Exam 17: Business Tax Credits and the Alternative Minimum Tax

Exam 1: Introduction to Taxation98 Questions

Exam 2: Working With the Tax Law102 Questions

Exam 3: Taxes on the Financial Statements68 Questions

Exam 4: Gross Income96 Questions

Exam 5: Business Deductions208 Questions

Exam 6: Losses and Loss Limitations185 Questions

Exam 7: Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges118 Questions

Exam 8: Property Transactions: Capital Gains and Losses109 Questions

Exam 9: Individuals As the Taxpayer105 Questions

Exam 10: Individuals: Income, Deductions, and Credits119 Questions

Exam 11: Individuals As Employees and Proprietors131 Questions

Exam 12: Corporations: Organization, Capital Structure, and Operating Rules128 Questions

Exam 13: Corporations: Earnings and Profits and Distributions125 Questions

Exam 14: Partnerships and Limited Liability Entities122 Questions

Exam 15: S Corporations118 Questions

Exam 16: Multijurisdictional Taxation145 Questions

Exam 17: Business Tax Credits and the Alternative Minimum Tax132 Questions

Exam 18: Comparative Forms of Doing Business97 Questions

Select questions type

What tax rates apply in calculating the TMT for an individual taxpayer?

(Essay)

4.9/5  (43)

(43)

The AMT adjustment for research and experimental expenditures can be avoided if the taxpayer capitalizes the expenditures and amortizes them over a 10-year period for regular tax purposes.

(True/False)

4.8/5  (41)

(41)

The phaseout of the AMT exemption amount for a taxpayer filing as a head of household both begins and ends at a higher income level than it does for a single taxpayer.

(True/False)

4.8/5  (33)

(33)

Tad and Audria, who are married filing a joint return, have AMTI of $1,256,000 for 2018.Calculate their AMT exemption.

(Essay)

4.9/5  (28)

(28)

What itemized deductions are allowed for both regular income tax purposes and for AMT purposes?

(Essay)

4.8/5  (39)

(39)

Several years ago, Sarah purchased a certified historic structure for $150,000 that was placed in service in 1929.In the current year, she incurred qualifying rehabilitation expenditures of $200,000.The amount of the tax credit for rehabilitation expenditures, and the amount by which the building's basis for cost recovery would increase as a result of the rehabilitation expenditures are the following amounts.

(Multiple Choice)

4.8/5  (42)

(42)

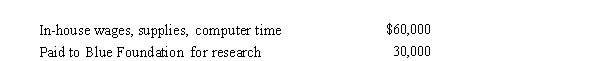

During the year, Green, Inc., incurs the following research expenditures:  Green's qualifying research expenditures for the year are:

Green's qualifying research expenditures for the year are:

(Multiple Choice)

4.9/5  (32)

(32)

Negative AMT adjustments for the current year caused by timing differences are offset by the positive AMT adjustments in prior tax years also caused by timing differences.

(True/False)

4.9/5  (48)

(48)

Which of the following statements concerning capital gains and losses and the AMT is correct?

(Multiple Choice)

4.8/5  (42)

(42)

BlueCo incurs $900,000 during the year to construct a facility that will be used exclusively for the care of its employees' pre-school age children during normal working hours.The credit for employer-provided child care available to BlueCo this year is $225,000.

(True/False)

4.8/5  (33)

(33)

In 2018, Liam's filing status is married filing separately.For regular tax purposes, he has three dependents.Liam does not itemize deductions; his regular taxable income is $456,000. What is Liam's 2018 AMT base?

(Multiple Choice)

4.8/5  (39)

(39)

Prior to consideration of tax credits, Clarence's regular income tax liability is $200,000 and his tentative minimum tax TMT) is $180,000.Clarence holds nonrefundable business tax credits of $35,000.His tax liability is $165,000.

(True/False)

5.0/5  (31)

(31)

The recognized gain for regular income tax purposes and the recognized gain for AMT purposes on the sale of stock acquired with an incentive stock option ISO) are always the same, because the adjusted basis is the same.

(True/False)

4.8/5  (32)

(32)

Waltz, Inc., a U.S.taxpayer, pays foreign taxes of $50,000 on foreign-source general basket income of $90,000.Waltz's worldwide taxable income is $450,000, on which it owes U.S.taxes of $94,500 before FTC.Waltz's FTC is

$50,000.

(True/False)

4.8/5  (33)

(33)

Andrea, will not itemize deductions in calculating her 2018 taxable income.What is the amount of the AMT adjustment in calculating AMTI?

(Essay)

4.8/5  (34)

(34)

The deduction for charitable contributions in calculating the regular income tax can differ from that in calculating the AMT, because the percentage limitations 20%, 30%, and 50%) may be applied to a different base amount.

(True/False)

4.8/5  (39)

(39)

Employers are encouraged by the work opportunity tax credit to hire individuals who have been long-term recipients of family assistance welfare benefits.

(True/False)

4.8/5  (35)

(35)

Because passive losses are not deductible in computing either taxable income or AMTI, no AMT adjustment for passive losses is required.

(True/False)

4.9/5  (42)

(42)

If a taxpayer deducts the standard deduction in calculating regular taxable income, what effect does this have in calculating AMTI?

(Essay)

4.9/5  (35)

(35)

Showing 21 - 40 of 132

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)