynesian View and the Historical Development of Macroeconomics112 Questions

Exam 12: Fiscal Policy: Incentives, and Secondary Effects154 Questions

Exam 13: Money and the Banking System198 Questions

Exam 14: Modern Macroeconomics and Monetary Policy204 Questions

Exam 15: Stabilization Policy, Output, and Employment170 Questions

Exam 16: Creating an Environment for Growth and Prosperity125 Questions

Exam 17: Institutions, Policies, and Cross-Country Differences in Income and Growth115 Questions

Exam 18: Gaining From International Trade182 Questions

Exam 19: International Finance and the Foreign Exchange Market148 Questions

Exam 20: Special Topics274 Questions

Select questions type

Other things constant, how will a decrease in the wages of teenagers affect the market for fast food hamburgers?

(Multiple Choice)

4.9/5  (38)

(38)

If a government imposed price ceiling legally sets the price of beef below market equilibrium, which of the following will most likely happen?

(Multiple Choice)

4.9/5  (35)

(35)

Suppose the U.S. Government banned the sale and production of cigarettes. What are likely effects of this action on the market for cigarettes?

(Essay)

4.8/5  (32)

(32)

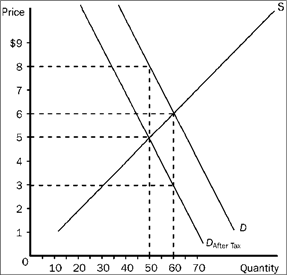

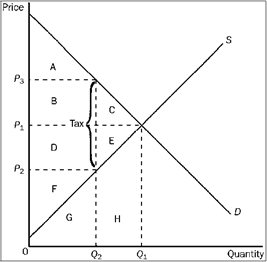

Figure 4-20  Refer to Figure 4-20. The equilibrium price in the market before the tax is imposed is

Refer to Figure 4-20. The equilibrium price in the market before the tax is imposed is

(Multiple Choice)

4.8/5  (38)

(38)

Suppose the federal excise tax rate on gasoline is increased by 50 percent. Which of the following is the most likely impact on the tax revenue derived from the federal gas tax?

(Multiple Choice)

4.8/5  (26)

(26)

Suppose that a tax is placed on a particular good. If the sellers end up bearing most of the tax burden, this indicates that the

(Multiple Choice)

4.7/5  (34)

(34)

If the supply of health care services is highly inelastic, programs that subsidize the cost of purchasing medical services will

(Multiple Choice)

4.8/5  (29)

(29)

Which of the following statements regarding black markets is true?

(Multiple Choice)

4.8/5  (40)

(40)

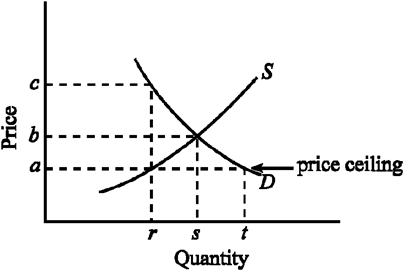

Figure 4-2  Given the demand and supply conditions shown in Figure 4-2, if the government imposes a price ceiling of a, indicate the quantity consumers would like to buy and the amount producers would be willing to supply.

Given the demand and supply conditions shown in Figure 4-2, if the government imposes a price ceiling of a, indicate the quantity consumers would like to buy and the amount producers would be willing to supply.

(Multiple Choice)

4.9/5  (33)

(33)

If political officials want to minimize the excess burden accompanying a tax, they should set the tax at a rate

(Multiple Choice)

4.7/5  (39)

(39)

If Aisha were to get a $3,000 bonus from her employer, which of the following tax rates would most accurately reflect the percent of this additional income that she would owe in taxes?

(Multiple Choice)

4.7/5  (38)

(38)

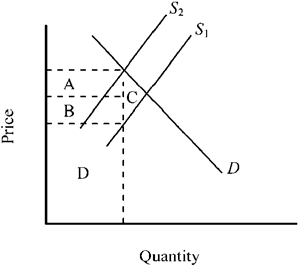

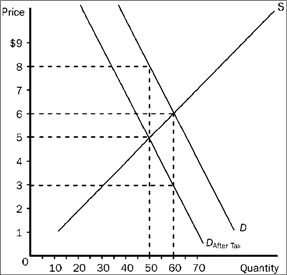

Use the figure below to answer the following question(s). Figure 4-10

Refer to Figure 4-10. The accompanying graph shows the market for a good before and after an excise tax is imposed. The total tax revenue generated is indicated by

Refer to Figure 4-10. The accompanying graph shows the market for a good before and after an excise tax is imposed. The total tax revenue generated is indicated by

(Multiple Choice)

4.8/5  (35)

(35)

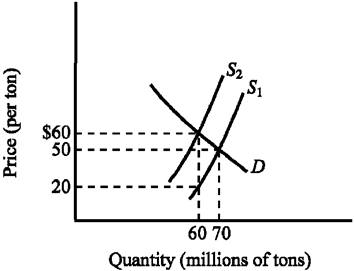

Use the figure below to answer the following question(s). Figure 4-8

Refer to Figure 4-8. The supply curve S1 and the demand curve D indicate initial conditions in the market for soft coal. A $40-per-ton tax on soft coal is levied, shifting the supply curve from S1 to S2. Which of the following states the actual burden of the tax?

Refer to Figure 4-8. The supply curve S1 and the demand curve D indicate initial conditions in the market for soft coal. A $40-per-ton tax on soft coal is levied, shifting the supply curve from S1 to S2. Which of the following states the actual burden of the tax?

(Multiple Choice)

4.9/5  (28)

(28)

In 2010 the federal government reduced the Social Security tax withholding rate from 12.4 percent (6.2 percent on both the employer and employee) to 8.4 percent (4.2 percent on both the employer and employee) on the wages of all workers. If the tax were redefined such that the entire 12.4 percent was statutorily levied on employers, economic analysis suggests that the actual burden of the tax would

(Multiple Choice)

4.8/5  (22)

(22)

Suppose that the federal government grants a 50 cent per gallon subsidy to buyers of gasoline and that the demand for gasoline is highly inelastic while the supply is highly elastic. Under these circumstances, the benefit of the subsidy

(Multiple Choice)

4.8/5  (28)

(28)

Figure 4-25  Refer to Figure 4-25. After the tax is levied, producer surplus is represented by area

Refer to Figure 4-25. After the tax is levied, producer surplus is represented by area

(Multiple Choice)

4.8/5  (35)

(35)

Figure 4-20  Refer to Figure 4-20. As the figure is drawn, who sends the tax payments to the government?

Refer to Figure 4-20. As the figure is drawn, who sends the tax payments to the government?

(Multiple Choice)

4.8/5  (35)

(35)

Showing 41 - 60 of 268

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)