Exam 3: Product Design and Development

Exam 1: Operations Management, Processes, and Supply Chain Management41 Questions

Exam 2: Corporate Strategy, Performance, and Sustainability55 Questions

Exam 3: Product Design and Development50 Questions

Exam 4: Process Design and Capacity Management48 Questions

Exam 5: Customer Relationships and Customer Service50 Questions

Exam 6: Demand Management, Forecasting, and Aggregate Planning45 Questions

Exam 7: Independent Demand Inventory Management45 Questions

Exam 8: Supplement: Job Scheduling and Vehicle Routing and Material Flow Analysis and Facility Layouts93 Questions

Exam 9: Lean Systems50 Questions

Exam 10: Managing Customer and Work Flows50 Questions

Exam 11: Managing Information Flowsmrp and ERP46 Questions

Exam 12: Managing Projects42 Questions

Exam 13: Supplement: Statistical Quality Control and Six Sigma Quality Management97 Questions

Exam 14: Supply Chain Processes50 Questions

Exam 15: Location, Logistics, and Product Returns49 Questions

Exam 16: Integrating Processes Along the Supply Chain42 Questions

Select questions type

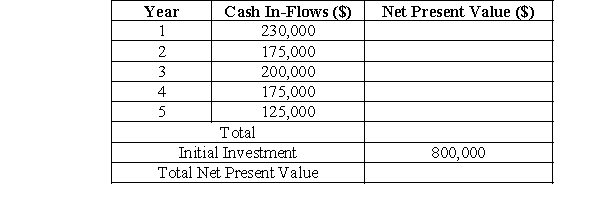

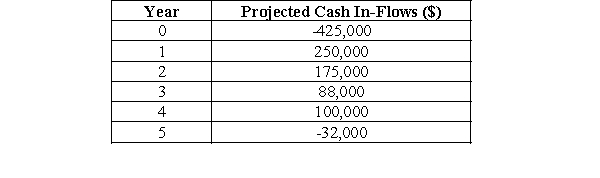

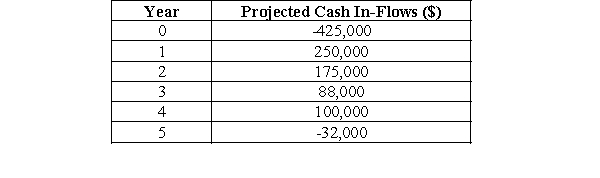

-Calculate the total net present value for the project.

-Calculate the total net present value for the project.

Free

(Multiple Choice)

4.9/5  (41)

(41)

Correct Answer:

B

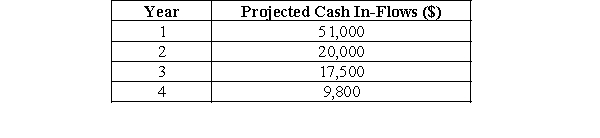

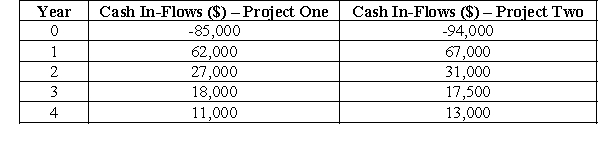

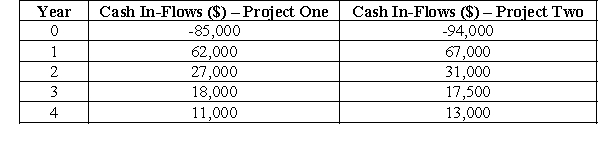

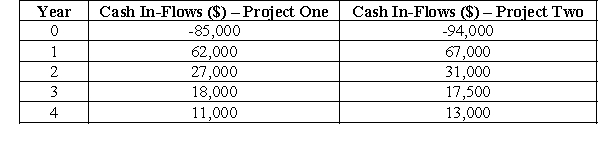

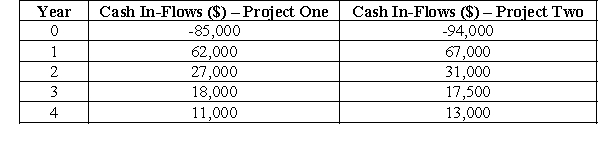

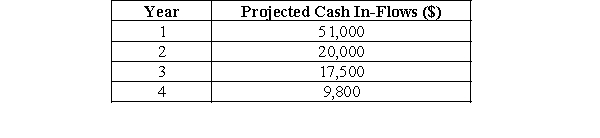

The product design costs are $75,000. The following table shows the projected cash in-flows. Assume a 4-year lifespan.

-The internal rate of return for the project is

-The internal rate of return for the project is

Free

(Multiple Choice)

4.8/5  (37)

(37)

Correct Answer:

D

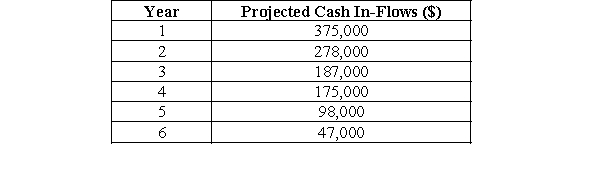

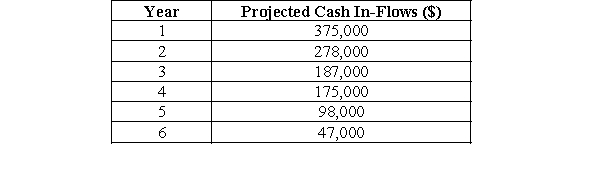

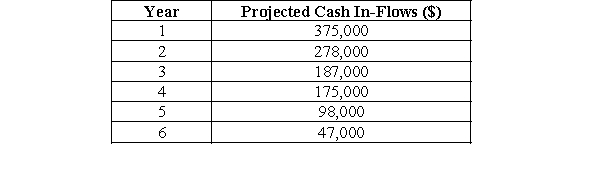

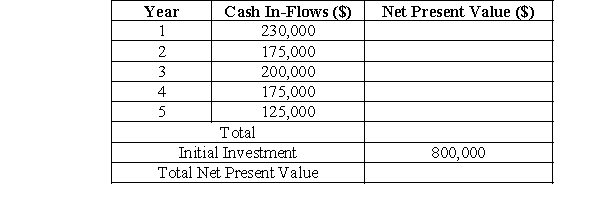

Fabricating Solutions is looking at the financials for a CNC machine. The expected life cycle for the machine is 6 years. The initial projected product design costs are $725,000. Fabricating Solutions typically uses a discount rate of 14% for all new product financials.

-For the project, how long will it take to recover the initial investments using a discount rate of 17%?

-For the project, how long will it take to recover the initial investments using a discount rate of 17%?

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

C

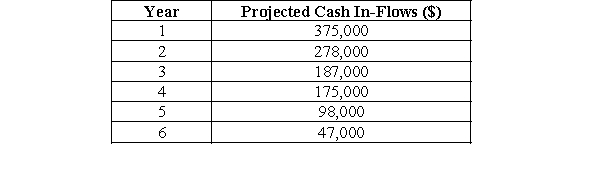

Fabricating Solutions is looking at the financials for a CNC machine. The expected life cycle for the machine is 6 years. The initial projected product design costs are $725,000. Fabricating Solutions typically uses a discount rate of 14% for all new product financials.

-The internal rate of return for the project is

-The internal rate of return for the project is

(Multiple Choice)

5.0/5  (34)

(34)

Fabricating Solutions is looking at the financials for a CNC machine. The expected life cycle for the machine is 6 years. The initial projected product design costs are $725,000. Fabricating Solutions typically uses a discount rate of 14% for all new product financials.

-The internal rate of return for the project is

-The internal rate of return for the project is

(Multiple Choice)

4.9/5  (36)

(36)

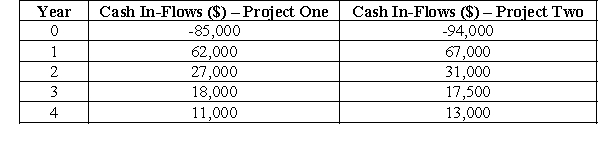

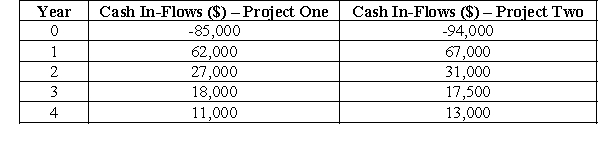

-For Project One, how long will it take to recover the initial investments using a discount rate of 15%?

-For Project One, how long will it take to recover the initial investments using a discount rate of 15%?

(Multiple Choice)

4.8/5  (38)

(38)

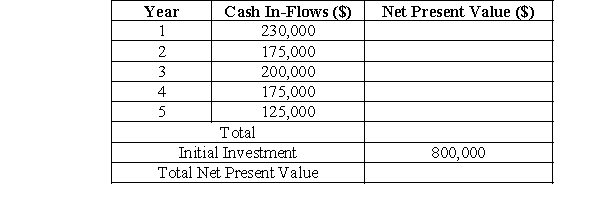

-What is the net present value of cash flows using a 7% discount rate for Year 4?

-What is the net present value of cash flows using a 7% discount rate for Year 4?

(Multiple Choice)

4.9/5  (38)

(38)

-Calculate the total net present value for Project Two using a discount rate of 15%.

-Calculate the total net present value for Project Two using a discount rate of 15%.

(Multiple Choice)

4.8/5  (38)

(38)

-Calculate the total net present value for the project using a discount rate of 15%.

-Calculate the total net present value for the project using a discount rate of 15%.

(Multiple Choice)

4.8/5  (37)

(37)

-Calculate the total net present value for Project One using a discount rate of 20%.

-Calculate the total net present value for Project One using a discount rate of 20%.

(Multiple Choice)

5.0/5  (36)

(36)

Fabricating Solutions is looking at the financials for a CNC machine. The expected life cycle for the machine is 6 years. The initial projected product design costs are $725,000. Fabricating Solutions typically uses a discount rate of 14% for all new product financials.

-Calculate the total net present value for the project using a discount rate of 20%.

-Calculate the total net present value for the project using a discount rate of 20%.

(Multiple Choice)

4.8/5  (37)

(37)

-Calculate the total net present value for the project using a discount rate of 10%.

-Calculate the total net present value for the project using a discount rate of 10%.

(Multiple Choice)

5.0/5  (33)

(33)

-Calculate the total net present value for Project Two using a discount rate of 12%.

-Calculate the total net present value for Project Two using a discount rate of 12%.

(Multiple Choice)

4.8/5  (28)

(28)

-If the discount rate for the project is changed to 11%, find the total net present value.

-If the discount rate for the project is changed to 11%, find the total net present value.

(Multiple Choice)

4.7/5  (31)

(31)

-Calculate the total net present value for Project One using a discount rate of 15%.

-Calculate the total net present value for Project One using a discount rate of 15%.

(Multiple Choice)

4.8/5  (25)

(25)

-For Project Two, how long will it take to recover the initial investments using a discount rate of 20%?

-For Project Two, how long will it take to recover the initial investments using a discount rate of 20%?

(Multiple Choice)

4.8/5  (29)

(29)

The product design costs are $75,000. The following table shows the projected cash in-flows. Assume a 4-year lifespan.

-Calculate the total net present value for the project using a discount rate of 9%.

-Calculate the total net present value for the project using a discount rate of 9%.

(Multiple Choice)

4.9/5  (36)

(36)

Showing 1 - 20 of 50

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)