Exam 10: Money, Banks, and the Bank of Canada

Exam 1: Economics: Foundations and Models148 Questions

Exam 2: Trade-Offs, Comparative Advantage, and the Market System314 Questions

Exam 3: Where Prices Come From: The Interaction of Supply and Demand314 Questions

Exam 4: GDP: Measuring Total Production and Income277 Questions

Exam 5: Unemployment and Inflation300 Questions

Exam 6: Economic Growth, The Financial System, and Business Cycles262 Questions

Exam 7: Long-Run Economic Growth: Sources and Policies280 Questions

Exam 8: Aggregate Expenditure and Output in the Short Run315 Questions

Exam 9: Aggregate Demand and Aggregate Supply Analysis246 Questions

Exam 10: Money, Banks, and the Bank of Canada285 Questions

Exam 11: Monetary Policy281 Questions

Exam 12: Fiscal Policy303 Questions

Exam 13: Inflation, Unemployment, and Bank of Canada Policy265 Questions

Exam 14: Macroeconomics in an Open Economy280 Questions

Exam 15: The International Financial System228 Questions

Select questions type

Suppose you transfer $2,000 from your non-money market mutual fund account to your chequing account.What is the immediate impact of this transfer on M1+ and M2++?

Free

(Essay)

4.9/5  (31)

(31)

Correct Answer:

Mutual fund balances are part of M2++, but are not part of M1+.Chequing account balances are included in both money supply measures.Thus, M1+ will increase by $2,000 with the increase in your chequing account balance.M2++ will not change, as the $2,000 increase in your chequing account balance is offset by the $2,000 decrease in mutual fund accounts.

According to the quantity theory of money, if the money supply grows at 20 percent and real GDP grows at 5 percent, then the inflation rate will be

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

B

Which of the following is not a reason why the Bank of Canada conducts monetary policy principally through open market operations?

(Multiple Choice)

4.8/5  (42)

(42)

Although gold is highly valued by most people, it is difficult to use as a medium of exchange.Explain.

(Essay)

4.9/5  (37)

(37)

Using the quantity equation, if the velocity of money grows at 5 percent, the money supply grows at 10 percent, and real GDP grows at 4 percent, then the inflation rate will be

(Multiple Choice)

4.9/5  (38)

(38)

An increase in the purchasing power of money need not lead to an increase in the purchasing power of income, because the falling price level would likely mean falling wages and salaries.

(True/False)

4.7/5  (36)

(36)

If the Bank of Canada wants to decrease the money supply through open market operations, it will

(Multiple Choice)

4.9/5  (17)

(17)

Suppose a bank has $100 million in chequing account deposits with no excess reserves and the desired reserve ratio is 10 percent.If commercial banks reduce the desired reserve ratio to 4 percent, then the bank can make a maximum loan of

(Multiple Choice)

4.8/5  (30)

(30)

A cash withdrawal reduces deposits, reserves, and excess reserves in the banking system.

(True/False)

4.8/5  (35)

(35)

If the desired reserve ratio is 10 percent, an increase in bank reserves of $1,000 can support an increase in chequing account deposits (including the original deposit)in the banking system as a whole of up to

(Multiple Choice)

4.9/5  (32)

(32)

Which of the following describes the degree of control that the Bank of Canada has over the money supply?

(Multiple Choice)

4.8/5  (31)

(31)

How effective is the overnight interest rate as compared to open market operations in managing the money supply? Explain how the Bank of Canada uses overnight interest rate today.

(Essay)

4.8/5  (30)

(30)

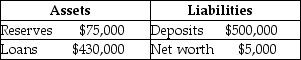

Suppose that the bank has the following balance sheet:  If the desired reserve ratio is 10 percent, what is the maximum the bank can loan out? Suppose the bank makes this loan and the borrower spends the money, which is deposited in a different bank.Show the impact of these transactions on the bank's balance sheet.

If the desired reserve ratio is 10 percent, what is the maximum the bank can loan out? Suppose the bank makes this loan and the borrower spends the money, which is deposited in a different bank.Show the impact of these transactions on the bank's balance sheet.

(Essay)

4.9/5  (33)

(33)

The quantity theory of money predicts that, in the long run, inflation results from the

(Multiple Choice)

4.7/5  (31)

(31)

For the purchasing power of money to increase, the price level has to fall.

(True/False)

4.9/5  (35)

(35)

An economy without money would have no exchanges of goods and services.

(True/False)

4.8/5  (26)

(26)

Showing 1 - 20 of 285

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)