Exam 6: Variable Costing and Segment Reporting: Tools for Management

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Production Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting255 Questions

Exam 4: Process Costing138 Questions

Exam 5: Cost-Volume-Profit Relationships260 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 7: Super-Variable Costing49 Questions

Exam 8: Master Budgeting234 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Differential Analysis: The Key to Decision Making203 Questions

Exam 13: Capital Budgeting Decisions179 Questions

Exam 14: Statement of Cash Flows132 Questions

Exam 15: Financial Statement Analysis289 Questions

Exam 16: Cost of Quality66 Questions

Exam 17: Activity-Based Absorption Costing20 Questions

Exam 18: The Predetermined Overhead Rate and Capacity42 Questions

Exam 19: Job-Order Costing: a Microsoft Excel-Based Approach28 Questions

Exam 20: Fifo Method100 Questions

Exam 21: Service Department Allocations60 Questions

Exam 22: Analyzing Mixed Costs81 Questions

Exam 23: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 24: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 25: Standard Cost Systems: a Financial Reporting Perspective Using Microsoft Excel138 Questions

Exam 26: Transfer Pricing102 Questions

Exam 27: Service Department Charges44 Questions

Exam 28: Pricing Decisions149 Questions

Exam 29: The Concept of Present Value16 Questions

Exam 30: Income Taxes and the Present Value Method150 Questions

Exam 31: the Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Select questions type

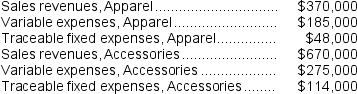

Spiess Corporation has two major business segments--Apparel and Accessories.Data concerning those segments for December appear below:

Common fixed expenses totaled $309,000 and were allocated as follows:

$142,000 to the Apparel business segment and $167,000 to the Accessories business segment.

Required:

Prepare a segmented income statement in the contribution format for the company.Omit percentages; show only dollar amounts.

Common fixed expenses totaled $309,000 and were allocated as follows:

$142,000 to the Apparel business segment and $167,000 to the Accessories business segment.

Required:

Prepare a segmented income statement in the contribution format for the company.Omit percentages; show only dollar amounts.

(Essay)

4.9/5  (39)

(39)

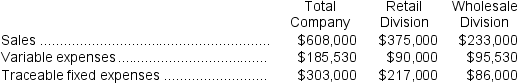

Bertie Corporation has two divisions: Retail Division and Wholesale Division. The following data are for the most recent operating period:

The common fixed expenses of the company are $103,360.

-The company's overall break-even sales is closest to:

The common fixed expenses of the company are $103,360.

-The company's overall break-even sales is closest to:

(Multiple Choice)

4.7/5  (39)

(39)

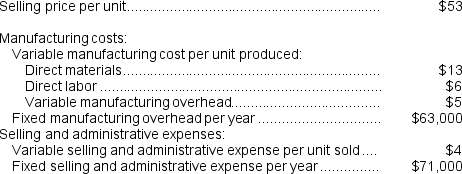

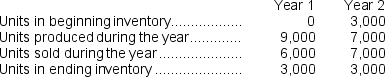

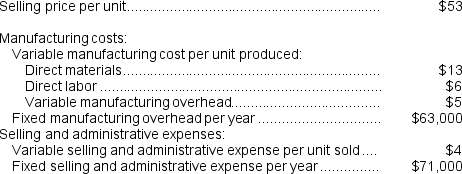

Bryans Corporation has provided the following data for its two most recent years of operation:

-The unit product cost under absorption costing in Year 1 is closest to:

-The unit product cost under absorption costing in Year 1 is closest to:

(Multiple Choice)

4.9/5  (42)

(42)

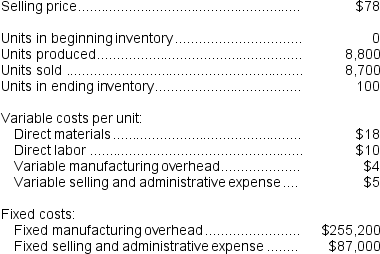

Hadley Corporation, which has only one product, has provided the following data concerning its most recent month of operations:

-The total contribution margin for the month under variable costing is:

-The total contribution margin for the month under variable costing is:

(Multiple Choice)

4.9/5  (35)

(35)

Younie Corporation has two divisions: the South Division and the West Division.The corporation's net operating income is $26,900.The South Division's divisional segment margin is $42,800 and the West Division's divisional segment margin is $29,900.What is the amount of the common fixed expense not traceable to the individual divisions?

(Multiple Choice)

4.8/5  (48)

(48)

Ross Corporation produces a single product. The company has direct materials costs of $8 per unit, direct labor costs of $6 per unit, and manufacturing overhead of $10 per unit. Sixty percent of the manufacturing overhead is for fixed costs. In addition, variable selling and administrative expenses are $2 per unit, and fixed selling and administrative expenses are $3 per unit at the current activity level. Assume that direct labor is a variable cost.

-Under variable costing,the unit product cost is:

(Multiple Choice)

4.9/5  (40)

(40)

Bryans Corporation has provided the following data for its two most recent years of operation:

-The unit product cost under absorption costing in Year 2 is closest to:

-The unit product cost under absorption costing in Year 2 is closest to:

(Multiple Choice)

4.9/5  (44)

(44)

Caruso Inc., which produces a single product, has provided the following data for its most recent month of operations:

There were no beginning or ending inventories.

-The unit product cost under absorption costing was:

There were no beginning or ending inventories.

-The unit product cost under absorption costing was:

(Multiple Choice)

4.9/5  (35)

(35)

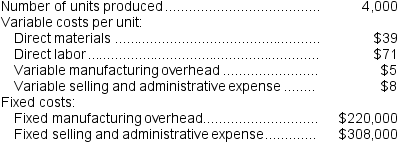

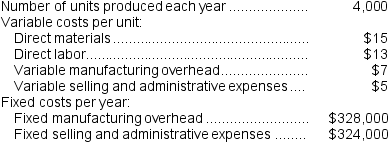

Olguin Corporation produces a single product and has the following cost structure:

Required:

a.Compute the unit product cost under absorption costing.Show your work!

b.Compute the unit product cost under variable costing.Show your work!

Required:

a.Compute the unit product cost under absorption costing.Show your work!

b.Compute the unit product cost under variable costing.Show your work!

(Essay)

4.8/5  (35)

(35)

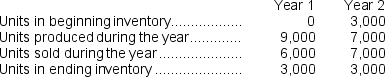

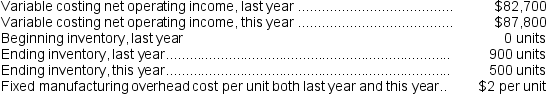

Phinisee Corporation manufactures a single product.The following data pertain to the company's operations over the last two years:

Required:

a.Determine the absorption costing net operating income for last year.Show your work!

b.Determine the absorption costing net operating income for this year.Show your work!

Required:

a.Determine the absorption costing net operating income for last year.Show your work!

b.Determine the absorption costing net operating income for this year.Show your work!

(Essay)

4.8/5  (32)

(32)

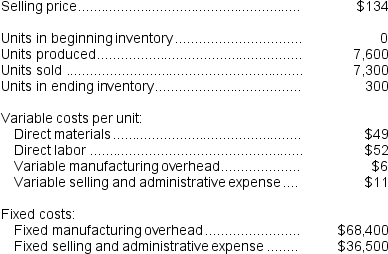

A manufacturing company that produces a single product has provided the following data concerning its most recent month of operations:

What is the net operating income for the month under absorption costing?

What is the net operating income for the month under absorption costing?

(Multiple Choice)

4.8/5  (31)

(31)

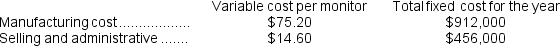

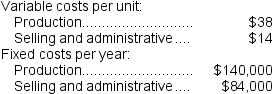

McCoy Corporation manufactures a computer monitor. Shown below is McCoy's cost structure:

In its first year of operations, McCoy produced 100,000 monitors but only sold 95,000. McCoy's gross margin in this first year was $2,629,600. McCoy's contribution margin in this first year was $2,109,000.

-Under variable costing,what is McCoy's net operating income for its first year?

In its first year of operations, McCoy produced 100,000 monitors but only sold 95,000. McCoy's gross margin in this first year was $2,629,600. McCoy's contribution margin in this first year was $2,109,000.

-Under variable costing,what is McCoy's net operating income for its first year?

(Multiple Choice)

4.8/5  (40)

(40)

J Corporation has two divisions.Division A has a contribution margin of $79,300 and Division B has a contribution margin of $126,200.If total traceable fixed expenses are $72,400 and total common fixed expenses are $34,900,what is J Corporation's net operating income?

(Multiple Choice)

4.9/5  (40)

(40)

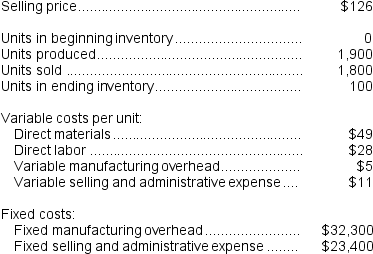

Farris Corporation, which has only one product, has provided the following data concerning its most recent month of operations:

-What is the net operating income for the month under variable costing?

-What is the net operating income for the month under variable costing?

(Multiple Choice)

4.7/5  (38)

(38)

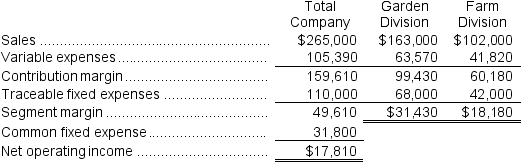

Koff Corporation has two divisions:

Garden Division and Farm Division.The following report is for the most recent operating period:

Required:

a.What is the Garden Division's break-even in sales dollars?

b.What is the Farm Division's break-even in sales dollars?

c.What is the company's overall break-even in sales dollars?

d.What would be the company's overall net operating income if the company operated at its two division's break-even points?

Required:

a.What is the Garden Division's break-even in sales dollars?

b.What is the Farm Division's break-even in sales dollars?

c.What is the company's overall break-even in sales dollars?

d.What would be the company's overall net operating income if the company operated at its two division's break-even points?

(Essay)

4.9/5  (32)

(32)

The Southern Corporation manufactures a single product and has the following cost structure:

Last year, 7,000 units were produced and 6,800 units were sold. There was no beginning inventory.

-Under variable costing,the unit product cost would be:

Last year, 7,000 units were produced and 6,800 units were sold. There was no beginning inventory.

-Under variable costing,the unit product cost would be:

(Multiple Choice)

4.8/5  (24)

(24)

Bellue Inc.manufactures a single product.Variable costing net operating income was $96,300 last year and its inventory decreased by 2,600 units.Fixed manufacturing overhead cost was $1 per unit for both units in beginning and in ending inventory.What was the absorption costing net operating income last year?

(Multiple Choice)

4.7/5  (35)

(35)

Absorption costing treats all manufacturing costs as product costs.

(True/False)

4.7/5  (34)

(34)

When sales exceed production and the company uses the LIFO inventory flow assumption,the net operating income reported under variable costing generally will be:

(Multiple Choice)

5.0/5  (36)

(36)

Showing 41 - 60 of 291

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)