Exam 2: Job-Order Costing: Calculating Unit Production Costs

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Production Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting255 Questions

Exam 4: Process Costing138 Questions

Exam 5: Cost-Volume-Profit Relationships260 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 7: Super-Variable Costing49 Questions

Exam 8: Master Budgeting234 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Differential Analysis: The Key to Decision Making203 Questions

Exam 13: Capital Budgeting Decisions179 Questions

Exam 14: Statement of Cash Flows132 Questions

Exam 15: Financial Statement Analysis289 Questions

Exam 16: Cost of Quality66 Questions

Exam 17: Activity-Based Absorption Costing20 Questions

Exam 18: The Predetermined Overhead Rate and Capacity42 Questions

Exam 19: Job-Order Costing: a Microsoft Excel-Based Approach28 Questions

Exam 20: Fifo Method100 Questions

Exam 21: Service Department Allocations60 Questions

Exam 22: Analyzing Mixed Costs81 Questions

Exam 23: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 24: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 25: Standard Cost Systems: a Financial Reporting Perspective Using Microsoft Excel138 Questions

Exam 26: Transfer Pricing102 Questions

Exam 27: Service Department Charges44 Questions

Exam 28: Pricing Decisions149 Questions

Exam 29: The Concept of Present Value16 Questions

Exam 30: Income Taxes and the Present Value Method150 Questions

Exam 31: the Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Select questions type

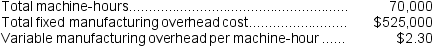

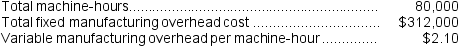

Petru Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours.The company based its predetermined overhead rate for the current year on the following data:

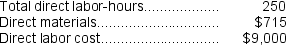

Recently Job P987 was completed with the following characteristics:

Recently Job P987 was completed with the following characteristics:

Required:

Calculate the unit product cost for Job P987.

Required:

Calculate the unit product cost for Job P987.

(Essay)

4.7/5  (43)

(43)

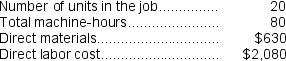

Swango Corporation has two production departments,Casting and Customizing.The company uses a job-order costing system and computes a predetermined overhead rate in each production department.The Casting Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours.At the beginning of the current year,the company had made the following estimates:

The estimated total manufacturing overhead for the Customizing Department is closest to:

The estimated total manufacturing overhead for the Customizing Department is closest to:

(Multiple Choice)

4.8/5  (35)

(35)

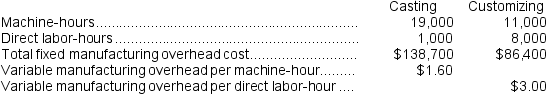

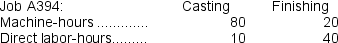

Rocher Corporation has two production departments,Casting and Finishing.The company uses a job-order costing system and computes a predetermined overhead rate in each production department.The Casting Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours.At the beginning of the current year,the company had made the following estimates:

During the current month the company started and finished Job A394.The following data were recorded for this job:

During the current month the company started and finished Job A394.The following data were recorded for this job:

Required:

a.Calculate the estimated total manufacturing overhead for the Casting Department.

b.Calculate the predetermined overhead rate for the Casting Department.

c.Calculate the amount of overhead applied in the Casting Department to Job A394.

Required:

a.Calculate the estimated total manufacturing overhead for the Casting Department.

b.Calculate the predetermined overhead rate for the Casting Department.

c.Calculate the amount of overhead applied in the Casting Department to Job A394.

(Essay)

4.7/5  (38)

(38)

Vanliere Corporation has two production departments, Machining and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Machining Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

During the current month the company started and finished Job A803. The following data were recorded for this job:

During the current month the company started and finished Job A803. The following data were recorded for this job:

-The amount of overhead applied in the Machining Department to Job A803 is closest to:

-The amount of overhead applied in the Machining Department to Job A803 is closest to:

(Multiple Choice)

4.8/5  (41)

(41)

Valvano Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours.The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $440,000,variable manufacturing overhead of $2.20 per machine-hour,and 50,000 machine-hours.The estimated total manufacturing overhead is closest to:

(Multiple Choice)

4.7/5  (41)

(41)

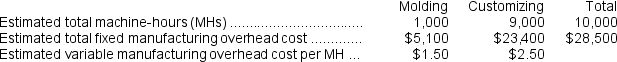

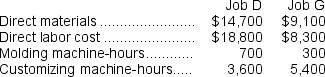

Sonneborn Corporation has two manufacturing departments--Molding and Customizing.The company used the following data at the beginning of the year to calculate predetermined overhead rates:

During the most recent month,the company started and completed two jobs--Job D and Job G.There were no beginning inventories.Data concerning those two jobs follow:

During the most recent month,the company started and completed two jobs--Job D and Job G.There were no beginning inventories.Data concerning those two jobs follow:

Required:

a.Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours.Calculate the amount of manufacturing overhead applied to Job D.

b.Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours.Calculate the amount of manufacturing overhead applied to Job G.

c.Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.How much manufacturing overhead will be applied to Job D?

d.Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.How much manufacturing overhead will be applied to Job G?

Required:

a.Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours.Calculate the amount of manufacturing overhead applied to Job D.

b.Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours.Calculate the amount of manufacturing overhead applied to Job G.

c.Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.How much manufacturing overhead will be applied to Job D?

d.Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.How much manufacturing overhead will be applied to Job G?

(Essay)

4.8/5  (35)

(35)

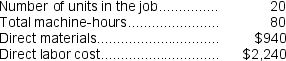

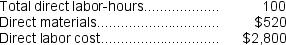

Cull Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $462,000, variable manufacturing overhead of $2.20 per machine-hour, and 60,000 machine-hours. The company has provided the following data concerning Job X455 which was recently completed:

-The unit product cost for Job X455 is closest to:

-The unit product cost for Job X455 is closest to:

(Multiple Choice)

4.8/5  (27)

(27)

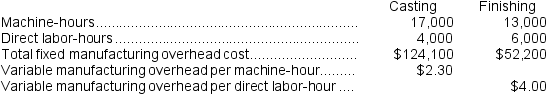

Harootunian Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data:

Recently, Job T629 was completed with the following characteristics:

Recently, Job T629 was completed with the following characteristics:

-The estimated total manufacturing overhead is closest to:

-The estimated total manufacturing overhead is closest to:

(Multiple Choice)

4.7/5  (31)

(31)

Branin Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $160,000, variable manufacturing overhead of $3.40 per direct labor-hour, and 80,000 direct labor-hours. The company has provided the following data concerning Job A578 which was recently completed:

-The total job cost for Job A578 is closest to:

-The total job cost for Job A578 is closest to:

(Multiple Choice)

4.9/5  (37)

(37)

Assigning manufacturing overhead to a specific job is complicated by all of the below except:

(Multiple Choice)

4.9/5  (48)

(48)

Kubes Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $90,000, variable manufacturing overhead of $3.50 per direct labor-hour, and 30,000 direct labor-hours. The company has provided the following data concerning Job A477 which was recently completed:

-The amount of overhead applied to Job A477 is closest to:

-The amount of overhead applied to Job A477 is closest to:

(Multiple Choice)

4.8/5  (46)

(46)

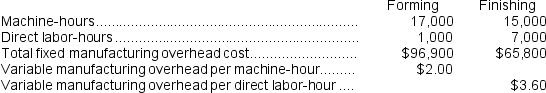

Hickingbottom Corporation has two production departments, Forming and Finishing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Finishing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

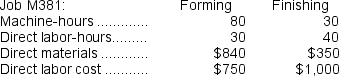

During the current month the company started and finished Job M381. The following data were recorded for this job:

During the current month the company started and finished Job M381. The following data were recorded for this job:

-The total job cost for Job M381 is closest to:

-The total job cost for Job M381 is closest to:

(Multiple Choice)

4.8/5  (36)

(36)

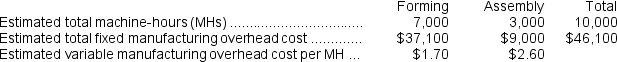

Marioni Corporation has two manufacturing departments--Forming and Assembly.The company used the following data at the beginning of the year to calculate predetermined overhead rates:

During the most recent month,the company started and completed two jobs--Job B and Job H.There were no beginning inventories.Data concerning those two jobs follow:

During the most recent month,the company started and completed two jobs--Job B and Job H.There were no beginning inventories.Data concerning those two jobs follow:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.The manufacturing overhead applied to Job B is closest to:

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments.The manufacturing overhead applied to Job B is closest to:

(Multiple Choice)

4.8/5  (35)

(35)

Gerstein Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $90,000, variable manufacturing overhead of $3.70 per direct labor-hour, and 50,000 direct labor-hours. The company recently completed Job M800 which required 150 direct labor-hours.

-The predetermined overhead rate is closest to:

(Multiple Choice)

4.9/5  (31)

(31)

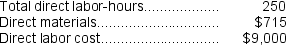

Juanita Corporation uses a job-order costing system and applies overhead on the basis of direct labor cost.At the end of October,Juanita had one job still in process.The job cost sheet for this job contained the following information:

An additional $100 of labor was needed in November to complete this job.For this job,how much should Juanita have transferred to finished goods inventory in November when it was completed?

An additional $100 of labor was needed in November to complete this job.For this job,how much should Juanita have transferred to finished goods inventory in November when it was completed?

(Multiple Choice)

4.7/5  (44)

(44)

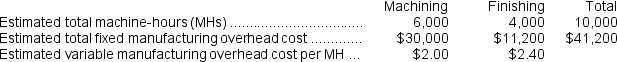

Atteberry Corporation has two manufacturing departments--Machining and Finishing.The company used the following data at the beginning of the year to calculate predetermined overhead rates:

During the most recent month,the company started and completed two jobs--Job E and Job L.There were no beginning inventories.Data concerning those two jobs follow:

During the most recent month,the company started and completed two jobs--Job E and Job L.There were no beginning inventories.Data concerning those two jobs follow:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours.The total manufacturing cost assigned to Job E is closest to:

Assume that the company uses a plantwide predetermined manufacturing overhead rate based on machine-hours.The total manufacturing cost assigned to Job E is closest to:

(Multiple Choice)

4.9/5  (36)

(36)

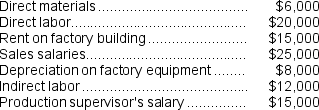

Johansen Corporation uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs.The Corporation has provided the following estimated costs for the next year:

Jameson estimates that 20,000 direct labor-hours will be worked during the year.The predetermined overhead rate per hour will be:

Jameson estimates that 20,000 direct labor-hours will be worked during the year.The predetermined overhead rate per hour will be:

(Multiple Choice)

4.8/5  (40)

(40)

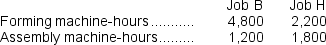

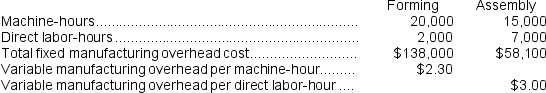

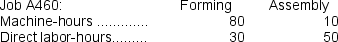

Stoke Corporation has two production departments, Forming and Assembly. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Forming Department's predetermined overhead rate is based on machine-hours and the Assembly Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

During the current month the company started and finished Job A460. The following data were recorded for this job:

During the current month the company started and finished Job A460. The following data were recorded for this job:

-The amount of overhead applied in the Assembly Department to Job A460 is closest to:

-The amount of overhead applied in the Assembly Department to Job A460 is closest to:

(Multiple Choice)

4.9/5  (33)

(33)

Moscone Corporation bases its predetermined overhead rate on the estimated labor-hours for the upcoming year.At the beginning of the most recently completed year,the company estimated the labor-hours for the upcoming year at 78,000 labor-hours.The estimated variable manufacturing overhead was $9.99 per labor-hour and the estimated total fixed manufacturing overhead was $985,920.

Required:

Compute the company's predetermined overhead rate.

(Essay)

4.9/5  (35)

(35)

Branin Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor-hours. The company based its predetermined overhead rate for the current year on total fixed manufacturing overhead cost of $160,000, variable manufacturing overhead of $3.40 per direct labor-hour, and 80,000 direct labor-hours. The company has provided the following data concerning Job A578 which was recently completed:

-The amount of overhead applied to Job A578 is closest to:

-The amount of overhead applied to Job A578 is closest to:

(Multiple Choice)

4.8/5  (32)

(32)

Showing 161 - 180 of 292

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)