Exam 17: Business Tax Credits and the Alternative Minimum Tax

Exam 1: Introduction to Taxation98 Questions

Exam 2: Working With the Tax Law102 Questions

Exam 3: Taxes on the Financial Statements68 Questions

Exam 4: Gross Income96 Questions

Exam 5: Business Deductions208 Questions

Exam 6: Losses and Loss Limitations185 Questions

Exam 7: Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges118 Questions

Exam 8: Property Transactions: Capital Gains and Losses109 Questions

Exam 9: Individuals As the Taxpayer105 Questions

Exam 10: Individuals: Income, Deductions, and Credits119 Questions

Exam 11: Individuals As Employees and Proprietors131 Questions

Exam 12: Corporations: Organization, Capital Structure, and Operating Rules128 Questions

Exam 13: Corporations: Earnings and Profits and Distributions125 Questions

Exam 14: Partnerships and Limited Liability Entities122 Questions

Exam 15: S Corporations118 Questions

Exam 16: Multijurisdictional Taxation145 Questions

Exam 17: Business Tax Credits and the Alternative Minimum Tax132 Questions

Exam 18: Comparative Forms of Doing Business97 Questions

Select questions type

Income from some long-term contracts can be reported using the completed contract method for regular income tax purposes, but the percentage of completion method is required for AMT purposes for all long-term contracts.

(True/False)

4.8/5  (31)

(31)

The purpose of the work opportunity tax credit is to encourage employers to hire individuals from specified target groups traditionally subject to high rates of unemployment.

(True/False)

4.9/5  (39)

(39)

Unless circulation expenditures are amortized over a three-year period for regular income tax purposes, there will be an AMT adjustment.

(True/False)

4.9/5  (34)

(34)

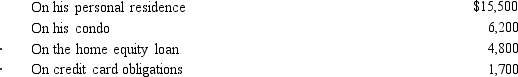

Ted, who is single, owns a personal residence in the city.He also owns a condo near the ocean.He uses the condo as a vacation home.In March, he borrowed $50,000 on a home equity loan and used the proceeds to acquire a luxury automobile.During the year, he paid the following amounts of interest.  What amount, if any, must Ted recognize as an AMT adjustment in 2018?

What amount, if any, must Ted recognize as an AMT adjustment in 2018?

(Multiple Choice)

4.9/5  (43)

(43)

How can an AMT adjustment be avoided by a taxpayer who incurs circulation expenditures in the current tax year?

(Essay)

4.7/5  (53)

(53)

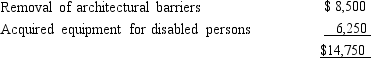

Golden Corporation is an eligible small business for purposes of the disabled access credit.During the year, Golden makes the following expenditures on a structure originally placed in service in 1988.

In addition, $8,000 was expended by Golden on a building originally placed in service in the current year to ensure easy accessibility by disabled individuals.Calculate the amount of the disabled access credit available to Golden Corporation.

In addition, $8,000 was expended by Golden on a building originally placed in service in the current year to ensure easy accessibility by disabled individuals.Calculate the amount of the disabled access credit available to Golden Corporation.

(Essay)

4.9/5  (35)

(35)

Brenda correctly has calculated her regular tax liability to be $32,500 and her tentative minimum tax TMT) to be $36,300.Additionally, Brenda has an adoption expense credit personal, nonrefundable credit) of $6,200.What is Brenda's total Federal income tax liability?

(Multiple Choice)

4.8/5  (33)

(33)

Cher sold undeveloped land that originally cost $150,000 for $225,000.There is a positive AMT adjustment of

$75,000 associated with the sale of the land.

(True/False)

4.8/5  (42)

(42)

In deciding whether to enact the alternative minimum tax, Congress was concerned about the inequity that resulted when taxpayers with substantial economic incomes could avoid paying regular income tax.

(True/False)

4.7/5  (33)

(33)

In 2018, the amount of the deduction for medical expenses for regular tax purposes may be different than for AMT purposes.

(True/False)

4.9/5  (40)

(40)

If Abby's alternative minimum taxable income exceeds her regular taxable income, she will incur an alternative minimum tax.

(True/False)

4.9/5  (39)

(39)

Nell records a personal casualty loss deduction of $14,500 for regular income tax purposes The loss was the result of a Federally-declared disaster.).The loss was computed as $26,600, but it was reduced by $100 and by $12,000 10% × $120,000 AGI).For AMT purposes, the casualty loss deduction also is $14,500.

(True/False)

4.8/5  (34)

(34)

Business tax credits reduce the AMT and the regular income tax in the same way.

(True/False)

4.8/5  (34)

(34)

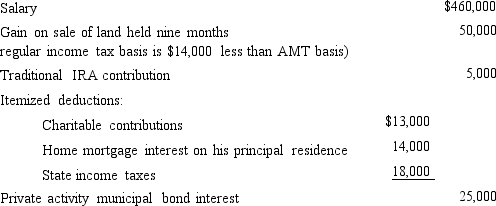

Gunter, who is divorced, provides you with the following financial information for the current year.Calculate Gunter's AMTI.

(Essay)

4.8/5  (34)

(34)

Evan is a contractor who constructs both commercial and residential buildings.Even though some of the contracts could qualify for the use of the completed contract method, Evan decides to use the percentage of the completion method for all of his contracts.This increases Evan's AMT adjustment associated with long-term contracts for the current year.

(True/False)

4.9/5  (39)

(39)

The tax credit for rehabilitation expenditures for certified historic structures differs from that for qualifying structures that are not certified historic structures.

(True/False)

4.7/5  (36)

(36)

Celia and Christian, who are married filing jointly, have one dependent and do not itemize deductions.They report taxable income of $492,000 and tax preferences of $53,000 in 2018.What is their AMT base for 2018?

(Multiple Choice)

4.9/5  (34)

(34)

Roger is considering making a $6,000 investment in a venture that its promoter promises will generate immediate tax benefits for him.Roger, who does not anticipate itemizing his deductions, is in the 30% marginal income tax bracket.If the investment is of a type that produces a tax credit of 40% of the amount of the expenditure, by how much will Roger's tax liability decline because of the investment?

(Multiple Choice)

4.9/5  (40)

(40)

When qualified residence interest exceeds qualified housing interest, the positive adjustment required in calculating AMT is a timing adjustment.That is, in the future, there will be an offsetting negative adjustment.Comment on the validity of this statement.

(Essay)

4.9/5  (34)

(34)

Showing 61 - 80 of 132

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)