Exam 5: Activity-Based Costing and Customer Profitability Analysis

Exam 1: Cost Management and Strategy79 Questions

Exam 2: Implementing Strategy: The Value Chain, the Balanced Scorecard, and the Strategy Map70 Questions

Exam 3: Basic Cost Management Concepts98 Questions

Exam 4: Job Costing118 Questions

Exam 5: Activity-Based Costing and Customer Profitability Analysis149 Questions

Exam 6: Process Costing106 Questions

Exam 7: Cost Allocation: Departments, Joint Products, and By-Products96 Questions

Exam 8: Cost Estimation120 Questions

Exam 9: Short-Term Profit Planning: Cost-Volume-Profit CVP Analysis105 Questions

Exam 10: Strategy and the Master Budget146 Questions

Exam 11: Decision Making With a Strategic Emphasis137 Questions

Exam 12: Strategy and the Analysis of Capital Investments167 Questions

Exam 13: Cost Planning for the Product Life Cycle: Target Costing, Theory of Constraints, and Strategic Pricing94 Questions

Exam 14: Operational Performance Measurement: Sales, Direct-Cost Variances, and the Role of Nonfinancial Performance Measures178 Questions

Exam 15: Operational Performance Measurement: Indirect-Cost Variances and Resource-Capacity Management167 Questions

Exam 16: Operational Performance Measurement: Further Analysis of Productivity and Sales134 Questions

Exam 17: The Management and Control of Quality146 Questions

Exam 18: Strategic Performance Measurement: Cost Centers, Profit Centers, and the Balanced Scorecard130 Questions

Exam 19: Strategic Performance Measurement: Investment Centers and Transfer Pricing151 Questions

Exam 20: Management Compensation, Business Analysis, and Business Valuation108 Questions

Select questions type

Zeta Company is preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the amount of manufacturing overhead that should be assigned to each of the two product lines from the information given below. Wall Mirrors Specialty Windows Total units produced 25 25 Total number of material moves 5 15 Direct labor hours per unit 200 200

Under a costing system that allocates manufacturing overhead on the basis of direct labor hours, the material-handling cost per wall mirror is:

(Multiple Choice)

4.9/5  (41)

(41)

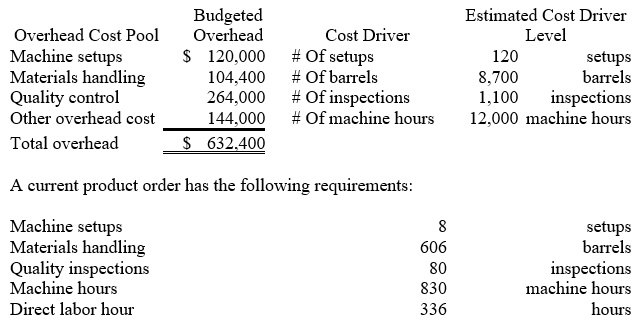

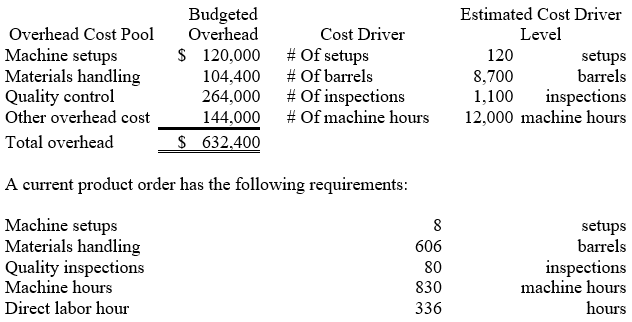

Everlast Co. manufactures a variety of drill bits. The company's plant is partially automated. The budget for the year includes $432,000 payroll for 4,800 direct labor-hours. Listed below is cost driver information used in the product-costing system: What is the total manufacturing overhead for the current product order if the firm assigns overhead costs based on machine hours?

What is the total manufacturing overhead for the current product order if the firm assigns overhead costs based on machine hours?

(Multiple Choice)

5.0/5  (34)

(34)

Pairing Company has the following cost drivers identified as A through F for determining product manufacturing overhead costs.

(A) Number of pieces of equipment

(B) Number of direct material purchase orders

(C) Number of production runs

(D) Square feet of warehouse space

(E) Number of machine hours

(F) Square feet of factory space

For each of the following activity cost pools, choose the letter of the most appropriate cost driver for each cost pool. Heating costs

Machinery power costs

Machinery set-up costs

Equipment maintenance costs

Materials storage costs

Purchasing department costs

(Essay)

4.7/5  (43)

(43)

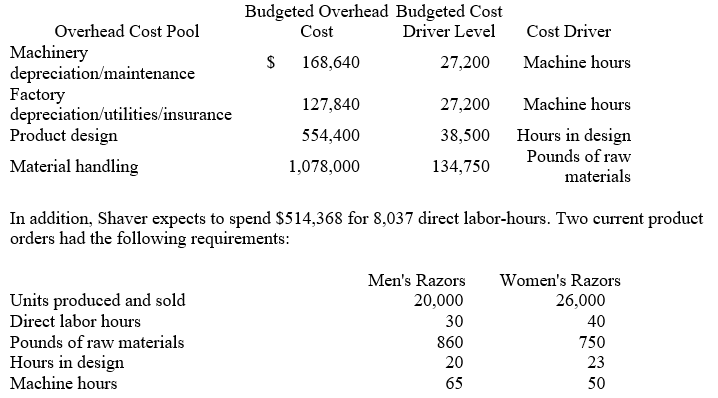

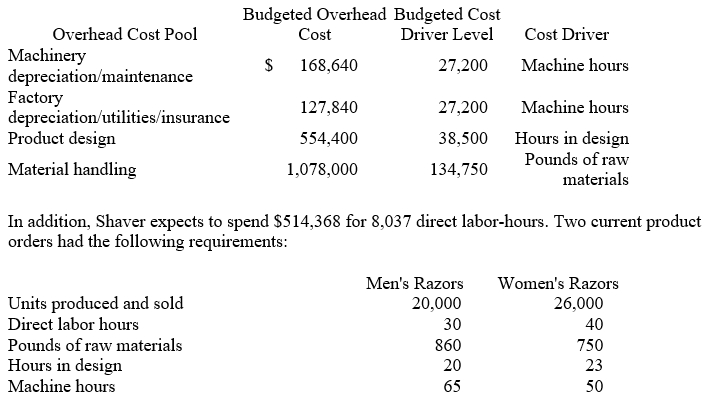

Shaver Co. manufactures a variety of electric razors for men and women. The company's plant is partially automated. Listed below is cost driver information used in the product-costing system: What is the total manufacturing overhead assigned to the current order for Women's Razors if the firm uses a volume-based plant wide overhead rate based on direct labor hours?

What is the total manufacturing overhead assigned to the current order for Women's Razors if the firm uses a volume-based plant wide overhead rate based on direct labor hours?

(Multiple Choice)

4.8/5  (41)

(41)

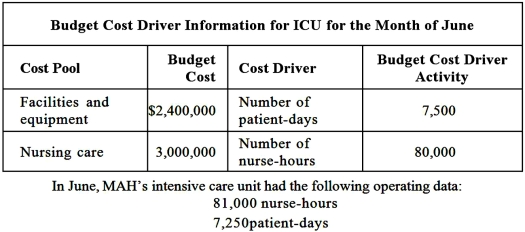

Volume-based Versus ABC Overhead Rate: Medical Arts Hospital (MAH) uses a hospital-wide overhead rate based on nurse-hours.The intensive care unit (ICU), which has 30 beds, applies overhead using patient-days.Its budgeted cost and operating data for the year follow: Hospital Budget Information Hospital total overhead \ 57,600,000 Hospital total nurse-hours 1,152,000  Required:

1.Calculate the ICU's overhead costs for the month of June using

a.The hospital-wide rate

b.The ICU department-wide rate

c.The cost driver rates for the ICU department

2.Explain the differences and determine which overhead assignment method is more appropriate

Required:

1.Calculate the ICU's overhead costs for the month of June using

a.The hospital-wide rate

b.The ICU department-wide rate

c.The cost driver rates for the ICU department

2.Explain the differences and determine which overhead assignment method is more appropriate

(Essay)

4.8/5  (41)

(41)

Classify each of the following costs as unit-level (U), batch-level (B), product-level (P), or facility-level (F) costs and identify an appropriate example of a possible cost driver for each item:

(1) Parts administration

(2) Production scheduling

(3) Materials handling

(4) Machine operations

(5) Personnel administration and training

(6) Plant security

(7) Machine setups

(8) Engineering changes

(9) Product design

(10) Rent for factory plant

(Essay)

4.7/5  (37)

(37)

Everlast Co. manufactures a variety of drill bits. The company's plant is partially automated. The budget for the year includes $432,000 payroll for 4,800 direct labor-hours. Listed below is cost driver information used in the product-costing system: Using ABC, how much material handling overhead is assigned to the order?

Using ABC, how much material handling overhead is assigned to the order?

(Multiple Choice)

4.9/5  (40)

(40)

Elimination of low-value-added activities in a firm should:

(Multiple Choice)

4.7/5  (36)

(36)

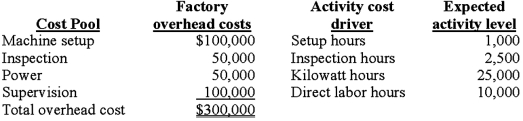

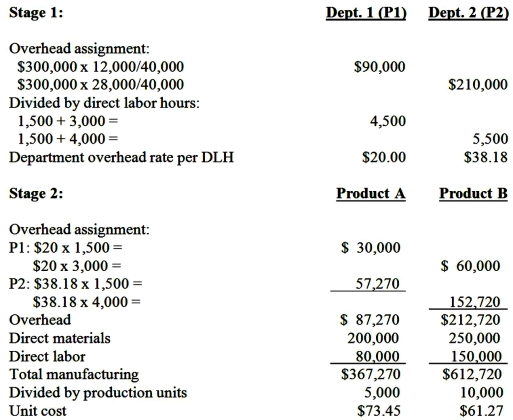

Demski Company has used a two-stage cost allocation system for many years.In the first stage, plant overhead costs are allocated to two production departments, P1 and P2, based on machine hours.In the second stage, Demski uses direct labor hours to assign overhead costs from the production departments to individual products A andB.

Budgeted factory overhead costs for the year are $300,000.Both the budgeted and actual machine hours in P1 and P2 are 12,000 and 28,000 hours, respectively.

After attending a seminar to learn the potential benefits of adopting an activity-based costing system (ABC), Ted Demski, the president of Demski Company, is considering implementing an ABC system.Upon his request, the controller at Demski Company has compiled the following information for analysis:

Demski manufactures two types of product, A and B, for which the following information is available:

A B Units produced and sold 5,000 10,000 Direct materials \ 200,000 \ 250,000 Direct labor costs \ 80,000 150,000 Direct labor hours in P1 1,500 3,000 Direct labor hours in P2 1,500 4,000 Setup hours 700 300 Inspection hours 1,500 1,000 Power (kilowatt hours) 12,500 12,500 Required:

1.Determine the unit cost for each of the two products using the traditional two-stage allocation method.Round calculations to 2 decimal places.

2.Determine the unit cost for each of the two products using the proposed ABC system.

3.Compare the unit manufacturing costs for product A and product B computed in requirements 1 and 2.

(a) Why do two the cost systems differ in their total cost for each product?

(b) Why might these differences be important to the Demski Company?

Answer may vary

Feedback: 1.Unit cost for each of two products using the traditional two-stage allocation method:

Demski manufactures two types of product, A and B, for which the following information is available:

A B Units produced and sold 5,000 10,000 Direct materials \ 200,000 \ 250,000 Direct labor costs \ 80,000 150,000 Direct labor hours in P1 1,500 3,000 Direct labor hours in P2 1,500 4,000 Setup hours 700 300 Inspection hours 1,500 1,000 Power (kilowatt hours) 12,500 12,500 Required:

1.Determine the unit cost for each of the two products using the traditional two-stage allocation method.Round calculations to 2 decimal places.

2.Determine the unit cost for each of the two products using the proposed ABC system.

3.Compare the unit manufacturing costs for product A and product B computed in requirements 1 and 2.

(a) Why do two the cost systems differ in their total cost for each product?

(b) Why might these differences be important to the Demski Company?

Answer may vary

Feedback: 1.Unit cost for each of two products using the traditional two-stage allocation method:

(Essay)

4.9/5  (45)

(45)

Which of the following activities is a facility-level activity?

(Multiple Choice)

4.9/5  (41)

(41)

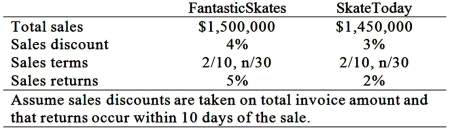

Skateline Inc.designs and manufactures roller skates.The following data pertain to two of its major

customers: FantasticSkates and SkateToday.  Required: Compare the net proceeds from each customer to Skateline Inc.30 days after sale.(rounded to nearest dollar for each step where applicable).

Required: Compare the net proceeds from each customer to Skateline Inc.30 days after sale.(rounded to nearest dollar for each step where applicable).

(Essay)

4.9/5  (41)

(41)

Volume-based overhead rates may cause undesirable strategic effects such as:

(Multiple Choice)

4.9/5  (43)

(43)

All of the following statements regarding activity-based costing systems are true except they:

(Multiple Choice)

4.9/5  (37)

(37)

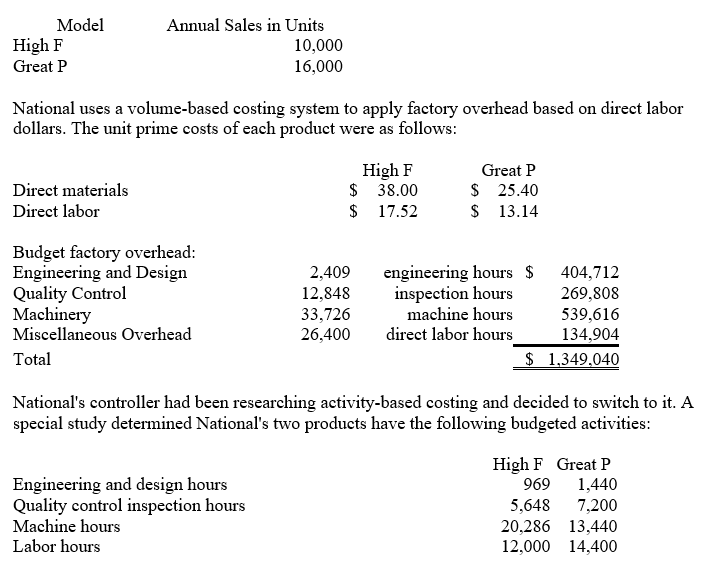

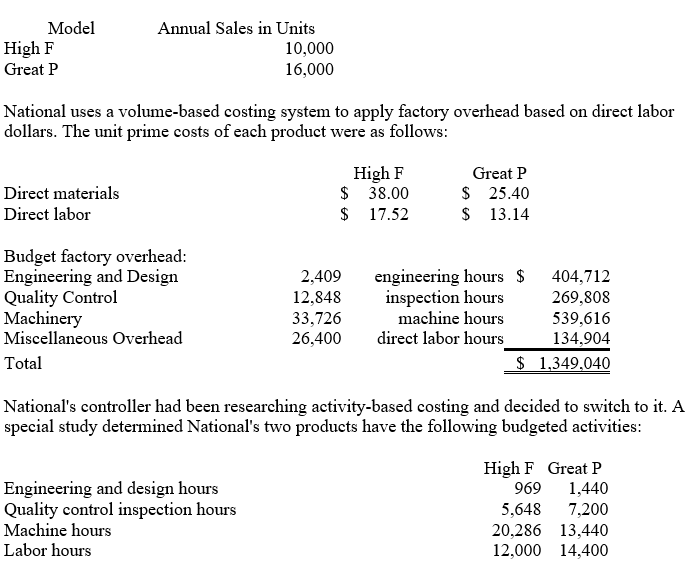

National Inc. manufactures two models of CMD that can be used as cell phones, MPX, and digital camcorders. Using the firm's volume-based costing, applied factory overhead per unit for the High F model is (rounded to the nearest cent):

Using the firm's volume-based costing, applied factory overhead per unit for the High F model is (rounded to the nearest cent):

(Multiple Choice)

4.7/5  (37)

(37)

Which of the following is a benefit of activity-based costing?

(Multiple Choice)

4.8/5  (38)

(38)

National Inc. manufactures two models of CMD that can be used as cell phones, MPX, and digital camcorders. What is the overhead application rate using the firm's volume-based costing system (rounded to the nearest percent or cents)?

What is the overhead application rate using the firm's volume-based costing system (rounded to the nearest percent or cents)?

(Multiple Choice)

4.8/5  (35)

(35)

Shaver Co. manufactures a variety of electric razors for men and women. The company's plant is partially automated. Listed below is cost driver information used in the product-costing system: Using ABC, how much batch-level overhead is assigned to the current order for Women's Razors based on pounds of raw materials?

Using ABC, how much batch-level overhead is assigned to the current order for Women's Razors based on pounds of raw materials?

(Multiple Choice)

4.9/5  (37)

(37)

Showing 41 - 60 of 149

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)