Exam 9: Intercompany Inventory Transfers

Exam 1: Wholly Owned Subsidiaries: at Date of Creation87 Questions

Exam 2: Wholly Owned Subsidiaries: Postcreation Periods110 Questions

Exam 3: Partially Owned Created Subsidiaries & Variable Interest Entities138 Questions

Exam 4: Introduction to Business Combinations105 Questions

Exam 5: The Purchase Method: at Date of Acquisition-100 Ownership135 Questions

Exam 6: The Purchase Method: Postacquisition Periods and Partial Ownerships74 Questions

Exam 7: New Basis of Accounting52 Questions

Exam 8: Introduction to Intercompany Transactions42 Questions

Exam 9: Intercompany Inventory Transfers66 Questions

Exam 10: Intercompany Fixed Asset Transfers & Bond Holdings31 Questions

Exam 12: Reporting Segment and Related Information90 Questions

Exam 13: International Accounting Standards & Translating Foreign Currency Transactions103 Questions

Exam 14: Using Derivatives to Manage Foreign Currency Exposures256 Questions

Exam 15: Translating Foreign Currency Statements: The Current Rate Method99 Questions

Exam 16: Translating Foreign Currency Statements: The Temporal Method and the Functional Currency Concept231 Questions

Exam 17: Interim Period Reporting49 Questions

Exam 18: Securities and Exchange Commission Reporting55 Questions

Exam 19: Bankruptcy Reorganizations and Liquidations51 Questions

Exam 20: Partnerships: Formation and Operation45 Questions

Exam 21: Partnerships: Changes in Ownership37 Questions

Exam 22: Partnerships: Liquidations35 Questions

Exam 23: Estates and Trusts40 Questions

Exam 24: Governmental Accounting: Basic Principles and the General Fund138 Questions

Exam 25: Governmental Accounting: The Special-Purpose Funds and Special General Ledger232 Questions

Exam 26: Not-For-Profit Organizations: Introduction and Private Npos218 Questions

Select questions type

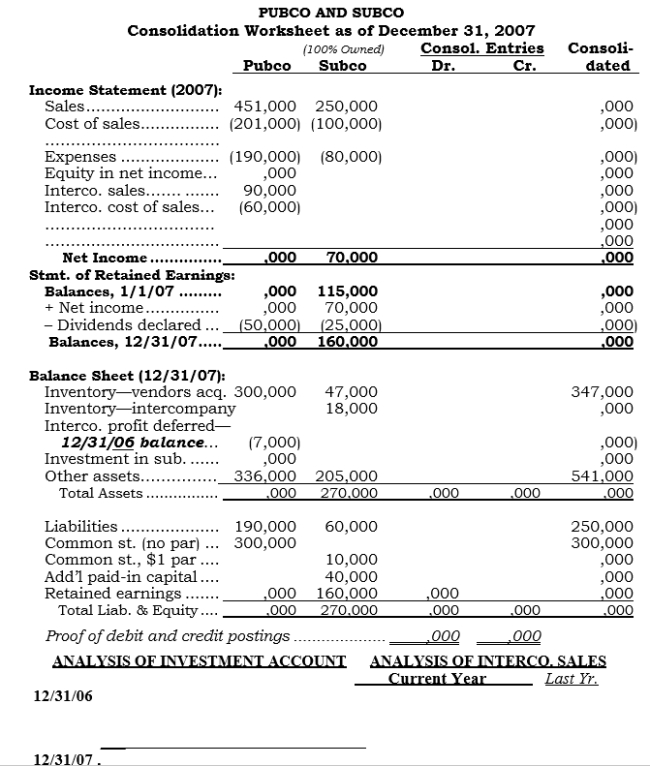

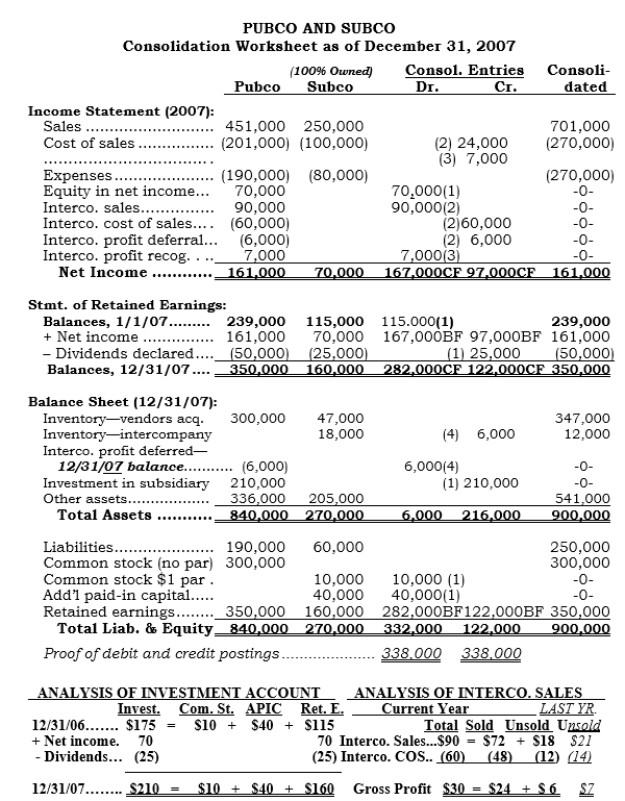

Equity Method Consolidation Worksheet (MODULE 1)

Complete the following consolidation worksheet assuming that Pubco (1) uses the equity method, (2) all intercompany inventory on hand at 12/31/06 (totaling $21,000) was resold by Subco in 2007 for $31,000. Make year-end adjusting entries in the Pubco or Subco column, as necessary. Show analyses at bottom of this sheet.

Free

(Essay)

4.8/5  (26)

(26)

Correct Answer:

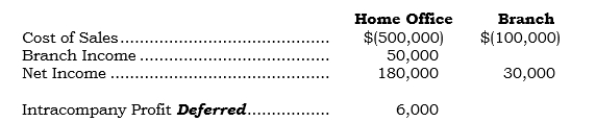

For the year ended 12/31/06, selected line items from the home office and branch columns of the combining statement worksheet follow:

What is the combined net income as reported in the combined column?

What is the combined net income as reported in the combined column?

Free

(Multiple Choice)

4.9/5  (26)

(26)

Correct Answer:

C

A home office ships inventory costing $40,000 to its branch at a transfer price of $50,000. The markup percentage (rounded) using the branch's cost basis is

Free

(Multiple Choice)

4.7/5  (40)

(40)

Correct Answer:

D

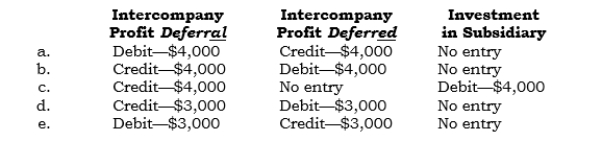

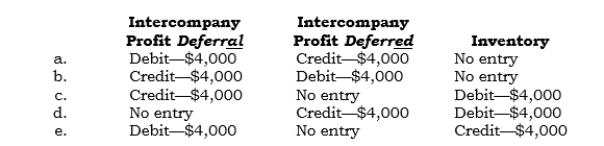

_____ (Module 1) In 2006, Sundax (a 75% owned subsidiary) sold inventory above cost to Pundax, its parent. At 12/31/06, $4,000 of unrealized intercompany profit existed. Which of the following entries is made in the general ledger at 12/31/06?

(Short Answer)

4.8/5  (32)

(32)

(Module 1) Pazda sold inventory costing $40,000 to its 100%-owned subsidiary, Sazda, for $100,000 in 2006. Sazda resold $70,000 of this inventory for $130,000 in 2006. Sazda reported $300,000 of net income for 2006.

Required:

a. Prepare the general ledger entry required at the end of 2006 under the complete equity method.

b. Prepare the consolidation entry or entries required at 12/31/06.

(Essay)

4.7/5  (43)

(43)

_____ In 2006, Pulco acquired inventory from its 75%-owned subsidiary, Sulco, for $250,000. Sulco's cost was $200,000. At 12/31/06, Pulco reported $40,000 of intercompany-acquired inventory in its balance sheet. The amount by which the 2006 consolidated net income that accrues to the controlling interest will be lower as a result of this being an intercompany transaction is

(Multiple Choice)

4.9/5  (45)

(45)

_____ In 2005, Palco sold inventory costing $70,000 to its 100%-owned subsidiary, Salco, for $110,000. At 12/31/05, $33,000 of this inventory was reported in Salco's balance sheet. In 2006, Salco resold this inventory for $55,000. Which of the following accounts is eliminated in consolidation at 12/31/06 as a result of the above transactions?

(Short Answer)

4.8/5  (36)

(36)

_____ (Module 1) In 2006, Pundax sold inventory above cost to Sundax, its 100%-owned subsidiary. At 12/31/06, $4,000 of unrealized intercompany profit existed. Which of the following entries is made in the general ledger at 12/31/06?

(Short Answer)

4.9/5  (33)

(33)

_____ (Module 2) Pageco sold inventory to its 100%-owned subsidiary, Sageco, in 2005 and 2006. At 12/31/05, $24,000 of intercompany profit was deferred in consolidation using the partial equity method. The related inventory was resold to an outside party in early 2006. At 12/31/06, $25,000 of intercompany profit was deferred in consolidation using the partial equity method. At 12/31/06,

a. Consolidated net income is $25,000 less than the parent's net income.

b. Consolidated net income is $25,000 more than the parent's net income.

c. Consolidated net income is $1,000 less than the parent's net income.

d. Consolidated net income is $1,000 more than the parent's net income.

(Short Answer)

4.8/5  (38)

(38)

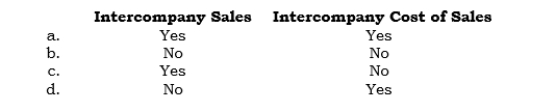

_____ In 2005, an intercompany inventory transfer above cost occurred. In 2006, all this inventory was resold to an outside party. Which of the following accounts would require adjustment or elimination in consolidation at 12/31/06?

(Multiple Choice)

4.9/5  (42)

(42)

_____ In its consolidated 2006 financial statements, Pozak recognized $37,000 of intercompany profit relating to upstream inventory sales from its 75%-owned subsidiary (Sozak). Of this amount, $7,000 pertained to intercompany profit deferred at 12/31/05. During 2006, downstream intercompany sales totaled $100,000 (Pozak's cost was $60,000). What amount was credited to Inventory in consolidation at 12/31/06? (Hint: Prepare the analysis of unrealized profit for the 2006 transfers-this is possible from the information given.)

(Multiple Choice)

4.8/5  (43)

(43)

_____ An intercompany inventory transfer above cost occurred in 2005. At 12/31/05, a portion of the transferred inventory remained unsold. Which of the following accounts would not require adjustment or elimination in consolidation at the end of 2005?

(Multiple Choice)

4.8/5  (42)

(42)

Downstream intercompany inventory transfers at cost to a 100%-owned subsidiary need not be eliminated in consolidation.

(True/False)

4.8/5  (36)

(36)

If intercompany profit is deferred for consolidated reporting purposes, then any income taxes recorded on that profit must also be deferred for consolidated reporting purposes.

(True/False)

4.8/5  (34)

(34)

_____ In 2005, Pimco sold inventory costing $45,000 to its 100%-owned subsidiary, Simco, for $75,000. At 12/31/05, $15,000 of this inventory was reported in Simco's balance sheet. In 2006, Simco resold this inventory for $25,000. What is the unrealized intercompany profit at 12/31/05?

(Multiple Choice)

4.8/5  (34)

(34)

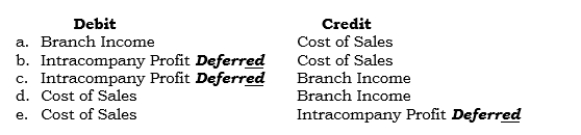

In 2006, a branch sold inventory it had acquired from its home office in 2005 at a markup of $8,000. Which entry is required in the combining statement worksheet in 2006?

(Short Answer)

4.7/5  (45)

(45)

Under current GAAP, the amount of intercompany profit or loss to be deferred for consolidated reporting purposes is not affected by the existence of a noncontrolling interest.

(True/False)

4.8/5  (37)

(37)

_____ In 2006, Semco resold for $40,000 inventory that it had acquired in 2005 from its parent company, Pemco, for $32,000. Pemco's cost was $25,000. In consolidation at the end of 2006, which of the following accounts is credited in consolidation?

(Multiple Choice)

5.0/5  (40)

(40)

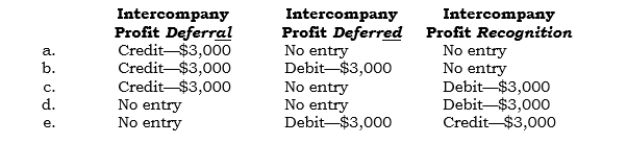

_____ (Module 1) In 2005, Paxco sold inventory above cost to Saxco, its 100%-owned subsidiary. At 12/31/05, $3,000 of unrealized intercompany profit existed. In 2006, Saxco resold this inventory. Which of the following entries is made in the general ledger at 12/31/06 (not 05)?

(Short Answer)

4.8/5  (42)

(42)

In 2006, a home office shipped inventory costing $400,000 to its newly established branch at a transfer price of $480,000. In the branch's year-end closing entries, the branch charged $360,000 of this inventory to Cost of Sales. The adjusted general ledger balance in the Intracompany Profit Deferred account at year-end should be

(Multiple Choice)

4.8/5  (40)

(40)

Showing 1 - 20 of 66

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)