Exam 30: Income Taxes and the Present Value Method

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Production Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting255 Questions

Exam 4: Process Costing138 Questions

Exam 5: Cost-Volume-Profit Relationships260 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 7: Super-Variable Costing49 Questions

Exam 8: Master Budgeting234 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Differential Analysis: The Key to Decision Making203 Questions

Exam 13: Capital Budgeting Decisions179 Questions

Exam 14: Statement of Cash Flows132 Questions

Exam 15: Financial Statement Analysis289 Questions

Exam 16: Cost of Quality66 Questions

Exam 17: Activity-Based Absorption Costing20 Questions

Exam 18: The Predetermined Overhead Rate and Capacity42 Questions

Exam 19: Job-Order Costing: a Microsoft Excel-Based Approach28 Questions

Exam 20: Fifo Method100 Questions

Exam 21: Service Department Allocations60 Questions

Exam 22: Analyzing Mixed Costs81 Questions

Exam 23: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 24: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 25: Standard Cost Systems: a Financial Reporting Perspective Using Microsoft Excel138 Questions

Exam 26: Transfer Pricing102 Questions

Exam 27: Service Department Charges44 Questions

Exam 28: Pricing Decisions149 Questions

Exam 29: The Concept of Present Value16 Questions

Exam 30: Income Taxes and the Present Value Method150 Questions

Exam 31: the Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Select questions type

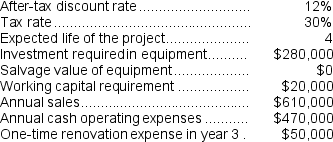

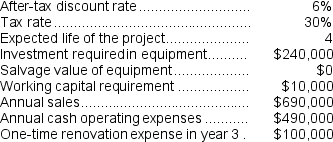

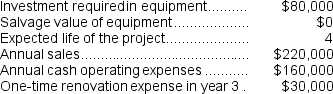

Eison Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment.

The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment.

The income tax expense in year 3 is:

(Multiple Choice)

4.8/5  (36)

(36)

Dunstan Corporation is considering a capital budgeting project that involves investing $450,000 in equipment that would have a useful life of 3 years and zero salvage value.The company would also need to invest $20,000 immediately in working capital which would be released for use elsewhere at the end of the project in 3 years.The net annual operating cash inflow,which is the difference between the incremental sales revenue and incremental cash operating expenses,would be $220,000 per year.The company uses straight-line depreciation and the depreciation expense on the equipment would be $150,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 35%.The after-tax discount rate is 11%.

Required:

Determine the net present value of the project.Show your work!

(Essay)

4.9/5  (35)

(35)

A company needs an increase in working capital of $50,000 in a project that will last 4 years.The company's tax rate is 30% and its after-tax discount rate is 8%.The present value of the release of the working capital at the end of the project is closest to:

(Multiple Choice)

4.7/5  (47)

(47)

(Appendix 13C) Boynes Corporation is considering a capital budgeting project that would require investing $200,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $490,000 and annual incremental cash operating expenses would be $330,000. The project would also require an immediate investment in working capital of $10,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $70,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 14%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

(Multiple Choice)

4.8/5  (34)

(34)

(Appendix 13C) Hinger Corporation is considering a capital budgeting project that would require investing $120,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $350,000 and annual incremental cash operating expenses would be $250,000. The project would also require an immediate investment in working capital of $10,000 which would be released for use elsewhere at the end of the project. The project would also require a one-time renovation cost of $40,000 in year 3. The company's income tax rate is 35% and its after-tax discount rate is 11%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

(Multiple Choice)

4.7/5  (38)

(38)

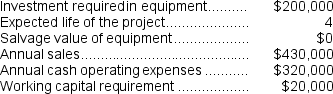

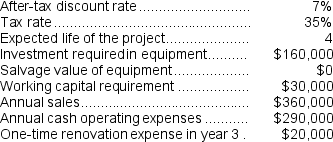

(Appendix 13C) Reye Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

The company's income tax rate is 30% and its after-tax discount rate is 9%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

(Multiple Choice)

4.8/5  (48)

(48)

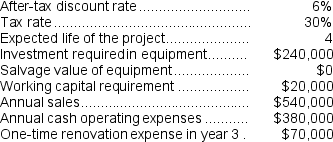

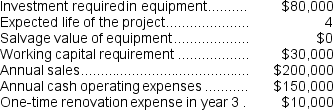

(Appendix 13C) Vanzant Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

(Multiple Choice)

4.7/5  (31)

(31)

(Appendix 13C) Mesko Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

The company's income tax rate is 35% and its after-tax discount rate is 15%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

(Multiple Choice)

4.9/5  (46)

(46)

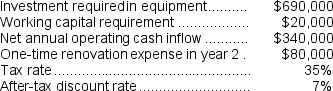

(Appendix 13C) Lafromboise Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

(Multiple Choice)

4.9/5  (44)

(44)

(Appendix 13C) Houze Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

(Multiple Choice)

4.9/5  (32)

(32)

Shanks Corporation is considering a capital budgeting project that involves investing $600,000 in equipment that would have a useful life of 3 years and zero salvage value.The company would also need to invest $20,000 immediately in working capital which would be released for use elsewhere at the end of the project in 3 years.The net annual operating cash inflow,which is the difference between the incremental sales revenue and incremental cash operating expenses,would be $300,000 per year.The project would require a one-time renovation expense of $60,000 at the end of year 2.The company uses straight-line depreciation and the depreciation expense on the equipment would be $200,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 35%.The after-tax discount rate is 15%.

Required:

Determine the net present value of the project.Show your work!

(Essay)

4.9/5  (35)

(35)

Galati Corporation has provided the following information concerning a capital budgeting project:

The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation.The depreciation expense will be $20,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 30% and the after-tax discount rate is 8%.

Required:

Determine the net present value of the project.Show your work!

The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation.The depreciation expense will be $20,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The income tax rate is 30% and the after-tax discount rate is 8%.

Required:

Determine the net present value of the project.Show your work!

(Essay)

4.8/5  (41)

(41)

(Appendix 13C) Stockinger Corporation has provided the following information concerning a capital budgeting project:

Investment requiredin equipment. \2 80,000 Expected life of the project. 4 Salvage value of equipment. \0 Annual sales. \5 80,000 Annual cash operating expenses \4 20,000 Working capital requirement. \3 0,000 One-time renovation expense in year 3 \8 0,000

The company's income tax rate is 35% and its after-tax discount rate is 11%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The total cash flow net of income taxes in year 2 is:

(Multiple Choice)

4.9/5  (41)

(41)

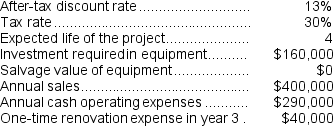

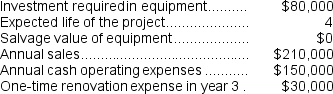

(Appendix 13C) Prudencio Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

(Multiple Choice)

4.8/5  (35)

(35)

Income taxes have no effect on whether a capital budgeting project should or should not be accepted in a for-profit company.

(True/False)

4.8/5  (33)

(33)

Marasco Corporation has provided the following information concerning a capital budgeting project:

The income tax rate is 30%.The after-tax discount rate is 13%.The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $20,000.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.

The net present value of the project is closest to:

The income tax rate is 30%.The after-tax discount rate is 13%.The company uses straight-line depreciation on all equipment; the annual depreciation expense will be $20,000.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.

The net present value of the project is closest to:

(Multiple Choice)

4.9/5  (37)

(37)

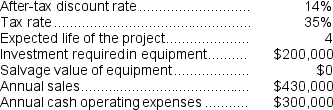

(Appendix 13C) Planas Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 35% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

The company's income tax rate is 35% and its after-tax discount rate is 14%. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 3 is:

(Multiple Choice)

4.9/5  (41)

(41)

(Appendix 13C) Rollans Corporation has provided the following information concerning a capital budgeting project:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

(Multiple Choice)

4.7/5  (42)

(42)

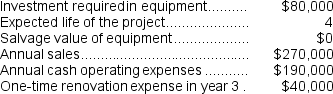

(Appendix 13C) Bourland Corporation is considering a capital budgeting project that would require investing $80,000 in equipment with an expected life of 4 years and zero salvage value. Annual incremental sales would be $250,000 and annual incremental cash operating expenses would be $180,000. The project would also require a one-time renovation cost of $40,000 in year 3. The company's income tax rate is 30% and its after-tax discount rate is 8%. The company uses straight-line depreciation. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The net present value of the entire project is closest to:

(Multiple Choice)

4.8/5  (39)

(39)

Patenaude Corporation has provided the following information concerning a capital budgeting project:

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $230,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

The expected life of the project and the equipment is 3 years and the equipment has zero salvage value.The working capital would be required immediately and would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment and the depreciation expense on the equipment would be $230,000 per year.Assume cash flows occur at the end of the year except for the initial investments.The company takes income taxes into account in its capital budgeting.The net annual operating cash inflow is the difference between the incremental sales revenue and incremental cash operating expenses.

Required:

Determine the net present value of the project.Show your work!

(Essay)

4.9/5  (35)

(35)

Showing 61 - 80 of 150

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)