Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis211 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control181 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control176 Questions

Exam 9: Inventory Costing and Capacity Analysis210 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy, Balanced Scorecard, and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management210 Questions

Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, Common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts151 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, Rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, Just-in-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations151 Questions

Exam 23: Performance Measurement, Compensation, and Multinational Considerations150 Questions

Select questions type

Time and Again Company makes clocks. The fixed overhead costs for 2017 total $900,000. The company uses direct labor-hours for fixed overhead allocation and anticipates 200,000 hours during the year for 330,000 units. An equal number of units are budgeted for each month.

During June, 32,000 clocks were produced and $72,000 was spent on fixed overhead.

Required:

a.Determine the fixed overhead rate for 2017 based on units of input.

b.Determine the fixed overhead static-budget variance for June.

c.Determine the production-volume overhead variance for June.

(Essay)

4.8/5  (31)

(31)

Wainwright has budgeted construction overhead for August of $435,000 for fixed costs. Actual costs for the month totaled for $450,000 for fixed. Allocated fixed overhead totaled $430,000. The company tracks each item in an overhead control account before allocations are made to individual jobs. The fixed overhead spending variance for August was $15,000 unfavorable for fixed.

Required:

a.Make journal entries for the actual costs incurred.

b.Make journal entries to record the variances for August.

(Essay)

4.8/5  (35)

(35)

Fixed costs for the period are by definition a lump sum of costs that remain unchanged and therefore the fixed overhead spending variance is always zero.

(True/False)

4.9/5  (36)

(36)

Explain how service-sector companies can benefit from variance analysis.

(Essay)

4.9/5  (43)

(43)

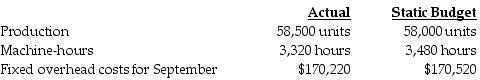

Davidson Corporation manufactured 58,500 units during September. The following fixed overhead data relates to September:

What is the amount of fixed overhead allocated to production?

What is the amount of fixed overhead allocated to production?

(Multiple Choice)

4.7/5  (36)

(36)

Briefly explain the meaning of the variable overhead efficiency variance and the variable overhead spending variance.

(Essay)

4.8/5  (30)

(30)

Timely Products Company makes watches. The fixed overhead costs for 2017 total $648,000. The company uses direct labor-hours for fixed overhead allocation and anticipates 21,600 hours during the year for 540,000 units. An equal number of units are budgeted for each month.

During October, 48,000 watches were produced and $52,000 was spent on fixed overhead.

Required:

a.Determine the fixed overhead rate for 2017 based on the units of input.

b.Determine the fixed overhead static-budget variance for October.

c.Determine the production-volume overhead variance for October.

(Essay)

4.8/5  (35)

(35)

If fixed overhead cost variances are always written off to Cost of Goods Sold, operating income can be manipulated for either financial reporting or income tax purposes.

(True/False)

4.9/5  (33)

(33)

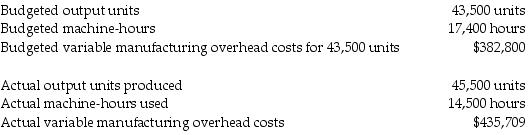

Lazy Guy Corporation manufactured 4,000 chairs during June. The following variable overhead data relates to June:

What is the variable overhead flexible-budget variance?

What is the variable overhead flexible-budget variance?

(Multiple Choice)

4.8/5  (35)

(35)

An unfavorable production-volume variance indicates an overallocation of fixed overhead costs.

(True/False)

4.8/5  (35)

(35)

The costs related to buildings (such as rent and insurance), equipment (such as lease payments or straight-line depreciation), and salaried labor in a factory are all examples of cost items that would be part of the fixed overhead budget.

(True/False)

4.7/5  (40)

(40)

A favorable production-volume variance arises when manufacturing capacity planned for is NOT used.

(True/False)

5.0/5  (41)

(41)

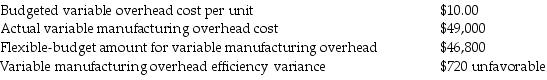

Majestic Corporation manufactures wheel barrows and uses budgeted machine hours to allocate variable manufacturing overhead. The following information relates to the company's manufacturing overhead data:

What is the flexible-budget variance for variable manufacturing overhead?

What is the flexible-budget variance for variable manufacturing overhead?

(Multiple Choice)

4.8/5  (37)

(37)

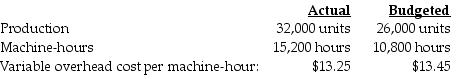

Cold Products Corporation manufactured 32,000 ice chests during September. The variable overhead cost-allocation base is $13.45 per machine-hour. The following variable overhead data pertain to September:

What is the variable overhead spending variance?

What is the variable overhead spending variance?

(Multiple Choice)

4.8/5  (37)

(37)

Managers can use variance analysis to make decisions about the mix of products to make.

(True/False)

4.9/5  (42)

(42)

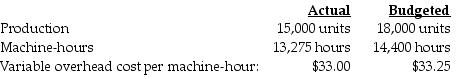

Russo Corporation manufactured 15,000 air conditioners during November. The overhead cost-allocation base is $33.25 per machine-hour. The following variable overhead data pertain to November:

What is the flexible-budget amount?

What is the flexible-budget amount?

(Multiple Choice)

4.8/5  (32)

(32)

Showing 121 - 140 of 176

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)