Exam 9: Intercompany Inventory Transfers

Exam 1: Wholly Owned Subsidiaries: at Date of Creation87 Questions

Exam 2: Wholly Owned Subsidiaries: Postcreation Periods110 Questions

Exam 3: Partially Owned Created Subsidiaries & Variable Interest Entities138 Questions

Exam 4: Introduction to Business Combinations105 Questions

Exam 5: The Purchase Method: at Date of Acquisition-100 Ownership135 Questions

Exam 6: The Purchase Method: Postacquisition Periods and Partial Ownerships74 Questions

Exam 7: New Basis of Accounting52 Questions

Exam 8: Introduction to Intercompany Transactions42 Questions

Exam 9: Intercompany Inventory Transfers66 Questions

Exam 10: Intercompany Fixed Asset Transfers & Bond Holdings31 Questions

Exam 12: Reporting Segment and Related Information90 Questions

Exam 13: International Accounting Standards & Translating Foreign Currency Transactions103 Questions

Exam 14: Using Derivatives to Manage Foreign Currency Exposures256 Questions

Exam 15: Translating Foreign Currency Statements: The Current Rate Method99 Questions

Exam 16: Translating Foreign Currency Statements: The Temporal Method and the Functional Currency Concept231 Questions

Exam 17: Interim Period Reporting49 Questions

Exam 18: Securities and Exchange Commission Reporting55 Questions

Exam 19: Bankruptcy Reorganizations and Liquidations51 Questions

Exam 20: Partnerships: Formation and Operation45 Questions

Exam 21: Partnerships: Changes in Ownership37 Questions

Exam 22: Partnerships: Liquidations35 Questions

Exam 23: Estates and Trusts40 Questions

Exam 24: Governmental Accounting: Basic Principles and the General Fund138 Questions

Exam 25: Governmental Accounting: The Special-Purpose Funds and Special General Ledger232 Questions

Exam 26: Not-For-Profit Organizations: Introduction and Private Npos218 Questions

Select questions type

In 2006, a home office shipped inventory costing $60,000 to its branch for $90,000. At the end of 2006, the branch reported $30,000 of this inventory in its balance sheet. The amount of unrealized intracompany profit at the end of 2006 is

(Multiple Choice)

4.8/5  (29)

(29)

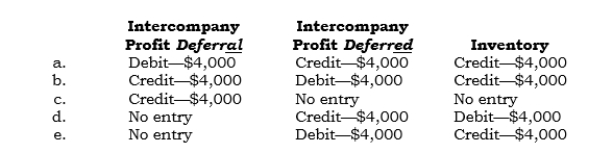

_____ (Module 1) In 2006, Pundax sold inventory above cost to Sundax, its 100%-owned subsidiary. At 12/31/06, $4,000 of unrealized intercompany profit existed. Which of the following "postings" is made in consolidation at 12/31/06?

(Short Answer)

4.9/5  (42)

(42)

_____ (Module 1) Which of the following accounts is a balance sheet account?

(Short Answer)

4.9/5  (33)

(33)

_____ In early 2005, Pye sold inventory costing $33,000 to its 100%-owned subsidiary, Slyce, for $44,000. At 12/31/05, Slyce made a lower-of-cost-or-market adjustment of $6,000 for this inventory, all of which was still on hand. What amount is reported for this inventory in the 12/31/05 consolidated balance sheet?

(Multiple Choice)

4.9/5  (35)

(35)

The general ledger entry to adjust the Intracompany Profit Deferred account at the end of an accounting period

(Multiple Choice)

4.9/5  (34)

(34)

(Module 2) In 2005, Sondex, an 80%-owned subsidiary of Pondex, sold inventory to Pondex for $500,000, which includes a markup of 25% on Sondex's cost. At 12/31/05, Pondex reported $80,000 of this inventory in its balance sheet. (This inventory was resold in 2006 by Pondex.) In 2006, Sondex sold to Pondex for $800,000 inventory that cost $600,000, of which $640,000 was resold by 12/31/06. Sondex reported $750,000 of net income for 2006.

Required:

Prepare the consolidation entry or entries required at 12/31/06 under the partial equity method.

(Essay)

4.8/5  (35)

(35)

If an intercompany inventory transfer occurs in late 2005 and all this inventory is not resold to an outside, third party until 2006, the intercompany sale is eliminated in consolidation in 2005-not 2006.

(True/False)

4.7/5  (40)

(40)

_____ (Module 1) In 2006, Sundax (a 75% owned subsidiary) sold inventory above cost to Pundax, its parent. At 12/31/06, $4,000 of unrealized intercompany profit existed. Which of the following "postings" is made in consolidation at 12/31/06?

(Short Answer)

4.9/5  (43)

(43)

_____ In 2005, Polex sold inventory costing $100,000 to its 100%-owned subsidiary, Solex, for $150,000. At the end of 2005, Solex reported $60,000 of intercompany-acquired inventory in its balance sheet. What is the unrealized intercompany profit at 12/31/05?

(Multiple Choice)

4.7/5  (29)

(29)

The concept of profit on intercompany transactions to be deferred for consolidated reporting purposes is gross profit.

(True/False)

4.8/5  (32)

(32)

_____ In 2005, Palex sold inventory costing $45,000 to its 100%-owned subsidiary, Salex, for $70,000. By 12/31/05, Salex had resold all this inventory for $100,000. Which of the following accounts would have to be eliminated in consolidation at 12/31/05?

(Short Answer)

4.9/5  (31)

(31)

(Module 2) In 2007, Puncor resold for $77,000 inventory that it had acquired from Suncor (an 80%-owned subsidiary) in 2006 for $55,000. Suncor's cost was $44,000.

Required:

Prepare the consolidation entry or entries required at 12/31/07 under the partial equity method.

(Essay)

5.0/5  (39)

(39)

Intercompany inventory transfers at cost need not be eliminated in consolidation.

(True/False)

4.9/5  (40)

(40)

_____ In 2005, Punco sold inventory costing $60,000 to its 100%-owned subsidiary, Sunco, for $100,000. At 12/31/05, $20,000 of this inventory was reported in Sunco's balance sheet. In 2006, Sunco resold this inventory for $30,000. What is the unrealized intercompany profit at 12/31/05?

(Multiple Choice)

4.8/5  (33)

(33)

For the year ended 12/31/06, the adjusted financial statements of a home office and its branch show net income of $700,000 and $100,000, respectively. At the end of 2005, the home office adjusted the Intracompany Profit Deferred account by debiting it for $40,000, leaving a balance of $10,000. The combined net income for 2006 is

(Multiple Choice)

4.8/5  (45)

(45)

(Module 1) In 2006, Salco (a 100%-owned subsidiary of Palco) resold for $66,000 inventory that it had acquired from Palco in 2005 for $40,000. Palco's cost was $23,000. Salco reported $200,000 of net income for 2006.

Required:

a. Prepare the general ledger entry required at the end of 2006 under the complete equity method.

b. Prepare the consolidation entry or entries required at 12/31/06.

(Essay)

4.7/5  (31)

(31)

(Module 2) In 2006, Salco (a 100%-owned subsidiary of Palco) resold for $66,000 inventory that it had acquired from Palco in 2005 for $40,000. Palco's cost was $23,000.

Required:

Prepare the consolidation entry or entries required at 12/31/06 under the partial equity method.

(Essay)

4.7/5  (38)

(38)

_____ In 2006, Semco resold for $55,000 inventory that it had acquired in 2005 from its parent, Pemco, for $30,000. Pemco's cost was $40,000. Which account is credited in consolidation at 12/31/06?

(Multiple Choice)

4.8/5  (40)

(40)

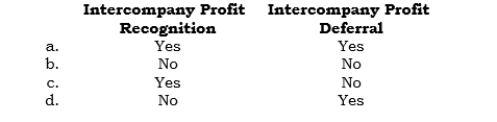

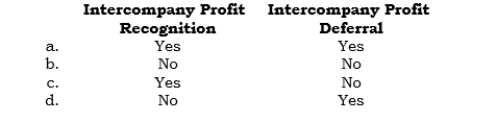

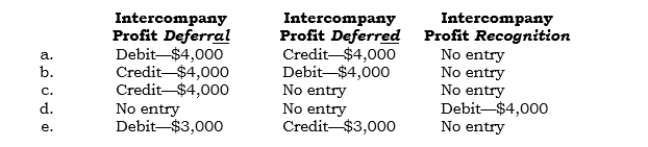

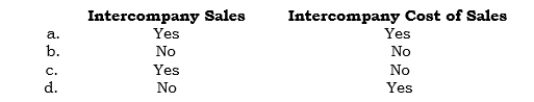

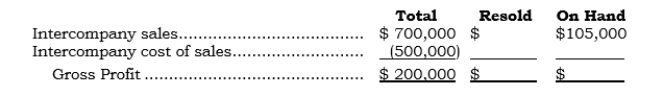

Complete the following analysis and prepare the related consolidation entry:

(Essay)

4.7/5  (44)

(44)

Showing 21 - 40 of 66

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)