Exam 17: Business Tax Credits and the Alternative Minimum Tax

Exam 1: Introduction to Taxation98 Questions

Exam 2: Working With the Tax Law102 Questions

Exam 3: Taxes on the Financial Statements68 Questions

Exam 4: Gross Income96 Questions

Exam 5: Business Deductions208 Questions

Exam 6: Losses and Loss Limitations185 Questions

Exam 7: Property Transactions: Basis, Gain and Loss, and Nontaxable Exchanges118 Questions

Exam 8: Property Transactions: Capital Gains and Losses109 Questions

Exam 9: Individuals As the Taxpayer105 Questions

Exam 10: Individuals: Income, Deductions, and Credits119 Questions

Exam 11: Individuals As Employees and Proprietors131 Questions

Exam 12: Corporations: Organization, Capital Structure, and Operating Rules128 Questions

Exam 13: Corporations: Earnings and Profits and Distributions125 Questions

Exam 14: Partnerships and Limited Liability Entities122 Questions

Exam 15: S Corporations118 Questions

Exam 16: Multijurisdictional Taxation145 Questions

Exam 17: Business Tax Credits and the Alternative Minimum Tax132 Questions

Exam 18: Comparative Forms of Doing Business97 Questions

Select questions type

Explain the purpose of the tax credit for rehabilitation expenditures and describe the general characteristics of its computation.

(Essay)

4.9/5  (42)

(42)

Interest on a home equity loan cannot be deducted for AMT purposes.

(True/False)

4.9/5  (41)

(41)

For individual taxpayers, the AMT credit is applicable for the AMT that results from timing differences, but it is not available for the AMT that results from the adjustment for itemized deductions or exclusion preferences.

(True/False)

4.7/5  (41)

(41)

In 2018, Brenda has calculated her regular tax liability to be $32,500 and her tentative minimum tax TMT) to be $36,300.Additionally, Brenda holds an alternative minimum tax credit of $6,200 from 2014.

What is Brenda's total 2018 Federal income tax liability?

(Multiple Choice)

4.9/5  (31)

(31)

Explain the purpose of the disabled access credit and describe the general characteristics of its computation.

(Essay)

4.9/5  (40)

(40)

The disabled access credit is computed at the rate of 50% of all access expenditures incurred by the taxpayer during the year.

(True/False)

4.9/5  (44)

(44)

If the regular income tax deduction for medical expenses is $0, under certain circumstances the AMT deduction for medical expenses can be greater than $0.

(True/False)

4.9/5  (32)

(32)

What is the purpose of the AMT exemption amount? What is the maximum amount for each filing status for an individual taxpayer?

(Essay)

4.8/5  (32)

(32)

The net capital gain included in an individual taxpayer's AMT base is eligible for the lower tax rate on net capital gain.This favorable alternative rate applies both in calculating the regular income tax and the AMT.

(True/False)

4.8/5  (39)

(39)

Paul incurred circulation expenditures of $180,000 in 2018 and deducted that amount for regular income tax purposes.Paul has a $60,000 negative AMT adjustment for each of 2019, 2020, and for 2021.

(True/False)

4.7/5  (36)

(36)

Prior to the effect of tax credits, Eunice's regular income tax liability is $325,000 and her tentative minimum tax is $312,000.Eunice has general business credits available of $20,000.Calculate Eunice's tax liability after tax credits.

(Multiple Choice)

4.8/5  (31)

(31)

A taxpayer who expenses circulation expenditures in the year incurred for regular income tax purposes will incur a positive AMT adjustment in the following year.

(True/False)

4.9/5  (28)

(28)

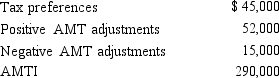

Use the following selected data to calculate Devon's taxable income.Devon itemizes deductions.

(Essay)

4.8/5  (40)

(40)

Tamara operates a natural gas sole proprietorship that incurred $68,000 of intangible drilling costs IDC) in the current year.Her sole proprietorship's net natural gas income for the year is $72,000. What is the sole proprietorship's current year IDC preference?

(Multiple Choice)

4.8/5  (41)

(41)

The tax benefits resulting from tax credits and tax deductions are affected by the tax rate bracket of the taxpayer.

(True/False)

4.7/5  (40)

(40)

A taxpayer has a passive activity loss for the current tax year for regular income tax purposes and for AMT purposes.Is it possible that the passive activity losses will be the same amount?

(Essay)

4.8/5  (31)

(31)

The incremental research activities credit is 20% of the qualified research expenses that exceed the base amount.

(True/False)

4.9/5  (36)

(36)

Any unused general business credit must be carried back 3 years and then forward for 20 years.

(True/False)

4.9/5  (36)

(36)

Showing 41 - 60 of 132

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)