Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control

Exam 1: The Manager and Management Accounting195 Questions

Exam 2: An Introduction to Cost Terms and Purposes224 Questions

Exam 3: Cost-Volume-Profit Analysis211 Questions

Exam 4: Job Costing203 Questions

Exam 5: Activity-Based Costing and Activity-Based Management176 Questions

Exam 6: Master Budget and Responsibility Accounting226 Questions

Exam 7: Flexible Budgets, Direct-Cost Variances, and Management Control181 Questions

Exam 8: Flexible Budgets, Overhead Cost Variances, and Management Control176 Questions

Exam 9: Inventory Costing and Capacity Analysis210 Questions

Exam 10: Determining How Costs Behave192 Questions

Exam 11: Decision Making and Relevant Information218 Questions

Exam 12: Strategy, Balanced Scorecard, and Strategic Profitability Analysis172 Questions

Exam 13: Pricing Decisions and Cost Management210 Questions

Exam 14: Cost Allocation, Customer-Profitability Analysis, and Sales-Variance Analysis167 Questions

Exam 15: Allocation of Support-Department Costs, Common Costs, and Revenues150 Questions

Exam 16: Cost Allocation: Joint Products and Byproducts151 Questions

Exam 17: Process Costing149 Questions

Exam 18: Spoilage, Rework, and Scrap153 Questions

Exam 19: Balanced Scorecard: Quality and Time150 Questions

Exam 20: Inventory Management, Just-in-Time, and Simplified Costing Methods150 Questions

Exam 21: Capital Budgeting and Cost Analysis151 Questions

Exam 22: Management Control Systems, Transfer Pricing, and Multinational Considerations151 Questions

Exam 23: Performance Measurement, Compensation, and Multinational Considerations150 Questions

Select questions type

Can the variable overhead efficiency variance

a.be computed the same way as the efficiency variance for direct-cost items?

b.be interpreted the same way as the efficiency variance for direct-cost items? Explain.

(Essay)

4.9/5  (36)

(36)

If the company's fixed overhead spending variance was unfavorable it could be attributed to higher plant-leasing costs.

(True/False)

4.8/5  (48)

(48)

Unskilled work force can lead to unfavorable efficiency variance.

(True/False)

4.8/5  (52)

(52)

While calculating the costs of products and services, a standard costing system ________.

(Multiple Choice)

4.8/5  (37)

(37)

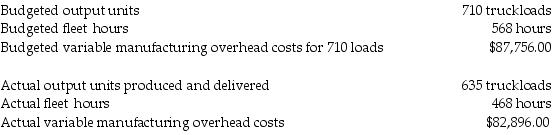

J&J Materials and Construction Corporation produces mulch and distributes the product by using dump trucks. The company uses budgeted fleet hours to allocate variable manufacturing overhead. The following information pertains to the company's manufacturing overhead data:

What is the budgeted variable manufacturing overhead cost per unit?

What is the budgeted variable manufacturing overhead cost per unit?

(Multiple Choice)

4.9/5  (38)

(38)

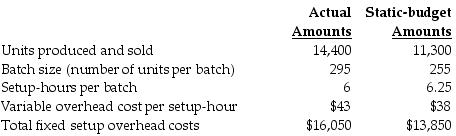

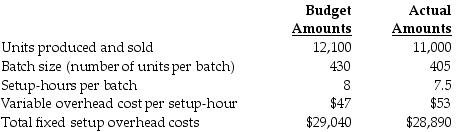

Raposa, Inc., produces a special line of plastic toy racing cars. Raposa, Inc., produces the cars in batches. To manufacture a batch of the cars, Raposa, Inc., must set up the machines and molds. Setup costs are batch-level costs because they are associated with batches rather than individual units of products. A separate Setup Department is responsible for setting up machines and molds for different styles of car.

Setup overhead costs consist of some costs that are variable and some costs that are fixed with respect to the number of setup-hours. The following information pertains to June 2015:

Calculate the spending variance for fixed setup overhead costs.

Calculate the spending variance for fixed setup overhead costs.

(Multiple Choice)

4.8/5  (33)

(33)

One possible reason for unfavorable variable overhead efficiency variance for materials handling is ________.

(Multiple Choice)

5.0/5  (34)

(34)

Effective planning of variable overhead costs means that managers must

(Multiple Choice)

4.7/5  (45)

(45)

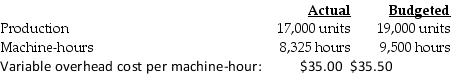

Russo Corporation manufactured 17,000 air conditioners during November. The overhead cost-allocation rate is $35.50 per machine-hour. The following variable overhead data pertain to November:

What is the variable overhead efficiency variance?

What is the variable overhead efficiency variance?

(Multiple Choice)

4.9/5  (33)

(33)

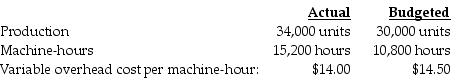

Cold Products Corporation manufactured 34,000 ice chests during September. The variable overhead cost-allocation base is $14.50 per machine-hour. The following variable overhead data pertain to September:

What is the actual variable overhead cost?

What is the actual variable overhead cost?

(Multiple Choice)

4.7/5  (39)

(39)

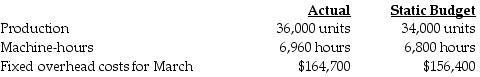

Castleton Corporation manufactured 36,000 units during March. The following fixed overhead data relates to March:

What is the flexible-budget amount?

What is the flexible-budget amount?

(Multiple Choice)

4.9/5  (32)

(32)

The level 3 components for the fixed overhead variance are the fixed overhead spending variance and the fixed overhead production volume variance.

(True/False)

4.9/5  (47)

(47)

Bristol Fabricators, Inc., produces air purifiers in batches. To manufacture a batch of the purifiers, Bristol Fabricators, Inc., must set up the machines and assembly line tooling. Setup costs are batch-level costs because they are associated with batches rather than individual units of products. A separate Setup Department is responsible for setting up machines and tooling for different models of the air purifiers.

Setup overhead costs consist of some costs that are variable and some costs that are fixed with respect to the number of setup-hours. The following information pertains to June 2015:

Calculate the flexible-budget variance for variable overhead setup costs. (Round all intermediary calculations two decimal places and your final answer to the nearest whole number.)

Calculate the flexible-budget variance for variable overhead setup costs. (Round all intermediary calculations two decimal places and your final answer to the nearest whole number.)

(Multiple Choice)

4.8/5  (40)

(40)

A company is using a standard cost system and receives its electricity bill. Electricity is considered a variable cost of operations for this company. The bill is for $15,000 and will be paid next month. Which of the following entries would be the correct recording of the electricity bill?

(Multiple Choice)

4.9/5  (41)

(41)

The variable overhead efficiency variance is the difference between actual quantity of the

cost-allocation base used and budgeted quantity of the cost-allocation base allowed for actual output, multiplied by the budgeted variable overhead cost per unit of the cost-allocation base.

(True/False)

4.9/5  (31)

(31)

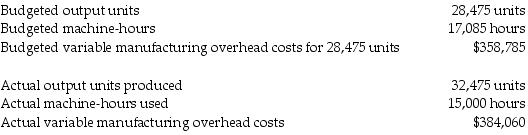

Majestic Corporation manufactures wheel barrows and uses budgeted machine hours to allocate variable manufacturing overhead. The following information relates to the company's manufacturing overhead data:

What is the flexible-budget amount for variable manufacturing overhead?

What is the flexible-budget amount for variable manufacturing overhead?

(Multiple Choice)

4.8/5  (41)

(41)

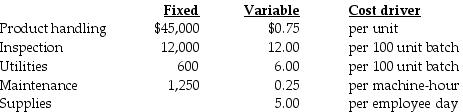

River Falls Company uses a flexible budget for its indirect manufacturing costs. For 2017, the company anticipated that it would produce 27,000 units with 4,800 machine-hours and 8,000 employee days. The costs and cost drivers were to be as follows:

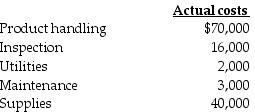

During the year, the company processed 26,500 units, worked 8,200 employee days, and had 4,850 machine-hours. The actual costs for 2017 were:

During the year, the company processed 26,500 units, worked 8,200 employee days, and had 4,850 machine-hours. The actual costs for 2017 were:

Required:

a.Prepare the static budget using the overhead items above and then compute the static-budget variances.

b.Prepare the flexible budget using the overhead items above and then compute the flexible-budget variances.

Required:

a.Prepare the static budget using the overhead items above and then compute the static-budget variances.

b.Prepare the flexible budget using the overhead items above and then compute the flexible-budget variances.

(Essay)

4.9/5  (37)

(37)

The following overhead variances would result in a total-overhead variance of $15,000 favorable: spending variance $5,000 U, efficiency variance $20,000 F, and production-volume variance $30,000 U.

(True/False)

4.9/5  (39)

(39)

Explain how fixed manufacturing overhead costs are treated under Generally Accepted Accounting Principles?

(Essay)

4.8/5  (37)

(37)

The variable overhead spending variance measures the difference between ________, multiplied by the actual quantity of variable overhead cost-allocation base used.

(Multiple Choice)

4.7/5  (34)

(34)

Showing 81 - 100 of 176

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)