Exam 25: Standard Cost Systems: a Financial Reporting Perspective Using Microsoft Excel

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Production Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting255 Questions

Exam 4: Process Costing138 Questions

Exam 5: Cost-Volume-Profit Relationships260 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 7: Super-Variable Costing49 Questions

Exam 8: Master Budgeting234 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Differential Analysis: The Key to Decision Making203 Questions

Exam 13: Capital Budgeting Decisions179 Questions

Exam 14: Statement of Cash Flows132 Questions

Exam 15: Financial Statement Analysis289 Questions

Exam 16: Cost of Quality66 Questions

Exam 17: Activity-Based Absorption Costing20 Questions

Exam 18: The Predetermined Overhead Rate and Capacity42 Questions

Exam 19: Job-Order Costing: a Microsoft Excel-Based Approach28 Questions

Exam 20: Fifo Method100 Questions

Exam 21: Service Department Allocations60 Questions

Exam 22: Analyzing Mixed Costs81 Questions

Exam 23: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 24: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 25: Standard Cost Systems: a Financial Reporting Perspective Using Microsoft Excel138 Questions

Exam 26: Transfer Pricing102 Questions

Exam 27: Service Department Charges44 Questions

Exam 28: Pricing Decisions149 Questions

Exam 29: The Concept of Present Value16 Questions

Exam 30: Income Taxes and the Present Value Method150 Questions

Exam 31: the Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Select questions type

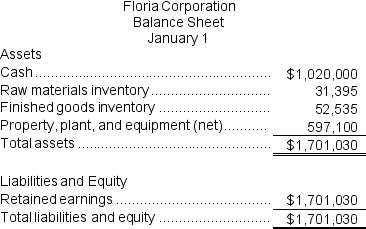

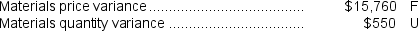

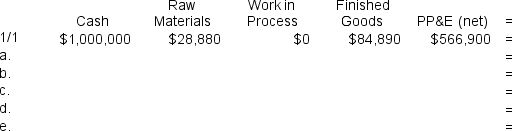

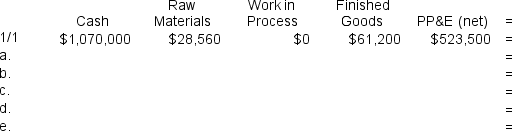

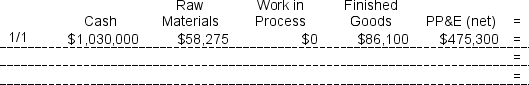

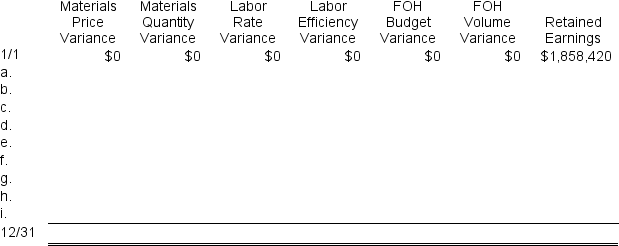

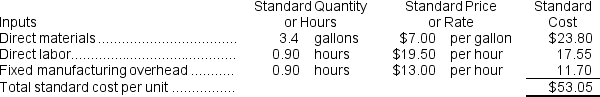

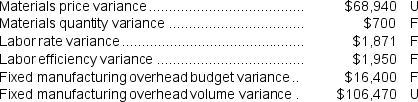

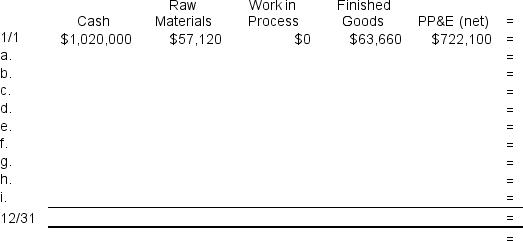

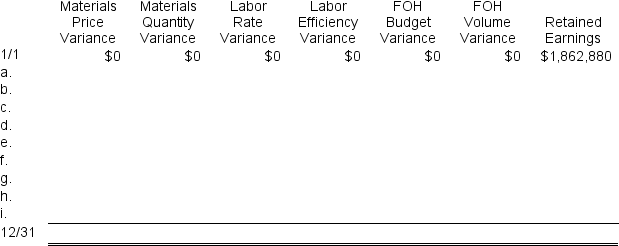

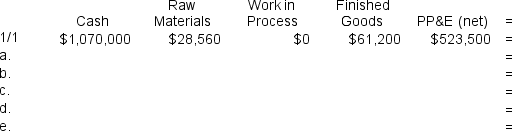

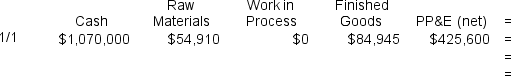

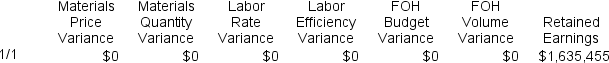

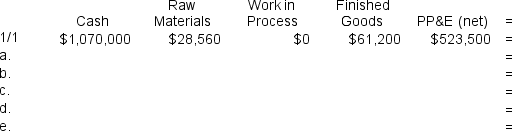

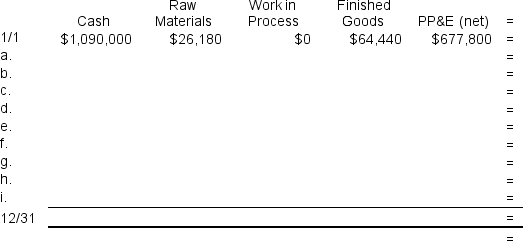

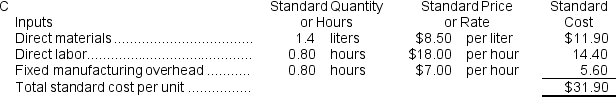

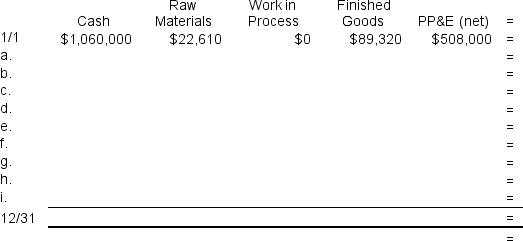

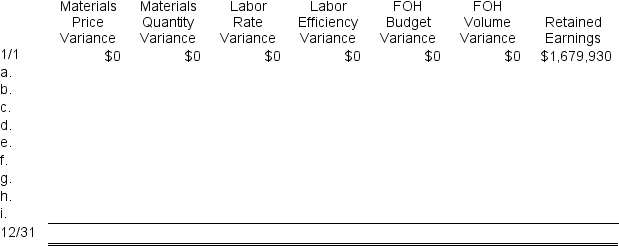

Floria Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The company's balance sheet at the beginning of the year was as follows:

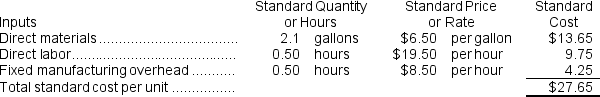

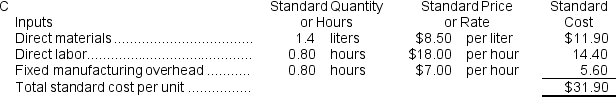

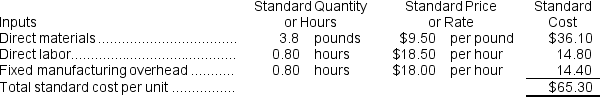

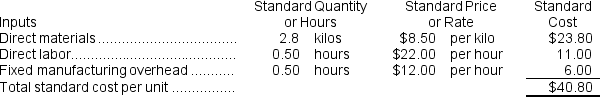

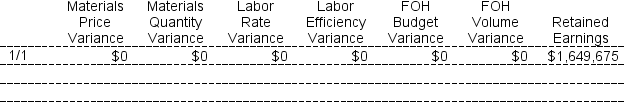

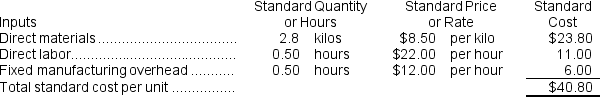

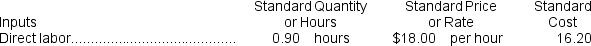

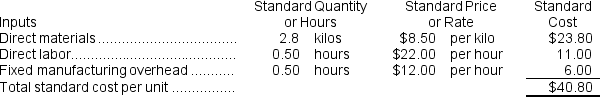

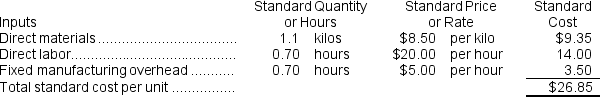

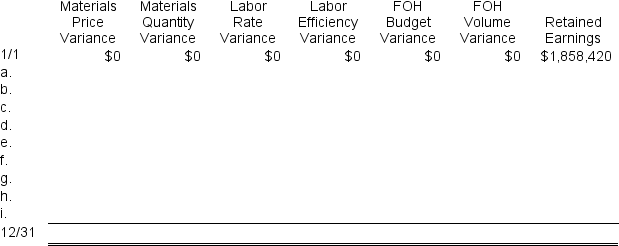

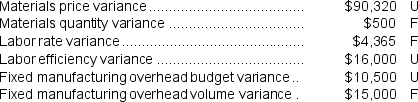

The standard cost card for the company's only product is as follows:

The standard cost card for the company's only product is as follows:

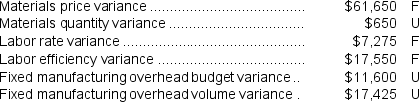

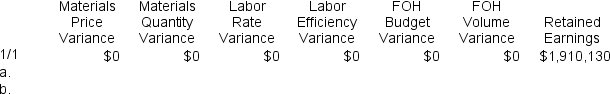

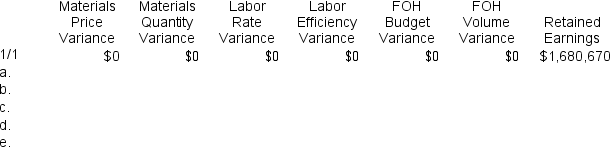

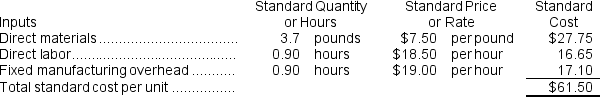

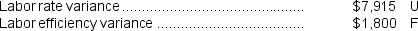

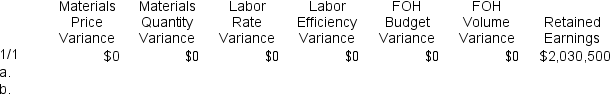

The company calculated the following variances for the year:

The company calculated the following variances for the year:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $148,750 and budgeted activity of 17,500 hours.

During the year,the company completed the following transactions:

a.Purchased 68,500 gallons of raw material at a price of $5.60 per gallon.

b.Used 64,990 gallons of the raw material to produce 30,900 units of work in process.

c.Assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 14,550 hours at an average cost of $19.00 per hour.

d.Applied fixed overhead to the 30,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed.Actual fixed overhead costs for the year were $160,350.Of this total,$78,350 related to items such as insurance,utilities,and indirect labor salaries that were all paid in cash and $82,000 related to depreciation of manufacturing equipment.

e.Transferred 30,900 units from work in process to finished goods.

f.Sold for cash 27,200 units to customers at a price of $33.50 per unit.

g.Completed and transferred the standard cost associated with the 27,200 units sold from finished goods to cost of goods sold.

h.Paid $79,000 of selling and administrative expenses.

i.Closed all standard cost variances to cost of goods sold.

Required:

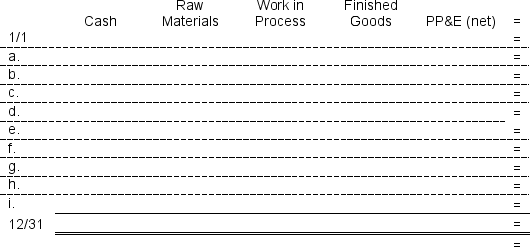

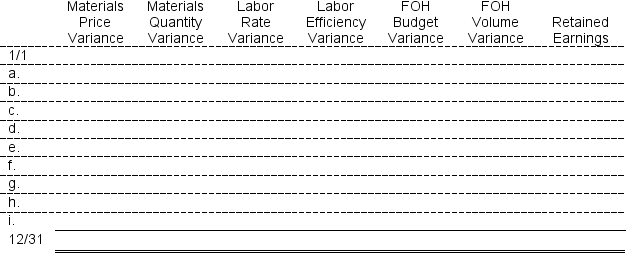

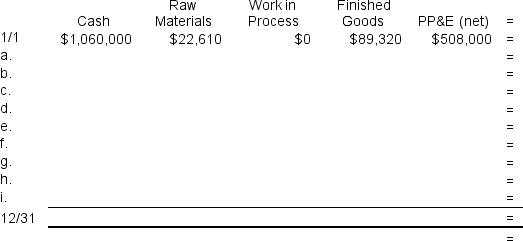

1.Enter the beginning balances and record the above transactions in the worksheet that appears below.Because of the width of the worksheet,it is in two parts.In your text,these two parts would be joined side-by-side to make one very wide worksheet.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $148,750 and budgeted activity of 17,500 hours.

During the year,the company completed the following transactions:

a.Purchased 68,500 gallons of raw material at a price of $5.60 per gallon.

b.Used 64,990 gallons of the raw material to produce 30,900 units of work in process.

c.Assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 14,550 hours at an average cost of $19.00 per hour.

d.Applied fixed overhead to the 30,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed.Actual fixed overhead costs for the year were $160,350.Of this total,$78,350 related to items such as insurance,utilities,and indirect labor salaries that were all paid in cash and $82,000 related to depreciation of manufacturing equipment.

e.Transferred 30,900 units from work in process to finished goods.

f.Sold for cash 27,200 units to customers at a price of $33.50 per unit.

g.Completed and transferred the standard cost associated with the 27,200 units sold from finished goods to cost of goods sold.

h.Paid $79,000 of selling and administrative expenses.

i.Closed all standard cost variances to cost of goods sold.

Required:

1.Enter the beginning balances and record the above transactions in the worksheet that appears below.Because of the width of the worksheet,it is in two parts.In your text,these two parts would be joined side-by-side to make one very wide worksheet.

2.Determine the ending balance (e.g.,12/31 balance)in each account.

2.Determine the ending balance (e.g.,12/31 balance)in each account.

(Essay)

4.9/5  (34)

(34)

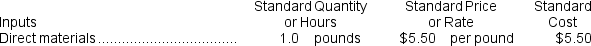

Bohon Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product contains the following information concerning direct materials:

During the year, the company completed the following transactions concerning direct materials:

a. Purchased 19,700 pounds of raw material at a price of $4.70 per pound.

b. Used 18,500 pounds of the raw material to produce 18,400 units of work in process.

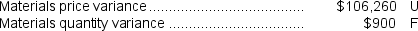

The company calculated the following direct materials variances for the year:

During the year, the company completed the following transactions concerning direct materials:

a. Purchased 19,700 pounds of raw material at a price of $4.70 per pound.

b. Used 18,500 pounds of the raw material to produce 18,400 units of work in process.

The company calculated the following direct materials variances for the year:

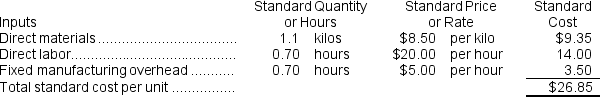

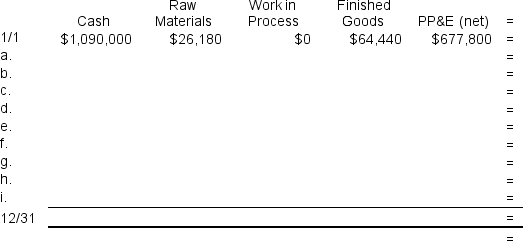

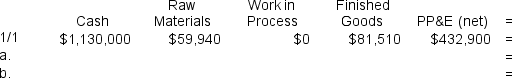

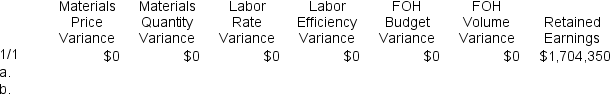

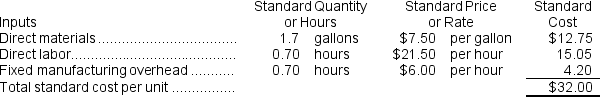

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When recording the raw materials purchases in transaction (a)above,the Raw Materials inventory account will increase (decrease)by:

-When recording the raw materials purchases in transaction (a)above,the Raw Materials inventory account will increase (decrease)by:

(Multiple Choice)

4.7/5  (37)

(37)

Samples Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead.

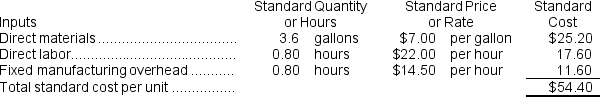

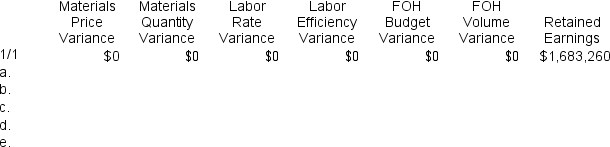

The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $140,000 and budgeted activity of 20,000 hours.

During the year, the company completed the following transactions:

a. Purchased 49,500 liters of raw material at a price of $8.00 per liter. The materials price variance was $24,750 F.

b. Used 45,820 liters of the raw material to produce 32,800 units of work in process. The materials quantity variance was $850 F.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 28,440 hours at an average cost of $17.00 per hour. The direct labor rate variance was $28,440 F. The labor efficiency variance was $39,600 U.

d. Applied fixed overhead to the 32,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $154,700. Of this total, $83,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $71,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $14,700 U. The fixed manufacturing overhead volume variance was $43,680 F.

e. Completed and transferred 32,800 units from work in process to finished goods.

f. Sold (for cash) 32,000 units to customers at a price of $38.20 per unit.

g. Transferred the standard cost associated with the 32,000 units sold from finished goods to cost of goods sold.

h. Paid $133,000 of selling and administrative expenses.

i. Closed all standard cost variances to cost of goods sold.

To answer the following questions, it would be advisable to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $140,000 and budgeted activity of 20,000 hours.

During the year, the company completed the following transactions:

a. Purchased 49,500 liters of raw material at a price of $8.00 per liter. The materials price variance was $24,750 F.

b. Used 45,820 liters of the raw material to produce 32,800 units of work in process. The materials quantity variance was $850 F.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 28,440 hours at an average cost of $17.00 per hour. The direct labor rate variance was $28,440 F. The labor efficiency variance was $39,600 U.

d. Applied fixed overhead to the 32,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $154,700. Of this total, $83,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $71,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $14,700 U. The fixed manufacturing overhead volume variance was $43,680 F.

e. Completed and transferred 32,800 units from work in process to finished goods.

f. Sold (for cash) 32,000 units to customers at a price of $38.20 per unit.

g. Transferred the standard cost associated with the 32,000 units sold from finished goods to cost of goods sold.

h. Paid $133,000 of selling and administrative expenses.

i. Closed all standard cost variances to cost of goods sold.

To answer the following questions, it would be advisable to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When the company closes its standard cost variances,the Cost of Goods Sold will increase (decrease)by:

-When the company closes its standard cost variances,the Cost of Goods Sold will increase (decrease)by:

(Multiple Choice)

4.8/5  (29)

(29)

Robins Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $360,000 and budgeted activity of 20,000 hours.

During the year, the company completed the following transactions:

a. Purchased 134,700 pounds of raw material at a price of $9.10 per pound.

b. Used 122,080 pounds of the raw material to produce 32,100 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 26,680 hours at an average cost of $17.20 per hour.

d. Applied fixed overhead to the 32,100 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $378,400. Of this total, $297,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $81,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 32,100 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $360,000 and budgeted activity of 20,000 hours.

During the year, the company completed the following transactions:

a. Purchased 134,700 pounds of raw material at a price of $9.10 per pound.

b. Used 122,080 pounds of the raw material to produce 32,100 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 26,680 hours at an average cost of $17.20 per hour.

d. Applied fixed overhead to the 32,100 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $378,400. Of this total, $297,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $81,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 32,100 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When recording the raw materials used in production in transaction (b)above,the Work in Process inventory account will increase (decrease)by:

-When recording the raw materials used in production in transaction (b)above,the Work in Process inventory account will increase (decrease)by:

(Multiple Choice)

4.9/5  (41)

(41)

Platko Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $348,000 and budgeted activity of 24,000 hours.During the year,38,900 units were started and completed.Actual fixed overhead costs for the year were $335,900.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the fixed manufacturing overhead cost is recorded,which of the following entries will be made?

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $348,000 and budgeted activity of 24,000 hours.During the year,38,900 units were started and completed.Actual fixed overhead costs for the year were $335,900.

Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When the fixed manufacturing overhead cost is recorded,which of the following entries will be made?

(Multiple Choice)

4.8/5  (36)

(36)

Phann Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When recording the direct labor costs in transaction (c)above,the Work in Process inventory account will increase (decrease)by:

-When recording the direct labor costs in transaction (c)above,the Work in Process inventory account will increase (decrease)by:

(Multiple Choice)

4.9/5  (34)

(34)

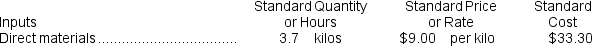

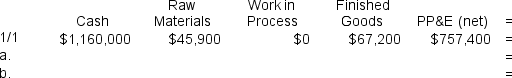

Herriot Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $598,500 and budgeted activity of 31,500 hours.

During the year,the company applied fixed overhead to the 37,500 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed.Actual fixed overhead costs for the year were $609,000.Of this total,$549,000 related to items such as insurance,utilities,and indirect labor salaries that were all paid in cash and $60,000 related to depreciation of manufacturing equipment.

Required:

Completely record the transactions involving fixed overhead,including any variances,in the worksheet that appears below.Because of the width of the worksheet,it is in two parts.In your text,these two parts would be joined side-by-side to make one very wide worksheet.The beginning balances have been provided for each of the accounts,including the Property,Plant,and Equipment (net)account which is abbreviated as PP&E (net).

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $598,500 and budgeted activity of 31,500 hours.

During the year,the company applied fixed overhead to the 37,500 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed.Actual fixed overhead costs for the year were $609,000.Of this total,$549,000 related to items such as insurance,utilities,and indirect labor salaries that were all paid in cash and $60,000 related to depreciation of manufacturing equipment.

Required:

Completely record the transactions involving fixed overhead,including any variances,in the worksheet that appears below.Because of the width of the worksheet,it is in two parts.In your text,these two parts would be joined side-by-side to make one very wide worksheet.The beginning balances have been provided for each of the accounts,including the Property,Plant,and Equipment (net)account which is abbreviated as PP&E (net).

(Essay)

4.8/5  (38)

(38)

Alvino Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead.

The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $70,000 and budgeted activity of 14,000 hours.

During the year, the company completed the following transactions:

a. Purchased 32,200 kilos of raw material at a price of $7.80 per kilo. The materials price variance was $22,540 F.

b. Used 30,480 kilos of the raw material to produce 27,800 units of work in process. The materials quantity variance was $850 F.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 18,260 hours at an average cost of $20.50 per hour. The direct labor rate variance was $9,130 U. The labor efficiency variance was $24,000 F.

d. Applied fixed overhead to the 27,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $59,500. Of this total, -$22,500 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $82,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $10,500 F. The fixed manufacturing overhead volume variance was $27,300 F.

e. Completed and transferred 27,800 units from work in process to finished goods.

f. Sold (for cash) 29,000 units to customers at a price of $31.90 per unit.

g. Transferred the standard cost associated with the 29,000 units sold from finished goods to cost of goods sold.

h. Paid $101,000 of selling and administrative expenses.

i. Closed all standard cost variances to cost of goods sold.

To answer the following questions, you will need to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $70,000 and budgeted activity of 14,000 hours.

During the year, the company completed the following transactions:

a. Purchased 32,200 kilos of raw material at a price of $7.80 per kilo. The materials price variance was $22,540 F.

b. Used 30,480 kilos of the raw material to produce 27,800 units of work in process. The materials quantity variance was $850 F.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 18,260 hours at an average cost of $20.50 per hour. The direct labor rate variance was $9,130 U. The labor efficiency variance was $24,000 F.

d. Applied fixed overhead to the 27,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $59,500. Of this total, -$22,500 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $82,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $10,500 F. The fixed manufacturing overhead volume variance was $27,300 F.

e. Completed and transferred 27,800 units from work in process to finished goods.

f. Sold (for cash) 29,000 units to customers at a price of $31.90 per unit.

g. Transferred the standard cost associated with the 29,000 units sold from finished goods to cost of goods sold.

h. Paid $101,000 of selling and administrative expenses.

i. Closed all standard cost variances to cost of goods sold.

To answer the following questions, you will need to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-The ending balance in the Finished Goods account will be closest to:

-The ending balance in the Finished Goods account will be closest to:

(Multiple Choice)

4.8/5  (38)

(38)

Jakeman Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead.

The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $351,000 and budgeted activity of 27,000 hours.

During the year, the company completed the following transactions:

a. Purchased 76,600 gallons of raw material at a price of $7.90 per gallon.

b. Used 70,960 gallons of the raw material to produce 20,900 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 18,710 hours at an average cost of $19.40 per hour.

d. Applied fixed overhead to the 20,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $334,600. Of this total, $252,600 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $82,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 20,900 units from work in process to finished goods.

f. Sold (for cash) 17,700 units to customers at a price of $74.30 per unit.

g. Transferred the standard cost associated with the 17,700 units sold from finished goods to cost of goods sold.

h. Paid $93,000 of selling and administrative expenses.

i. Closed all standard cost variances to cost of goods sold.

The company calculated the following variances for the year:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $351,000 and budgeted activity of 27,000 hours.

During the year, the company completed the following transactions:

a. Purchased 76,600 gallons of raw material at a price of $7.90 per gallon.

b. Used 70,960 gallons of the raw material to produce 20,900 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 18,710 hours at an average cost of $19.40 per hour.

d. Applied fixed overhead to the 20,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $334,600. Of this total, $252,600 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $82,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 20,900 units from work in process to finished goods.

f. Sold (for cash) 17,700 units to customers at a price of $74.30 per unit.

g. Transferred the standard cost associated with the 17,700 units sold from finished goods to cost of goods sold.

h. Paid $93,000 of selling and administrative expenses.

i. Closed all standard cost variances to cost of goods sold.

The company calculated the following variances for the year:

To answer the following questions, it would be advisable to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

To answer the following questions, it would be advisable to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-The adjusted Cost of Goods Sold after closing all of the variances to Cost of Goods Sold will be closest to:

-The adjusted Cost of Goods Sold after closing all of the variances to Cost of Goods Sold will be closest to:

(Multiple Choice)

5.0/5  (43)

(43)

Phann Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When the work in process is completed and transferred to finished goods in transaction (e)above,the Finished Goods inventory account will increase (decrease)by:

-When the work in process is completed and transferred to finished goods in transaction (e)above,the Finished Goods inventory account will increase (decrease)by:

(Multiple Choice)

4.8/5  (36)

(36)

Landoni Corporation uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The standards for direct materials for the company's only product specify 2.7 kilos per unit at $5.00 per kilo or $13.50 per unit.During the year,the company purchased 75,200 kilos of raw material at a price of $4.90 per kilo and used 69,290 kilos of the raw material to produce 25,700 units of work in process. Assume that all transactions are recorded on a worksheet as shown in the text.On the left-hand side of the equals sign in the worksheet are columns for Cash,Raw Materials,Work in Process,Finished Goods,and PP&E (net).All of the variance columns are on the right-hand-side of the equals sign along with the column for Retained Earnings.

When recording the raw materials purchases,the Raw Materials inventory account will increase (decrease)by:

(Multiple Choice)

4.8/5  (38)

(38)

Decena Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. Information concerning the direct labor standards for the company's only product is as follows:

During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 15,830 hours at an average cost of $18.50 per hour. The company calculated the following direct labor variances for the year:

During the year, the company assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 15,830 hours at an average cost of $18.50 per hour. The company calculated the following direct labor variances for the year:

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When recording the direct labor costs,the Work in Process inventory account will increase (decrease)by:

-When recording the direct labor costs,the Work in Process inventory account will increase (decrease)by:

(Multiple Choice)

4.7/5  (29)

(29)

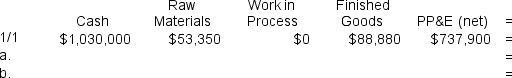

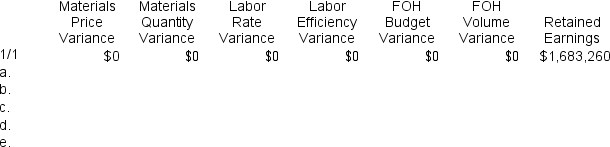

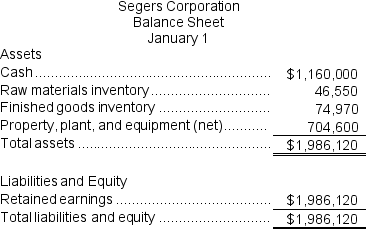

Segers Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The company's balance sheet at the beginning of the year was as follows:

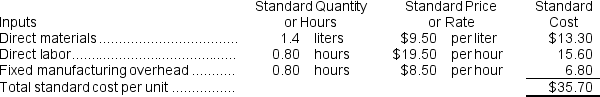

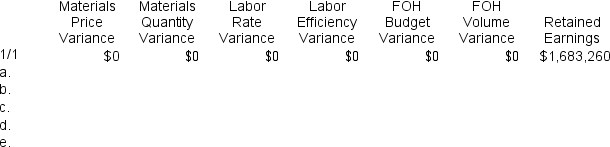

The standard cost card for the company's only product is as follows:

The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $238,000 and budgeted activity of 28,000 hours.

During the year,the company completed the following transactions:

a.Purchased 51,000 liters of raw material at a price of $9.20 per liter.

b.Used 46,100 liters of the raw material to produce 33,000 units of work in process.

c.Assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 26,200 hours at an average cost of $19.90 per hour.

d.Applied fixed overhead to the 33,000 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed.Actual fixed overhead costs for the year were $251,800.Of this total,$165,800 related to items such as insurance,utilities,and indirect labor salaries that were all paid in cash and $86,000 related to depreciation of manufacturing equipment.

e.Transferred 33,000 units from work in process to finished goods.

f.Sold for cash 34,800 units to customers at a price of $44.00 per unit.

g.Completed and transferred the standard cost associated with the 34,800 units sold from finished goods to cost of goods sold.

h.Paid $156,000 of selling and administrative expenses.

i.Closed all standard cost variances to cost of goods sold.

Required:

1.Compute all direct materials,direct labor,and fixed overhead variances for the year.

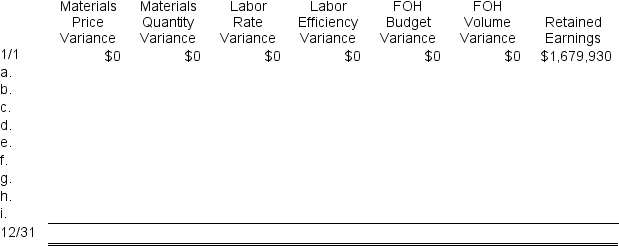

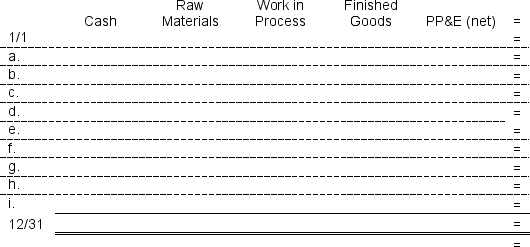

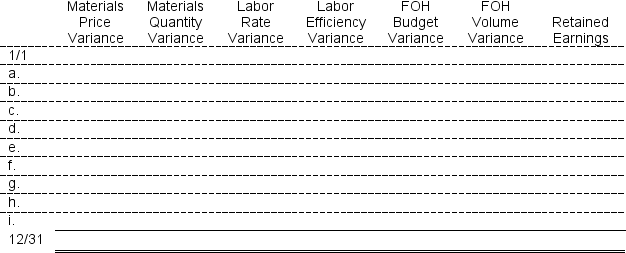

2.Enter the beginning balances and record the above transactions in the worksheet that appears below.Because of the width of the worksheet,it is in two parts.In your text,these two parts would be joined side-by-side to make one very wide worksheet.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $238,000 and budgeted activity of 28,000 hours.

During the year,the company completed the following transactions:

a.Purchased 51,000 liters of raw material at a price of $9.20 per liter.

b.Used 46,100 liters of the raw material to produce 33,000 units of work in process.

c.Assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 26,200 hours at an average cost of $19.90 per hour.

d.Applied fixed overhead to the 33,000 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed.Actual fixed overhead costs for the year were $251,800.Of this total,$165,800 related to items such as insurance,utilities,and indirect labor salaries that were all paid in cash and $86,000 related to depreciation of manufacturing equipment.

e.Transferred 33,000 units from work in process to finished goods.

f.Sold for cash 34,800 units to customers at a price of $44.00 per unit.

g.Completed and transferred the standard cost associated with the 34,800 units sold from finished goods to cost of goods sold.

h.Paid $156,000 of selling and administrative expenses.

i.Closed all standard cost variances to cost of goods sold.

Required:

1.Compute all direct materials,direct labor,and fixed overhead variances for the year.

2.Enter the beginning balances and record the above transactions in the worksheet that appears below.Because of the width of the worksheet,it is in two parts.In your text,these two parts would be joined side-by-side to make one very wide worksheet.

3.Determine the ending balance (e.g.,12/31 balance)in each account.

3.Determine the ending balance (e.g.,12/31 balance)in each account.

(Essay)

4.7/5  (43)

(43)

As defined it the text,the ending balance in retained earnings equals the beginning balance in retained earnings plus net operating income minus dividends.

(True/False)

4.8/5  (42)

(42)

Phann Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $90,000 and budgeted activity of 7,500 hours.

During the year, the company completed the following transactions:

a. Purchased 59,000 kilos of raw material at a price of $9.20 per kilo.

b. Used 51,340 kilos of the raw material to produce 18,300 units of work in process.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 8,850 hours at an average cost of $23.70 per hour.

d. Applied fixed overhead to the 18,300 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $79,400. Of this total, $22,400 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $57,000 related to depreciation of manufacturing equipment.

e. Completed and transferred 18,300 units from work in process to finished goods.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When recording the direct labor costs in transaction (c)above,the Cash account will increase (decrease)by:

-When recording the direct labor costs in transaction (c)above,the Cash account will increase (decrease)by:

(Multiple Choice)

4.8/5  (38)

(38)

Lakatos Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product contains the following information concerning direct materials:

During the year, the company completed the following transactions concerning direct materials:

a. Purchased 151,800 kilos of raw material at a price of $9.70 per kilo.

b. Used 140,870 kilos of the raw material to produce 38,100 units of work in process.

The company calculated the following direct materials variances for the year:

During the year, the company completed the following transactions concerning direct materials:

a. Purchased 151,800 kilos of raw material at a price of $9.70 per kilo.

b. Used 140,870 kilos of the raw material to produce 38,100 units of work in process.

The company calculated the following direct materials variances for the year:

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When the purchase of raw materials is recorded in transaction (a)above,which of the following entries will be made?

-When the purchase of raw materials is recorded in transaction (a)above,which of the following entries will be made?

(Multiple Choice)

5.0/5  (27)

(27)

Alvino Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead.

The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $70,000 and budgeted activity of 14,000 hours.

During the year, the company completed the following transactions:

a. Purchased 32,200 kilos of raw material at a price of $7.80 per kilo. The materials price variance was $22,540 F.

b. Used 30,480 kilos of the raw material to produce 27,800 units of work in process. The materials quantity variance was $850 F.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 18,260 hours at an average cost of $20.50 per hour. The direct labor rate variance was $9,130 U. The labor efficiency variance was $24,000 F.

d. Applied fixed overhead to the 27,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $59,500. Of this total, -$22,500 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $82,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $10,500 F. The fixed manufacturing overhead volume variance was $27,300 F.

e. Completed and transferred 27,800 units from work in process to finished goods.

f. Sold (for cash) 29,000 units to customers at a price of $31.90 per unit.

g. Transferred the standard cost associated with the 29,000 units sold from finished goods to cost of goods sold.

h. Paid $101,000 of selling and administrative expenses.

i. Closed all standard cost variances to cost of goods sold.

To answer the following questions, you will need to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $70,000 and budgeted activity of 14,000 hours.

During the year, the company completed the following transactions:

a. Purchased 32,200 kilos of raw material at a price of $7.80 per kilo. The materials price variance was $22,540 F.

b. Used 30,480 kilos of the raw material to produce 27,800 units of work in process. The materials quantity variance was $850 F.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 18,260 hours at an average cost of $20.50 per hour. The direct labor rate variance was $9,130 U. The labor efficiency variance was $24,000 F.

d. Applied fixed overhead to the 27,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $59,500. Of this total, -$22,500 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $82,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $10,500 F. The fixed manufacturing overhead volume variance was $27,300 F.

e. Completed and transferred 27,800 units from work in process to finished goods.

f. Sold (for cash) 29,000 units to customers at a price of $31.90 per unit.

g. Transferred the standard cost associated with the 29,000 units sold from finished goods to cost of goods sold.

h. Paid $101,000 of selling and administrative expenses.

i. Closed all standard cost variances to cost of goods sold.

To answer the following questions, you will need to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-The ending balance in the Cash account will be closest to:

-The ending balance in the Cash account will be closest to:

(Multiple Choice)

4.7/5  (32)

(32)

Neuhaus Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

During the year, the company completed the following transactions:

a. Purchased 52,900 gallons of raw material at a price of $7.60 per gallon.

b. Used 46,820 gallons of the raw material to produce 27,600 units of work in process.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

During the year, the company completed the following transactions:

a. Purchased 52,900 gallons of raw material at a price of $7.60 per gallon.

b. Used 46,820 gallons of the raw material to produce 27,600 units of work in process.

Assume that all transactions are recorded on the below worksheet, which is similar to the worksheet shown in your text except that it has been divided into two parts so that it fits on one page. The beginning balances in each of the accounts have been given. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-When the raw materials used in production are recorded in transaction (b)above,which of the following entries will be made?

-When the raw materials used in production are recorded in transaction (b)above,which of the following entries will be made?

(Multiple Choice)

4.8/5  (37)

(37)

Isenberg Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.The company does not have any variable manufacturing overhead costs.It recorded the following variances during the year:

When the company closes its standard cost variances,the Cost of Goods Sold will increase (decrease)by:

When the company closes its standard cost variances,the Cost of Goods Sold will increase (decrease)by:

(Multiple Choice)

5.0/5  (37)

(37)

Samples Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead.

The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $140,000 and budgeted activity of 20,000 hours.

During the year, the company completed the following transactions:

a. Purchased 49,500 liters of raw material at a price of $8.00 per liter. The materials price variance was $24,750 F.

b. Used 45,820 liters of the raw material to produce 32,800 units of work in process. The materials quantity variance was $850 F.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 28,440 hours at an average cost of $17.00 per hour. The direct labor rate variance was $28,440 F. The labor efficiency variance was $39,600 U.

d. Applied fixed overhead to the 32,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $154,700. Of this total, $83,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $71,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $14,700 U. The fixed manufacturing overhead volume variance was $43,680 F.

e. Completed and transferred 32,800 units from work in process to finished goods.

f. Sold (for cash) 32,000 units to customers at a price of $38.20 per unit.

g. Transferred the standard cost associated with the 32,000 units sold from finished goods to cost of goods sold.

h. Paid $133,000 of selling and administrative expenses.

i. Closed all standard cost variances to cost of goods sold.

To answer the following questions, it would be advisable to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $140,000 and budgeted activity of 20,000 hours.

During the year, the company completed the following transactions:

a. Purchased 49,500 liters of raw material at a price of $8.00 per liter. The materials price variance was $24,750 F.

b. Used 45,820 liters of the raw material to produce 32,800 units of work in process. The materials quantity variance was $850 F.

c. Assigned direct labor costs to work in process. The direct labor workers (who were paid in cash) worked 28,440 hours at an average cost of $17.00 per hour. The direct labor rate variance was $28,440 F. The labor efficiency variance was $39,600 U.

d. Applied fixed overhead to the 32,800 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $154,700. Of this total, $83,700 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $71,000 related to depreciation of manufacturing equipment. The fixed manufacturing overhead budget variance was $14,700 U. The fixed manufacturing overhead volume variance was $43,680 F.

e. Completed and transferred 32,800 units from work in process to finished goods.

f. Sold (for cash) 32,000 units to customers at a price of $38.20 per unit.

g. Transferred the standard cost associated with the 32,000 units sold from finished goods to cost of goods sold.

h. Paid $133,000 of selling and administrative expenses.

i. Closed all standard cost variances to cost of goods sold.

To answer the following questions, it would be advisable to record transactions a through i in the worksheet below. This worksheet is similar to the worksheets in your text except that it has been split into two parts to fit on the page. PP&E (net) stands for Property, Plant, and Equipment net of depreciation.

-The net operating income for the year is closest to:

-The net operating income for the year is closest to:

(Multiple Choice)

4.9/5  (42)

(42)

Showing 61 - 80 of 138

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)