Exam 21: Property Transactions: Capital Gains and Losses

Exam 1: Tax Research114 Questions

Exam 2: Corporate Formations and Capital Structure123 Questions

Exam 3: the Corporate Income Tax127 Questions

Exam 4: Corporate Nonliquidating Distributions113 Questions

Exam 5: Other Corporate Tax Levies103 Questions

Exam 6: Corporate Liquidating Distributions107 Questions

Exam 7: Corporate Acquisitions and Reorganizations108 Questions

Exam 8: Consolidated Tax Returns104 Questions

Exam 9: Partnership Formation and Operation116 Questions

Exam 10: Special Partnership Issues107 Questions

Exam 11: S Corporations103 Questions

Exam 12: The Gift Tax105 Questions

Exam 13: The Estate Tax107 Questions

Exam 14: Income Taxation of Trusts and Estates105 Questions

Exam 15: Administrative Procedures104 Questions

Exam 16: Ustaxation of Foreign-Related Transactions97 Questions

Exam 17: An Introduction to Taxation109 Questions

Exam 18: Determination of Tax152 Questions

Exam 19: Gross Income: Inclusions144 Questions

Exam 20: Gross Income: Exclusions116 Questions

Exam 21: Property Transactions: Capital Gains and Losses147 Questions

Exam 22: Deductions and Losses146 Questions

Exam 23: Itemized Deductions130 Questions

Exam 24: Losses and Bad Debts125 Questions

Exam 25: Employee Expenses and Deferred Compensation151 Questions

Exam 26: Depreciation, cost Recovery, amortization, and Depletion106 Questions

Exam 27: Accounting Periods and Methods124 Questions

Exam 28: Property Transactions: Nontaxable Exchanges125 Questions

Exam 29: Property Transactions: Sec1231 and Recapture115 Questions

Exam 30: Special Tax Computation Methods, tax Credits, and Payment of Tax147 Questions

Exam 31: Tax Research133 Questions

Exam 32: Corporations149 Questions

Exam 33: Partnerships and S Corporations150 Questions

Exam 34: Taxes and Investment Planning84 Questions

Select questions type

Jessica owned 200 shares of OK Corporation with a basis of $12,000 and a FMV of $24,000.Jessica received 20 stock rights as a nontaxable distribution with a total FMV of $8,000.Jessica sold the stock rights for $4,000.Jessica's gain or loss on the sale was

(Multiple Choice)

4.9/5  (30)

(30)

In a common law state,jointly owned property left to the surviving spouse will have a basis after the estate is settled equal to

(Multiple Choice)

4.8/5  (38)

(38)

Sergio acquires a $100,000 Ternco Corporation bond (5%,20-year bond)on January 1,2017 for $75,000.The bond had been issue on January 1,2015.If Sergio holds the bond to maturity,at redemption he will recognize

(Multiple Choice)

4.7/5  (39)

(39)

In a basket purchase,the total cost is apportioned among the assets purchased according to the relative adjusted basis of the assets.

(True/False)

4.8/5  (32)

(32)

During the current year,Don's aunt Natalie gave him a house.At the time of the gift,the house had a FMV of $144,000 and his aunt's adjusted basis was $133,000.After deducting the annual exclusion,the amount of the gift was $130,000.His aunt paid a gift tax of $20,000 on the house.What is Don's basis in the house for purposes of determining gain?

(Multiple Choice)

4.8/5  (43)

(43)

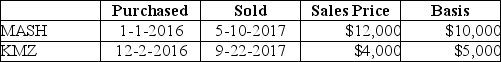

Nate sold two securities in 2017:  Nate has a 25% marginal tax rate.What is the additional tax resulting from the above sales?

Nate has a 25% marginal tax rate.What is the additional tax resulting from the above sales?

(Multiple Choice)

4.8/5  (41)

(41)

Rana purchases a 5%,$100,000 corporate bond at issuance on January 1,2017 for $91,500.The bond matures in five years.In 2017 Rana will recognize interest income of

(Multiple Choice)

4.7/5  (39)

(39)

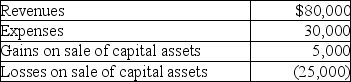

Topaz Corporation had the following income and expenses during the current year:  What is Topaz's taxable income?

What is Topaz's taxable income?

(Multiple Choice)

4.8/5  (43)

(43)

Gina owns 100 shares of XYZ common stock with a $12,000 basis and a $25,000 FMV.She receives 100 stock rights with a total FMV of $15,000.Answer the following:

a.What is the basis of the 100 shares of stock?

b.What is the basis of the 100 stock rights?

(Essay)

4.8/5  (45)

(45)

On January 31 of the current year,Sophia pays $1,000 for an option to acquire 100 shares of Texas Corporation common stock for $105 per share at any time prior to December 31.As of December 31,Sophia had not exercised the option or sold it.Which of the following statements is correct?

(Multiple Choice)

4.9/5  (22)

(22)

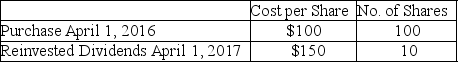

Rachel holds 110 shares of Argon Mutual Fund.She is planning to sell 90 shares.Her record of the share purchases is noted below.What could be her basis for the 90 shares to be sold for purposes of determining gain?

(Multiple Choice)

4.8/5  (37)

(37)

What type of property should be transferred to heirs at a decedent's death and why? Should estate planning also mean that some property is transferred prior to death? Why?

(Essay)

4.9/5  (37)

(37)

An individual taxpayer who is not a dealer in real estate plans to subdivide a parcel of land into four lots and sell them at a substantial gain.The parcel of land had been held six years.In order to qualify for capital gain treatment,the individual must satisfy all of the requirements except

(Multiple Choice)

4.9/5  (33)

(33)

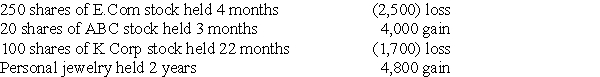

Trista,a taxpayer in the 33% marginal tax bracket sold the following capital assets this year:

What is the amount of and nature of (LT or ST)capital gain or loss? Be specific as to the rates at which gains,if any,are taxed.

What is the amount of and nature of (LT or ST)capital gain or loss? Be specific as to the rates at which gains,if any,are taxed.

(Essay)

4.9/5  (26)

(26)

Rita died on January 1,2017 owning an asset with a FMV of $730,000 that she purchased in 2010 for $600,000.Bert inherited the asset from Rita.When Bert sells the asset for $800,000 on August 20,2017,he must recognize a

(Multiple Choice)

4.7/5  (36)

(36)

Erik purchased qualified small business corporation stock on December 1,2010 and sold it for a $500,000 gain on December 12,2017.The gain subject to tax is

(Multiple Choice)

4.8/5  (43)

(43)

Margaret died on September 16,2017,when she owned securities with a basis of $50,000 and a FMV of $60,000.Caroline inherited the property and sold it on December 19,2017 for $67,000.What is Caroline's reported gain on this sale?

(Multiple Choice)

4.8/5  (40)

(40)

What are arguments for and against preferential treatment of capital gains?

(Essay)

4.9/5  (30)

(30)

Arthur,age 99,holds some stock purchased many years ago for $10,000 which is now worth $100,000.He is trying to plan for the eventual disposition of this stock.Arthur's only remaining family member is his grandson.For income tax purposes,Arthur should

(Multiple Choice)

4.8/5  (33)

(33)

Rick sells stock of Ty Corporation,which has an adjusted basis of $20,000,for $22,000.He pays a sales commission of $500.In computing his gain or loss,the amount realized by Rick is $1,500.

(True/False)

4.8/5  (38)

(38)

Showing 41 - 60 of 147

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)