Exam 26: Transfer Pricing

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Production Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting255 Questions

Exam 4: Process Costing138 Questions

Exam 5: Cost-Volume-Profit Relationships260 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 7: Super-Variable Costing49 Questions

Exam 8: Master Budgeting234 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Differential Analysis: The Key to Decision Making203 Questions

Exam 13: Capital Budgeting Decisions179 Questions

Exam 14: Statement of Cash Flows132 Questions

Exam 15: Financial Statement Analysis289 Questions

Exam 16: Cost of Quality66 Questions

Exam 17: Activity-Based Absorption Costing20 Questions

Exam 18: The Predetermined Overhead Rate and Capacity42 Questions

Exam 19: Job-Order Costing: a Microsoft Excel-Based Approach28 Questions

Exam 20: Fifo Method100 Questions

Exam 21: Service Department Allocations60 Questions

Exam 22: Analyzing Mixed Costs81 Questions

Exam 23: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 24: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 25: Standard Cost Systems: a Financial Reporting Perspective Using Microsoft Excel138 Questions

Exam 26: Transfer Pricing102 Questions

Exam 27: Service Department Charges44 Questions

Exam 28: Pricing Decisions149 Questions

Exam 29: The Concept of Present Value16 Questions

Exam 30: Income Taxes and the Present Value Method150 Questions

Exam 31: the Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Select questions type

Division Delta of Golvin Corporation makes and sells a single product which is used by manufacturers of fork lift trucks.Presently it sells 9,000 units per year to outside customers at $57 per unit.The annual capacity is 10,000 units and the variable cost to make each unit is $32.Division Echo of Golvin Corporation would like to buy 2,000 units a year from Division Delta to use in its products.There would be no cost savings from transferring the units within the company rather than selling them on the outside market.What should be the lowest acceptable transfer price from the perspective of Division Delta?

(Multiple Choice)

4.9/5  (33)

(33)

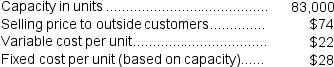

(Appendix 11A) Tommasino Products, Inc., has a Motor Division that manufactures and sells a number of products, including a standard motor that could be used by another division in the company, the Automotive Division, in one of its products. Data concerning that motor appear below:

The Automotive Division is currently purchasing 9,000 of these motors per year from an overseas supplier at a cost of $72 per motor.

-Assume that the Motor Division is selling all of the motors it can produce to outside customers.Does there exist a transfer price that would make both the Motor and Automotive Division financially better off than if the Automotive Division were to continue buying its motors from the outside supplier?

The Automotive Division is currently purchasing 9,000 of these motors per year from an overseas supplier at a cost of $72 per motor.

-Assume that the Motor Division is selling all of the motors it can produce to outside customers.Does there exist a transfer price that would make both the Motor and Automotive Division financially better off than if the Automotive Division were to continue buying its motors from the outside supplier?

(Multiple Choice)

4.8/5  (43)

(43)

Showing 101 - 102 of 102

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)