Exam 21: Decision Analysis

Exam 1: Data and Statistics98 Questions

Exam 2: Descriptive Statistics: Tabular and Graphical Presentations64 Questions

Exam 3: Descriptive Statistics: Numerical Measures156 Questions

Exam 4: Introduction to Probability138 Questions

Exam 5: Discrete Probability Distributions122 Questions

Exam 6: Continuous Probability Distributions165 Questions

Exam 7: Sampling and Sampling Distributions131 Questions

Exam 8: Interval Estimation131 Questions

Exam 9: Hypothesis Tests133 Questions

Exam 10: Statistical Inference About Means and Proportions With Two Populations121 Questions

Exam 11: Inferences About Population Variances91 Questions

Exam 12: Tests of Goodness of Fit and Independence80 Questions

Exam 13: Analysis of Variance and Experimental Design113 Questions

Exam 14: Simple Linear Regression140 Questions

Exam 15: Multiple Regression106 Questions

Exam 16: Regression Analysis: Model Building75 Questions

Exam 17: Index Numbers52 Questions

Exam 18: Forecasting67 Questions

Exam 19: Nonparametric Methods81 Questions

Exam 20: Statistical Methods for Quality Control30 Questions

Exam 21: Decision Analysis65 Questions

Exam 22: Sample Survey63 Questions

Select questions type

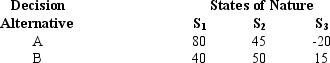

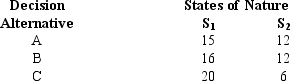

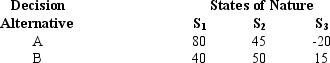

Exhibit 21-2

Below you are given a payoff table involving three states of nature and two decision alternatives.

The probability that S1 will occur is 0.1;the probability that S2 will occur is 0.6.

-Refer to Exhibit 21-2.The expected value of the best alternative equals

The probability that S1 will occur is 0.1;the probability that S2 will occur is 0.6.

-Refer to Exhibit 21-2.The expected value of the best alternative equals

Free

(Multiple Choice)

4.7/5  (40)

(40)

Correct Answer:

D

The efficiency of information is the ratio of

Free

(Multiple Choice)

4.8/5  (32)

(32)

Correct Answer:

D

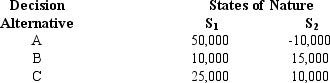

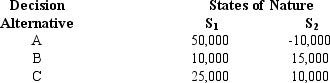

Exhibit 21-3

Below you are given a payoff table involving two states of nature and three decision alternatives.

The probability of the occurrence of state of nature S1 is 0.4.

-Refer to Exhibit 21-3.The expected monetary value of the best alternative equals

The probability of the occurrence of state of nature S1 is 0.4.

-Refer to Exhibit 21-3.The expected monetary value of the best alternative equals

Free

(Multiple Choice)

4.9/5  (31)

(31)

Correct Answer:

D

Nodes indicating points where an uncertain event will occur are known as

(Multiple Choice)

4.8/5  (38)

(38)

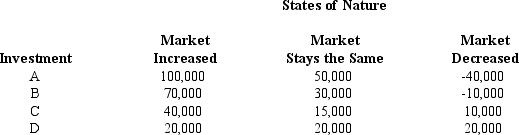

An investor has a choice between four investments.The profitability of the investments depends upon the market.The payoff table is given below for different market conditions.

a.A market economist has stated that there is a 25% chance that the market will stay the same,a 35% chance that the market will decrease,and a 40% chance that the market will increase.Compute the expected monetary value for each investment.Which investment is the best?

b.Compute the expected value of perfect information.

a.A market economist has stated that there is a 25% chance that the market will stay the same,a 35% chance that the market will decrease,and a 40% chance that the market will increase.Compute the expected monetary value for each investment.Which investment is the best?

b.Compute the expected value of perfect information.

(Essay)

4.9/5  (37)

(37)

The probability of both sample information and a particular state of nature occurring simultaneously is

(Multiple Choice)

4.9/5  (33)

(33)

New information obtained through research or experimentation that enables an updating or revision of the state-of-nature probabilities is

(Multiple Choice)

4.7/5  (36)

(36)

A tabular representation of the payoffs for a decision problem is a

(Multiple Choice)

4.9/5  (38)

(38)

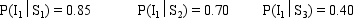

You are given a decision situation with three possible states of nature S1,S2,and S3.The prior probabilities of the three states are 0.20,0.45,and 0.35.With sample information I,you are provided with the following information.

a.Compute P(I).

b.Compute the revised probabilities of P(S1|I),P(S2|I),and P(S3|I).

a.Compute P(I).

b.Compute the revised probabilities of P(S1|I),P(S2|I),and P(S3|I).

(Essay)

4.8/5  (29)

(29)

Exhibit 21-4

Below you are given a payoff table involving two states of nature and three decision alternatives.

The probability of the occurrence of S1 = 0.3.

-Refer to Exhibit 21-4.The recommended decision alternative based on the expected monetary value is

The probability of the occurrence of S1 = 0.3.

-Refer to Exhibit 21-4.The recommended decision alternative based on the expected monetary value is

(Multiple Choice)

4.9/5  (33)

(33)

A graphic presentation of the expected gain from the various options open to the decision maker is called

(Multiple Choice)

4.8/5  (39)

(39)

The expected opportunity loss of the best decision alternative is the

(Multiple Choice)

4.9/5  (31)

(31)

The process of revising prior probabilities to create posterior probabilities based on sample information is a

(Multiple Choice)

4.8/5  (32)

(32)

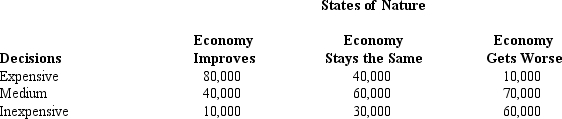

A fashion designer wants to produce a new line of clothes.In the production of the clothes,expensive,medium-priced,or inexpensive materials can be used.The profits associated with each type of material depend upon economic conditions next year.Below you are given the payoff table.

An economist believes that the probability that the economy will improve is 20%,the probability that the economy will stay the same is 70%,and the probability that the economy will get worse is 10%.

a.Compute the expected monetary value for each decision.Which decision is the best?

b.Compute the expected value of perfect information.

An economist believes that the probability that the economy will improve is 20%,the probability that the economy will stay the same is 70%,and the probability that the economy will get worse is 10%.

a.Compute the expected monetary value for each decision.Which decision is the best?

b.Compute the expected value of perfect information.

(Essay)

4.9/5  (35)

(35)

Exhibit 21-3

Below you are given a payoff table involving two states of nature and three decision alternatives.

The probability of the occurrence of state of nature S1 is 0.4.

-Refer to Exhibit 21-3.The expected value of perfect information equals

The probability of the occurrence of state of nature S1 is 0.4.

-Refer to Exhibit 21-3.The expected value of perfect information equals

(Multiple Choice)

4.9/5  (28)

(28)

An uncertain future event affecting the consequence,or payoff,associated with a decision is known as

(Multiple Choice)

4.9/5  (33)

(33)

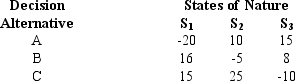

Exhibit 21-5

Below you are given a payoff table involving three states of nature and three decision alternatives.

The probability of occurrence of S1 is 0.2 and the probability of occurrence of S2 is 0.3.

-Refer to Exhibit 21-5.The expected monetary value of the best alternative is

The probability of occurrence of S1 is 0.2 and the probability of occurrence of S2 is 0.3.

-Refer to Exhibit 21-5.The expected monetary value of the best alternative is

(Multiple Choice)

4.8/5  (35)

(35)

The uncontrollable future events that can affect the outcome of a decision are known as

(Multiple Choice)

4.9/5  (33)

(33)

Exhibit 21-2

Below you are given a payoff table involving three states of nature and two decision alternatives.

The probability that S1 will occur is 0.1;the probability that S2 will occur is 0.6.

-Refer to Exhibit 21-2.The recommended decision based on the expected value criterion is

The probability that S1 will occur is 0.1;the probability that S2 will occur is 0.6.

-Refer to Exhibit 21-2.The recommended decision based on the expected value criterion is

(Multiple Choice)

4.7/5  (39)

(39)

Prior probabilities are the probabilities of the states of nature

(Multiple Choice)

5.0/5  (26)

(26)

Showing 1 - 20 of 65

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)