Exam 7: Futures and Options on Foreign Exchange

Exam 1: International Monetary System100 Questions

Exam 2: Globalization and the Multinational Firm100 Questions

Exam 3: Balance of Payments97 Questions

Exam 4: Corporate Governance Around the World100 Questions

Exam 5: The Market for Foreign Exchange100 Questions

Exam 6: International Parity Relationships and Forecasting Foreign Exchange Rates85 Questions

Exam 7: Futures and Options on Foreign Exchange94 Questions

Exam 8: Management of Transaction Exposure100 Questions

Exam 9: Management of Economic Exposure100 Questions

Exam 10: Management of Translation Exposure81 Questions

Exam 11: International Banking and Money Market100 Questions

Exam 12: International Bond Market100 Questions

Exam 13: International Equity Markets100 Questions

Exam 14: Interest Rate and Currency Swaps100 Questions

Exam 15: International Portfolio Investment100 Questions

Exam 16: Foreign Direct Investment and Cross-Border Acquisitions100 Questions

Exam 17: International Capital Structure and the Cost of Capital100 Questions

Exam 18: International Capital Budgeting99 Questions

Exam 19: Multinational Cash Management82 Questions

Exam 20: International Trade Finance100 Questions

Exam 21: International Tax Environment and Transfer Pricing98 Questions

Select questions type

The Black-Scholes option pricing formula

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

A

The current spot exchange rate is $1.55 = €1.00 and the three-month forward rate is $1.60 = €1.00.Consider a three-month American call option on €62,500 with a strike price of $1.50 = €1.00.If you pay an option premium of $5,000 to buy this call,at what exchange rate will you break-even?

Free

(Multiple Choice)

4.8/5  (31)

(31)

Correct Answer:

A

Which of the follow options strategies are consistent in their belief about the future behavior of the underlying asset price?

Free

(Multiple Choice)

4.9/5  (26)

(26)

Correct Answer:

C

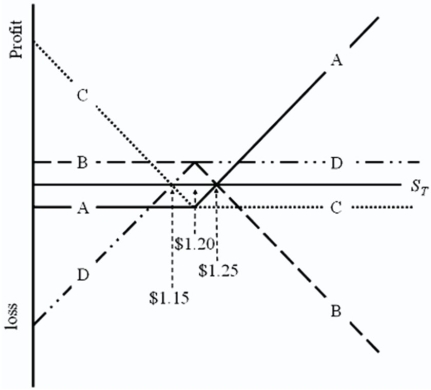

Which of the lines is a graph of the profit at maturity of writing a call option on €62,500 with a strike price of $1.20 = €1.00 and an option premium of $3,125?

(Multiple Choice)

5.0/5  (30)

(30)

The current spot exchange rate is $1.55 = €1.00 and the three-month forward rate is $1.60 = €1.00.Consider a three-month American call option on €62,500 with a strike price of $1.50 = €1.00.Immediate exercise of this option will generate a profit of

(Multiple Choice)

4.8/5  (35)

(35)

The current spot exchange rate is $1.55 = €1.00 and the three-month forward rate is $1.60 = €1.00.Consider a three-month American call option on €62,500.For this option to be considered at-the-money,the strike price must be

(Multiple Choice)

4.7/5  (39)

(39)

The "open interest" shown in currency futures quotations is

(Multiple Choice)

4.8/5  (40)

(40)

Consider an option to buy €12,500 for £10,000.In the next period,the euro can strengthen against the pound by 25 percent (i.e.,each euro will buy 25 percent more pounds)or weaken by 20 percent.

Big hint: don't round,keep exchange rates out to at least 4 decimal places.

spotRates Risk-treeRates (\ /) \ 1.60=1.00 i\ 3.00\% \ /£) \ 2.00=£1.00 i4.00\% /£) 1.25=£1.00 i£4.00\% Find the value of the call.

(Essay)

4.8/5  (36)

(36)

Assume that the dollar-euro spot rate is $1.28 and the six-month forward rate is = $1.28 = $1.2864.The six-month U.S.dollar rate is 5 percent and the Eurodollar rate is 4 percent.The minimum price that a six-month American call option with a striking price of $1.25 should sell for in a rational market is

(Multiple Choice)

4.8/5  (27)

(27)

Find the input d1 of the Black-Scholes price of a six-month call option written on €100,000 with a strike price of $1.00 = €1.00.The current exchange rate is $1.25 = €1.00; The U.S.risk-free rate is 5% over the period and the euro-zone risk-free rate is 4%.The volatility of the underlying asset is 10.7 percent.

(Multiple Choice)

4.9/5  (38)

(38)

Use the European option pricing formula to find the value of a six-month call option on Japanese yen.The strike price is $1 = ¥100.The volatility is 25 percent per annum; r$ = 5.5% and r¥ = 6%.

(Multiple Choice)

4.7/5  (31)

(31)

For European currency options written on euro with a strike price in dollars,what is the effect of an increase in r$?

(Multiple Choice)

4.8/5  (31)

(31)

Consider an option to buy £10,000 for €12,500.In the next period,if the pound appreciates against the dollar by 37.5 percent then the euro will appreciate against the dollar by ten percent.On the other hand,the euro could depreciate against the pound by 20 percent.

Big hint: don't round,keep exchange rates out to at least 4 decimal places.

spotRates Risk-treeRates (\ /) \ 1.60=1.00 i\ 3.00\% \ /£) \ 2.00=£1.00 i4.00\% /£) 1.25=£1.00 i£4.00\% Calculate the current €/£ spot exchange rate.

(Essay)

4.7/5  (36)

(36)

Consider an option to buy €12,500 for £10,000.In the next period,the euro can strengthen against the pound by 25 percent (i.e.,each euro will buy 25 percent more pounds)or weaken by 20 percent.

Big hint: don't round,keep exchange rates out to at least 4 decimal places.

spotRates Risk-treeRates (\ /) \ 1.60=1.00 i\ 3.00\% \ /£) \ 2.00=£1.00 i4.00\% /£) 1.25=£1.00 i£4.00\% Find the cost today of your hedge portfolio in pounds.

(Essay)

4.9/5  (35)

(35)

Draw the tree for a call option on $20,000 with a strike price of £10,000.The current exchange rate is £1.00 = $2.00 and in one period the dollar value of the pound will either double or be cut in half.The current interest rates are i$ = 3% and are i£ = 2%.

(Multiple Choice)

4.7/5  (43)

(43)

Showing 1 - 20 of 94

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)