Exam 21: Partnerships: Changes in Ownership

Exam 1: Wholly Owned Subsidiaries: at Date of Creation87 Questions

Exam 2: Wholly Owned Subsidiaries: Postcreation Periods110 Questions

Exam 3: Partially Owned Created Subsidiaries & Variable Interest Entities138 Questions

Exam 4: Introduction to Business Combinations105 Questions

Exam 5: The Purchase Method: at Date of Acquisition-100 Ownership135 Questions

Exam 6: The Purchase Method: Postacquisition Periods and Partial Ownerships74 Questions

Exam 7: New Basis of Accounting52 Questions

Exam 8: Introduction to Intercompany Transactions42 Questions

Exam 9: Intercompany Inventory Transfers66 Questions

Exam 10: Intercompany Fixed Asset Transfers & Bond Holdings31 Questions

Exam 12: Reporting Segment and Related Information90 Questions

Exam 13: International Accounting Standards & Translating Foreign Currency Transactions103 Questions

Exam 14: Using Derivatives to Manage Foreign Currency Exposures256 Questions

Exam 15: Translating Foreign Currency Statements: The Current Rate Method99 Questions

Exam 16: Translating Foreign Currency Statements: The Temporal Method and the Functional Currency Concept231 Questions

Exam 17: Interim Period Reporting49 Questions

Exam 18: Securities and Exchange Commission Reporting55 Questions

Exam 19: Bankruptcy Reorganizations and Liquidations51 Questions

Exam 20: Partnerships: Formation and Operation45 Questions

Exam 21: Partnerships: Changes in Ownership37 Questions

Exam 22: Partnerships: Liquidations35 Questions

Exam 23: Estates and Trusts40 Questions

Exam 24: Governmental Accounting: Basic Principles and the General Fund138 Questions

Exam 25: Governmental Accounting: The Special-Purpose Funds and Special General Ledger232 Questions

Exam 26: Not-For-Profit Organizations: Introduction and Private Npos218 Questions

Select questions type

In partnerships, when goodwill is recorded it cannot be amortized.

Free

(True/False)

4.9/5  (41)

(41)

Correct Answer:

False

A gain or loss for income tax-reporting purposes on a partner's disposal of a partnership interest is computed by comparing the partner's __________________ to his or her _________________________________.

Free

(Short Answer)

5.0/5  (24)

(24)

Correct Answer:

proceeds, tax basis

When a partnership change in ownership occurs and the partnership has goodwill, a method intended to prevent an inequity from occurring among the partners that results in (a) entries being recorded in the general ledger relating to the goodwill and (b) a deviation from GAAP is the __________________________________ method.

Free

(Short Answer)

4.8/5  (32)

(32)

Correct Answer:

recording the goodwill

When a partnership's existence is terminated, the Revised Uniform Partnership Act refers to that as a _____________________________ of the partnership.

(Short Answer)

5.0/5  (49)

(49)

When an existing partnership has goodwill and a new partner is being admitted, a method of dealing with the goodwill that does not deviate from GAAP but may favor the old partners if the goodwill does not materialize is the _________________ _________________________ method.

(Short Answer)

4.7/5  (31)

(31)

_____ When a person is being admitted into a partnership and the special profit and loss sharing provision method has been selected,

(Multiple Choice)

4.8/5  (42)

(42)

_____ When a person is being admitted into a partnership and recording the goodwill method has been selected,

(Multiple Choice)

4.8/5  (42)

(42)

When an existing partnership that has goodwill admits a new partner, the end result on the new partner's capital account will be the same under both the bonus method and the recording the goodwill method, regardless of whether the agreed-upon value of the goodwill is eventually realized.

(True/False)

4.8/5  (42)

(42)

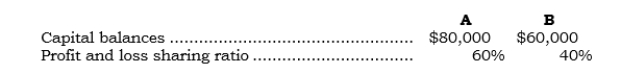

_____ Data for the partnership of A and B follow:

Cook is to be admitted into the partnership and is to have a one-fifth interest in capital and profits with a cash contribution of $40,000. The balances in the capital accounts of A, B, and C under the bonus method are:

Cook is to be admitted into the partnership and is to have a one-fifth interest in capital and profits with a cash contribution of $40,000. The balances in the capital accounts of A, B, and C under the bonus method are:

(Multiple Choice)

4.9/5  (35)

(35)

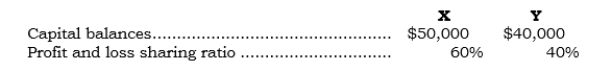

_____ Data for the partnership of X and Y follow:

Z is to be admitted into the partnership and is to have a one-third interest in capital and profits with a cash contribution of $30,000. What are the balances in the capital accounts of X, Y, and Z under the bonus method?

Z is to be admitted into the partnership and is to have a one-third interest in capital and profits with a cash contribution of $30,000. What are the balances in the capital accounts of X, Y, and Z under the bonus method?

(Multiple Choice)

4.9/5  (35)

(35)

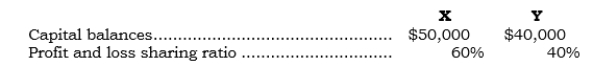

_____ Data for the partnership of X and Y follow:

Z is to be admitted into the partnership and is to have a one-third interest in capital and profits with a cash contribution of $30,000. The balances in the capital accounts of X, Y, and Z under the recording the goodwill method are:

Z is to be admitted into the partnership and is to have a one-third interest in capital and profits with a cash contribution of $30,000. The balances in the capital accounts of X, Y, and Z under the recording the goodwill method are:

(Multiple Choice)

4.9/5  (42)

(42)

Legally, a change in the ownership of a partnership is not a(n) ______________________________________________ of the old partnership.

(Short Answer)

4.7/5  (43)

(43)

_____ The purchase of an interest from one or more of the existing partners of a partnership results in

(Multiple Choice)

4.9/5  (35)

(35)

_____ When a partner withdraws from a partnership, the determination of the withdrawing partner's gain or loss for income tax-reporting purposes is made by comparing:

(Multiple Choice)

5.0/5  (41)

(41)

_____ When Dubke retired from the partnership of Dubke, Logan, and Flaherty, the final settlement of Dubke's partnership interest exceeded Dubke's capital account balance. Under the bonus method, the excess

(Multiple Choice)

4.9/5  (38)

(38)

When a partner retires from a partnership, the balance in that partner's capital account that is distributed to that partner is treated as ________________________ for income tax-reporting purposes.

(Short Answer)

4.8/5  (36)

(36)

When a partnership change in ownership occurs and the partnership has undervalued tangible assets, a method intended to prevent an inequity from occurring among the partners that results in (a) no entries being recorded in the general ledger to revalue the assets and (b) no departure from GAAP is the ______________ ______________________________ method.

(Short Answer)

4.9/5  (38)

(38)

When a partner retires from a partnership, the amount of existing partnership liabilities for which the retiring partner is no longer responsible is treated for income tax-reporting purposes as _______________________________________.

(Short Answer)

4.8/5  (42)

(42)

When two partnerships combine in a manner that is substantively a pooling of interests, the assets of the combining partnerships cannot be revalued to their current values.

(True/False)

4.8/5  (45)

(45)

When a partnership change in ownership occurs and the partnership has goodwill, a method intended to prevent an inequity from occurring among the partners that results in (a) no entries being recorded in the general ledger relating to the goodwill and (b) no deviation from GAAP is the _____________________________ method.

(Short Answer)

4.8/5  (32)

(32)

Showing 1 - 20 of 37

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)