Exam 21: Property Transactions: Capital Gains and Losses

Exam 1: Tax Research114 Questions

Exam 2: Corporate Formations and Capital Structure123 Questions

Exam 3: the Corporate Income Tax127 Questions

Exam 4: Corporate Nonliquidating Distributions113 Questions

Exam 5: Other Corporate Tax Levies103 Questions

Exam 6: Corporate Liquidating Distributions107 Questions

Exam 7: Corporate Acquisitions and Reorganizations108 Questions

Exam 8: Consolidated Tax Returns104 Questions

Exam 9: Partnership Formation and Operation116 Questions

Exam 10: Special Partnership Issues107 Questions

Exam 11: S Corporations103 Questions

Exam 12: The Gift Tax105 Questions

Exam 13: The Estate Tax107 Questions

Exam 14: Income Taxation of Trusts and Estates105 Questions

Exam 15: Administrative Procedures104 Questions

Exam 16: Ustaxation of Foreign-Related Transactions97 Questions

Exam 17: An Introduction to Taxation109 Questions

Exam 18: Determination of Tax152 Questions

Exam 19: Gross Income: Inclusions144 Questions

Exam 20: Gross Income: Exclusions116 Questions

Exam 21: Property Transactions: Capital Gains and Losses147 Questions

Exam 22: Deductions and Losses146 Questions

Exam 23: Itemized Deductions130 Questions

Exam 24: Losses and Bad Debts125 Questions

Exam 25: Employee Expenses and Deferred Compensation151 Questions

Exam 26: Depreciation, cost Recovery, amortization, and Depletion106 Questions

Exam 27: Accounting Periods and Methods124 Questions

Exam 28: Property Transactions: Nontaxable Exchanges125 Questions

Exam 29: Property Transactions: Sec1231 and Recapture115 Questions

Exam 30: Special Tax Computation Methods, tax Credits, and Payment of Tax147 Questions

Exam 31: Tax Research133 Questions

Exam 32: Corporations149 Questions

Exam 33: Partnerships and S Corporations150 Questions

Exam 34: Taxes and Investment Planning84 Questions

Select questions type

Kathleen received land as a gift from her grandfather.At the time of the gift,the land had a FMV of $85,000 and an adjusted basis of $110,000 to Kathleen's grandfather.One year later,Kathleen sold the land for $80,000.What was her gain or (loss)on this transaction?

(Multiple Choice)

4.8/5  (42)

(42)

Gains and losses are recognized when property is disposed of by gift or bequest.

(True/False)

4.8/5  (44)

(44)

Bev has one daughter and three grandchildren.Bev owns approximately $6 million of assets primarily composed of a very valuable parcel of real estate and a savings account of $500,000.Bev can gift $56,000 in total in 2017 to her family members without creating taxable gifts.

(True/False)

4.9/5  (27)

(27)

Dustin purchased 50 shares of Short Corporation for $500.During the current year,Short declared a nontaxable 10% stock dividend.What is the basis per share before and after the stock dividend is distributed?

(Multiple Choice)

4.9/5  (32)

(32)

Adjusted net capital gain is taxed at 15% for individual taxpayers with marginal tax rates of 15% or higher,but less than 39.6%.

(True/False)

4.8/5  (27)

(27)

An uncle gifts a parcel of land to his niece,and he has to pay $25,000 of gift taxes.The land has appreciated substantially since he purchased it 20 year ago.The niece's basis in the land will be the uncle's cost plus the full $25,000 of gift taxes paid by the uncle.

(True/False)

4.8/5  (34)

(34)

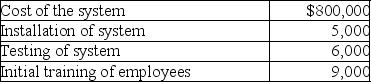

Terra Corp.purchased a new enterprise software system and incurred the following costs:  What is Terra Corp.'s basis in the software system?

What is Terra Corp.'s basis in the software system?

(Multiple Choice)

4.9/5  (45)

(45)

Terrell and Michelle are married and living in New York,which is a not a community property state.They jointly own property with an adjusted basis of $240,000.On December 2 of this year,Michelle died when the property had a fair market value of $260,000.Terrell's basis in the property after Michelle's death is

(Multiple Choice)

4.9/5  (31)

(31)

Jade is a single taxpayer in the top tax bracket,with salary of $450,000 and investment income of $100,000.She is considering the sale of some shares of stock which will result in a $50,000 gain.She purchased the shares three years ago.Taking all taxes into account,how much tax will she pay due to this gain?

(Essay)

4.8/5  (28)

(28)

Gain on sale of a patent by an inventor generally is ordinary income.

(True/False)

4.7/5  (41)

(41)

Taj Corporation has started construction of a new mall with a cost estimate of $50 million.The mall is expected to be ready to open in 18 months.Taj cannot deduct the interest expense on the construction loan.

(True/False)

4.8/5  (24)

(24)

If the stock received as a nontaxable stock dividend is not the same type as the stock owned prior to the dividend,the allocation of basis is based on relative fair market values of the stock.

(True/False)

4.9/5  (41)

(41)

Gertie has a NSTCL of $9,000 and a NLTCG of $5,500 during the current taxable year.After gains and losses are offset,Gertie reports

(Multiple Choice)

4.9/5  (39)

(39)

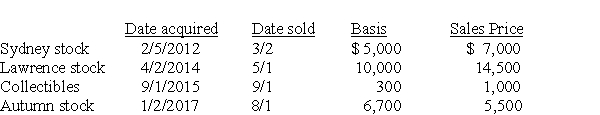

Chen had the following capital asset transactions during 2017:

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

What is the adjusted net capital gain or loss and the related tax due to the above transactions,assuming Chen has a 25% marginal tax rate?

(Essay)

4.8/5  (39)

(39)

Unless the alternate valuation date is elected,the basis of property received from a decedent is generally the property's fair market value at the date of decedent's death.

(True/False)

5.0/5  (36)

(36)

Monte inherited 1,000 shares of Corporation Zero stock from his father who died on March 4 of the current year.His father paid $30 per share for the stock on September 2,2005.The FMV of the stock on the date of death was $50 per share.On September 4 this year,the FMV of the stock was $55 per share.The executor did not elect the alternate valuation date.Monte sold the stock for $65 per share on December 3.What is the amount and nature of any gain or loss?

(Multiple Choice)

4.7/5  (41)

(41)

How long must a capital asset be held to qualify for long-term treatment?

(Multiple Choice)

4.8/5  (44)

(44)

Allison buys equipment and pays cash of $50,000,signs a note of $10,000 and assumes a liability on the property for $3,000.In addition,Allison pays an installation cost of $500 and a delivery cost of $800.Allison's basis in the asset is

(Multiple Choice)

4.8/5  (35)

(35)

In 2012,Regina purchased a home in Las Vegas which cost $280,000.Due to increase in the market value of the home,she refinanced her mortgage and her debt on the home totaled $300,000 at the end of 2014.Regina accepted a new job in Dallas in April 2015.Unable to sell her home,she rented it in November 2015,at which time its fair market value was $240,000.In June 2017,she sold the home for $230,000.What tax issues should Regina consider?

(Essay)

4.8/5  (39)

(39)

Courtney sells a cottage at the lake that the family had used for their summer vacations.The purchaser paid Courtney $100,000 and assumed the mortgage which had a principal balance of $50,000.Courtney had purchased the cottage five years ago for $170,000.Courtney will recognize

(Multiple Choice)

4.9/5  (37)

(37)

Showing 101 - 120 of 147

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)