Exam 17: Business Tax Credits and the Alternative Minimum Tax

Exam 1: Introduction to Taxation98 Questions

Exam 2: Working With the Tax Law102 Questions

Exam 3: Taxes on the Financial Statements68 Questions

Exam 4: Gross Income96 Questions

Exam 5: Business Deductions208 Questions

Exam 6: Losses and Loss Limitations185 Questions

Exam 7: Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges118 Questions

Exam 8: Property Transactions: Capital Gains and Losses109 Questions

Exam 9: Individuals As the Taxpayer105 Questions

Exam 10: Individuals: Income, Deductions, and Credits119 Questions

Exam 11: Individuals As Employees and Proprietors131 Questions

Exam 12: Corporations: Organization, Capital Structure, and Operating Rules128 Questions

Exam 13: Corporations: Earnings and Profits and Distributions125 Questions

Exam 14: Partnerships and Limited Liability Entities122 Questions

Exam 15: S Corporations118 Questions

Exam 16: Multijurisdictional Taxation145 Questions

Exam 17: Business Tax Credits and the Alternative Minimum Tax132 Questions

Exam 18: Comparative Forms of Doing Business97 Questions

Select questions type

Discuss the tax year in which an AMT adjustment is first required for an incentive stock option ISO).

(Essay)

4.8/5  (33)

(33)

Kerri, who has AGI of $120,000, itemized her deductions in the current year.She incurred unreimbursed employee business expenses of $8,500.Kerri incurs a positive AMT adjustment of $2,400 in computing AMT.

(True/False)

4.8/5  (46)

(46)

A LIFO method is applied to general business credit carryovers, carrybacks, and utilization of credits earned during a particular year.

(True/False)

4.9/5  (36)

(36)

What is the relationship between the regular income tax liability and the TMT?

(Essay)

4.8/5  (35)

(35)

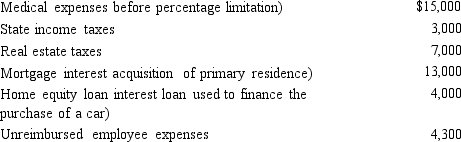

Mitch, who is single and age 46 and has no dependents, had AGI of $100,000 this year.His potential itemized deductions were as follows.  What is the amount of Mitch's AMT adjustment for itemized deductions for 2018?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2018?

(Multiple Choice)

4.7/5  (24)

(24)

Steve records a tentative general business credit of $110,000 for the current year.His net regular tax liability before t general business credit is $125,000, and his tentative minimum tax is $100,000.Compute Steve's allowable general business credit for the year.

(Essay)

4.8/5  (35)

(35)

The AMT calculated using the indirect method will produce a different amount than the AMT calculated using the direct method.

(True/False)

4.8/5  (35)

(35)

In the current tax year, for regular tax purposes, Avery reports $65,000 of income and $190,000 of deductions from passive activities.For AMT purposes, the passive activity income amount is unchanged, but deductions from passive activities total $150,000. What is Avery's suspended passive loss for regular tax and for AMT purposes?

(Multiple Choice)

4.9/5  (36)

(36)

Benita expensed mining exploration and development costs of $500,000 incurred in the current tax year.She will be required to make negative AMT adjustments for each of the next ten years and a positive AMT adjustment in the current tax year.

(True/False)

4.8/5  (33)

(33)

Without the foreign tax credit, double taxation would result when:

(Multiple Choice)

4.9/5  (32)

(32)

A small employer incurs $1,500 for consulting fees related to establishing a qualified retirement plan for its 75 employees.As a result, the employer may claim the credit for small employer pension plan startup costs for $750.

(True/False)

4.8/5  (37)

(37)

AMT adjustments can be positive or negative, whereas AMT preferences always are positive.

(True/False)

4.8/5  (39)

(39)

An employer's tax deduction for wages is affected by the work opportunity tax credit.

(True/False)

4.8/5  (31)

(31)

Madge's tentative minimum tax TMT) is $112,000.Her regular income tax liability is $99,000.Madge's AMT is

$13,000.

(True/False)

4.7/5  (38)

(38)

Qualified rehabilitation expenditures include the cost of acquiring the building, but not the cost of acquiring the land.

(True/False)

4.7/5  (45)

(45)

Why does Congress see a need for a second tax system called the alternative minimum tax?

(Essay)

4.7/5  (37)

(37)

Which, if any, of the following correctly describes the research activities credit?

(Multiple Choice)

4.8/5  (28)

(28)

Molly has generated general business credits over the years that have not been utilized.The amounts generated and not utilized follow:

In the current year, 2018, her business generates an additional $15,000 general business credit.In 2018, based on her tax liability before credits, she can utilize a general business credit of up to $20,000.After utilizing the carryforwards and the current year credits, how much of the general business credit generated in 2018 is available for future years?

In the current year, 2018, her business generates an additional $15,000 general business credit.In 2018, based on her tax liability before credits, she can utilize a general business credit of up to $20,000.After utilizing the carryforwards and the current year credits, how much of the general business credit generated in 2018 is available for future years?

(Multiple Choice)

4.9/5  (37)

(37)

The standard deduction is allowed for regular income tax purposes, but is disallowed for AMT purposes.This results in a positive AMT adjustment.

(True/False)

4.7/5  (40)

(40)

Amber is in the process this year of renovating the office building placed in service in 1976) used by her business.Because of current Federal Regulations that require the structure to be accessible to handicapped individuals, she incurs an additional $11,000 for various features, such as ramps and widened doorways, to make her office building more accessible.The $11,000 incurred will produce a disabled access credit of what amount?

(Multiple Choice)

4.8/5  (43)

(43)

Showing 101 - 120 of 132

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)