Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis211 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control181 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control176 Questions

Exam 9: Inventory Costing and Capacity Analysis210 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy, Balanced Scorecard, and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management210 Questions

Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, Common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts151 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, Rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, Just-in-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations151 Questions

Exam 23: Performance Measurement, Compensation, and Multinational Considerations150 Questions

Select questions type

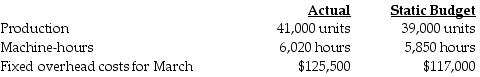

Castleton Corporation manufactured 41,000 units during March. The following fixed overhead data relates to March:

What is the amount of fixed overhead allocated to production?

What is the amount of fixed overhead allocated to production?

(Multiple Choice)

4.8/5  (39)

(39)

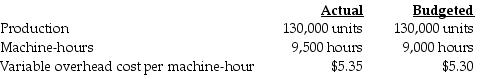

Zitrik Corporation manufactured 130,000 buckets during February. The variable overhead cost-allocation base is $5.30 per machine-hour. The following variable overhead data pertain to February:

What is the variable overhead efficiency variance?

What is the variable overhead efficiency variance?

(Multiple Choice)

4.8/5  (40)

(40)

When distribution costs are high, managers can use standard costing to analyze variances for spending and efficiency variances.

(True/False)

5.0/5  (32)

(32)

Favorable overhead variances are always recorded with credits in a standard cost system.

(True/False)

4.8/5  (36)

(36)

When variable overhead efficiency variance is favorable, it can be safely assumed that the ________.

(Multiple Choice)

4.9/5  (35)

(35)

A $5,000 unfavorable flexible-budget variance indicates that ________.

(Multiple Choice)

4.8/5  (37)

(37)

Abby Company has just implemented a new cost accounting system that provides two variances for fixed manufacturing overhead. While the company's managers are familiar with the concept of spending variances, they are unclear as to how to interpret the production-volume overhead variances. Currently, the company has a production capacity of 54,000 units a month, although it generally produces only 46,000 units. However, in any given month the actual production is probably something other than 46,000.

Required:

a.Does the production-volume overhead variance measure the difference between the 54,000 and 46,000, or the difference between the 46,000 and the actual monthly production? Explain.

b.What advice can you provide the managers that will help them interpret the production-volume overhead variances?

(Essay)

4.8/5  (42)

(42)

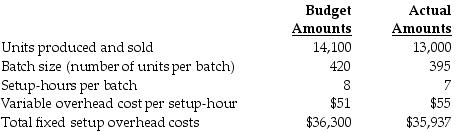

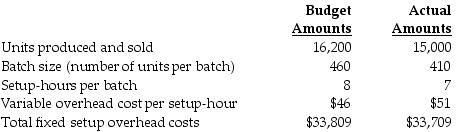

Bristol Fabricators, Inc., produces air purifiers in batches. To manufacture a batch of the purifiers, Bristol Fabricators, Inc., must set up the machines and assembly line tooling. Setup costs are batch-level costs because they are associated with batches rather than individual units of products. A separate Setup Department is responsible for setting up machines and tooling for different models of the air purifiers.

Setup overhead costs consist of some costs that are variable and some costs that are fixed with respect to the number of setup-hours. The following information pertains to June 2015:

Calculate the production-volume variance for fixed overhead setup costs. (Round all intermediary calculations to two decimal places and your final answer to the nearest whole number.)

Calculate the production-volume variance for fixed overhead setup costs. (Round all intermediary calculations to two decimal places and your final answer to the nearest whole number.)

(Multiple Choice)

5.0/5  (42)

(42)

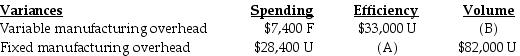

In the above table, the amounts for (A) and (B), respectively, are ________.

In the above table, the amounts for (A) and (B), respectively, are ________.

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following statements is true of variable overhead costs?

(Multiple Choice)

4.8/5  (39)

(39)

Which of the following statements is true of fixed overhead cost variances?

(Multiple Choice)

4.8/5  (29)

(29)

Bristol Fabricators, Inc., produces air purifiers in batches. To manufacture a batch of the purifiers, Bristol Fabricators, Inc., must set up the machines and assembly line tooling. Setup costs are batch-level costs because they are associated with batches rather than individual units of products. A separate Setup Department is responsible for setting up machines and tooling for different models of the air purifiers.

Setup overhead costs consist of some costs that are variable and some costs that are fixed with respect to the number of setup-hours. The following information pertains to June 2015:

Calculate the spending variance for fixed overhead setup costs.

Calculate the spending variance for fixed overhead setup costs.

(Multiple Choice)

4.9/5  (31)

(31)

A favorable fixed overhead flexible-budget variance indicates that actual fixed costs exceeded the lump-sum amount budgeted.

(True/False)

4.9/5  (39)

(39)

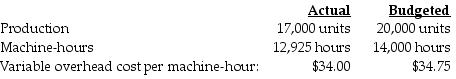

Russo Corporation manufactured 17,000 air conditioners during November. The overhead cost-allocation base is $34.75 per machine-hour. The following variable overhead data pertain to November:

What is the actual variable overhead cost?

What is the actual variable overhead cost?

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following is the mathematical expression for the budgeted fixed overhead cost per unit of cost allocation base?

(Multiple Choice)

4.9/5  (41)

(41)

Which of the following is not true of the 3 level variance analysis of operating income?

(Multiple Choice)

4.8/5  (30)

(30)

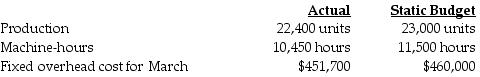

Hockey Accessories Corporation manufactured 22,400 duffle bags during March. The following fixed overhead data pertain to March:

What is the flexible-budget amount?

What is the flexible-budget amount?

(Multiple Choice)

4.9/5  (35)

(35)

What are the arguments for prorating a production-volume variance that has been deemed to be material among work-in-process, finished goods, cost and cost of goods sold as opposed to writing it all off to cost of goods sold?

(Essay)

4.8/5  (43)

(43)

Which of the following mathematical expression is used to calculate budgeted variable overhead cost rate per output unit?

(Multiple Choice)

4.7/5  (44)

(44)

If the production planners set the budgeted machine hours standards too tight, one could anticipate there would be a favorable variable overhead efficiency variance.

(True/False)

4.7/5  (42)

(42)

Showing 41 - 60 of 176

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)