Exam 3: Job-Order Costing: Cost Flows and External Reporting

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Production Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting255 Questions

Exam 4: Process Costing138 Questions

Exam 5: Cost-Volume-Profit Relationships260 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 7: Super-Variable Costing49 Questions

Exam 8: Master Budgeting234 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Differential Analysis: The Key to Decision Making203 Questions

Exam 13: Capital Budgeting Decisions179 Questions

Exam 14: Statement of Cash Flows132 Questions

Exam 15: Financial Statement Analysis289 Questions

Exam 16: Cost of Quality66 Questions

Exam 17: Activity-Based Absorption Costing20 Questions

Exam 18: The Predetermined Overhead Rate and Capacity42 Questions

Exam 19: Job-Order Costing: a Microsoft Excel-Based Approach28 Questions

Exam 20: Fifo Method100 Questions

Exam 21: Service Department Allocations60 Questions

Exam 22: Analyzing Mixed Costs81 Questions

Exam 23: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 24: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 25: Standard Cost Systems: a Financial Reporting Perspective Using Microsoft Excel138 Questions

Exam 26: Transfer Pricing102 Questions

Exam 27: Service Department Charges44 Questions

Exam 28: Pricing Decisions149 Questions

Exam 29: The Concept of Present Value16 Questions

Exam 30: Income Taxes and the Present Value Method150 Questions

Exam 31: the Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Select questions type

The schedule of cost of goods manufactured contains three elements of product costs-direct materials,direct labor,and manufacturing overhead-and it summarizes the portions of those costs that remain in ending Work in Process inventory and that are transferred out of Work in Process into Finished Goods.

(True/False)

4.9/5  (34)

(34)

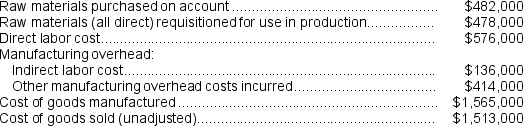

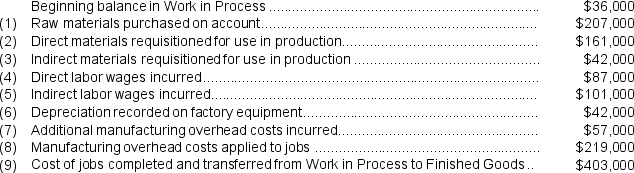

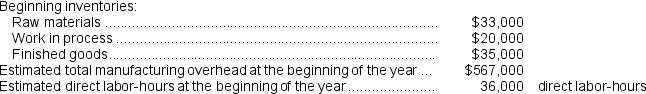

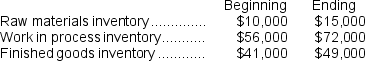

Buckovitch Corporation is a manufacturer that uses job-order costing.The company has supplied the following data for the just completed year:

Required:

a.What is the journal entry to record raw materials used in production?

b.What is the journal entry to record the direct and indirect labor costs incurred during the year?

c.What is the journal entry to record the transfer of completed goods from Work in Process to Finished Goods?

d.What is the journal entry to record the unadjusted cost of goods sold?

Required:

a.What is the journal entry to record raw materials used in production?

b.What is the journal entry to record the direct and indirect labor costs incurred during the year?

c.What is the journal entry to record the transfer of completed goods from Work in Process to Finished Goods?

d.What is the journal entry to record the unadjusted cost of goods sold?

(Essay)

4.9/5  (34)

(34)

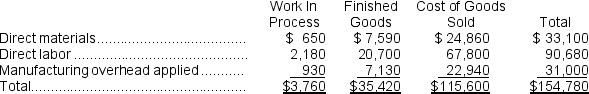

Centore Inc. has provided the following data for the month of June. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.

Manufacturing overhead for the month was underapplied by $3,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

-The work in process inventory at the end of June after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

Manufacturing overhead for the month was underapplied by $3,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

-The work in process inventory at the end of June after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

(Multiple Choice)

4.7/5  (37)

(37)

The Tse Manufacturing Corporation uses a job-order costing system and applies overhead to jobs using a predetermined overhead rate. The company closes any balance in the Manufacturing Overhead account to Cost of Goods Sold. During the year the company's Finished Goods inventory account was debited for $125,000 and credited for $110,000. The ending balance in the Finished Goods inventory account was $28,000. At the end of the year, manufacturing overhead was overapplied by $4,500.

-The balance in the Finished Goods inventory account at the beginning of the year was:

(Multiple Choice)

4.7/5  (27)

(27)

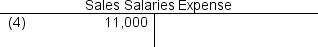

Leak Enterprises LLC recorded the following transactions for the just completed month. The company had no beginning inventories.

(1) Raw materials purchased for cash, $96,000

(2) Direct materials requisitioned for use in production, $69,000

(3) Indirect materials requisitioned for use in production, $22,000

(4) Direct labor wages incurred and paid, $129,000

(5) Indirect labor wages incurred and paid, $16,000

(6) Additional manufacturing overhead costs incurred and paid, $121,000

(7) Manufacturing overhead costs applied to jobs, $163,000

(8) All of the jobs in process were completed.

(9) All of the completed jobs were shipped to customers.

(10) Any underapplied or overapplied overhead for the period was closed out to Cost of Goods Sold.

Enter the transactions in the T-accounts below and then answer the following questions.

-The ending balance in the Raw Materials account is closest to:

-The ending balance in the Raw Materials account is closest to:

(Multiple Choice)

4.9/5  (38)

(38)

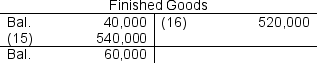

Entry (16)in the below T-account represents the cost of goods manufactured transferred to Finished Goods from Work in Process.

(True/False)

4.8/5  (33)

(33)

Dacosta Corporation had only one job in process on May 1. The job had been charged with $1,800 of direct materials, $6,966 of direct labor, and $9,936 of manufacturing overhead cost. The company assigns overhead cost to jobs using the predetermined overhead rate of $18.40 per direct labor-hour.

During May, the following activity was recorded:

Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.

-The cost of goods manufactured for May was:

Work in process inventory on May 30 contains $3,741 of direct labor cost. Raw materials consist solely of items that are classified as direct materials.

-The cost of goods manufactured for May was:

(Multiple Choice)

4.8/5  (29)

(29)

Bottum Corporation,a manufacturing Corporation,has provided data concerning its operations for May.The beginning balance in the raw materials account was $20,000 and the ending balance was $36,000.Raw materials purchases during the month totaled $63,000.Manufacturing overhead cost incurred during the month was $111,000,of which $2,000 consisted of raw materials classified as indirect materials.The direct materials cost for May was:

(Multiple Choice)

4.8/5  (35)

(35)

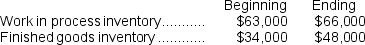

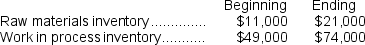

Tenneson Corporation's cost of goods manufactured for the just completed month was $151,000 and its inventories were as follows:

How much was the cost of goods available for sale on the Schedule of Cost of Goods Sold?

How much was the cost of goods available for sale on the Schedule of Cost of Goods Sold?

(Multiple Choice)

4.8/5  (39)

(39)

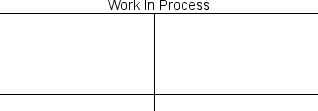

Hardigree Corporation uses a job-order costing system. The following data relate to the just completed month's operations.

Where appropriate, post the above transactions to the Work in Process and Manufacturing Overhead T-accounts below.

Where appropriate, post the above transactions to the Work in Process and Manufacturing Overhead T-accounts below.

-The total amount of manufacturing overhead actually incurred was:

-The total amount of manufacturing overhead actually incurred was:

(Multiple Choice)

4.8/5  (40)

(40)

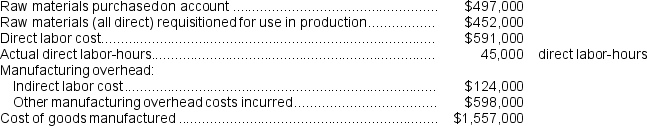

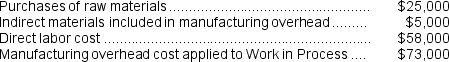

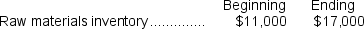

Mcie Corporation is a manufacturer that uses job-order costing.The company has supplied the following data for the just completed year:

Results of operations:

Results of operations:

Required:

a.What is the ending balance in Raw Materials?

b.What is the ending balance in Work in Process?

Required:

a.What is the ending balance in Raw Materials?

b.What is the ending balance in Work in Process?

(Essay)

4.9/5  (37)

(37)

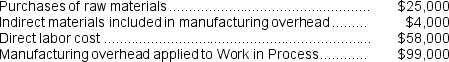

Boursaw Corporation has provided the following data concerning last month's operations.

Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.

-How much is the unadjusted cost of goods sold on the Schedule of Cost of Goods Sold?

Any underapplied or overapplied manufacturing overhead is closed out to cost of goods sold.

-How much is the unadjusted cost of goods sold on the Schedule of Cost of Goods Sold?

(Multiple Choice)

4.8/5  (30)

(30)

Echher Corporation uses a job-order costing system and applies overhead to jobs using a predetermined overhead rate. During the year the company's Finished Goods inventory account was debited for $218,000 and credited for $218,500. The ending balance in the Finished Goods inventory account was $13,000. At the end of the year, manufacturing overhead was overapplied by $36,700.

-The manufacturing overhead for the year was:

(Multiple Choice)

4.9/5  (40)

(40)

Rochford Corporation has provided the following data concerning last month's operations.

Required:

Determine the cost of goods manufactured for the month.

Required:

Determine the cost of goods manufactured for the month.

(Essay)

4.8/5  (38)

(38)

Durphey Corporation has provided the following data concerning last month's operations.

How much is the total manufacturing cost for the month on the Schedule of Cost of Goods Manufactured?

How much is the total manufacturing cost for the month on the Schedule of Cost of Goods Manufactured?

(Multiple Choice)

4.9/5  (41)

(41)

Crich Corporation uses direct labor-hours in its predetermined overhead rate.At the beginning of the year,the estimated direct labor-hours were 21,800 hours and the total estimated manufacturing overhead was $497,040.At the end of the year,actual direct labor-hours for the year were 21,500 hours and the actual manufacturing overhead for the year was $492,040.Overhead at the end of the year was:

(Multiple Choice)

4.8/5  (38)

(38)

If a company uses a predetermined overhead rate,actual manufacturing overhead costs of a period will be recorded in the Manufacturing Overhead account and will be recorded on the job cost sheets.

(True/False)

4.8/5  (43)

(43)

Luebke Inc.has provided the following data for the month of November.The balance in the Finished Goods inventory account at the beginning of the month was $52,000 and at the end of the month was $30,000.The cost of goods manufactured for the month was $212,000.The actual manufacturing overhead cost incurred was $55,000 and the manufacturing overhead cost applied to Work in Process was $58,000.The company closes out any underapplied or overapplied manufacturing overhead to cost of goods sold.The adjusted cost of goods sold that would appear on the income statement for November is:

(Multiple Choice)

4.9/5  (37)

(37)

The following partially completed T-accounts are for Stanford Corporation:

-The cost of goods manufactured is:

-The cost of goods manufactured is:

(Multiple Choice)

4.9/5  (30)

(30)

Gallon Corporation had $24,000 of raw materials on hand on April 1.During the month,the Corporation purchased an additional $52,000 of raw materials.During April,$62,000 of raw materials were requisitioned from the storeroom for use in production.These raw materials included both direct and indirect materials.The indirect materials totaled $2,000.The debits to the Work in Process account as a consequence of the raw materials transactions in April total:

(Multiple Choice)

4.9/5  (35)

(35)

Showing 121 - 140 of 255

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)