Exam 21: Property Transactions: Capital Gains and Losses

Exam 1: Tax Research114 Questions

Exam 2: Corporate Formations and Capital Structure123 Questions

Exam 3: the Corporate Income Tax127 Questions

Exam 4: Corporate Nonliquidating Distributions113 Questions

Exam 5: Other Corporate Tax Levies103 Questions

Exam 6: Corporate Liquidating Distributions107 Questions

Exam 7: Corporate Acquisitions and Reorganizations108 Questions

Exam 8: Consolidated Tax Returns104 Questions

Exam 9: Partnership Formation and Operation116 Questions

Exam 10: Special Partnership Issues107 Questions

Exam 11: S Corporations103 Questions

Exam 12: The Gift Tax105 Questions

Exam 13: The Estate Tax107 Questions

Exam 14: Income Taxation of Trusts and Estates105 Questions

Exam 15: Administrative Procedures104 Questions

Exam 16: Ustaxation of Foreign-Related Transactions97 Questions

Exam 17: An Introduction to Taxation109 Questions

Exam 18: Determination of Tax152 Questions

Exam 19: Gross Income: Inclusions144 Questions

Exam 20: Gross Income: Exclusions116 Questions

Exam 21: Property Transactions: Capital Gains and Losses147 Questions

Exam 22: Deductions and Losses146 Questions

Exam 23: Itemized Deductions130 Questions

Exam 24: Losses and Bad Debts125 Questions

Exam 25: Employee Expenses and Deferred Compensation151 Questions

Exam 26: Depreciation, cost Recovery, amortization, and Depletion106 Questions

Exam 27: Accounting Periods and Methods124 Questions

Exam 28: Property Transactions: Nontaxable Exchanges125 Questions

Exam 29: Property Transactions: Sec1231 and Recapture115 Questions

Exam 30: Special Tax Computation Methods, tax Credits, and Payment of Tax147 Questions

Exam 31: Tax Research133 Questions

Exam 32: Corporations149 Questions

Exam 33: Partnerships and S Corporations150 Questions

Exam 34: Taxes and Investment Planning84 Questions

Select questions type

Joycelyn gave a diamond necklace to her granddaughter Emma.Joycelyn had purchased the necklace in 1980 for $15,000.The FMV of the necklace at the time of the gift was $44,000.After deducting the annual exclusion,the amount of the gift was $30,000.Gift taxes of $10,000 were paid.What is Emma's adjusted basis in the necklace?

(Multiple Choice)

4.7/5  (36)

(36)

With regard to taxable gifts after 1976,no gift tax is added to the basis of the property if the donor's basis is greater than the FMV of the property.

(True/False)

4.9/5  (38)

(38)

In 2015,Toni purchased 100 shares of common stock in Blue Corporation for $5,280.In 2016,Blue declared a stock dividend of one share of its common stock for each 10 shares held.In 2017,Blue's common stock split 2-for-1 at a time when the FMV was $80 a share.What is Toni's basis in each of her shares of the Blue Corporation stock if both of the earlier stock dividends were tax-free?

(Multiple Choice)

4.8/5  (36)

(36)

Adam purchased 1,000 shares of Airco Inc.common stock for $22,000 on February 3,2014.On April 1,2017,Adam received 100 new shares in a nontaxable stock dividend.As of April 1,the stock was trading at $25 per share.Adam sells the 100 new shares on June 15,2017 for $2,400.Due to the stock sale,Adam will recognize a

(Multiple Choice)

4.9/5  (35)

(35)

If an individual taxpayer's net long-term capital losses exceed the net short-term capital gains,the excess may be offset against ordinary income up to $3,000 per year.Any excess losses over $3,000 may be carried over indefinitely.

(True/False)

4.8/5  (37)

(37)

If an individual taxpayer's net long-term capital losses exceed the net short-term capital gains,the excess may be offset against ordinary income up to $3,000 per year.Any excess losses over $3,000 may be carried back three years and carried forward five years.

(True/False)

4.8/5  (35)

(35)

Kathleen received land as a gift from her grandfather.At the time of the gift,the land had a FMV of $105,000 and an adjusted basis of $85,000 to Kathleen's grandfather.The grandfather did not have any gift taxes due.One year later,Kathleen sold the land for $110,000.What was her gain or (loss)on this transaction?

(Multiple Choice)

4.8/5  (33)

(33)

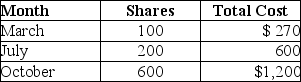

Edward purchased stock last year as follows:  In April of this year,Edward sells 80 shares for $250.Edward cannot specifically identify the stock sold.The basis for the 80 shares sold is

In April of this year,Edward sells 80 shares for $250.Edward cannot specifically identify the stock sold.The basis for the 80 shares sold is

(Multiple Choice)

4.9/5  (43)

(43)

Emma Grace acquires three machines for $80,000,which have FMVs of $32,000,$28,000,and $20,000 respectively.The delivery cost is $500,and installation costs amount to $2,500.What is the basis of each machine?

(Essay)

4.9/5  (36)

(36)

In the current year,Andrew received a gift of property from his uncle.At the time of the gift,the property had a FMV of $114,000 and an adjusted basis to his uncle of $70,000.After deducting the annual exclusion,the amount of the gift was $100,000.Andrew's uncle paid a gift tax on the property of $24,000.What is the amount of Andrew's basis in the property?

(Multiple Choice)

4.9/5  (38)

(38)

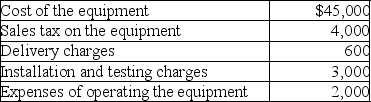

During the current year,Tony purchased new car wash equipment for use in his service station business.Tony's costs in connection with the new equipment this year were as follows:  What is Tony's basis in the car wash equipment?

What is Tony's basis in the car wash equipment?

(Multiple Choice)

4.8/5  (32)

(32)

Net long-term capital gains receive preferential tax treatment if they exceed net short-term capital losses.

(True/False)

4.8/5  (37)

(37)

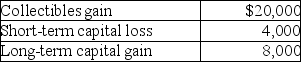

Kendrick,who has a 33% marginal tax rate,had the following results from transactions during the year:  After offsetting the STCL,what is (are)the resulting gain(s)?

After offsetting the STCL,what is (are)the resulting gain(s)?

(Multiple Choice)

4.7/5  (41)

(41)

On July 25,2016,Marilyn gives stock with a FMV of $7,500 and a basis of $5,000 to her nephew Darryl.Marilyn had purchased the stock on March 18,2016.Darryl sold the stock on April 18,2017 for $7,800.As a result of the sale,what will Darryl report on his 2017 tax return?

(Multiple Choice)

4.9/5  (38)

(38)

Section 1221 specifically states that inventory or property held primarily for sale to customers is not classified as a capital asset of the trade or business.

(True/False)

4.7/5  (35)

(35)

Normally,a security dealer reports ordinary income on the sale of securities unless it is specifically identified as a security being held for investment.

(True/False)

4.7/5  (36)

(36)

Joel has four transactions involving the sale of capital assets during the year resulting in a STCG of $5,000,a STCL of $12,000,a LTCG of $1,800 and a LTCL of $1,000.As a result of these transactions,Joel will

(Multiple Choice)

5.0/5  (37)

(37)

Renee is single and has taxable income of $480,000 without considering the sale of a capital asset (land held for investment)in September of 2017 for $25,000.That asset was purchased six years earlier and has a tax basis of $5,000.The tax liability applicable to only the capital gain (without consideration of the additional Medicare tax)is

(Multiple Choice)

4.9/5  (36)

(36)

When an individual taxpayer has NSTCL and NLTCG,the loss is offset against NLTCG from the 28% group,then NLTCG from the 25% group,and finally against NLTCG from the 15% or 20% group.

(True/False)

4.8/5  (30)

(30)

On January 31 of this year,Jennifer pays $700 for an option to acquire 100 shares of Lifetime Corporation common stock for $70 per share.Jennifer exercises the option on June 2.Jennifer sells the stock on April 30 of next year for $10,000.Jennifer's basis for the stock immediately before the sale is

(Multiple Choice)

4.8/5  (40)

(40)

Showing 121 - 140 of 147

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)