Exam 10: The Monetary System

Exam 1: Ten Principles of Economics205 Questions

Exam 2: Thinking Like an Economist230 Questions

Exam 3: Interdependence and the Gains From Trade200 Questions

Exam 4: The Market Forces of Supply and Demand303 Questions

Exam 5: Measuring a Nations Income168 Questions

Exam 6: Measuring the Cost of Living176 Questions

Exam 7: Production and Growth185 Questions

Exam 8: Saving, Investment, and the Financial System208 Questions

Exam 9: Unemployment and Its Natural Rate186 Questions

Exam 10: The Monetary System196 Questions

Exam 11: Money Growth and Inflation193 Questions

Exam 12: Open-Economy Macroeconomics: Basic Concepts215 Questions

Exam 13: A Macroeconomic Theory of the Open Economy184 Questions

Exam 14: Aggregate Demand and Aggregate Supply241 Questions

Exam 15: The Influence of Monetary and Fiscal Policy on Aggregate Demand219 Questions

Exam 16: The Short-Run Tradeoff Between Inflation and Unemployment203 Questions

Exam 17: Five Debates Over Macroeconomic Policy118 Questions

Select questions type

How are credit card balances treated in M1 as compared to M2?

(Multiple Choice)

4.8/5  (28)

(28)

Which of the following best describes the consequences of an increase in the bank rate?

(Multiple Choice)

4.9/5  (38)

(38)

A central bank raised the reserve requirement ratio from 10 percent to 12 percent. Other things the same, how does the money multiplier change?

(Multiple Choice)

4.9/5  (36)

(36)

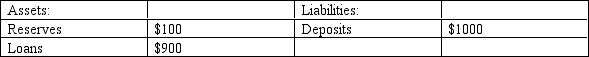

Table 29-4 The following information pertains to the Bank of Edmonton.

-Refer to Table 29-4. Assume that the Bank of Edmonton is holding the required percent of deposits as reserves. Also, assume all other banks hold only the required percent of deposits as reserves, and that people hold only deposits and no currency. What is the money multiplier?

-Refer to Table 29-4. Assume that the Bank of Edmonton is holding the required percent of deposits as reserves. Also, assume all other banks hold only the required percent of deposits as reserves, and that people hold only deposits and no currency. What is the money multiplier?

(Multiple Choice)

4.9/5  (37)

(37)

When the Soviet Union began breaking up in the late 1980s, cigarettes began replacing the ruble as the medium of exchange, even though the ruble was legal tender. The cigarettes provide an example of fiat money.

(True/False)

4.9/5  (42)

(42)

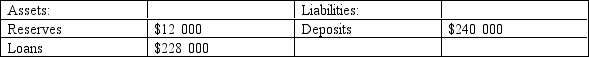

Table 29-5 The following information pertains to the Bank of Kingston.

-Refer to Table 29-5. Assume that the Bank of Kingston is holding the required percent of deposits as reserves. Also, assume all other banks hold only the required percent of deposits as reserves. What is the money multiplier?

-Refer to Table 29-5. Assume that the Bank of Kingston is holding the required percent of deposits as reserves. Also, assume all other banks hold only the required percent of deposits as reserves. What is the money multiplier?

(Multiple Choice)

4.9/5  (39)

(39)

Describe the two things that limit the precision of the Bank of Canada's control of the money supply and explain how each limits that control.

(Essay)

4.8/5  (31)

(31)

If the central bank in some country lowered the reserve ratio, which of the following would happen to the money multiplier?

(Multiple Choice)

4.9/5  (35)

(35)

The money supply of Hooba is $10 000 under a 100 percent reserve banking system. If Hooba decreases the reserve requirement to 10 percent, the money supply could increase by no more than $9000.

(True/False)

4.9/5  (39)

(39)

Which of the following best explains whether bank runs are a problem for the economy?

(Multiple Choice)

5.0/5  (37)

(37)

Which of the following lists contains only actions that decrease the money supply?

(Multiple Choice)

4.8/5  (25)

(25)

Which of the following lists contains only actions that decrease the money supply?

(Multiple Choice)

4.8/5  (36)

(36)

Which of the following lists ranks assets from most to least liquid?

(Multiple Choice)

4.8/5  (40)

(40)

In order to support the Canadian dollar, suppose the Bank of Canada buys an amount of Euros from some major commercial Canadian banks (a type of operation the Bank of Canada rarely undertakes).

a.What is the immediate and the longer term impact of this operation on the money supply?

b.If the Bank of Canada does not wish that the currency swap influence the money supply, what does it have to do?

(Essay)

4.7/5  (37)

(37)

What is the interest rate the Bank of Canada charges on loans it makes to banks?

(Multiple Choice)

4.9/5  (29)

(29)

Suppose the reserve ratio is 10 percent, banks do not hold excess reserves, people do not hold currency, and the Bank of Canada purchases $20 million of government bonds. Which of the following best describes the effects of Bank of Canada's purchase?

(Multiple Choice)

4.8/5  (43)

(43)

Showing 121 - 140 of 196

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)