Exam 5: Interest Rate Risk Measurement: The Repricing Model

Which of the following statements is true?

A

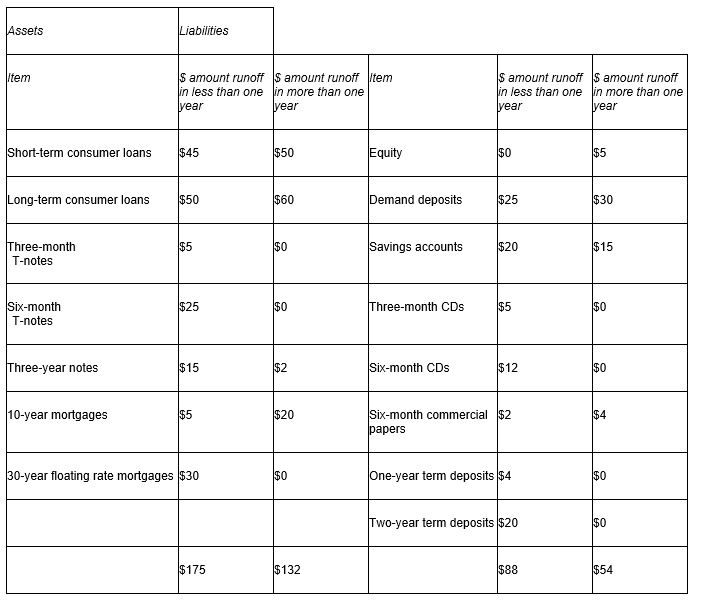

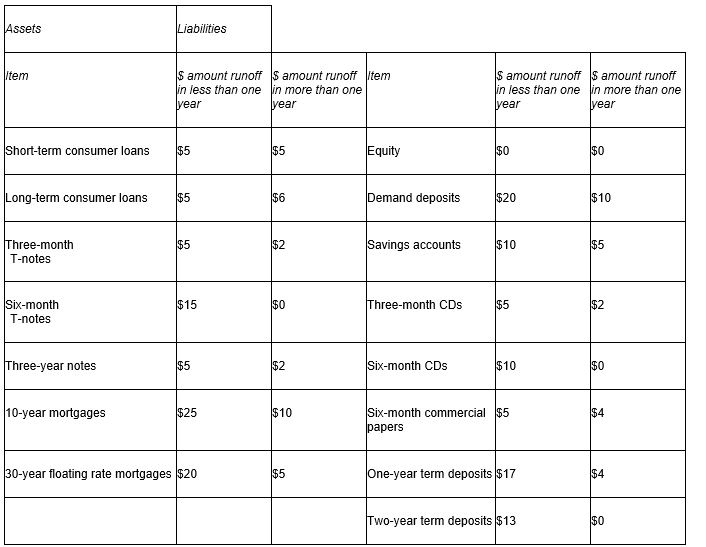

What is meant by the 'run-off' problem and how can bank managers deal with this problem?

In the simple repricing model, we assume that loans of one type mature at the same time; for example, all one-year consumer loans mature in one year's time and all 10-year fixed-rate mortgages mature in 10 years' time.

In reality, the bank continuously originates and retires consumer mortgages and all types of loans as it creates and retires deposits.For example, today some 10-year fixed-rate mortgages may only have one year left before they are repriced; that is, they are in their 9th year.In addition, virtually all housing mortgages pay at least some principal back to the bank each month.

As a result, the bank receives a runoff cash flow from its conventional mortgage portfolio that can be reinvested at current market rates, making this runoff component rate sensitive.The bank manager can easily deal with this in the repricing model by identifying for each asset and liability item the estimated dollar cash flow that will runoff, reprice or mature within the next year and adding these amounts to the rate-sensitive assets and liabilities.

Would you consider the repricing model to be a good and well-founded interest rate risk measurement and management tool? Why or why not?

The repricing gap is a measure of interest rate risk which uses book or historical values of assets and liabilities.It is conceptually easy to understand and can be used to forecast changes in profitability for given changes in interest rates.In this way it can assist FI managers to decide the structure of their balance sheet in light of projected interest rate changes.However, because of the book value approach, the repricing model concentrates on the net interest income effects of rate changes and ignores the market value effects.In addition, the model ignores important cash flow issues associated with over-aggregation, runoffs and off-balance-sheet activities.As such, the model does not provide an accurate picture of an FI's interest rate risk exposure.More complete measures of interest rate risk are provided by duration and the duration gap model

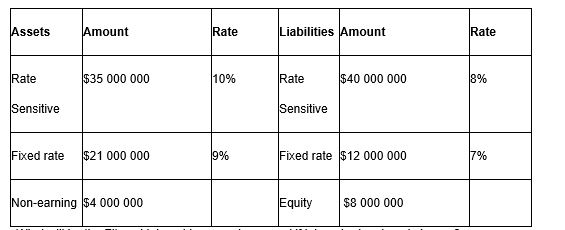

Consider the following information to answer the question:  What is the repricing gap for the FI?

What is the repricing gap for the FI?

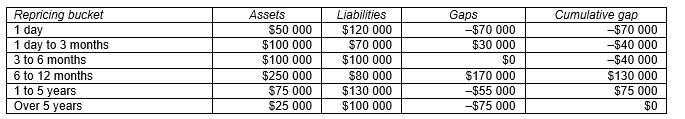

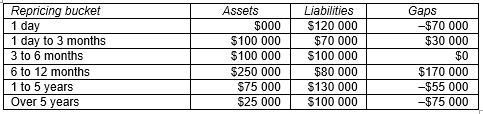

Consider the following repricing buckets and gaps:  What is the annualised change in the bank's future net interest income if the average rate change for assets and liabilities that can be repriced over five years is an increase of 50 basis points?

What is the annualised change in the bank's future net interest income if the average rate change for assets and liabilities that can be repriced over five years is an increase of 50 basis points?

An FI with a positive repricing gap expects interest rates to decrease.

The market segmentation theory of the term structure of interest rates:

Assume you are the manager of an FI.How would you structure your balance sheet using the repricing gap model if you expected interest rates to increase?

Consider the following table:  How does a decrease in the average one-year interest rate of 50 basis points affect the FI's future net interest income?

How does a decrease in the average one-year interest rate of 50 basis points affect the FI's future net interest income?

Consider the following table:  How does an increase in the average one-year interest rate of 50 basis points affect the FI's future net interest income ?

How does an increase in the average one-year interest rate of 50 basis points affect the FI's future net interest income ?

Consider the following repricing buckets and gaps:  What is the annualised change in the bank's future net interest income if the overnight interest rate increased by 100 basis points?

A)-$700

B)$700

C)-$7000

D)$700

What is the annualised change in the bank's future net interest income if the overnight interest rate increased by 100 basis points?

A)-$700

B)$700

C)-$7000

D)$700

Outline what is meant by the CGAP effect and explain the relationship between interest rate changes and changes in net interest income.Specifically indicate whether a FI would wish to hold a negative or positive CGAP and under which interest rate conditions.

The bank has a negative repricing gap.Is it exposed to interest rate increases or decreases and why?

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)