Exam 10: The Monetary System

Exam 1: Ten Principles of Economics205 Questions

Exam 2: Thinking Like an Economist230 Questions

Exam 3: Interdependence and the Gains From Trade200 Questions

Exam 4: The Market Forces of Supply and Demand303 Questions

Exam 5: Measuring a Nations Income168 Questions

Exam 6: Measuring the Cost of Living176 Questions

Exam 7: Production and Growth185 Questions

Exam 8: Saving, Investment, and the Financial System208 Questions

Exam 9: Unemployment and Its Natural Rate186 Questions

Exam 10: The Monetary System196 Questions

Exam 11: Money Growth and Inflation193 Questions

Exam 12: Open-Economy Macroeconomics: Basic Concepts215 Questions

Exam 13: A Macroeconomic Theory of the Open Economy184 Questions

Exam 14: Aggregate Demand and Aggregate Supply241 Questions

Exam 15: The Influence of Monetary and Fiscal Policy on Aggregate Demand219 Questions

Exam 16: The Short-Run Tradeoff Between Inflation and Unemployment203 Questions

Exam 17: Five Debates Over Macroeconomic Policy118 Questions

Select questions type

Which of the following lists contains only actions that increase the money supply?

(Multiple Choice)

4.8/5  (39)

(39)

How does the Bank of Canada conduct open market transactions?

(Multiple Choice)

4.9/5  (38)

(38)

What is the reason behind the seven-year appointment for the governor of Bank of Canada?

(Multiple Choice)

4.9/5  (37)

(37)

Banks could not change the money supply if they were required to hold all deposits in reserve.

(True/False)

4.9/5  (40)

(40)

Which of the following happened during the Great Depression in the early 1930s?

(Multiple Choice)

4.9/5  (45)

(45)

At one time, the country of Aquilonia had no banks, but had currency of $10 million. Then a banking system was established with a reserve requirement of 20 percent. The people of Aquilonia deposited half of their currency into the banking system. If banks do not hold excess reserves, what is Aquilonia's money supply now?

(Multiple Choice)

4.9/5  (46)

(46)

Mia puts money into a piggy bank so she can spend it later. Which of the following functions of money does this illustrate?

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following happens in a 100-percent-reserve banking system?

(Multiple Choice)

4.8/5  (37)

(37)

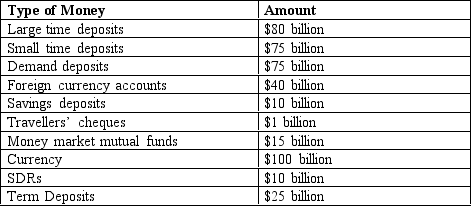

Table 29-1

-Refer to Table 29-1. What is the M1 money supply?

-Refer to Table 29-1. What is the M1 money supply?

(Multiple Choice)

4.8/5  (43)

(43)

Gary's wealth is $1 million. Economists would say that Gary has $1 million worth of money.

(True/False)

4.8/5  (32)

(32)

If you deposit $5000 into First Hawkeye Bank, what will the bank most likely do?

(Multiple Choice)

4.9/5  (33)

(33)

The banking system has $20 million in reserves and has a reserve requirement of 20 percent. The public holds $10 million in currency. Bankers previously did not hold any excess reserves, but difficult economic times make them decide that it is prudent to hold 25 percent of deposits as reserves. At the same time, the public decides to withdraw $10 million in currency from the banking system. Other things equal, by how much must the Bank of Canada increase bank reserves to keep the money supply the same?

(Multiple Choice)

4.9/5  (39)

(39)

Suppose the reserve ratio is 10 percent, and banks do not hold excess reserves. Suppose the Bank of Canada sells $10 million of bonds to the public. Which of the following best describes the effects of this open market operation?

(Multiple Choice)

4.9/5  (32)

(32)

Suppose a bank has a 5 percent reserve ratio, $4000 in deposits, and it loans out all it can, given the reserve ratio. Which of the following describes the bank's assets?

(Multiple Choice)

4.9/5  (37)

(37)

If the reserve ratio is 7 percent and a bank receives a new deposit of $300, which of the following will this bank most likely do?

(Multiple Choice)

5.0/5  (36)

(36)

Which of the following best describes the consequences of a decrease in the bank rate?

(Multiple Choice)

4.9/5  (39)

(39)

Draw a simple T-account for First National Bank of Me, which has $5000 of deposits, a reserve ratio of 10 percent, and excess reserves of $300.

(Essay)

4.9/5  (41)

(41)

Assume that banks do not hold excess reserves. The banking system has $20 million in reserves and has a reserve requirement of 20 percent. The public holds $10 million in currency. Then the public decides to withdraw $5 million in currency from the banking system. If the Bank of Canada wants to keep the money supply stable by changing the reserve requirement, then what will the new reserve requirement be?

(Multiple Choice)

4.7/5  (40)

(40)

Showing 101 - 120 of 196

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)