Exam 21: Property Transactions: Capital Gains and Losses

Exam 1: Tax Research114 Questions

Exam 2: Corporate Formations and Capital Structure123 Questions

Exam 3: the Corporate Income Tax127 Questions

Exam 4: Corporate Nonliquidating Distributions113 Questions

Exam 5: Other Corporate Tax Levies103 Questions

Exam 6: Corporate Liquidating Distributions107 Questions

Exam 7: Corporate Acquisitions and Reorganizations108 Questions

Exam 8: Consolidated Tax Returns104 Questions

Exam 9: Partnership Formation and Operation116 Questions

Exam 10: Special Partnership Issues107 Questions

Exam 11: S Corporations103 Questions

Exam 12: The Gift Tax105 Questions

Exam 13: The Estate Tax107 Questions

Exam 14: Income Taxation of Trusts and Estates105 Questions

Exam 15: Administrative Procedures104 Questions

Exam 16: Ustaxation of Foreign-Related Transactions97 Questions

Exam 17: An Introduction to Taxation109 Questions

Exam 18: Determination of Tax152 Questions

Exam 19: Gross Income: Inclusions144 Questions

Exam 20: Gross Income: Exclusions116 Questions

Exam 21: Property Transactions: Capital Gains and Losses147 Questions

Exam 22: Deductions and Losses146 Questions

Exam 23: Itemized Deductions130 Questions

Exam 24: Losses and Bad Debts125 Questions

Exam 25: Employee Expenses and Deferred Compensation151 Questions

Exam 26: Depreciation, cost Recovery, amortization, and Depletion106 Questions

Exam 27: Accounting Periods and Methods124 Questions

Exam 28: Property Transactions: Nontaxable Exchanges125 Questions

Exam 29: Property Transactions: Sec1231 and Recapture115 Questions

Exam 30: Special Tax Computation Methods, tax Credits, and Payment of Tax147 Questions

Exam 31: Tax Research133 Questions

Exam 32: Corporations149 Questions

Exam 33: Partnerships and S Corporations150 Questions

Exam 34: Taxes and Investment Planning84 Questions

Select questions type

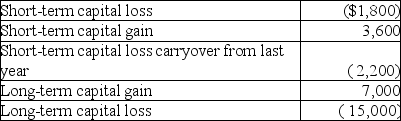

During the current year,Nancy had the following transactions:  What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

What is the amount of her capital loss deduction for the current year,and what is the amount and character of her capital loss carryover?

(Multiple Choice)

4.9/5  (36)

(36)

On January 1 of this year,Brad purchased 100 shares of stock at $4,000.By December 31 of this year,the stock had declined in value to $2,200,but Brad still held the shares.Brad has realized a $1,800 loss for tax purposes this year.

(True/False)

4.7/5  (30)

(30)

Stella has two transactions involving the sale of capital assets during the year resulting in a STCL of $5,200 and LTCL of $2,400.As a result,Stella can offset

(Multiple Choice)

4.9/5  (36)

(36)

Antonio owns land held for investment with a basis of $28,000.The city of Lafayette exercises the right of eminent domain and Antonio receives a payment of $48,000.What is Antonio's realized gain?

(Multiple Choice)

4.9/5  (48)

(48)

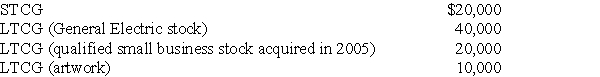

Tina,whose marginal tax rate is 33%,has the following capital gains this year:

What is the increase in income tax caused by these items (ignore the Medicare tax on net investment income)?

What is the increase in income tax caused by these items (ignore the Medicare tax on net investment income)?

(Essay)

4.9/5  (29)

(29)

Candice owns a mutual fund that reinvests her dividends and capital gains earned during the year.The mutual fund reported to her that her share of earnings was: $500 in dividends,$1,500 in short-term net capital gains,and $1,300 in long-term net capital gains.She reported the items on her tax return and paid the appropriate tax on these earnings.If her basis in the fund was $25,000 at the beginning of the year,what is her basis at the end of the year?

(Multiple Choice)

4.9/5  (34)

(34)

Armanti received a football championship ring in college.During difficult economic times,Armanti sold the ring at a pawn shop.What are the tax issues of the sale to Armanti?

(Essay)

4.8/5  (33)

(33)

Richard exchanges a building with a basis of $35,000,and subject to a liability of $25,000,for land with a FMV of $50,000 owned by Bill.Bill takes the building subject to the liability.What is the amount of Richard's realized gain?

(Multiple Choice)

4.9/5  (34)

(34)

If property received as a gift has a basis of the fair market value of the property on the date of the gift,the donee's holding period starts on the day after the date of the gift.

(True/False)

4.9/5  (41)

(41)

A taxpayer owns 200 shares of stock in a corporation purchased in two blocks of 100 shares for different amounts and at different dates.The taxpayer sells 100 shares.Barring any specific instructions,the brokerage firm will report the cost basis using the higher cost block of stock first.

(True/False)

4.8/5  (36)

(36)

Tina purchases a personal residence for $278,000,but subsequently converts the property to rental property when its FMV is $275,000.Assume depreciation of $65,000 has been deducted after conversion to rental use.If Tina sells the property for $200,000,her realized gain or loss will be

(Multiple Choice)

4.9/5  (31)

(31)

Empire Corporation purchased an office building for $500,000 cash on April 1.Prior to renting it out to tenants on July 1,Empire spent $200,000 on materials and labor to renovate the property.It funded $50,000 of the renovation cost with its own funds and borrowed the remaining $150,000.As of July 1,$2,000 of interest had been paid to the bank,but none of the principal had been repaid.The basis of the building on July 1 is

(Multiple Choice)

4.9/5  (36)

(36)

If the shares of stock sold or exchanged are not specifically identified,the average cost method of identification must be used.

(True/False)

4.9/5  (38)

(38)

Melanie,a single taxpayer,has AGI of $220,000 which includes $160,000 of salary and $60,000 of investment income.She will pay Medicare tax on the $60,000 of investment income of

(Multiple Choice)

4.8/5  (39)

(39)

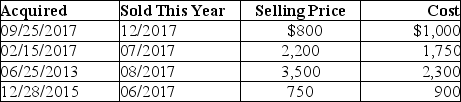

This year,Lauren sold several shares of stock held for investment.The following is a summary of her capital transactions for 2017:  What are the amounts of Lauren's capital gains (losses)for this year?

What are the amounts of Lauren's capital gains (losses)for this year?

(Multiple Choice)

4.7/5  (42)

(42)

Abra Corporation generated $100,000 of taxable income from operations this year and realized a $4,000 loss on the sale of Starbucks stock.Abra Corporation will pay taxes on $97,000 of taxable income.

(True/False)

4.8/5  (40)

(40)

Jordan paid $30,000 for equipment two years ago and has claimed total depreciation deductions of $15,600 for the two years.The cost of repairs during the same time period was $2,000 while a major overhaul which extended the life of the equipment cost $7,000.What is Jordan's adjusted basis in the equipment at the end of the two-year period?

(Multiple Choice)

4.7/5  (37)

(37)

Melody inherited 1,000 shares of Corporation Zappa stock from her mother who died on March 4 of the current year.Her mother paid $30 per share for the stock on September 2,2005.The FMV of the stock on the date of death was $65 per share.On September 4 of the current year,the FMV of the stock was $70 per share.Melody sold the stock for $85 per share on December 3.The estate qualified for,and the executor elected,the alternate valuation method for these and other assets in the estate.An estate tax return was filed.What was Melody's basis in the stock on the date of the sale?

(Multiple Choice)

4.9/5  (40)

(40)

Purchase of a bond at a significant discount will result in the investor recognizing a capital gain when the bond matures.

(True/False)

4.9/5  (38)

(38)

Showing 61 - 80 of 147

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)