Exam 8: Stock Transactions, Dividends, and EPS

Exam 1: Financial Accounting for MBAS71 Questions

Exam 2: Introducing Financial Statements90 Questions

Exam 3: Transactions, Adjustments, and Financial Statements61 Questions

Exam 4: Analyzing and Interpreting Financial Statements66 Questions

Exam 5: Revenues, Receivables, and Operating Expenses60 Questions

Exam 6: Inventory, Accounts Payable, and Long-Term Assets58 Questions

Exam 7: Current Liabilities and Long-Term Liabilities65 Questions

Exam 8: Stock Transactions, Dividends, and EPS75 Questions

Exam 9: Intercorporate Investments75 Questions

Exam 10: Leases, Pensions, and Income Taxes68 Questions

Exam 11: Cash Flows64 Questions

Exam 12: Forecasting Financial Statements70 Questions

Exam 13: Using Financial Statements for Valuation83 Questions

Select questions type

Kimberly-Clark recently repurchased 6.198 million shares of common stock at a cost of $778 million. One plausible reason for this is that the company feels that its stock is overvalued at the current market price.

(True/False)

4.9/5  (51)

(51)

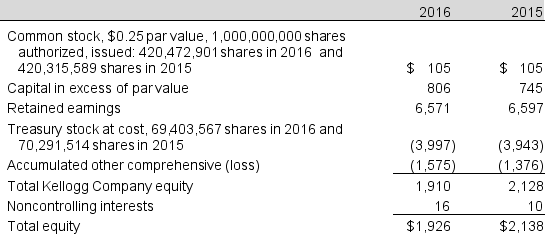

Following is the stockholders' equity section of the 2016 Kellogg Company balance sheet. ($ in millions, except par value):

Required:

a. How many common shares are issued at year end 2016?

b. At what average price was the common stock issued as of 2016?

c. How many common shares are outstanding at year end 2016?

d. How many shares of treasury stock (net) did Kellogg acquire or retire or sell during 2016?

e. What average price did Kellogg acquire its treasury stock as of year-end 2016?

f. In general, what is accumulated other comprehensive income? List three items that affect this account.

g. What is noncontrolling interest?

Required:

a. How many common shares are issued at year end 2016?

b. At what average price was the common stock issued as of 2016?

c. How many common shares are outstanding at year end 2016?

d. How many shares of treasury stock (net) did Kellogg acquire or retire or sell during 2016?

e. What average price did Kellogg acquire its treasury stock as of year-end 2016?

f. In general, what is accumulated other comprehensive income? List three items that affect this account.

g. What is noncontrolling interest?

(Short Answer)

4.8/5  (50)

(50)

On its 2017 balance sheet, Walgreens Boot Alliance, Inc., reports treasury stock at cost of $4,934 million. The company has a total of 1,172,513,618 shares issued and 1,082,986,591 shares outstanding.

What average price did Walgreen pay for treasury shares?

(Multiple Choice)

4.8/5  (35)

(35)

eBay's footnote regarding employee stock compensation details the grant of 2 million options during the year of 2015, the fair-value of which was computed as $6.84.

If the options have, on average, a four-year vesting schedule and the company faces a 35% tax rate on income, what affect would this option grant have on eBay's accounts in 2015?

(Multiple Choice)

4.8/5  (42)

(42)

A re-issuance of treasury stock at a price lower than what it was repurchased for results in a loss on the income statement.

(True/False)

4.8/5  (38)

(38)

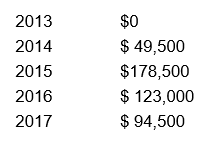

At the start of 2013, Shasta Corporation has 15,000 outstanding shares of preferred stock, each with a $60 par value and a cumulative 7% annual dividend. The company also has 28,000 shares of common stock outstanding with par value of $37.50 per share. At the beginning of 2017, the company has a 3-for-2 common stock split. The company pays total cash dividends as follows.

Calculate the dividends paid to each category of stockholders, in total and per share.

Calculate the dividends paid to each category of stockholders, in total and per share.

(Short Answer)

4.8/5  (30)

(30)

Convertible preferred stock conveys what additional benefit over common stock?

(Multiple Choice)

4.9/5  (45)

(45)

During the year, Salem, Inc. had several stockholders' equity transactions, which are summarized in the following table. Preferred stock has a par value of $75 and is convertible into common stock at the ratio of 1:1. The common stock has a par value of $5.

a. How many shares of common stock did Salem sell during the year and at what price per share?

b. How many shares of preferred stock were converted during the year?

c. Why would a company such as Salem offer a conversion feature on preferred stock?

d. Why would a shareholder exercise the conversion privilege?

e. What dividends did Salem pay during the year?

a. How many shares of common stock did Salem sell during the year and at what price per share?

b. How many shares of preferred stock were converted during the year?

c. Why would a company such as Salem offer a conversion feature on preferred stock?

d. Why would a shareholder exercise the conversion privilege?

e. What dividends did Salem pay during the year?

(Short Answer)

4.9/5  (40)

(40)

The following is an excerpt from the 2017 statement of cash flows of Fey Company.

A footnote to the Fey Company financial statements included the following:

(a) Mandatory Convertible Preferred Stock

On March 13, 2017, Fey Company completed an offering of 1,245,000 shares of its 5.75% mandatory convertible preferred stock (the "Preferred Stock") at a public offering price of $582.40 per share, resulting in net proceeds of $714,212 million. At any time prior to March 14, 2020, holders of the Preferred Stock may elect to convert each share of Preferred Stock into 0.8680 shares of Common Stock, subject to anti-dilution adjustments.

Continued next page

Required:

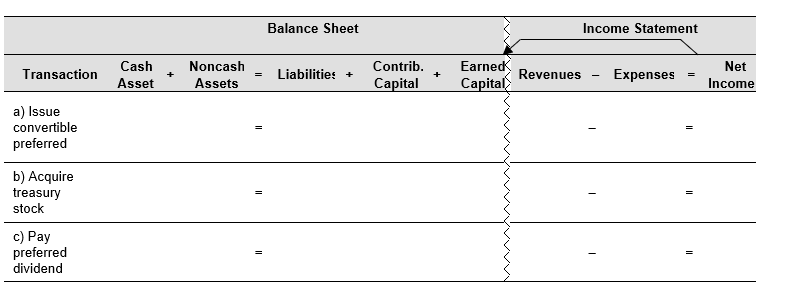

a. Use the financial statements effects template below to record the convertible preferred stock issued during 2017. The company reduced additional paid-in capital for the issuance costs paid to the underwriter.

b. Use the financial statements effects template below to record the treasury stock acquired.

c. Use the financial statements effects template below to record the dividend paid to preferred stockholders.

d. Assume that on January 1, 2018, all preferred shares are converted to $2.00 par common stock. Explain how Fey Company's balance sheet will be affected by this conversion. How would total equity change?

(Short Answer)

4.8/5  (37)

(37)

In June 2017, Newcastle Inc. announced a 3-for-1 stock split. On the split date, Newcastle had about 81.9 million shares outstanding.

After the split the number of shares outstanding was:

(Multiple Choice)

4.9/5  (34)

(34)

When there is a purchase and sale of stock, or a payment of dividends, there is never any gain or loss recorded.

(True/False)

5.0/5  (39)

(39)

Mayhill Inc. reports 4,287,000 stock options granted during fiscal 2017 at a weighted-average fair-value of $23.10. The average vesting period for these options is four years. Mayhill should record a $99,029,700 expense on its income statement related to this option grant.

(True/False)

4.9/5  (32)

(32)

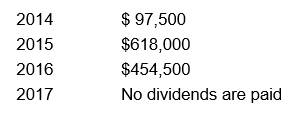

Redding Exports has the following stock outstanding:

25,000 shares of $120 par value, 6% cumulative preferred stock

150,000 shares of $3,075 par value, common stock

The company declares and pays the following dividends for the past four years:

Compute the total cash dividends paid to each class of stock in 2014 through 2017.

Compute the total cash dividends paid to each class of stock in 2014 through 2017.

(Short Answer)

4.8/5  (39)

(39)

Verizon Communications Inc. reported the following in its 2016 statement of shareholders' equity.

Required:

a. In general, what is "Accumulated other comprehensive income (loss)"?

b. Explain each of the following components of Verizon's accumulated other comprehensive income account:

• Foreign currency translation adjustment

• Unrealized losses on marketable securities

• Defined benefit pension and postretirement plans

c. If the U.S. $ weakens in 2017 vis-à-vis the foreign currency of Verizon's foreign subsidiaries, what will be the effect on the foreign currency translation adjustment?

Required:

a. In general, what is "Accumulated other comprehensive income (loss)"?

b. Explain each of the following components of Verizon's accumulated other comprehensive income account:

• Foreign currency translation adjustment

• Unrealized losses on marketable securities

• Defined benefit pension and postretirement plans

c. If the U.S. $ weakens in 2017 vis-à-vis the foreign currency of Verizon's foreign subsidiaries, what will be the effect on the foreign currency translation adjustment?

(Short Answer)

4.7/5  (44)

(44)

DuBois, Inc. announces a large stock dividend of 65% of the 4.96 million outstanding shares of common stock. The current price per share is $13.85. Par value of the stock is $0.01 per share.

What effect does this dividend have on retained earnings?

(Multiple Choice)

4.8/5  (37)

(37)

All of the following are potentially dilutive in computing diluted EPS except:

A) Employee stock options

B) Convertible preferred stock

C) Convertible bonds

D) Warrants

E) All of the above are dilutive securities

(Short Answer)

4.9/5  (35)

(35)

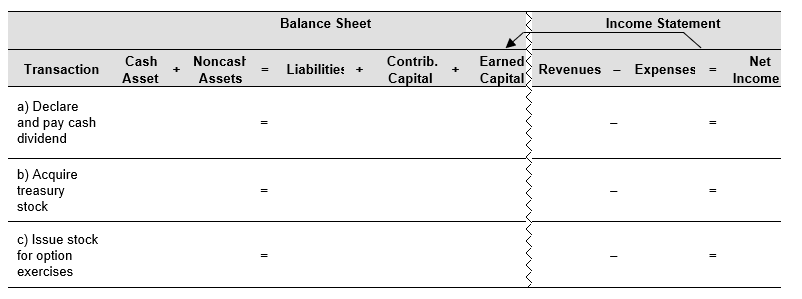

Chemult Company reported the following transactions on a recent statement of stockholders' equity

a. Declare and pay cash dividends of $5.95 per common share. There are 205,000 shares issued and outstanding.

b. Repurchase 3,455 shares at $49 per share.

c. Issue 202 shares of common stock under employee stock option plan. Exercise price is $49 per share and market price is $67.20 per share.

Assume that the par value of common stock is $1 per share. Use the financial statement effects template, below to record these transactions.

(Short Answer)

4.8/5  (35)

(35)

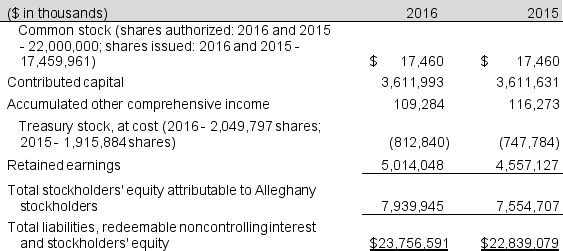

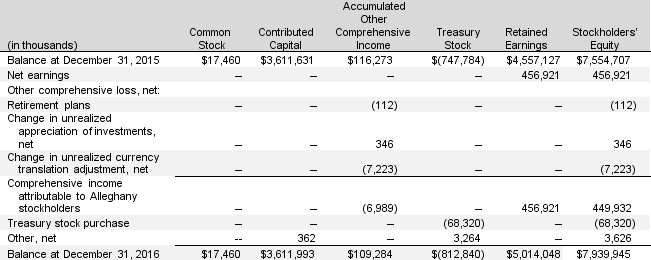

Below are excerpts from the 2016 Alleghany Corporation and Subsidiaries' balance sheet and statement of stockholders' equity:

Required:

a. How many common shares are issued at year-end 2016?

b. What is the par value of Alleghany's common stock?

c. At what average price was the common stock issued as of 2016?

d. Explain the treasury stock transaction of $68,320 thousand during the year.

e. How much was net income in 2016? How much was comprehensive income? Explain the difference between the two.

Required:

a. How many common shares are issued at year-end 2016?

b. What is the par value of Alleghany's common stock?

c. At what average price was the common stock issued as of 2016?

d. Explain the treasury stock transaction of $68,320 thousand during the year.

e. How much was net income in 2016? How much was comprehensive income? Explain the difference between the two.

(Short Answer)

4.8/5  (35)

(35)

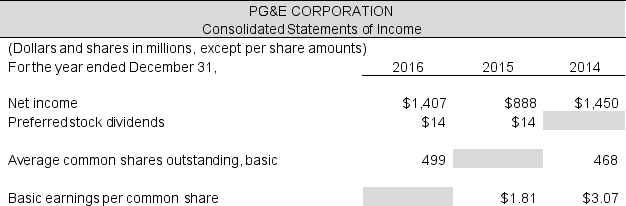

The 2016 Form 10-K of Pacific Gas & Electric Corporation includes the following information in the income statement. Compute the missing amounts.

(Short Answer)

4.7/5  (31)

(31)

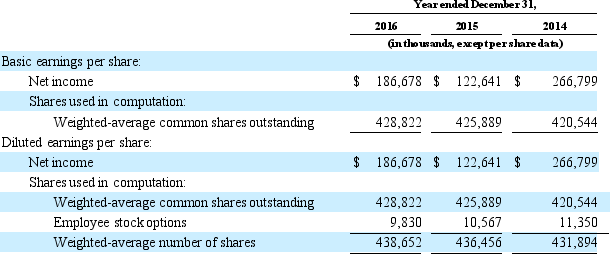

The 2016 Form 10-K of NetFlix includes the following footnoted information. Use this information to answer the required.

The computation of net income per share is as follows:

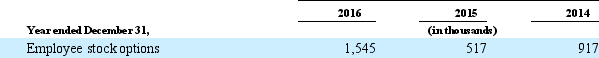

Employee stock options with exercise prices greater than the average market price of the common stock were excluded from the diluted calculation as their inclusion would have been anti-dilutive.

The following table summarizes the potential common shares excluded from the diluted calculation (in thousands):

Employee stock options with exercise prices greater than the average market price of the common stock were excluded from the diluted calculation as their inclusion would have been anti-dilutive.

The following table summarizes the potential common shares excluded from the diluted calculation (in thousands):

Required:

a. What are the potential sources of dilution of NetFlix's earnings per share?

b. List two additional dilutive securities (other than those NetFlix includes).

c. NetFlix did not include all outstanding employee stock options in the calculation of diluted net income per share in 2016? Why not? How many options were excluded?

d. Calculate basic EPS for each of the three years.

e. Calculate diluted EPS for each of the three years.

Required:

a. What are the potential sources of dilution of NetFlix's earnings per share?

b. List two additional dilutive securities (other than those NetFlix includes).

c. NetFlix did not include all outstanding employee stock options in the calculation of diluted net income per share in 2016? Why not? How many options were excluded?

d. Calculate basic EPS for each of the three years.

e. Calculate diluted EPS for each of the three years.

(Short Answer)

4.8/5  (36)

(36)

Showing 21 - 40 of 75

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)