Exam 21: Property Transactions: Capital Gains and Losses

Exam 1: Tax Research114 Questions

Exam 2: Corporate Formations and Capital Structure123 Questions

Exam 3: the Corporate Income Tax127 Questions

Exam 4: Corporate Nonliquidating Distributions113 Questions

Exam 5: Other Corporate Tax Levies103 Questions

Exam 6: Corporate Liquidating Distributions107 Questions

Exam 7: Corporate Acquisitions and Reorganizations108 Questions

Exam 8: Consolidated Tax Returns104 Questions

Exam 9: Partnership Formation and Operation116 Questions

Exam 10: Special Partnership Issues107 Questions

Exam 11: S Corporations103 Questions

Exam 12: The Gift Tax105 Questions

Exam 13: The Estate Tax107 Questions

Exam 14: Income Taxation of Trusts and Estates105 Questions

Exam 15: Administrative Procedures104 Questions

Exam 16: Ustaxation of Foreign-Related Transactions97 Questions

Exam 17: An Introduction to Taxation109 Questions

Exam 18: Determination of Tax152 Questions

Exam 19: Gross Income: Inclusions144 Questions

Exam 20: Gross Income: Exclusions116 Questions

Exam 21: Property Transactions: Capital Gains and Losses147 Questions

Exam 22: Deductions and Losses146 Questions

Exam 23: Itemized Deductions130 Questions

Exam 24: Losses and Bad Debts125 Questions

Exam 25: Employee Expenses and Deferred Compensation151 Questions

Exam 26: Depreciation, cost Recovery, amortization, and Depletion106 Questions

Exam 27: Accounting Periods and Methods124 Questions

Exam 28: Property Transactions: Nontaxable Exchanges125 Questions

Exam 29: Property Transactions: Sec1231 and Recapture115 Questions

Exam 30: Special Tax Computation Methods, tax Credits, and Payment of Tax147 Questions

Exam 31: Tax Research133 Questions

Exam 32: Corporations149 Questions

Exam 33: Partnerships and S Corporations150 Questions

Exam 34: Taxes and Investment Planning84 Questions

Select questions type

All of the following are capital assets with the exception of

(Multiple Choice)

4.8/5  (40)

(40)

Brad owns 100 shares of AAA Corporation with a basis of $6,000 and a FMV of $24,000.Brad receives 15 stock rights as a nontaxable distribution with a total FMV of $6,000.Brad allows the stock rights to expire.Brad's loss recognized and the basis of the original 100 shares after expiration of the stock rights is

(Multiple Choice)

4.9/5  (37)

(37)

David gave property with a basis of $133,000 to Hannah when the property had a FMV of $100,000 and paid gift taxes of $8,000.If Hannah later sells the property for $140,000,Hannah's basis (to determine gain)in the property immediately before the sale is

(Multiple Choice)

4.9/5  (42)

(42)

If a capital asset held for one year or more is sold at a gain,the gain is classified as long-term capital gain.

(True/False)

4.8/5  (45)

(45)

Sanjay is single and has taxable income of $13,000 without considering the sale of a capital asset in November of 2017 for $15,000.That asset was purchased six years earlier and has a tax basis of $5,000.The tax liability applicable to only the capital gain is

(Multiple Choice)

4.9/5  (39)

(39)

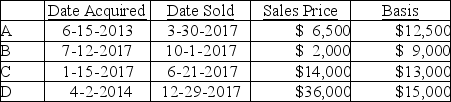

Coretta sold the following securities during 2017:  What is Coretta's net capital gain or loss result for the year?

What is Coretta's net capital gain or loss result for the year?

(Multiple Choice)

4.9/5  (40)

(40)

Taxpayers who own mutual funds recognize their share of capital gains even if no distributions are received.

(True/False)

4.7/5  (40)

(40)

Michelle purchased her home for $150,000,and subsequently added a garage costing $25,000 and a new porch costing $5,000.Repairs to the home's plumbing cost $1,000.The adjusted basis in the home is

(Multiple Choice)

4.9/5  (36)

(36)

Amanda,whose tax rate is 33%,has NSTCL of $25,000,a $30,000 LTCG from sale of a rare coin held 15 months and a $18,000 LTCG from the sale of stock held for three years.By what amount will Amanda's tax liability increase?

(Multiple Choice)

4.9/5  (35)

(35)

Donald has retired from his job as a corporate manager.He buys and sells stocks on a daily basis.He spends 8-9 hours daily studying prospective stock purchases and market news.What tax issues should Donald consider?

(Essay)

4.8/5  (35)

(35)

If Houston Printing Co.purchases a new printing press during the current year for $30,000,pays sales taxes of $2,000,and pays $1,000 for installation,the cost basis for the printing press is $33,000.

(True/False)

4.9/5  (30)

(30)

Douglas and Julie are a married couple who live in Louisiana,a community property state.They jointly own property with an adjusted basis of $140,000.On December 2 of this year,Julie died when the property had a fair market value of $160,000.Douglas's basis in the property after Julie's death is

(Multiple Choice)

4.9/5  (30)

(30)

Jack exchanged land with an adjusted basis of $65,000 subject to a liability of $22,000 for $50,000 (FMV)of stock owned by Hayden.Hayden takes the land subject to the liability.Jack incurs $500 of selling expenses.What is the amount of Jack's realized gain on the exchange?

(Multiple Choice)

4.9/5  (37)

(37)

Everest Inc.is a corporation in the 35% marginal tax bracket.It sold two stockholdings this year,resulting in a long-term capital gain of $15,000 on stock A and a short-term capital loss of $5,000 on stock B.What is the extra tax that Everest will pay due to the sales of these stocks?

(Multiple Choice)

4.8/5  (37)

(37)

A taxpayer sells an asset with a basis of $25,000 to an unrelated party for $28,000.The taxpayer has a realized gain of $3,000.

(True/False)

4.8/5  (35)

(35)

The holding period of property received from a decedent is based on the actual time the property is held by the decedent.

(True/False)

4.8/5  (28)

(28)

Andrea died with an unused capital loss carryover of $3,300.The carryover

(Multiple Choice)

4.8/5  (38)

(38)

Losses are generally deductible if incurred in carrying on a trade or business or incurred in an activity engaged in for profit.

(True/False)

4.8/5  (32)

(32)

On July 25,2016,Karen gives stock with a FMV of $7,500 and a basis of $8,000 to her nephew Bill.Karen had purchased the stock on March 18,2016.Bill sold the stock on April 18,2017 for $6,000.As a result of the sale,what must Bill report on his 2016 tax return?

(Multiple Choice)

4.8/5  (39)

(39)

Rita,who has a marginal tax rate of 39.6%,is planning to make a gift to her grandson who is in the lowest tax bracket.Which of the following holdings of stock would be the most tax advantageous gift from Rita's perspective?

(Multiple Choice)

4.9/5  (39)

(39)

Showing 21 - 40 of 147

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)