Exam 1: Managerial Accounting and Cost Concepts

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Production Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting255 Questions

Exam 4: Process Costing138 Questions

Exam 5: Cost-Volume-Profit Relationships260 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 7: Super-Variable Costing49 Questions

Exam 8: Master Budgeting234 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Differential Analysis: The Key to Decision Making203 Questions

Exam 13: Capital Budgeting Decisions179 Questions

Exam 14: Statement of Cash Flows132 Questions

Exam 15: Financial Statement Analysis289 Questions

Exam 16: Cost of Quality66 Questions

Exam 17: Activity-Based Absorption Costing20 Questions

Exam 18: The Predetermined Overhead Rate and Capacity42 Questions

Exam 19: Job-Order Costing: a Microsoft Excel-Based Approach28 Questions

Exam 20: Fifo Method100 Questions

Exam 21: Service Department Allocations60 Questions

Exam 22: Analyzing Mixed Costs81 Questions

Exam 23: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 24: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 25: Standard Cost Systems: a Financial Reporting Perspective Using Microsoft Excel138 Questions

Exam 26: Transfer Pricing102 Questions

Exam 27: Service Department Charges44 Questions

Exam 28: Pricing Decisions149 Questions

Exam 29: The Concept of Present Value16 Questions

Exam 30: Income Taxes and the Present Value Method150 Questions

Exam 31: the Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Select questions type

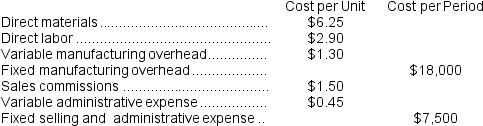

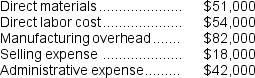

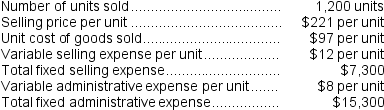

Asplund Corporation has provided the following information:

Required:

a.For financial reporting purposes,what is the total amount of product costs incurred to make 5,000 units?

b.For financial reporting purposes,what is the total amount of period costs incurred to sell 5,000 units?

Required:

a.For financial reporting purposes,what is the total amount of product costs incurred to make 5,000 units?

b.For financial reporting purposes,what is the total amount of period costs incurred to sell 5,000 units?

(Essay)

4.8/5  (33)

(33)

The following costs are all examples of committed fixed costs:

depreciation on buildings,salaries of highly trained engineers,real estate taxes,and insurance expenses.

(True/False)

4.9/5  (31)

(31)

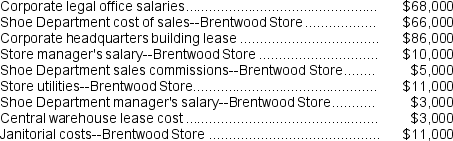

The following cost data pertain to the operations of Ladwig Department Stores, Inc., for the month of December.

The Brentwood Store is just one of many stores owned and operated by the company. The Shoe Department is one of many departments at the Brentwood Store. The central warehouse serves all of the company's stores.

-What is the total amount of the costs listed above that are direct costs of the Shoe Department?

The Brentwood Store is just one of many stores owned and operated by the company. The Shoe Department is one of many departments at the Brentwood Store. The central warehouse serves all of the company's stores.

-What is the total amount of the costs listed above that are direct costs of the Shoe Department?

(Multiple Choice)

4.9/5  (37)

(37)

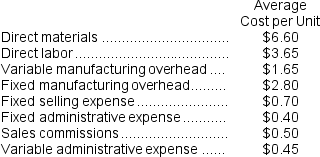

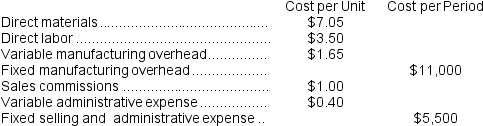

Barredo Corporation's relevant range of activity is 3,000 units to 7,000 units. When it produces and sells 5,000 units, its average costs per unit are as follows:

-If 4,000 units are sold,the total variable cost is closest to:

-If 4,000 units are sold,the total variable cost is closest to:

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following statements concerning direct and indirect costs is NOT true?

(Multiple Choice)

4.7/5  (38)

(38)

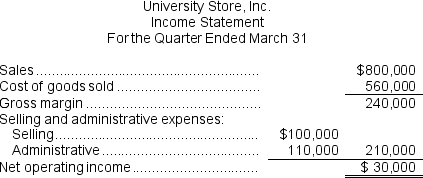

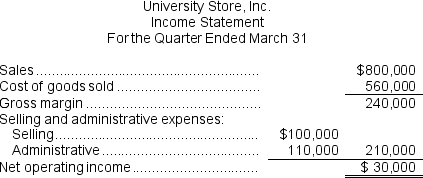

The University Store, Inc. is the major bookseller for four nearby colleges. An income statement for the first quarter of the year is presented below:

On average, a book sells for $40.00. Variable selling expenses are $3.00 per book; the remaining selling expenses are fixed. The variable administrative expenses are 5% of sales; the remainder of the administrative expenses are fixed.

-The net operating income computed using the contribution approach for the first quarter is:

On average, a book sells for $40.00. Variable selling expenses are $3.00 per book; the remaining selling expenses are fixed. The variable administrative expenses are 5% of sales; the remainder of the administrative expenses are fixed.

-The net operating income computed using the contribution approach for the first quarter is:

(Multiple Choice)

4.7/5  (36)

(36)

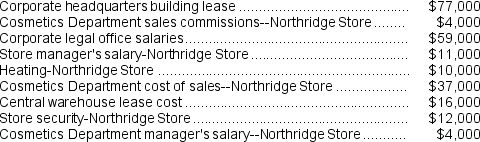

The following cost data pertain to the operations of Quinonez Department Stores, Inc., for the month of September.

The Northridge Store is just one of many stores owned and operated by the company. The Cosmetics Department is one of many departments at the Northridge Store. The central warehouse serves all of the company's stores.

-What is the total amount of the costs listed above that are NOT direct costs of the Northridge Store?

The Northridge Store is just one of many stores owned and operated by the company. The Cosmetics Department is one of many departments at the Northridge Store. The central warehouse serves all of the company's stores.

-What is the total amount of the costs listed above that are NOT direct costs of the Northridge Store?

(Multiple Choice)

4.8/5  (40)

(40)

Fassino Corporation reported the following data for the month of November:

-The conversion cost for November was:

-The conversion cost for November was:

(Multiple Choice)

4.8/5  (36)

(36)

Indirect costs,such as manufacturing overhead,are variable costs.

(True/False)

4.8/5  (35)

(35)

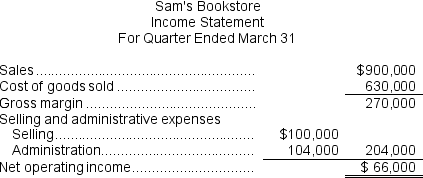

The University Store, Inc. is the major bookseller for four nearby colleges. An income statement for the first quarter of the year is presented below:

On average, a book sells for $40.00. Variable selling expenses are $3.00 per book; the remaining selling expenses are fixed. The variable administrative expenses are 5% of sales; the remainder of the administrative expenses are fixed.

-The cost formula for selling and administrative expenses with "X" equal to the number of books sold is:

On average, a book sells for $40.00. Variable selling expenses are $3.00 per book; the remaining selling expenses are fixed. The variable administrative expenses are 5% of sales; the remainder of the administrative expenses are fixed.

-The cost formula for selling and administrative expenses with "X" equal to the number of books sold is:

(Multiple Choice)

4.8/5  (27)

(27)

Schwiesow Corporation has provided the following information:

-If 4,000 units are produced,the total amount of manufacturing overhead cost is closest to:

-If 4,000 units are produced,the total amount of manufacturing overhead cost is closest to:

(Multiple Choice)

4.7/5  (32)

(32)

If managers are reluctant to lay off direct labor employees when activity declines leads to a decrease in the ratio of variable to fixed costs.

(True/False)

4.8/5  (36)

(36)

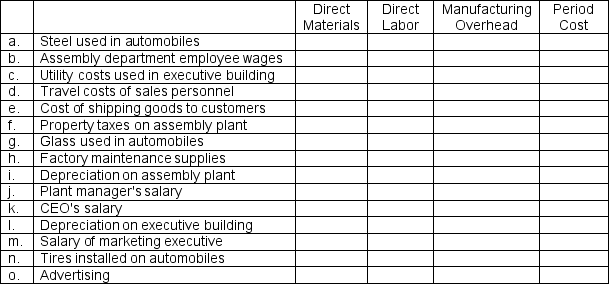

Classify the following costs for an auto manufacturer as either direct materials,direct labor,manufacturing overhead,or period costs.

Required:

Complete the answer sheet above by placing an "X" under each heading that identifies the cost involved.

Required:

Complete the answer sheet above by placing an "X" under each heading that identifies the cost involved.

(Essay)

4.8/5  (38)

(38)

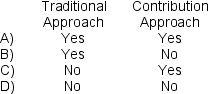

Which of the following approaches to preparing an income statement includes a calculation of the gross margin?

(Short Answer)

4.8/5  (43)

(43)

An income statement for Sam's Bookstore for the first quarter of the year is presented below:

On average, a book sells for $50. Variable selling expenses are $5 per book with the remaining selling expenses being fixed. The variable administrative expenses are 4% of sales with the remainder being fixed.

-The contribution margin for Sam's Bookstore for the first quarter is:

On average, a book sells for $50. Variable selling expenses are $5 per book with the remaining selling expenses being fixed. The variable administrative expenses are 4% of sales with the remainder being fixed.

-The contribution margin for Sam's Bookstore for the first quarter is:

(Multiple Choice)

4.9/5  (45)

(45)

The relative proportion of variable,fixed,and mixed costs in a company is known as the company's:

(Multiple Choice)

4.9/5  (45)

(45)

When operations are interrupted or cut back,committed fixed costs are cut in the short term because the costs of restoring them later are likely to be far less than the short-run savings that are realized

(True/False)

4.7/5  (34)

(34)

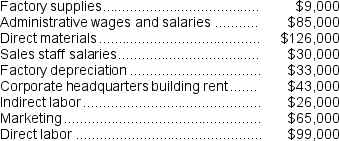

A partial listing of costs incurred during March at Febbo Corporation appears below:

-The total of the period costs listed above for March is:

-The total of the period costs listed above for March is:

(Multiple Choice)

4.9/5  (34)

(34)

Delongis Corporation, a merchandising company, reported the following results for June:

Cost of goods sold is a variable cost in this company.

-The contribution margin for June is:

Cost of goods sold is a variable cost in this company.

-The contribution margin for June is:

(Multiple Choice)

4.9/5  (40)

(40)

Showing 181 - 200 of 299

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)