Exam 16: Translating Foreign Currency Statements: The Temporal Method and the Functional Currency Concept

Exam 1: Wholly Owned Subsidiaries: at Date of Creation87 Questions

Exam 2: Wholly Owned Subsidiaries: Postcreation Periods110 Questions

Exam 3: Partially Owned Created Subsidiaries & Variable Interest Entities138 Questions

Exam 4: Introduction to Business Combinations105 Questions

Exam 5: The Purchase Method: at Date of Acquisition-100 Ownership135 Questions

Exam 6: The Purchase Method: Postacquisition Periods and Partial Ownerships74 Questions

Exam 7: New Basis of Accounting52 Questions

Exam 8: Introduction to Intercompany Transactions42 Questions

Exam 9: Intercompany Inventory Transfers66 Questions

Exam 10: Intercompany Fixed Asset Transfers & Bond Holdings31 Questions

Exam 12: Reporting Segment and Related Information90 Questions

Exam 13: International Accounting Standards & Translating Foreign Currency Transactions103 Questions

Exam 14: Using Derivatives to Manage Foreign Currency Exposures256 Questions

Exam 15: Translating Foreign Currency Statements: The Current Rate Method99 Questions

Exam 16: Translating Foreign Currency Statements: The Temporal Method and the Functional Currency Concept231 Questions

Exam 17: Interim Period Reporting49 Questions

Exam 18: Securities and Exchange Commission Reporting55 Questions

Exam 19: Bankruptcy Reorganizations and Liquidations51 Questions

Exam 20: Partnerships: Formation and Operation45 Questions

Exam 21: Partnerships: Changes in Ownership37 Questions

Exam 22: Partnerships: Liquidations35 Questions

Exam 23: Estates and Trusts40 Questions

Exam 24: Governmental Accounting: Basic Principles and the General Fund138 Questions

Exam 25: Governmental Accounting: The Special-Purpose Funds and Special General Ledger232 Questions

Exam 26: Not-For-Profit Organizations: Introduction and Private Npos218 Questions

Select questions type

Under FAS 52, "remeasurement" is going from the reporting currency to the functional currency.

Free

(True/False)

4.8/5  (44)

(44)

Correct Answer:

False

_____ The mixing of valuation bases (foreign fixed assets and domestic fixed assets) occurs

Free

(Multiple Choice)

4.9/5  (34)

(34)

Correct Answer:

D

The translation methods that fit under the U.S. dollar unit of measure are the ________________________________ method, the _________________________________ method, and the _____________________________________ method.

Free

(Short Answer)

4.7/5  (35)

(35)

Correct Answer:

temporal, monetary-nonmonetary, current-noncurrent

_____ On 1/1/06, the direct exchange rate was $.60. On 12/31/06, the direct exchange rate was $.39. During 2001, the United States had 6% inflation, and the foreign country had 20% inflation. How much of the change in the exchange rate was the result of domestic inflation?

(Multiple Choice)

4.8/5  (38)

(38)

A factor pointing toward the use of the foreign currency as the functional currency is a significant level of intercompany inventory transfers.

(True/False)

4.8/5  (38)

(38)

_____ Which of the following statements does not hold true for the U.S. dollar unit of measure approach?

(Multiple Choice)

4.9/5  (42)

(42)

A factor pointing toward the use of the foreign currency as the functional currency is the foreign unit selling its products locally rather than in the United States.

(True/False)

4.9/5  (40)

(40)

Under FAS 52, the effect of an exchange rate change is reported in Other Comprehensive Income when the temporal method is used.

(True/False)

4.9/5  (41)

(41)

Under FAS 52, the effect of an exchange rate change is referred to as a translation adjustment only if the foreign currency is the functional currency.

(True/False)

4.8/5  (30)

(30)

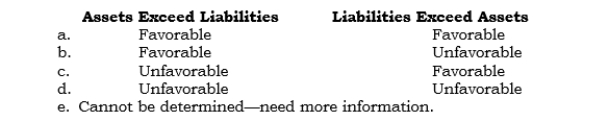

_____ Under the temporal method, what is the effect of an increase in the direct exchange rate under each of the following situations?

(Short Answer)

4.8/5  (35)

(35)

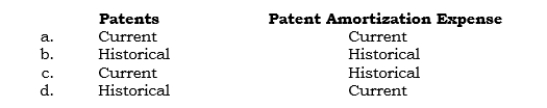

_____ Which exchange rates are used to express the following accounts in dollars under the temporal method of translation?

(Short Answer)

4.8/5  (40)

(40)

_____ Under APB Opinion No. 23, parent companies must provide income taxes on earnings of their foreign subsidiaries in a manner most analogous to

(Multiple Choice)

4.8/5  (30)

(30)

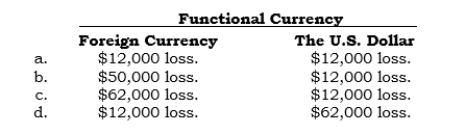

_____ On 12/31/06, Polex's payable to a foreign vendor was properly reported at $512,000 in its balance sheet after recording a $12,000 upward adjustment as a result of a change in the exchange rate. On 1/7/07, the settlement required $505,000. Also, Polex owns a foreign subsidiary. For 2006, an adverse result of $50,000 occurred in translation or remeasurement (as appropriate) for this subsidiary. What amount should be reported in the 2006 consolidated income statement under each of the following situations?

(Short Answer)

4.9/5  (36)

(36)

The current rate method properly reports the economic effect of noninflationary factors.

(True/False)

4.9/5  (29)

(29)

Under FAS 52, "translation" is the process of going from the functional currency into the reporting currency.

(True/False)

4.9/5  (27)

(27)

When a foreign subsidiary has the U.S. dollar as its functional currency, the parent would hedge the ____________________________________________ to prevent reporting an adverse impact on stockholders' equity as a result of an adverse exchange rate change.

(Short Answer)

4.8/5  (32)

(32)

Dividend withholding taxes are a tax to the ___________________________________.

(Short Answer)

4.8/5  (39)

(39)

To satisfy the "invested indefinitely" condition of APB Opinion No. 23, the subsidiary cannot pay any dividends.

(True/False)

4.8/5  (30)

(30)

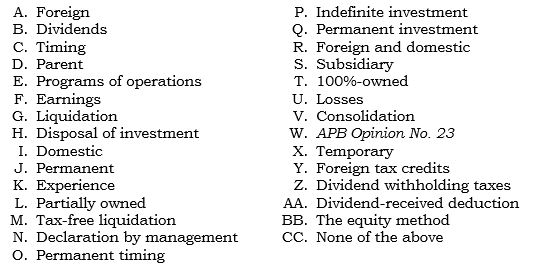

Using the following answer code, select the proper letter(s) and insert it (them) in the space provided:

a. _____ _____ The two things in APB Opinion No. 23 that allow the nonprovision for taxes on the net income of subsidiaries.

b. _____ _____ The category of subsidiary to which the 100% dividend received deduction is applicable.

c. _____ _____ The two examples of evidence required to satisfy the conditions for indefinite investment.

d. _____ _____ On whose books are dividend withholding taxes recorded?

e. _____ _____ The type of subsidiary with which a domestic parent can file a consolidated income tax return. (This does not pertain to ownership percentage; the answer is not T.)

f. _____ _____ Something that is applicable only to foreign subsidiaries.

a. _____ _____ The two things in APB Opinion No. 23 that allow the nonprovision for taxes on the net income of subsidiaries.

b. _____ _____ The category of subsidiary to which the 100% dividend received deduction is applicable.

c. _____ _____ The two examples of evidence required to satisfy the conditions for indefinite investment.

d. _____ _____ On whose books are dividend withholding taxes recorded?

e. _____ _____ The type of subsidiary with which a domestic parent can file a consolidated income tax return. (This does not pertain to ownership percentage; the answer is not T.)

f. _____ _____ Something that is applicable only to foreign subsidiaries.

(Short Answer)

4.8/5  (40)

(40)

FAS 8 used a(n) __________________________________________ unit of measure, which was the _______________________________.

(Short Answer)

4.8/5  (48)

(48)

Showing 1 - 20 of 231

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)