Exam 26: Not-For-Profit Organizations: Introduction and Private Npos

Exam 1: Wholly Owned Subsidiaries: at Date of Creation87 Questions

Exam 2: Wholly Owned Subsidiaries: Postcreation Periods110 Questions

Exam 3: Partially Owned Created Subsidiaries & Variable Interest Entities138 Questions

Exam 4: Introduction to Business Combinations105 Questions

Exam 5: The Purchase Method: at Date of Acquisition-100 Ownership135 Questions

Exam 6: The Purchase Method: Postacquisition Periods and Partial Ownerships74 Questions

Exam 7: New Basis of Accounting52 Questions

Exam 8: Introduction to Intercompany Transactions42 Questions

Exam 9: Intercompany Inventory Transfers66 Questions

Exam 10: Intercompany Fixed Asset Transfers & Bond Holdings31 Questions

Exam 12: Reporting Segment and Related Information90 Questions

Exam 13: International Accounting Standards & Translating Foreign Currency Transactions103 Questions

Exam 14: Using Derivatives to Manage Foreign Currency Exposures256 Questions

Exam 15: Translating Foreign Currency Statements: The Current Rate Method99 Questions

Exam 16: Translating Foreign Currency Statements: The Temporal Method and the Functional Currency Concept231 Questions

Exam 17: Interim Period Reporting49 Questions

Exam 18: Securities and Exchange Commission Reporting55 Questions

Exam 19: Bankruptcy Reorganizations and Liquidations51 Questions

Exam 20: Partnerships: Formation and Operation45 Questions

Exam 21: Partnerships: Changes in Ownership37 Questions

Exam 22: Partnerships: Liquidations35 Questions

Exam 23: Estates and Trusts40 Questions

Exam 24: Governmental Accounting: Basic Principles and the General Fund138 Questions

Exam 25: Governmental Accounting: The Special-Purpose Funds and Special General Ledger232 Questions

Exam 26: Not-For-Profit Organizations: Introduction and Private Npos218 Questions

Select questions type

Under FAS 117, private nonprofit organizations must present financial statements that focus on the nonprofit organization as a whole.

Free

(True/False)

4.9/5  (43)

(43)

Correct Answer:

True

_____ Under FAS 117, how would the spending of money donated in the prior year for spending in the current year be reported in the statement of activities?

Free

(Multiple Choice)

4.9/5  (33)

(33)

Correct Answer:

B

_____ Under FAS 117, how would the expiration of a prior-year donor restriction as to purpose be reflected in the current-year statement of activities?

Free

(Multiple Choice)

4.8/5  (39)

(39)

Correct Answer:

D

_____ Under FAS 116, donor-restricted contributions are recognized in the financial statements

(Multiple Choice)

4.8/5  (32)

(32)

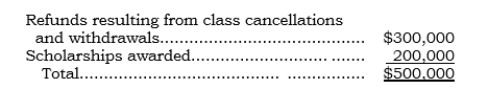

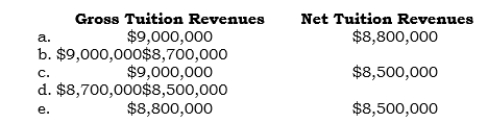

_____ During 2006, Sodona State University (SSU) billed its students $9,000,000 for tuition. The net amount contractually to be paid was only $8,500,000, however, because of the following items:

Which of the following amounts should SSU--which engages only in business-type activities-report in its 2006 statement of revenues, expenses, and changes in net assets?

Which of the following amounts should SSU--which engages only in business-type activities-report in its 2006 statement of revenues, expenses, and changes in net assets?

(Short Answer)

4.8/5  (48)

(48)

Under FAS 117, private nonprofit organizations must classify their net assets (equity) based on (a) whether _______________________________________ exist and (b) the type of _________________________________________.

(Short Answer)

4.9/5  (37)

(37)

Under FAS 117, expirations of restrictions must be reported separately in the statement of activities.

(True/False)

4.9/5  (32)

(32)

For a permanent endowment created by a cash donation, subsequent investment gains that restore the fair value of the endowment fund investments to the donor's stipulated amount are reported as increases in UR net assets.

(True/False)

4.8/5  (52)

(52)

The imputed value of charity care provided is reported below the operating income or loss line in the statement of operations.

(True/False)

4.7/5  (38)

(38)

_____ For a public C&U engaged in business-type activities, which of the following items are not reported in the statement of revenues, expenses, and changes in net assets?

(Multiple Choice)

4.8/5  (34)

(34)

Contributions of monetary and nonmonetary assets are valued at their __________________.

(Short Answer)

4.7/5  (38)

(38)

The three categories in which contributions are to be reported are ____________________________________, _________________________, and _________________________.

(Short Answer)

4.8/5  (33)

(33)

Under FAS 116, the interest element in a present-value measurement is subsequently recognized as contribution income-not interest income.

(True/False)

4.8/5  (40)

(40)

Under FAS 117, all expenses are reported in the unrestricted category-even expenses incurred in satisfying donor-imposed restrictions.

(True/False)

4.8/5  (37)

(37)

Under FAS 116, contributions that create endowments are classified as increasing permanently restricted net assets.

(True/False)

4.9/5  (34)

(34)

Under FAS 116, contributions that create term endowments are classified as increasing permanently restricted net assets.

(True/False)

4.7/5  (34)

(34)

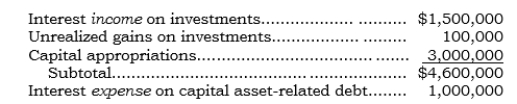

_____ For 2006, Sasko State University (SSU) had the following items:

What is the total of the items that SSU reports for nonoperating revenues and expenses in its statement of revenues, expenses, and changes in net assets for 2006?

What is the total of the items that SSU reports for nonoperating revenues and expenses in its statement of revenues, expenses, and changes in net assets for 2006?

(Multiple Choice)

4.9/5  (31)

(31)

Only certain public C&Us must follow the guidance in GAS 34 that pertains to special purpose governments.

(True/False)

4.8/5  (37)

(37)

_____ A historical society received several old pictures as a gift from the family whose ancestors settled the town. The pictures are of the downtown area 80 years ago. The staff of the society has determined that the pictures have potential historical and educational use to those who may be interested in studying the area. The pictures are suitable for display, and no alternative use exists. Under FAS 116, the historical society

(Multiple Choice)

4.8/5  (40)

(40)

Showing 1 - 20 of 218

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)