Exam 3: Job-Order Costing: Cost Flows and External Reporting

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Production Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting255 Questions

Exam 4: Process Costing138 Questions

Exam 5: Cost-Volume-Profit Relationships260 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 7: Super-Variable Costing49 Questions

Exam 8: Master Budgeting234 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Differential Analysis: The Key to Decision Making203 Questions

Exam 13: Capital Budgeting Decisions179 Questions

Exam 14: Statement of Cash Flows132 Questions

Exam 15: Financial Statement Analysis289 Questions

Exam 16: Cost of Quality66 Questions

Exam 17: Activity-Based Absorption Costing20 Questions

Exam 18: The Predetermined Overhead Rate and Capacity42 Questions

Exam 19: Job-Order Costing: a Microsoft Excel-Based Approach28 Questions

Exam 20: Fifo Method100 Questions

Exam 21: Service Department Allocations60 Questions

Exam 22: Analyzing Mixed Costs81 Questions

Exam 23: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 24: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 25: Standard Cost Systems: a Financial Reporting Perspective Using Microsoft Excel138 Questions

Exam 26: Transfer Pricing102 Questions

Exam 27: Service Department Charges44 Questions

Exam 28: Pricing Decisions149 Questions

Exam 29: The Concept of Present Value16 Questions

Exam 30: Income Taxes and the Present Value Method150 Questions

Exam 31: the Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Select questions type

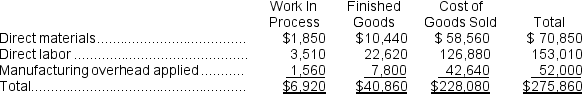

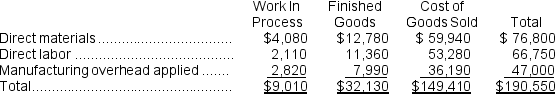

Reith Inc. has provided the following data for the month of November. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month.

Manufacturing overhead for the month was overapplied by $4,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

-The cost of goods sold for November after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

Manufacturing overhead for the month was overapplied by $4,000.

The company allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the overhead applied during the month in those accounts.

-The cost of goods sold for November after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to:

(Multiple Choice)

4.8/5  (46)

(46)

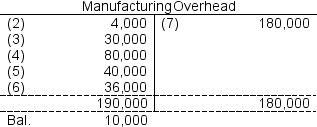

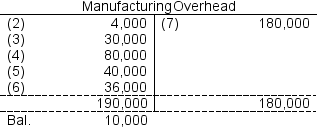

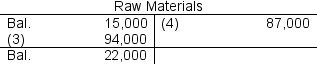

Entry (4)in the below T-account could represent the cost of property taxes and insurance incurred on the factory.

(True/False)

4.7/5  (28)

(28)

Able Corporation uses a job-order costing system.In reviewing its records at the end of the year,the company has discovered that $2,000 of raw materials has been drawn from the storeroom and used in the production of Job 110,but that no entry has been made in the accounting records for the use of these materials.Job 110 has been completed but it is unsold at year end.This error will cause:

(Multiple Choice)

4.8/5  (33)

(33)

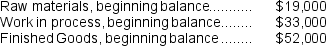

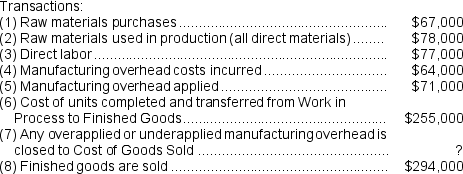

Prahm Inc.has provided the following data for August:

Required:

Prepare T-accounts for Raw Materials,Work in Process,Finished Goods,and Manufacturing Overhead,and Cost of Goods Sold.Record the beginning balances and each of the transactions listed above.Finally,determine the ending balances.

Required:

Prepare T-accounts for Raw Materials,Work in Process,Finished Goods,and Manufacturing Overhead,and Cost of Goods Sold.Record the beginning balances and each of the transactions listed above.Finally,determine the ending balances.

(Essay)

4.9/5  (37)

(37)

The Tse Manufacturing Corporation uses a job-order costing system and applies overhead to jobs using a predetermined overhead rate. The company closes any balance in the Manufacturing Overhead account to Cost of Goods Sold. During the year the company's Finished Goods inventory account was debited for $125,000 and credited for $110,000. The ending balance in the Finished Goods inventory account was $28,000. At the end of the year, manufacturing overhead was overapplied by $4,500.

-If the estimated manufacturing overhead for the year was $24,000,and the applied overhead was $26,500,the actual manufacturing overhead cost for the year was:

(Multiple Choice)

4.9/5  (38)

(38)

Daget Corporation uses direct labor-hours in its predetermined overhead rate.At the beginning of the year,the total estimated manufacturing overhead was $364,140.At the end of the year,actual direct labor-hours for the year were 24,000 hours,manufacturing overhead for the year was overapplied by $8,060,and the actual manufacturing overhead was $359,140.The predetermined overhead rate for the year must have been closest to:

(Multiple Choice)

4.8/5  (34)

(34)

During March,Zea Inc.transferred $50,000 from Work in Process to Finished Goods and recorded a Cost of Goods Sold of $56,000.The journal entries to record these transactions would include a:

(Multiple Choice)

4.9/5  (36)

(36)

In the Schedule of Cost of Goods Sold,Unadjusted cost of goods sold = Beginning finished goods inventory + Cost of goods manufactured − Ending finished goods inventory.

(True/False)

4.8/5  (28)

(28)

Dagostino Corporation uses a job-order costing system. The following data relate to the just completed month's operations.

(1) Direct materials requisitioned for use in production, $154,000

(2) Indirect materials requisitioned for use in production, $45,000

(3) Direct labor wages incurred, $94,000

(4) Indirect labor wages incurred, $119,000

(5) Depreciation recorded on factory equipment, $44,000

(6) Additional manufacturing overhead costs incurred, $83,000

(7) Manufacturing overhead costs applied to jobs, $236,000

(8) Cost of jobs completed and transferred from Work in Process to Finished Goods, $458,000

Where appropriate, post the above transactions to the Work in Process and Manufacturing Overhead T-accounts below.

-The manufacturing overhead was:

-The manufacturing overhead was:

(Multiple Choice)

4.8/5  (40)

(40)

Fils Inc.has provided the following data for the month of March.There were no beginning inventories; consequently,the direct materials,direct labor,and manufacturing overhead applied listed below are all for the current month.  Manufacturing overhead for the month was underapplied by $4,000.

The Corporation allocates any underapplied or overapplied manufacturing overhead among work in process,finished goods,and cost of goods sold at the end of the month on the basis of the manufacturing overhead applied during the month in those accounts.

The journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for March would include the following:

Manufacturing overhead for the month was underapplied by $4,000.

The Corporation allocates any underapplied or overapplied manufacturing overhead among work in process,finished goods,and cost of goods sold at the end of the month on the basis of the manufacturing overhead applied during the month in those accounts.

The journal entry to record the allocation of any underapplied or overapplied manufacturing overhead for March would include the following:

(Multiple Choice)

4.8/5  (44)

(44)

Entry (4)in the below T-account could represent the cost of overhead applied to Work in Process.

(True/False)

4.8/5  (40)

(40)

During July at Loeb Corporation,$83,000 of raw materials were requisitioned from the storeroom for use in production.These raw materials included both direct and indirect materials.The indirect materials totaled $4,000.The journal entry to record the requisition from the storeroom would include a:

(Multiple Choice)

4.8/5  (35)

(35)

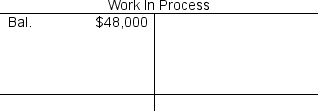

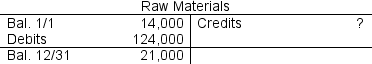

Janeway Corporation uses a job-order costing system and has provided the following partially completed T-account summary for the past year.

Required:

What was the cost of raw materials requisitioned for use in production during the year?

Required:

What was the cost of raw materials requisitioned for use in production during the year?

(Essay)

4.8/5  (33)

(33)

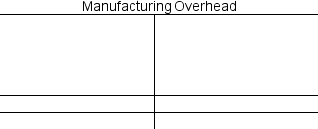

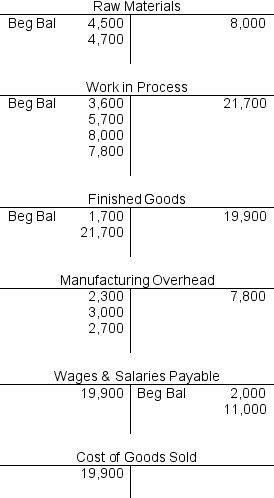

The following partially completed T-accounts summarize transactions for Faaberg Corporation during the year:

-The Cost of Goods Manufactured was:

-The Cost of Goods Manufactured was:

(Multiple Choice)

4.8/5  (40)

(40)

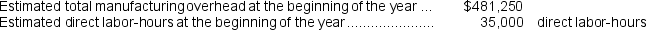

Molzahn Corporation is a manufacturer that uses job-order costing.The company closes out any overapplied or underapplied overhead to Cost of Goods Sold at the end of the year.The company has supplied the following data for the just completed year:

Results of operations:

Results of operations:

Manufacturing overhead is overapplied or underapplied by:

Manufacturing overhead is overapplied or underapplied by:

(Multiple Choice)

4.8/5  (38)

(38)

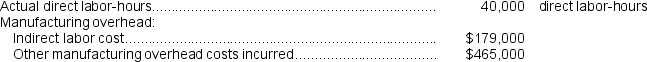

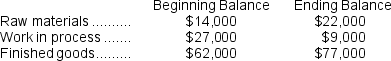

Baab Corporation is a manufacturing firm that uses job-order costing.The company's inventory balances were as follows at the beginning and end of the year:

The company applies overhead to jobs using a predetermined overhead rate based on machine-hours.At the beginning of the year,the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost.The following transactions were recorded for the year:

• Raw materials were purchased,$315,000.

• Raw materials were requisitioned for use in production,$307,000 ($281,000 direct and $26,000 indirect).

• The following employee costs were incurred:

direct labor,$377,000; indirect labor,$96,000; and administrative salaries,$172,000.

• Selling costs,$147,000.

• Factory utility costs,$10,000.

• Depreciation for the year was $127,000 of which $120,000 is related to factory operations and $7,000 is related to selling,general,and administrative activities.

• Manufacturing overhead was applied to jobs.The actual level of activity for the year was 34,000 machine-hours.

• Sales for the year totaled $1,253,000.

Required:

a.Prepare a schedule of cost of goods manufactured.

b.Was the overhead underapplied or overapplied? By how much?

c.Prepare an income statement for the year.The company closes any underapplied or overapplied overhead to Cost of Goods Sold.

The company applies overhead to jobs using a predetermined overhead rate based on machine-hours.At the beginning of the year,the company estimated that it would work 33,000 machine-hours and incur $231,000 in manufacturing overhead cost.The following transactions were recorded for the year:

• Raw materials were purchased,$315,000.

• Raw materials were requisitioned for use in production,$307,000 ($281,000 direct and $26,000 indirect).

• The following employee costs were incurred:

direct labor,$377,000; indirect labor,$96,000; and administrative salaries,$172,000.

• Selling costs,$147,000.

• Factory utility costs,$10,000.

• Depreciation for the year was $127,000 of which $120,000 is related to factory operations and $7,000 is related to selling,general,and administrative activities.

• Manufacturing overhead was applied to jobs.The actual level of activity for the year was 34,000 machine-hours.

• Sales for the year totaled $1,253,000.

Required:

a.Prepare a schedule of cost of goods manufactured.

b.Was the overhead underapplied or overapplied? By how much?

c.Prepare an income statement for the year.The company closes any underapplied or overapplied overhead to Cost of Goods Sold.

(Essay)

4.7/5  (39)

(39)

In the Vasquez Corporation,any overapplied or underapplied manufacturing overhead is closed out to Cost of Goods Sold.Last year,the Corporation incurred $27,000 in actual manufacturing overhead cost,and applied $29,000 of manufacturing overhead cost to jobs.The beginning and ending balances of Finished Goods were equal,and the Corporation's Cost of Goods Manufactured for the year totaled $71,000.Given this information,Cost of Goods Sold,after adjustment for any overapplied or underapplied manufacturing overhead,for the year must have been:

(Multiple Choice)

4.7/5  (45)

(45)

Piekos Corporation incurred $90,000 of actual Manufacturing Overhead costs during June.During the same period,the Manufacturing Overhead applied to Work in Process was $92,000.The journal entry to record the application of Manufacturing Overhead to Work in Process would include a:

(Multiple Choice)

4.9/5  (46)

(46)

Entry (4)in the T-account below represents raw materials requisitioned for use in production.

(True/False)

4.8/5  (32)

(32)

Showing 161 - 180 of 255

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)